NCLT Admits Application for CIRP Over Rs. 25.75 Cr Financial Assistance: In a significant move that showcases the proactive measures banks are taking to handle non-performing assets (NPAs), State Bank of India (SBI) has successfully initiated the Corporate Insolvency Resolution Process (CIRP) against Raninga Paper Mills Private Limited. The application was admitted by the National Company Law Tribunal (NCLT), following the company’s failure to repay a substantial ₹28.12 crores debt. This case highlights an essential legal process under the Insolvency and Bankruptcy Code (IBC), which allows financial institutions to recover their dues from companies facing financial distress.

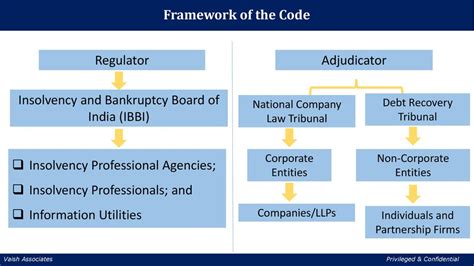

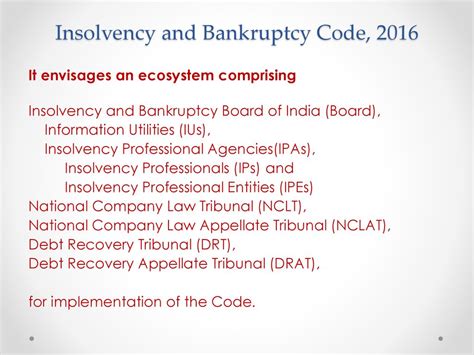

This action by SBI is particularly important in the context of rising NPAs in the Indian financial system. The IBC was introduced in 2016 to address this growing concern and provide a structured mechanism for resolving financial defaults. The CIRP, which can lead to either the restructuring of a company’s operations or its liquidation, plays a vital role in ensuring that creditors can recover outstanding debts while giving businesses an opportunity to resolve their financial issues.

NCLT Admits Application for CIRP Over Rs. 25.75 Cr Financial Assistance

SBI’s decision to file for CIRP against Raninga Paper Mills underscores the importance of managing non-performing assets (NPAs) and provides a clear path for resolving financial distress. The CIRP is an essential tool for maintaining the stability of the financial sector, offering both creditors and debtors an opportunity to resolve financial disputes through restructuring or liquidation. As the IBC continues to evolve, its role in ensuring efficient debt recovery and protecting the interests of both lenders and borrowers is more important than ever. Understanding this process and seeking timely advice can make all the difference for businesses and banks navigating financial challenges.

| Key Factor | Details |

|---|---|

| Case | Corporate Insolvency Resolution Process (CIRP) by SBI against Raninga Paper Mills |

| Debt Amount | ₹28.12 Crores including interest |

| NCLT Admission | Ahmedabad Bench of NCLT |

| Legal Framework | Section 7 of the Insolvency and Bankruptcy Code (IBC) |

| Interim Resolution Professional (IRP) | Jigar Tarunkumar Bhatt |

| Moratorium | Legal protection against creditor actions during CIRP |

| Corporate Debt Resolution | Potential for restructuring or liquidation |

| Official Link | Taxscan |

The Context Behind SBI’s Application

Before diving into the specifics of how CIRP works and its implications, it’s important to understand the broader context of this move. SBI, India’s largest public-sector bank, has had to contend with a growing number of non-performing assets (NPAs) over the years. NPAs occur when borrowers fail to repay their loans, creating stress for financial institutions. As the banking sector works to manage these NPAs, SBI turned to the IBC to recover its loan from Raninga Paper Mills.

The Insolvency and Bankruptcy Code (IBC) provides a legal process to address cases like this. By filing an application with the NCLT, SBI is using a structured approach to recover the debt while potentially restructuring the company’s operations, thereby saving the business if it’s feasible. This process provides clear steps for banks to resolve debts without dragging the matter through lengthy court battles.

How Does the Corporate Insolvency Resolution Process (CIRP) Work?

The CIRP is a legal framework that businesses and creditors use to resolve issues when a company is unable to pay its debts. This process is crucial for SBI and other financial institutions that need to recover loans while also giving the business a chance to survive. Here’s a step-by-step breakdown of how the CIRP works:

1. Initiating the Process

The first step in the CIRP is the filing of an application by the creditor. In this case, SBI, as the primary creditor, filed the application under Section 7 of the IBC. This section is specifically designed for financial creditors (banks, financial institutions, etc.) to file for the insolvency resolution of a defaulting debtor.

