New £40,000 Pension Rule Could Hit Every UK Household: If you’ve been following the financial headlines out of the UK, you’ve likely seen chatter about the new £40,000 pension rule. At first glance, it sounds like just another policy tweak, but in reality, this proposed change could shake the foundations of retirement planning for millions of households. Whether you’re a 30-year-old just starting to save, or a 65-year-old counting down the days to retirement, this rule could change how you manage money in your later years. And if you’re reading this in the United States, it’s still worth paying attention—because what happens in the UK often inspires conversations in Congress around Social Security and retirement policies.

New £40,000 Pension Rule Could Hit Every UK Household

The proposed £40,000 pension rule is more than a technical adjustment. It’s a potential game-changer that could affect every UK household, from middle-class families to high-earning professionals. While the government frames it as a fair way to raise funds, it risks undermining trust in pensions as a savings vehicle. For households, the key is preparation: diversify, seek advice, and stay informed. Retirement is a long game, and while the rules may change, having a flexible plan will always put you ahead.

| Topic | Details |

|---|---|

| New Rule | Proposal to slash tax-free pension lump sum from ~£268,000 to £40,000 |

| Who’s Affected | Any UK pension saver planning to use the current lump sum rules |

| Tax Hit | Higher-rate taxpayers could lose ~£34,000 extra per £1M pension pot |

| Why It Matters | Impacts retirement planning, family wealth, and estate transfers |

| Revenue Raised | Treasury could bring in ~£2 billion |

| Official Source | UK Government HMRC |

What Exactly Is the £40,000 Pension Rule?

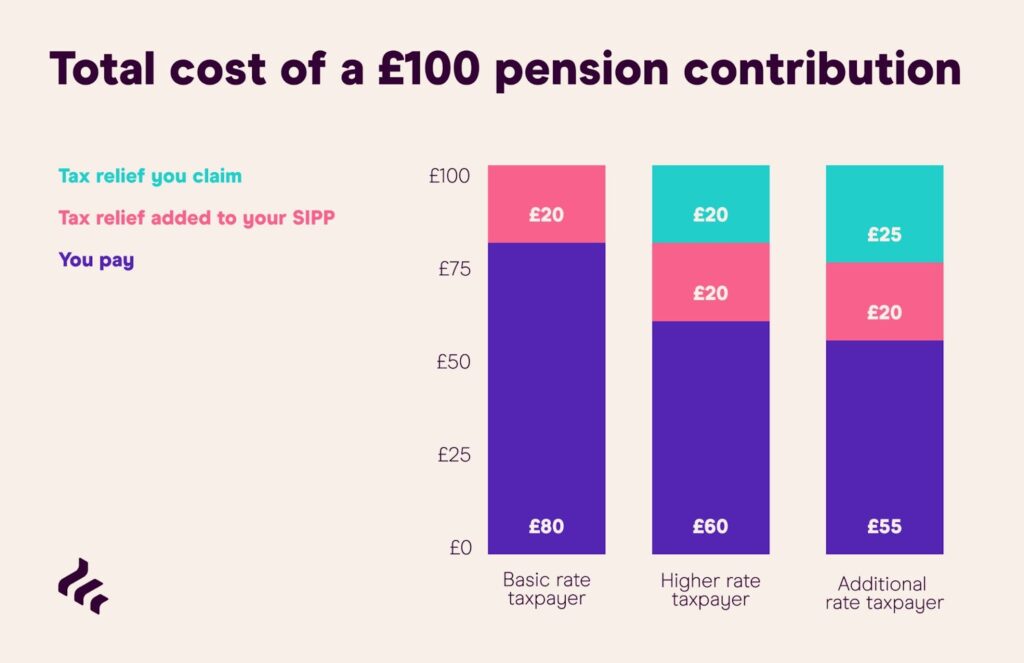

Right now, UK workers can withdraw 25% of their pension pot tax-free, capped at around £268,000. For someone with a £1 million pot, that’s a generous £268,000 tax-free payday.

