Next Canada Carbon Tax Rebate Payment Schedule: If you’ve been looking up the Canada Carbon Tax Rebate Payment Schedule in 2025, here’s the truth: the program officially ended in April 2025. That deposit you might’ve relied on each quarter? Gone. The Canada Carbon Rebate (CCR) — formerly known as the Climate Action Incentive Payment (CAIP) — paid its final round starting April 22, 2025, and after that, no more deposits hit Canadian bank accounts. This article breaks down everything you need to know: eligibility, amounts, timelines, why the program ended, and what you can do now to make up for it.

Next Canada Carbon Tax Rebate Payment Schedule

The Canada Carbon Rebate Payment Schedule in 2025 ended with the April 22 payout, closing the chapter on a policy that shaped household budgets for years. While Canadians lost predictable quarterly deposits, they gained lower pump prices after the carbon tax was repealed. For families, it’s one less income stream to count on. For professionals, it’s a case study in how politics, economics, and climate policy collide. Bottom line: CCR is gone, but with smart budgeting and other benefit programs, Canadians can still adapt.

| Topic | Details |

|---|---|

| Last Payment Date | April 22, 2025 (final CCR rebate) |

| Payment Frequency | Used to be quarterly: January, April, July, October |

| Eligibility | File 2024 taxes by April 2, 2025. Late filers still received payment once assessed. |

| Rural Supplement | Extra 20% for rural and small-town residents |

| Program Status | Ended in April 2025 after repeal of carbon tax |

| Official Resource | Canada.ca – CCR Payment Info |

A Quick History of the Canada Carbon Rebate

The CCR began in 2019, originally branded the Climate Action Incentive Payment (CAIP). It was part of Canada’s federal carbon pricing plan — a way to make polluters pay while shielding households from rising costs.

Here’s how it worked:

- The government charged a carbon tax on fuels like gasoline, diesel, and heating oil.

- Revenues went into a pool.

- Most of that money flowed back to households as quarterly rebates.

The promise? Over 80% of households would receive more in rebates than they paid in higher costs. Families in provinces without their own carbon pricing (like Ontario, Alberta, Manitoba, and Saskatchewan) became the main recipients.

Why Did the Canada Carbon Rebate End?

The shift came in March 2025. Just a day after taking office, Prime Minister Mark Carney announced the federal carbon fuel charge would be set to zero starting April 1, 2025. With no carbon tax revenue coming in, the rebate lost its purpose.

- Last payment: April 22, 2025.

- No July, October, or future payments.

- Program officially terminated.

For supporters, this meant cheaper fuel and heating — a relief for households struggling with inflation. Critics, however, argued that removing the carbon price weakened Canada’s climate fight.

Eligibility for the 2025 Payment

To get the final CCR rebate:

- File your 2024 taxes by April 2, 2025. If you filed late, CRA still sent the rebate once your return was processed.

