Modi’s New GST Reform Is a Game-Changer for Every Indian: When we talk about tax reforms that can shake up an entire country’s economy, Modi’s new GST reform deserves front-row seats. India just rolled out a major update to its Goods and Services Tax (GST) system, and experts are calling it a game-changer. Whether you’re a consumer, a small business owner, or a global investor keeping tabs on India’s growth story, this reform has ripple effects you can’t ignore. For Americans, think of it like a nationwide sales tax overhaul where groceries, cars, and even electronics suddenly become cheaper because the government simplified the whole system. That’s pretty much what’s happening in India right now.

Modi’s New GST Reform Is a Game-Changer for Every Indian

Modi’s new GST reform is more than just a tax tweak—it’s a strategic economic reset. By cutting slabs, making goods cheaper, and reducing compliance burdens, India is betting on its domestic consumers to drive growth. Yes, challenges exist—from state revenue losses to uneven benefits—but the big picture is clear: this reform simplifies the system, boosts confidence, and strengthens India’s position on the global stage. If implemented well, this could be remembered as one of the most transformative economic moves of the decade.

| Aspect | Details |

|---|---|

| Reform | GST slabs cut from 4 (5%, 12%, 18%, 28%) to 2–3 slabs (5%, 18%, 40% sin/luxury goods) |

| Impact on Consumers | Essentials like groceries and appliances cheaper, big relief for middle-class families |

| Impact on Businesses | MSMEs see reduced compliance burden and better cash flow |

| GDP Boost | Expected to stimulate private consumption (60% of India’s GDP) |

| Global Confidence | S&P gives India a sovereign rating upgrade after 18 years |

| Official Resource | Government of India GST Portal |

A Quick Recap: What is GST?

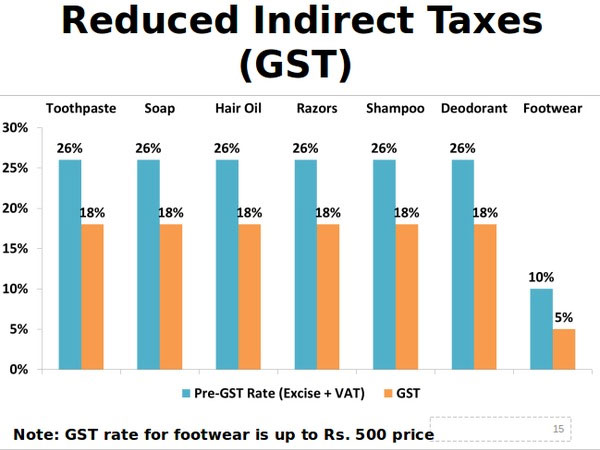

The Goods and Services Tax (GST) was introduced in July 2017 as India’s biggest tax reform since independence. The idea was to replace a messy web of indirect taxes—like excise duty, VAT, service tax, and entry taxes—with one unified system. It was marketed as “One Nation, One Tax.”

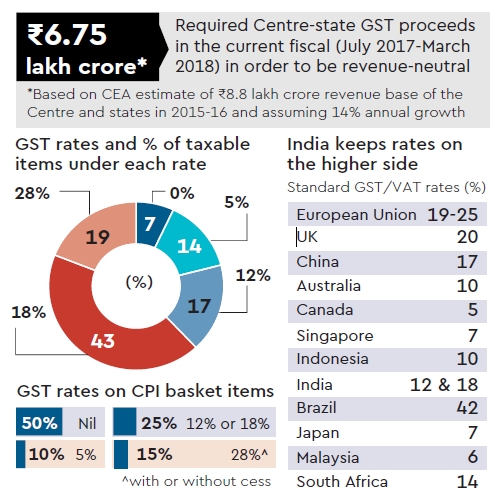

In practice, however, the GST quickly became complicated. Multiple slabs (5%, 12%, 18%, 28%) created confusion, compliance became a burden, and many small businesses felt choked. Critics argued that instead of simplification, India had layered complexity on top of reform.

That’s why today’s announcement feels like a second birth—a “GST 2.0”.

Why Modi’s New GST Reform Is a Game-Changer for Every Indian Matters Right Now?

Fast forward to 2025: Prime Minister Narendra Modi’s government slashed the four-tier GST system into just two major slabs (5% and 18%), with a “sin tax” of 40% for luxury goods like fancy cars, alcohol, and cigarettes.

The timing is important. India is navigating global economic turbulence—U.S. tariffs, high fuel costs, and shifting supply chains. A reform that puts more cash in people’s hands not only boosts domestic demand but also helps India stay resilient.

1. Simplified Tax System: Less Confusion, More Transparency

For years, both consumers and businesses asked: why so many slabs? A packet of biscuits could be taxed differently from a cake, and an AC could be taxed higher than a fan, even if both were household essentials.

By cutting down to two slabs, India moves closer to international best practices. Transparency improves because consumers don’t need to second-guess final prices.

Practical Example:

- Old System: Refrigerator → 28% tax.

- New System: Refrigerator → 18% tax.

That’s a direct 10% drop in cost, encouraging purchases.

This simplification also reduces disputes between states and the central government over revenue sharing.

2. Cheaper Essentials and Consumer Goods = Inflation Relief

Inflation is like that pesky roommate who just won’t leave. For India’s 1.4 billion people, even a small rise in food or household costs hits hard.

