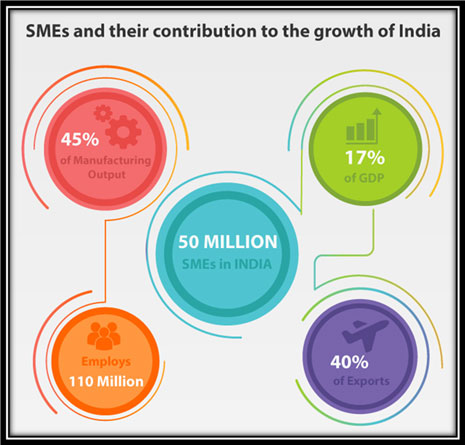

MSMEs Hit Hard as Labour Tax Cut Denied: When GST 2.0 (Goods and Services Tax 2.0) rolled out in India, it was hailed as a historic reform—simplifying the tax system, reducing rates on essentials, and streamlining compliance. Prime Minister Narendra Modi even called it “a defining moment for the common man, farmers, and MSMEs.” But here’s the reality check: MSMEs (Micro, Small, and Medium Enterprises), which employ over 111 million people and contribute nearly 30% to India’s GDP, feel left out. Instead of getting relief, they were hit by an unexpected blow—labour and job work GST was raised from 12% to 18%. For small manufacturers and service providers, that single change has far-reaching consequences.

MSMEs Hit Hard as Labour Tax Cut Denied

The GST 2.0 overhaul was designed to simplify India’s tax regime and cut costs for households and corporates. While those goals were met, MSMEs—the backbone of India’s economy—ended up bearing a heavier burden with the hike in job work GST from 12% to 18%. This move risks stifling small manufacturers at a time when they need the most support. Unless policymakers revisit labour taxation, India’s MSMEs may lose their competitive edge, hurting jobs, exports, and long-term growth.

| Factor | Impact on MSMEs | Data/Stats | Reference |

|---|---|---|---|

| Labour/Job Work Tax | Increased from 12% → 18% | 6% extra cost burden on job work | GST Council |