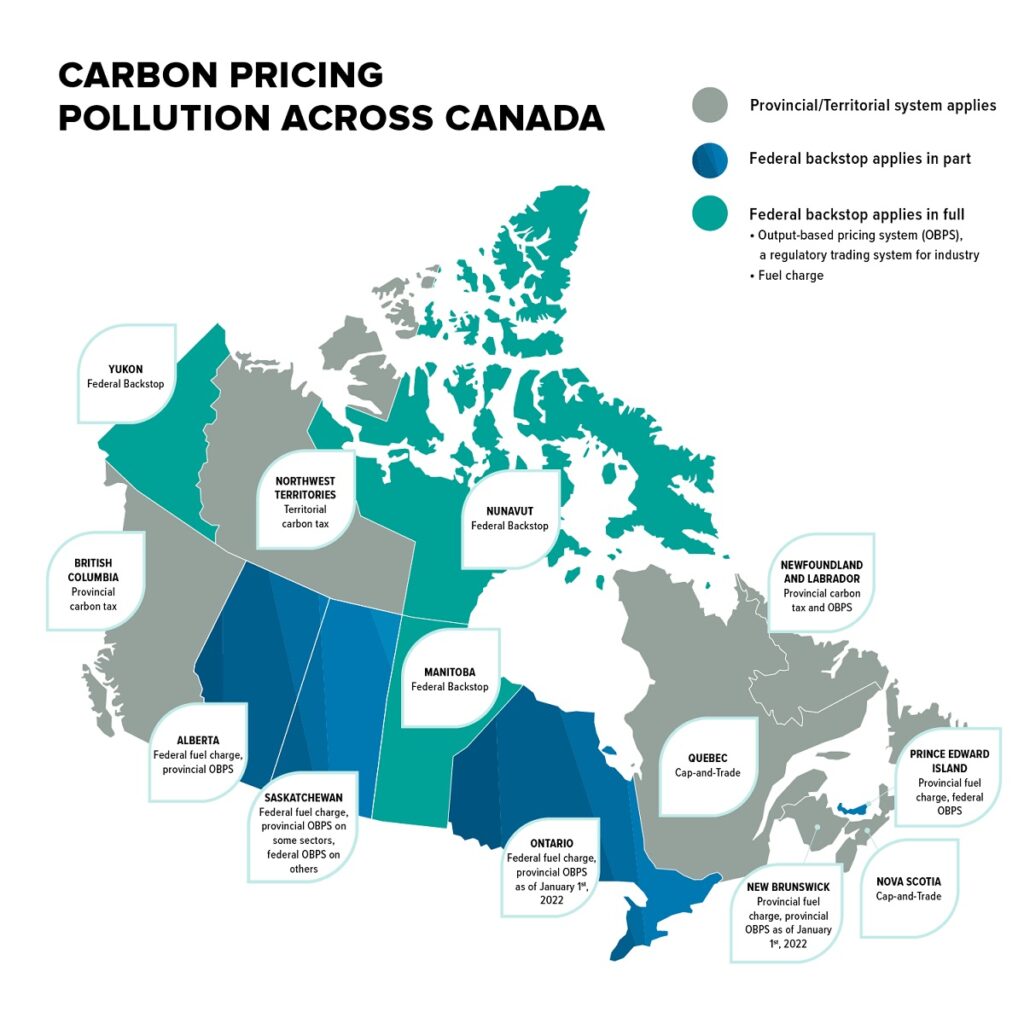

- Live in an eligible province: Alberta, Saskatchewan, Manitoba, Ontario, and a few others that relied on federal carbon pricing.

- Claim the rural supplement: Rural and small-town residents checked a box on their return to get 20% extra.

Payment Amounts: Province-by-Province

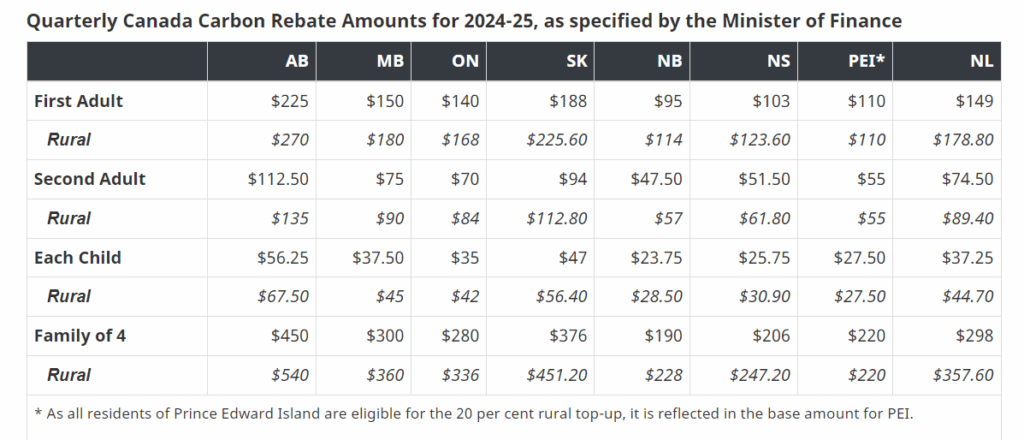

Rebate amounts varied depending on where you lived. Households in provinces with higher fuel use often got bigger rebates. Here’s a snapshot of annual CCR amounts for 2024–25:

- Ontario: Single adult – about $488; Family of 4 – roughly $976.

- Alberta: Single adult – around $772; Family of 4 – about $1,544.

- Saskatchewan: Single adult – roughly $680; Family of 4 – about $1,360.

- Manitoba: Single adult – about $528; Family of 4 – about $1,056.

With the 20% rural top-up, a family of four in Alberta could bring in nearly $1,900 annually.