The reform reduces tax rates on a range of goods:

- Packaged foods and toiletries drop from 12% → 5%.

- Appliances like washing machines, ACs, and refrigerators drop from 28% → 18%.

- Cars, scooters, and electronics see a similar cut.

According to Economic Times, India’s retail inflation stood at 5.5% in mid-2025. Analysts expect this move to shave off 0.3–0.5%, bringing prices closer to the Reserve Bank of India’s comfort zone of 4%.

In simple terms: more breathing space for middle-class families, especially ahead of the festive season.

3. Boosting Consumer Spending and Economic Growth

Consumption is the backbone of India’s economy. Over 60% of India’s GDP comes from consumer spending.

Here’s the domino effect:

- Lower GST → cheaper goods.

- Cheaper goods → more people buy.

- More buying → businesses produce more.

- Higher production → more jobs.

This cycle fuels GDP growth. The government is betting on a $20 billion fiscal push to stimulate demand.

For global readers: Imagine if the U.S. slashed sales tax on electronics from 8% to 3%. Suddenly, households buy that extra iPad, TV, or laptop. The ripple effect is massive. That’s India’s playbook right now.

4. MSMEs Get Much-Needed Relief

India’s Micro, Small, and Medium Enterprises (MSMEs) contribute nearly 30% of GDP and employ more than 110 million people. Yet, they’ve been among the worst hit by compliance-heavy tax structures.

The reform eases:

- Monthly filing burdens.

- Inverted duty structures (when raw materials are taxed higher than finished goods).

- Working capital crunches caused by refund delays.

This matters because MSMEs are the backbone of India’s exports, from textiles to auto parts. With GST simplified, they can focus on scaling operations, innovating, and creating jobs.

Industry bodies like CII and FICCI have welcomed the move, calling it “historic” and a step toward making India globally competitive.

5. Market Confidence and Global Credibility

Markets love clarity. Following the announcement, the Sensex surged and the Nifty crossed 25,000 points. That’s investor confidence in action.

Adding to this, S&P upgraded India’s sovereign credit rating for the first time in 18 years, citing structural reforms like GST rationalization. For global investors, this means lower risk premiums and greater interest in Indian bonds and equities.

For India, it means easier access to foreign capital, more FDI, and a stronger rupee in the long run.

Expert Voices

- Arvind Subramanian, former Chief Economic Adviser: “Simplification was overdue. Two slabs make GST more predictable and business-friendly.”

- Confederation of Indian Industry (CII): “This is a relief for MSMEs and a step towards global competitiveness.”

- Critics warn: Some economists caution about short-term revenue loss, meaning states may push for higher compensation from the central government.

Global Comparison

How does India’s new GST compare internationally?

- United States: No federal sales tax; state-level rates between 0%–7%. Creates a patchwork system.

- Canada: Federal GST of 5% plus provincial sales tax (PST). Simple, predictable.

- European Union: VAT system, usually 17–25%.

India’s reformed GST is closer to Canada’s model, but with a unique “sin tax” layer to discourage luxury and harmful consumption.

Challenges and Risks

Every reform has speed bumps. Key challenges include:

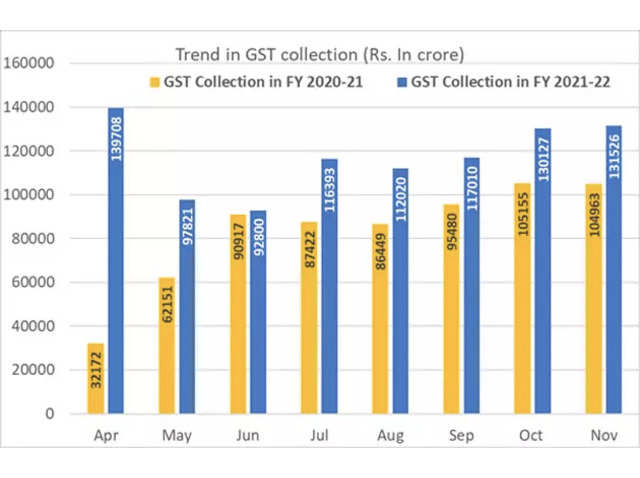

- Revenue Loss – States may initially see collections fall. The central government may need to provide compensation.

- Implementation Lag – Businesses must quickly adapt billing, pricing, and IT systems.

- Unequal Impact – Urban households benefit first, while rural households—who spend less on taxed goods—see delayed gains.

- Political Pushback – Some states may resist, arguing that their revenues are disproportionately affected.

Step-by-Step Guide: What This Means for You

- If You’re a Consumer → Expect lower prices on essentials, cars, electronics, and home goods by the festive season.

- If You’re a Business Owner → Simplified tax compliance saves time and money, boosting your bottom line.

- If You’re an Investor → India’s reforms signal long-term growth stability; consumer-driven sectors will benefit the most.

- If You’re Watching Global Trends → India is positioning itself as a counterweight to tariff shocks and global slowdowns.

Your Expenses Could Change Soon—GST Council Eyes Rationalising 12% & 18% Rates

GST Structure Simplified – Key Changes Explained

Coimbatore Trade Bodies Petition CM Against State GST Harassment