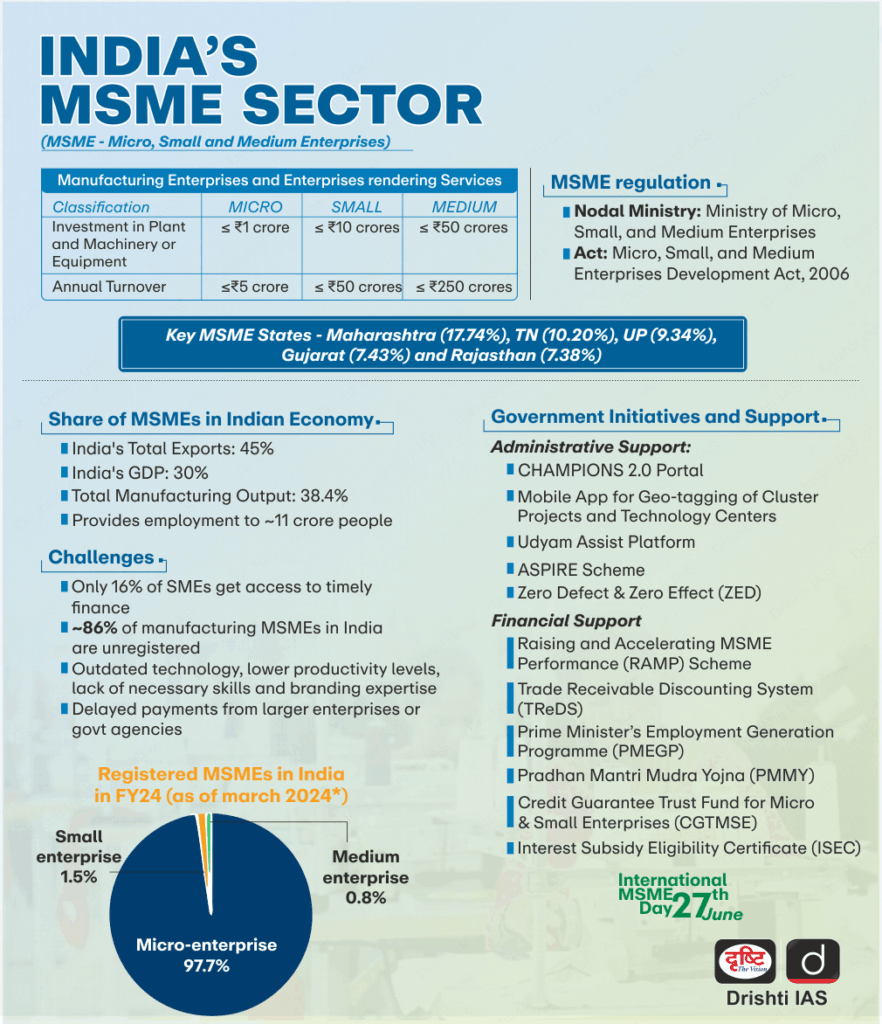

| MSME Sector Size | 63+ million units, 111 million employees | Contributes ~30% of GDP | MSME Ministry |

| Shutdowns | 3,100+ MSMEs shut in Gujarat (2024–25) | Textile, ceramics, steel affected | The Federal |

| Consumer Goods Relief | Soap, toothpaste, shampoo at 5% | Families save on essentials | Economic Times |

| Compliance Change | Slabs cut to 2: 5% & 18% (plus 40%) | Simpler compliance for businesses | PIB |

A Brief History: From GST 2017 to GST 2.0

India’s first GST reform in 2017 promised “One Nation, One Tax.” It replaced a messy patchwork of state VAT, excise, and service taxes. But the honeymoon ended quickly for small businesses.

Why? Too many tax slabs (0%, 5%, 12%, 18%, 28%), delayed refunds, and high compliance costs overwhelmed MSMEs. For example, textile traders in Surat and ceramic factories in Morbi often had to hire full-time accountants just to manage returns.

Enter GST 2.0 in 2025—marketed as a simplified, business-friendly system. It introduced:

- Two main slabs (5% and 18%) with a 40% slab for luxury/sin goods.

- Reduced rates on essentials like soap, shampoo, bicycles, tableware, milk, and paneer.

- Compliance ease with simplified return filing.

But the catch? Labour taxes went up.

Why MSMEs Feel Betrayed?

Job work is the heart of MSMEs. In industries like textiles, garments, steel, and ceramics, outsourcing specific labour tasks—stitching, dyeing, polishing—is routine.

When GST on job work jumps from 12% to 18%, it feels like a hidden penalty.

Example:

- A textile unit outsourcing stitching worth ₹10 lakh now pays ₹1.8 lakh GST instead of ₹1.2 lakh. That extra ₹60,000 eats into already thin margins.

- A ceramic unit in Morbi producing sanitaryware sees no tax relief as their products remain in the 18% slab.

MSMEs argue this contradicts the government’s “Ease of Doing Business” agenda. Instead of encouraging small-scale manufacturers, it increases their costs at a time when global competition is heating up.

The Silver Lining: Benefits of GST 2.0

To be fair, GST 2.0 has several positives:

- Household Savings

Everyday goods like soap, toothpaste, shampoo, bicycles, and utensils moved to the 5% slab. That’s direct savings for families. - Food Relief

UHT milk, paneer, and Indian breads (naan, chapati, paratha) went tax-free. - Simplified Tax Structure

Moving from five slabs to just two makes compliance easier, particularly for mid-sized firms. - Boost to Key Sectors

Medical devices, pharma drugs, cement, and fertilizers saw tax cuts, reducing production costs for larger industries.

So, while households and corporates celebrate, MSMEs continue to feel sidelined.

Case Studies: Real Impact on MSMEs Hit Hard as Labour Tax Cut Denied

- Textile Hub in Surat

Traders wanted a uniform 5% GST on garments. Instead, apparel above ₹1,000 stayed at 18%. As a result, festive-season sales dropped by 20%. - Ceramic Units in Morbi

Small factories producing tiles and sanitaryware complained of rising costs and stagnant demand. Over 3,100 MSMEs shut down in Gujarat in 2024–25, highlighting the severity. - Ludhiana’s Machine Shops

With job work GST up to 18%, costs for outsourced machining and welding increased. Many shops reported cash flow issues because GST refunds are often delayed for months.

