New GST Rates From Sep 22: The Goods and Services Tax (GST) system in India is about to undergo some major changes that will impact every consumer, business, and industry across the country. Starting from September 22, 2025, a new set of GST rates will be implemented, making some items cheaper while others will become more expensive. This update is significant because it directly affects our everyday lives—from the price we pay for basic essentials to luxury items, and even healthcare and education. In this article, we’ll break down the new GST rates, explain what products will be affected, and provide you with practical tips on how these changes might impact your spending habits, business, and life. Whether you’re a regular consumer, a small business owner, or a corporate professional, understanding these changes can help you plan your budget, optimize your expenses, and make informed decisions.

New GST Rates From Sep 22

The GST overhaul, effective September 22, 2025, promises to bring major changes to the way goods and services are taxed in India. While the reduction in taxes on essential items like food and healthcare products is a win for consumers, the 40% tax rate on luxury items and tobacco signals the government’s intent to reduce consumption of non-essential goods. For businesses, this revision presents an opportunity to refine pricing strategies, but also challenges in adapting to new tax compliance rules. Whether you’re a consumer or a business owner, understanding the implications of these changes can help you make informed financial decisions.

| Topic | Details |

|---|---|

| Effective Date | September 22, 2025 |

| Items Getting Cheaper | Food products, essential goods, medical items, basic utilities, etc. |

| Items Getting Costlier | Luxury items, tobacco, high-end vehicles, aerated drinks, etc. |

| New GST Slabs | 5%, 18%, and 40% depending on the product category |

| Official Source | GST Council Press Release |

| Impact on Consumers | Price reduction on essentials; higher taxes on luxury goods |

| Impact on Businesses | Adjusted pricing models, compliance with new tax laws, changes in the supply chain structure |

What Are the New GST Rates?

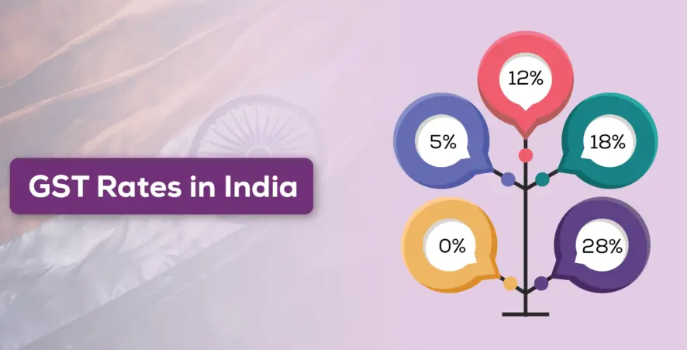

As part of a long-awaited revision to India’s Goods and Services Tax system, the government has introduced new rates that will simplify the existing complex structure. Historically, the GST rates in India have ranged from 0% to 28%, with certain items also attracting an additional cess. The new update, which comes into effect from September 22, 2025, will reduce the number of slabs and introduce new tax rates for various product categories.

The revised GST system is designed to make life easier for consumers, businesses, and the government alike. With fewer tax brackets, the overall structure will be more straightforward and efficient.

- 5% GST will apply to many commonly used items, making essential goods more affordable.

- 18% GST will be levied on most regular goods, providing a balanced rate for everyday consumer products.

- 40% GST will apply to luxury and “sin” goods like tobacco and high-end automobiles.

This major overhaul is expected to increase efficiency, boost government revenue, and help consumers by lowering the cost of everyday items.

How Will It Affect Consumers?

This new GST revision will have a direct impact on the average Indian consumer. If you’re wondering whether your shopping bills will increase or decrease, the answer lies in what you buy. Here’s a breakdown of the key categories:

Items That Will Become Cheaper

- Essential Food Items

- Milk (including UHT milk)

- Butter, Ghee, and Cheese

- Pre-packaged Chana, Paneer

These will no longer attract any GST at all, which will reduce costs for consumers, especially those purchasing daily essentials.

- Healthcare Products

Items like medical-grade oxygen, diagnostic kits, and glucose meters will be taxed at a reduced rate of 5%. These lower costs are expected to make healthcare more affordable and accessible for the general public. - Education Materials

- Stationery items, like notebooks, pens, and educational charts, will be tax-free, which is a big win for students, teachers, and parents.

- Personal Care Items

Everyday products like toothpaste, soap, and shampoo will see a 5% tax. These small but frequent purchases will become more affordable.

Items That Will Become More Expensive

- Luxury Cars and High-End Vehicles

High-end cars (including those over 1,200 cc engines) and luxury motorcycles (those above 350 cc) will attract a 40% GST. This could increase the price of these products by a significant margin, making them less affordable to the general public. - Tobacco and Alcohol

Cigarettes, chewing tobacco, and aerated drinks will fall under the 40% GST slab. The government’s strategy is clear: these products are now more expensive, and consumption is discouraged. - Luxury Goods

Items like yachts, high-end electronics, and even racing cars will also be taxed at a higher rate of 40%. If you’ve been eyeing a yacht or a luxury item, now might not be the right time to make that purchase.

What Does New GST Rates From Sep 22 Mean for Businesses?

If you run a business, these GST changes will certainly affect your pricing, procurement, and logistics models. Here are a few key things businesses need to keep in mind:

Review Your Product Pricing

Businesses that deal in goods that are subject to a 5% GST reduction can pass on the savings to their customers. If you’re in the food, healthcare, or education sectors, now is a good time to update your pricing strategy.

Adapt Your Supply Chain

Businesses that deal with luxury goods or high-end products might need to factor in the additional 40% tax when negotiating prices with suppliers and customers. You may need to adjust your margins or rethink your product offerings to stay competitive.

Stay Updated on Compliance

With the introduction of new GST slabs, businesses will need to update their internal systems to comply with the new tax structure. Make sure your accounting systems, billing software, and tax filing processes are in sync with the new rules.

A Step-by-Step Guide to Adjusting Your Business Model for the New GST Rates

- Step 1: Assess Your Product Range

Review your inventory and classify your products into the new GST categories (5%, 18%, 40%). Understand which products are getting cheaper and which are becoming more expensive. - Step 2: Update Pricing Strategy

For products that fall under the reduced GST slabs, lower your prices where applicable. Conversely, for items that are now subject to higher taxes, adjust prices accordingly to avoid losses. - Step 3: Revise Contracts and Agreements

Update contracts with suppliers, clients, and service providers to reflect new tax rates. This ensures that you stay compliant and avoid any legal issues. - Step 4: Train Your Team

Conduct workshops or training sessions for your finance and sales teams to ensure they fully understand the new GST rates and how to apply them. - Step 5: Inform Your Customers

Clear communication with your customers is key. Make sure they understand any changes in pricing and how the new tax rates may affect their purchase decisions.

Hotel Rooms, Casinos, and Services Face 12%–28% GST Rates — Full List in Focus

GST Collections Rise 6.5% Driven By Domestic Demand

Media And Advertising Sector Seeks Urgent GST Relief From Government