New Income Tax Law Explained: The New Income Tax Law 2025 is one of the biggest overhauls India’s tax system has seen in decades. If you’ve ever been confused by endless tax jargon, complicated deductions, or had to spend hours with your accountant trying to make sense of your return, you’re not alone. For over sixty years, India’s tax system was governed by the Income-Tax Act of 1961, a bulky piece of legislation with 819 sections and 47 chapters. Now, with the Income-Tax Bill 2025, the government has rewritten the rules to make things simpler, clearer, and friendlier for ordinary taxpayers. But as with any major change, there are both winners and losers. This article breaks it down in plain English—easy enough for a 10-year-old to follow, but packed with insights professionals and business owners need.

New Income Tax Law Explained

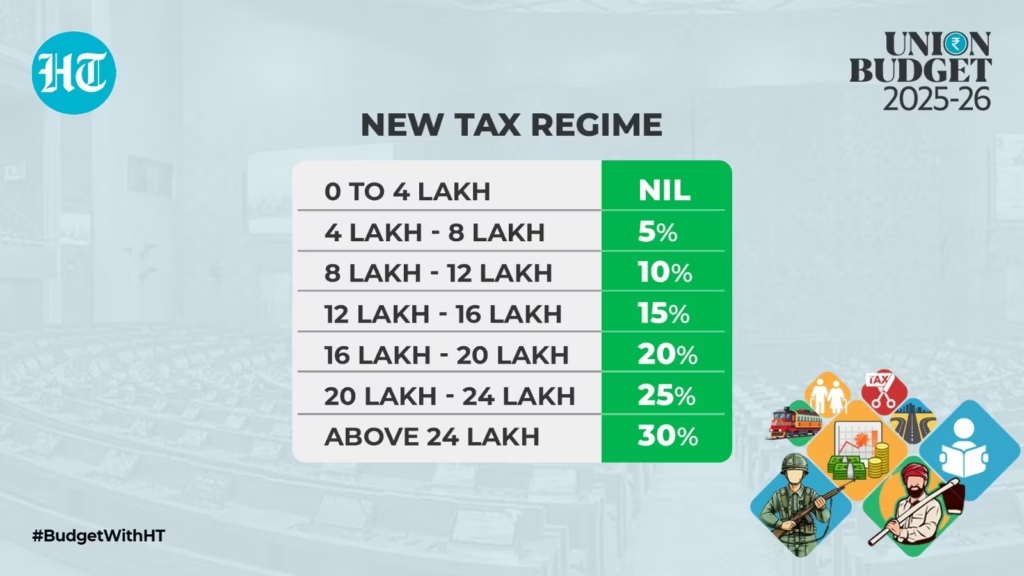

The New Income Tax Law 2025 is a landmark reform that simplifies India’s taxation system, raises the tax-free slab to ₹12.75 lakh, and cuts down hundreds of sections to make compliance easier. Middle-class earners, retirees, and freelancers stand to gain the most. High earners and deduction-heavy taxpayers may not benefit as much, but the overall shift promotes fairness, transparency, and trust. In practical terms, it means more money in the hands of ordinary taxpayers, a smoother filing process, and a more modern tax system for India’s growing economy.

| Aspect | Details |

|---|---|

| Tax-Free Income | Up to ₹12.75 lakh (₹12 lakh exemption + ₹75,000 standard deduction) |

| Who Gains Most | Middle-class earners, especially those making under ₹12.75 lakh |

| Who Loses Out | High-income earners, deduction-heavy taxpayers (HRA, 80C, home loan) |

| Simplification | Law reduced from 819 sections to 536 |

| Digital-first approach | Faceless assessments, faster refunds, less corruption |

| Special Changes | Pension fully deductible, crypto taxed, anonymous trust donations curbed |

| Comparison with Old Regime | Fewer deductions, higher base exemption |

| Official Reference | Income Tax Department – Government of India |

Why This Tax Reform Matters?