Expert Opinions

Economist Dr. Arvind Subramanian, former Chief Economic Advisor, noted:

“While GST 2.0 simplifies tax slabs, it burdens labour-intensive MSMEs. Policymakers must revisit the 18% labour rate to protect jobs and competitiveness.”

The Confederation of Indian Industry (CII) stated in a policy note:

“MSMEs are critical to India’s manufacturing supply chain. Raising job work GST risks pushing them out of business.”

How Do Other Countries Treat Small Businesses?

- United States

Small businesses enjoy deductions and tax credits. For example, the IRS allows those under $25 million turnover to use cash accounting, reducing compliance burdens. - United Kingdom

Traders with revenue under £90,000 are exempt from VAT registration. - Singapore

Small firms below SGD 1 million turnover don’t need GST registration at all.

Compared globally, India’s MSMEs face higher taxes and slower refunds, putting them at a disadvantage in international trade.

Practical Advice for MSMEs

1. Maximize Input Tax Credits (ITC)

Check eligible credits carefully. Many MSMEs lose out due to poor record-keeping. Hiring a part-time tax consultant can pay off.

2. Adopt Digital Compliance Tools

Software like ClearTax, Tally, or Zoho Books ensures accuracy and faster refunds.

3. Adjust Pricing Wisely

Passing all costs to customers may hurt demand. Instead, spread increases strategically—small hikes combined with operational efficiency.

4. Collaborate in Clusters

Pooling resources in industrial hubs helps MSMEs negotiate better raw material rates and share compliance costs.

5. Engage in Policy Advocacy

Join associations like FICCI, CII, or MSME chambers. Collective lobbying has historically led to policy rollbacks.

Long-Term Implications of GST 2.0 for MSMEs

While the immediate pain of higher labour GST rates is visible, the long-term implications for MSMEs go beyond just monthly balance sheets. If left unaddressed, these changes could reshape the sector in the following ways:

1. Shift Towards Informality

One big risk is that smaller businesses may prefer to stay outside the formal tax net to avoid compliance costs. This could reduce transparency, hurt tax revenues, and stall India’s push toward a fully formalized economy.

2. Reduced Competitiveness in Exports

India’s MSMEs are key exporters in textiles, handicrafts, auto parts, and ceramics. With labour costs artificially inflated by higher GST, Indian goods could lose ground to competitors from countries like Vietnam or Bangladesh, where governments actively subsidize small manufacturers.

3. Pressure on Employment

Since MSMEs employ over 111 million people, higher costs may push firms to cut jobs or reduce hiring. This could worsen India’s employment challenge, especially in labour-intensive states like Gujarat, Maharashtra, and Tamil Nadu.

4. Innovation and Technology Adoption

On the flip side, higher costs might nudge MSMEs to innovate—by automating parts of production or adopting digital systems to save money. This could accelerate long-term modernization, but only for firms with the capital to invest.

5. Policy Reevaluation

Historically, unpopular GST measures have been rolled back after industry protests. If lobbying continues, the GST Council may consider reducing labour taxes back to 12% or creating a special “MSME slab” to support the sector.

Quick Checklist: Surviving GST 2.0

- Review ITC claims monthly

- Switch to digital GST filing systems

- Explore bulk sourcing for raw materials

- Re-negotiate job work contracts

- Stay active in MSME associations

MSMEs Eye Relief as GST Revamp Promises Easier Compliance and Faster ITC Refunds

PAN-Aadhaar Linking Deadline – Check Last Date and What Happens If You Miss It

GST Overhaul Ahead Of Diwali – Relief For Consumers, Risk For Revenue

What MSMEs Should Do Next

- Conduct a cost-benefit analysis of outsourcing vs. in-house labour.

- Explore alternative markets where tax burdens are lower.

- Improve financial literacy within teams to avoid compliance penalties.

- Push for reforms through associations and chambers of commerce.