Once the application is filed, the NCLT evaluates the case and verifies whether the default is above the threshold of ₹1 crore (the minimum required for an insolvency application under the IBC). In this case, Raninga Paper Mills had defaulted on a debt of ₹28.12 crores, so the application was accepted.

2. NCLT Admission and IRP Appointment

Once the NCLT admits the application, it appoints an Interim Resolution Professional (IRP), who is responsible for taking control of the company’s operations and managing the CIRP process. In the case of Raninga Paper Mills, Jigar Tarunkumar Bhatt was appointed as the IRP.

The IRP plays a crucial role in overseeing the company’s management during the resolution process. They are tasked with taking stock of the company’s financial position and working with creditors and stakeholders to come up with a resolution plan.

3. The Moratorium Period

Upon admission of the CIRP application, a moratorium is declared. This is a legal freeze that prevents creditors from taking further legal action against the company. It also halts any pending lawsuits, the recovery of assets, and other actions that could harm the business or interfere with the resolution process.

This period provides the company with the time and space to negotiate with creditors and explore solutions for its financial troubles without the threat of legal or financial pressure.

4. Resolution Plan Development

The key part of the CIRP is the development of a resolution plan. During this stage, the company, under the supervision of the IRP, works to present a solution for repaying or restructuring its debts. The plan may involve debt restructuring, asset sales, or other measures that can help the company become solvent again.

The resolution plan is submitted to the Committee of Creditors (CoC), which is made up of financial creditors. The CoC must approve the plan by a majority vote, after which it is presented to the NCLT for final approval.

5. Liquidation Option

If the company fails to propose a satisfactory resolution plan, or if the creditors are unable to agree on one, the company may enter the liquidation phase. During liquidation, the NCLT orders the sale of the company’s assets, and the proceeds are distributed among the creditors.

Why Is NCLT Admits Application for CIRP Over Rs. 25.75 Cr Financial Assistance Important for Businesses and the Economy?

The CIRP plays an important role in maintaining financial stability and resolving insolvency cases efficiently. The IBC helps businesses and creditors avoid prolonged legal disputes and provides a clear pathway for debt recovery or restructuring. The process benefits both creditors and debtors in several ways:

1. Efficient Debt Recovery for Financial Institutions

For financial institutions like SBI, the CIRP provides a legal tool to recover outstanding debts. In cases where the company cannot pay, it also provides a transparent process for the liquidation of assets. This enables banks to get their dues faster, which is important in managing NPAs.

2. A Fair Opportunity for Business Owners

For companies facing financial challenges, CIRP provides a fair opportunity to reorganize and restructure. In many cases, companies can avoid liquidation and continue their operations. A good resolution plan may allow businesses to repay their debts over time, helping them get back on track without shutting down.

3. Protecting the Economy from Financial Instability

By resolving defaults quickly and fairly, the IBC ensures that the financial system remains stable. CIRP processes prevent the buildup of bad loans in the banking sector, which could cause a broader financial crisis.

Practical Advice for Business Owners Facing Insolvency

For businesses struggling with debt, here are some practical steps to consider:

1. Communicate Early and Often with Creditors

If you are unable to meet your debt obligations, don’t wait for your creditors to take legal action. Open communication with your creditors and seek possible solutions such as debt restructuring or extended repayment terms. Most creditors prefer to find a mutually beneficial solution rather than push for immediate liquidation.

2. Understand Your Legal Rights

If creditors file for CIRP, it’s essential to understand your legal rights. Hiring a legal professional or financial advisor with experience in insolvency can help you navigate the process and find the best possible outcome.

3. Evaluate All Your Options

Before entering the CIRP, evaluate all your options. Could you restructure the business? Are there assets that could be sold to pay down debt? Discuss these with your advisors to ensure the best possible outcome.

India’s Manufacturing Boom Pushes July GST Inflows Up by 7.5 Percent

Rs 44 Crore Customs Evasion Exposed: Bombay HC Grants Anticipatory Bail in Walnut Import Scandal

India’s GDP to Get Smarter? MoSPI Eyes GST, UPI, and Vehicle Data for Accuracy Boost