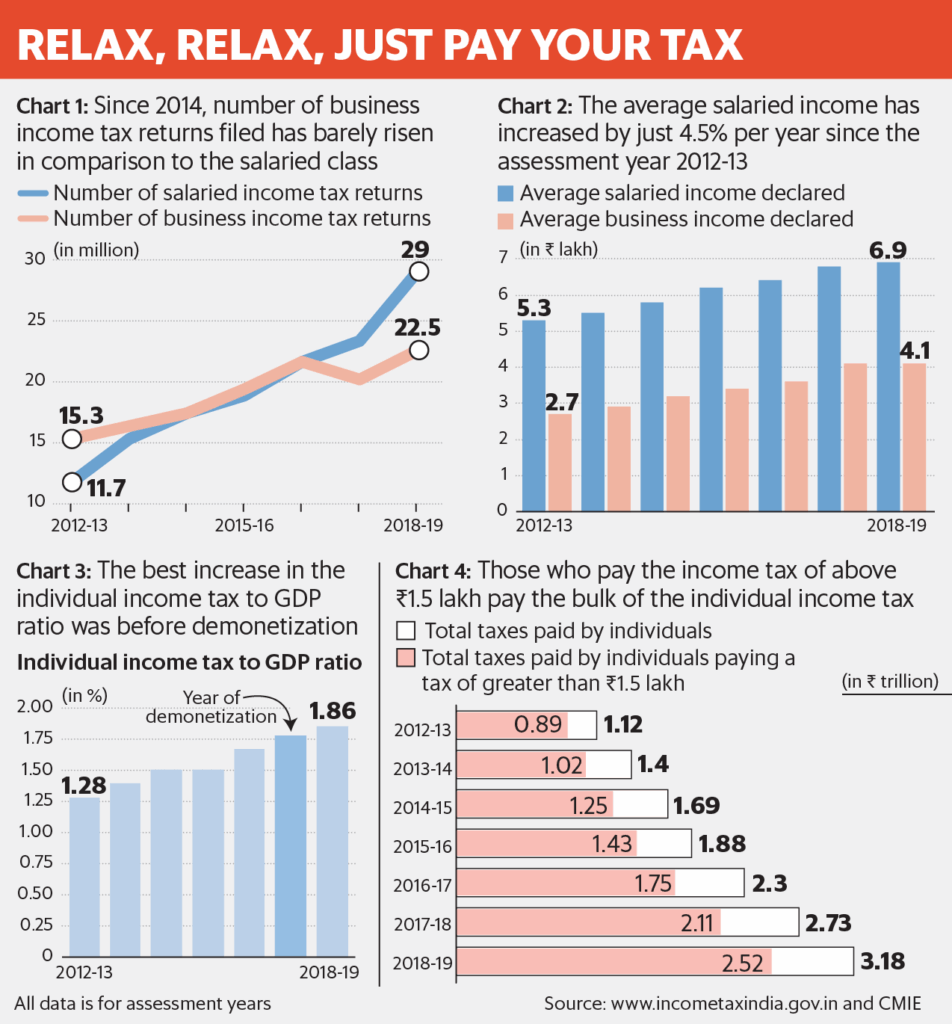

The old 1961 law was outdated. It was drafted in a very different India—one with a smaller economy, limited digital infrastructure, and far fewer taxpayers. By 2025, India has become the world’s fifth-largest economy, with millions of new taxpayers entering the system every year.

The government’s goals with the new law are clear:

- Simplicity: Cut down on jargon, reduce sections, and make filing easier.

- Transparency: Introduce faceless assessments to reduce corruption and intimidation.

- Fairness: Provide significant relief to middle-income households who make up the majority of taxpayers.

- Digital India push: Encourage online filing, automated processing, and quick refunds.

In short, the government wants to create a tax system that is easier for individuals and businesses, while ensuring stricter compliance from big earners and digital asset holders.

Who Gains Under the New Income Tax Law Explained?

Middle-Income Earners (Up to ₹12.75 Lakh)

This group gets the most benefit. With the new exemption and standard deduction, anyone earning up to ₹12.75 lakh annually now pays zero tax.

Example: A salaried professional earning ₹10 lakh would previously have paid close to ₹1 lakh in tax, even after deductions. Now, that same professional owes nothing. That is direct savings in take-home pay.

Seniors and Pensioners

Retired individuals, especially those receiving commuted pensions, are now fully exempt. This provides security to households living on fixed incomes and reduces their tax burden significantly.

Freelancers and Gig Workers

For independent professionals and gig economy workers, filing taxes has often been a headache. The new system reduces reliance on deductions, simplifies returns, and makes compliance less of a chore.

Refund Seekers

Refund delays have long been a sore point for taxpayers. Under the new law, refunds are faster and penalties on delayed claims have been removed. This builds trust and provides financial relief.

Who Loses Under the New Income Tax Law?

High-Income Earners

The wealthy still face higher tax rates. While they benefit from simplification, they do not see the same savings as the middle class.

Deduction-Heavy Taxpayers

Previously, people who maximized deductions under 80C, HRA, medical premiums, and home loan interest often lowered their tax liability significantly. The new regime reduces the impact of these deductions, making them less valuable.

Home Loan Borrowers

The earlier system gave major tax relief for home loan interest, incentivizing home ownership. Under the new setup, that benefit does not weigh as heavily. Individuals with large mortgages may prefer sticking to the old regime.