The proposed change would reduce that allowance to £40,000 flat, no matter how big your pot is.

- Today: £1,000,000 pot = £268,000 tax-free.

- Under new rule: £1,000,000 pot = only £40,000 tax-free.

Everything above £40,000 would be taxed as income. For higher-rate taxpayers, that could mean an extra £34,000 tax bill per million saved.

Why Every Household Should Pay Attention?

It’s tempting to dismiss this as a policy hitting only the wealthy with massive pensions. But here’s why it affects almost everyone:

- Middle-class savers: Even smaller pension pots will see less flexibility.

- Household budgeting: Less tax-free cash means adjustments to lifestyle and retirement spending.

- Estate planning: Families counting on pensions to pass down wealth will be forced to rethink.

- Younger workers: Constant rule changes create uncertainty, discouraging long-term saving.

Think of your retirement plan as a Jenga tower. Each tax perk is a block supporting the structure. Remove too many, and the whole tower wobbles.

Historical Context: How Pension Rules Keep Changing

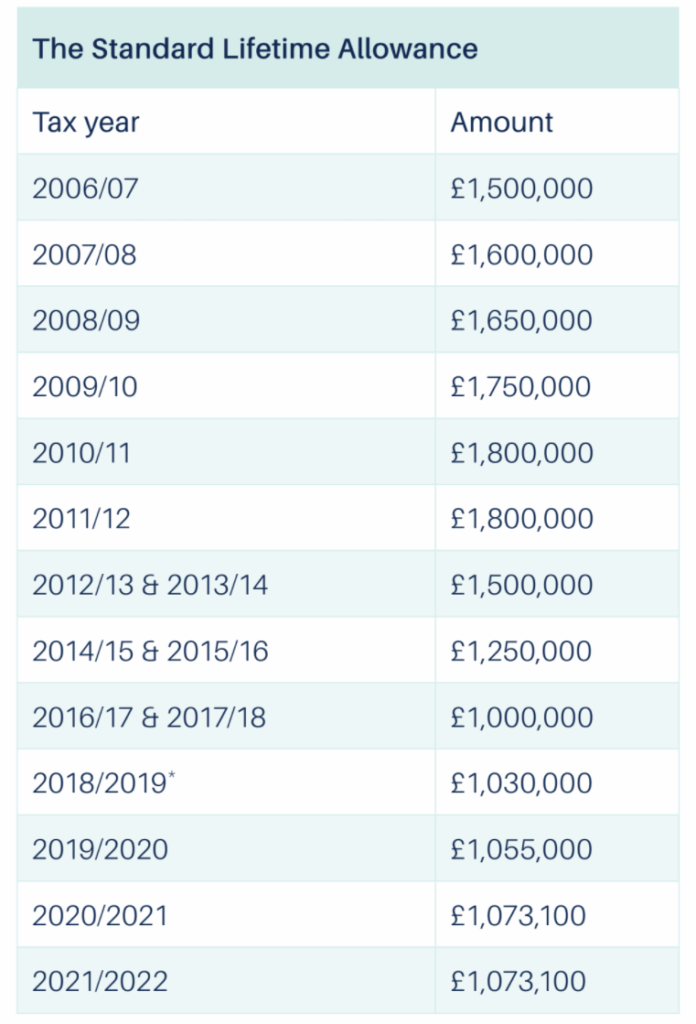

To understand the frustration, you need to see how much the goalposts have moved over the years:

- 2006: The government introduced the Lifetime Allowance (LTA), capping how much you could save tax-efficiently.

- 2010–2020: The Annual Allowance was slashed from £255,000 down to £40,000.

- 2023: The Conservative government scrapped the LTA entirely, restoring confidence for high savers.

- 2025 (Proposal): Labour may now reduce the tax-free lump sum cap to £40,000.