Why the Differences by Province?

Not every province got the same rebate. That’s because the CCR was designed to match the average carbon tax paid by households in each region.

- Alberta and Saskatchewan (high driving distances, higher fuel reliance) got larger payments.

- Ontario (denser cities, more transit) received smaller amounts.

- Provinces with their own pricing systems — like British Columbia and Quebec — didn’t get CCR at all.

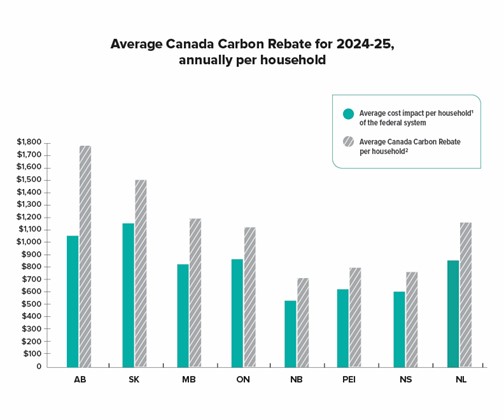

The Economic Impact of CCR

For many families, the CCR was more than just “bonus cash” — it was a budget stabilizer. According to federal estimates, about 8 out of 10 households came out ahead with the rebate.

Example:

- If a family in Saskatchewan paid $900 more in fuel costs due to the carbon tax, they might’ve received $1,200 back through CCR.

- That extra $300? Straight into their pockets, often helping cover food, rent, or gas.

The end of CCR shifted things. While fuel prices dropped after the tax was cut, households lost the certainty of quarterly rebates. For lower-income families, that steady injection of cash mattered more than fluctuating pump prices.

How Households Can Adapt Without the CCR?

With the Canada Carbon Rebate (CCR) gone, many families are asking: “How do we make up for the missing cash?” The good news is, while the program ended, there are still smart ways to stay ahead.

First, focus on energy efficiency at home. Small upgrades like switching to LED bulbs, sealing windows, or using smart thermostats can cut utility bills. Next, track your monthly spending with budgeting apps — even trimming $50 a month can replace a quarter’s worth of CCR payments. Finally, keep an eye out for provincial rebates and green grants, which often go underused. Think of it like a financial scavenger hunt: the money’s out there, you just need to claim it.

Bottom line? Canadians can adapt by treating CCR’s end not as a loss, but as a push toward smarter money management.

Political Reactions

- Supporters of repeal: Argued that ending the carbon tax lowered the cost of living and reduced inflationary pressure.

- Critics: Said cutting the tax undermined Canada’s climate commitments and removed a reliable income stream for families.

- Economists: Noted that while fuel got cheaper, households might actually lose in the long run without the rebate cushion.

This split echoed the broader debate: affordability vs. climate action.

Step-by-Step Guide: What To Do Now

Even though the program ended, Canadians can still take steps:

Step 1: Check CRA My Account

If you filed late, log into CRA My Account to confirm your payment status.

Step 2: Explore Other Benefits

Look into the GST/HST credit, the Canada Child Benefit (CCB), and provincial relief programs.

Step 3: Adjust Household Budgets

Practical hacks to make up for CCR’s absence:

- Brew coffee at home (save $15–20 per week).

- Carpool or use public transit twice a week (cut gas costs by 10–15%).

- Meal prep to reduce takeout spending.

Step 4: Tap Into Energy Grants

Programs like the Canada Greener Homes Grant cover insulation, windows, and heat pumps. That means long-term savings on utility bills.

U.S. Comparison: “Like Losing a Stimulus Check”

For context, Americans can think of CCR as similar to a stimulus check — only split into four quarterly deposits. Imagine expecting a mini refund every few months and suddenly, poof, gone. That’s the Canadian reality after April 2025.

Looking Ahead: What’s Next for Canadian Households?

While CCR is gone, don’t assume energy affordability is off the table. The government still funds programs aimed at:

- Green home retrofits to cut long-term energy bills.

- Targeted tax credits for families with kids or low incomes.

- Inflation relief payments from provinces.

Some experts predict provinces may roll out their own rebate-style programs to fill the gap. But for now, households are on their own to absorb the difference.

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid

Costly Mistake: CRA Penalizes Taxpayer for Not Reporting Home Sale

Outrage Erupts as Federal Union Slams Cuts to CRA Call Centres