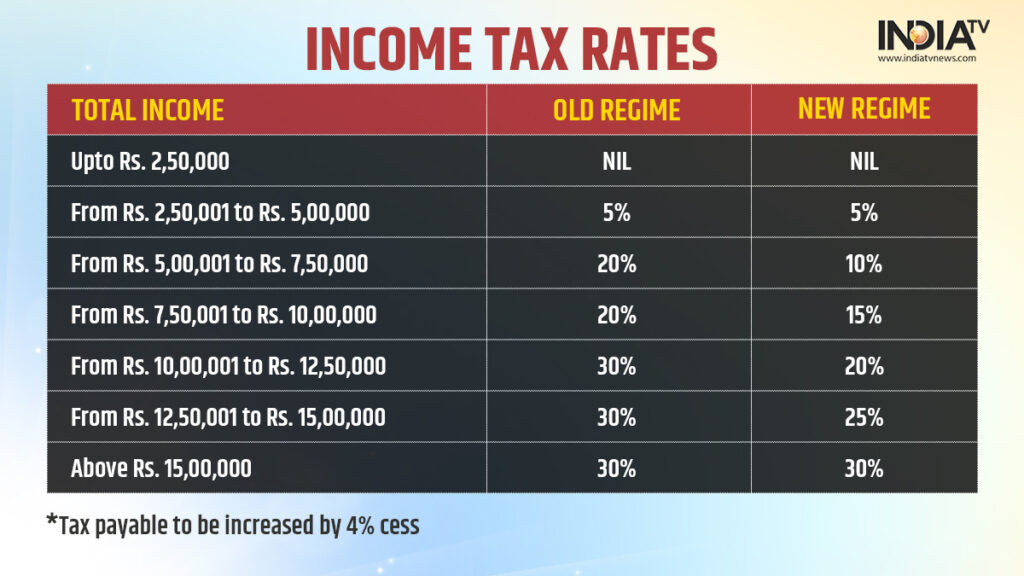

Tax Slabs: Old vs. New

| Income Level | Old Regime (Approx. Tax) | New Regime (Approx. Tax) |

|---|---|---|

| ₹8 lakh | ~₹52,000 | ₹0 |

| ₹15 lakh | ~₹2.1 lakh | ~₹1.5 lakh |

| ₹30 lakh | ~₹7.8 lakh (with deductions) | ~₹8.4 lakh |

This shows clearly that middle-income earners win, while high earners may end up paying slightly more under the new system.

Step-by-Step Guide to Filing Under the New Law

- Check Your Income: If it’s under ₹12.75 lakh, you are exempt under the new regime.

- Choose Your Regime: Salaried individuals can switch annually between old and new regimes.

- Collect Documents: Salary slips, Form 16, bank statements, and investment proofs if using old regime.

- Log in to the IT Portal: Use PAN and Aadhaar to access your profile.

- Select the Right ITR Form: Different forms apply for salaried, freelancers, or business owners.

- Fill and Submit: Enter details, verify deductions (if applicable), and submit.

- E-Verify: Use Aadhaar OTP or net banking.

- Track Refunds: Refunds are now faster and can be tracked online.

Case Studies: Who Gains and Who Loses

- Rohit, 30, IT Engineer – Salary ₹11 lakh. Under the new law: zero tax. Big winner.

- Meena, 42, Banker with a Home Loan – Salary ₹25 lakh. Old regime with deductions saves her more. Loses under the new law.

- Arjun, 65, Retiree – Pension ₹7 lakh. Fully deductible under new law. Gains significant relief.

- Startup Owner with ₹40 lakh income – Sees minimal relief since higher slabs apply. May prefer old regime if deductions are high.

Broader Economic Impact

This reform has ripple effects beyond individuals.

- Startups and Small Businesses: Less harassment from officials due to faceless assessments.

- Compliance Costs: Reduced, as fewer deductions mean less paperwork.

- Government Revenue: While middle-class relief reduces collections in the short term, broader compliance and inclusion of crypto under taxable assets strengthens long-term revenue.

- Consumer Spending: More disposable income for middle-class earners means higher retail and service demand, which fuels growth.

Expert Insights and Practical Advice

- Run Comparisons Every Year – Salaried individuals should compare both regimes annually before filing.

- Rework Investments – With fewer deductions, invest based on goals, not just tax breaks.

- Stay Updated on Crypto Rules – VDAs are clearly included in taxable income. Non-compliance could attract penalties.

- Plan Retirement Early – With higher exemptions, use tax savings for retirement planning, mutual funds, or skill upgrades.

Looking Ahead: The Future of Indian Taxation

The New Income Tax Law 2025 is more than just a tax reform; it is a signal of India’s broader direction. By simplifying compliance, encouraging digital filing, and targeting fairness, the government is aligning the tax system with its vision of a modern, technology-driven economy.

This move also puts India on par with international practices, where simpler codes and digital-first systems are the norm. But future budgets may continue to tweak slabs, deductions, and digital asset rules as the economy evolves.

New Income Tax Bill Tackles Filing Delays and Gives Your Refund Back

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Planning A Second Home? These Tax Rules On Rental Income Could Cost You