In short: people save for decades under one set of rules, only to see the rules rewritten when they’re close to retirement. That’s like training for a marathon, then being told halfway that the course is uphill instead of flat.

Why Is the Government Considering New £40,000 Pension Rule Could Hit Every UK Household?

The UK Treasury needs money—fast. Cutting tax perks is one of the easiest ways to raise revenue without directly raising income tax rates. According to GB News, this change could add around £2 billion to government coffers each year.

It’s also politically attractive because it can be framed as a move targeting the wealthy. But in practice, it affects a far broader base of savers.

Global Comparison: How Does the UK Stack Up?

Looking abroad helps put this in perspective:

- United States: With 401(k)s and IRAs, there’s no big lump-sum tax-free withdrawal. Instead, Americans pay taxes on distributions, unless they use a Roth IRA, which offers tax-free withdrawals. The rules are clearer and more stable compared to constant UK changes.

- Germany: Pensions are taxed as income in retirement, but state pension benefits are substantial.

- France: Pension income is taxed, but retirement ages and contribution rates are the bigger debates.

Compared to peers, the UK looks unstable, frequently shifting policies that discourage long-term saving.

Pros and Cons of the Rule

Pros (Government’s Perspective)

- Raises revenue for public spending (~£2B per year).

- Seen as fairer—larger pots pay more tax.

- Simplifies the system (flat allowance is easier to calculate).

Cons (Saver’s Perspective)

- Breaks trust—savers planned under old rules.

- Could discourage pension contributions.

- Reduces retirement flexibility and wealth transfer options.

Who Gets Hit the Hardest?

Different groups will feel the impact in different ways:

- High earners: Biggest hit, losing six figures of tax-free access.

- Middle-income workers: Less dramatic, but still limits choices (e.g., retiring early or paying off mortgages).

- Younger generations: Uncertainty makes pensions less attractive compared to ISAs or property.

- Employers: Will need to rethink how pensions are offered as part of recruitment packages.

Case Studies: What This Means in Real Life

- John, 60, £800k pot: Planned to give his daughter £200k tax-free for a house deposit. New rule slashes that to £40k, with the rest taxed. His family’s wealth transfer strategy is wrecked.

- Sarah, 45, £200k pot: Expected £50k tax-free. With new rules, it’s only £40k. She’s not rich, but she loses flexibility.

- Mike, 30, £50k pot: Thinks this doesn’t apply. But in 30 years, he’ll face an uncertain retirement landscape.

Step-by-Step Guide: How to Prepare

- Stay Calm – It’s still just a proposal. Don’t make rash decisions.

- Check Your Pot – Know exactly how much you’ve saved and your projected growth.

- Seek Advice – A regulated financial adviser can model different withdrawal strategies.

- Diversify Savings – Don’t rely solely on pensions. Use ISAs, property, or for U.S. readers, Roth IRAs.

- Review Estate Plans – If you plan to pass pensions to children, consider how this impacts inheritance tax.

- Stay Updated – Bookmark HMRC Pension Guidance.

Quick Checklist for Households

- Review pension statements.

- Speak with a financial adviser before making big moves.

- Explore ISAs and other tax-efficient vehicles.

- Reassess inheritance strategies.

- Track Autumn Budget announcements closely.

Professional Insights

Financial advisers are already seeing clients considering early withdrawals to lock in the current rules. But here’s the warning: pulling cash early can trigger income tax sooner and reduce growth potential.

It’s like selling your stocks during a market dip—you lock in a loss instead of letting them rebound. Smart planning often beats panic moves.

Long-Term Implications

If this rule passes, it could reshape how Brits save for retirement. People may:

- Shift savings from pensions to ISAs.

- Delay retirement due to reduced tax-free income.

- Demand higher wages to offset reduced pension perks.

- See growing distrust in long-term government promises.

The knock-on effects could extend to the housing market, consumer spending, and intergenerational wealth transfer.