No GST on Compost Centers or Chennai’s Wet Waste Processing: India is embracing its green future—and now, tax law is stepping up to help. In a major pro-environment decision, the Tamil Nadu Authority for Advance Ruling (AAR) has clarified that no GST (Goods and Services Tax) applies to certain composting and wet waste processing services—as long as they are rendered as pure services to a local authority like the Greater Chennai Corporation (GCC). For contractors, civic officials, accountants, and eco-entrepreneurs, this is big news. This ruling not only clarifies the legal position but also strengthens India’s strategy toward sustainable and cost-effective waste management. Let’s unpack what the ruling means, who qualifies, what the risks are, and how to ensure you’re GST-compliant and audit-ready.

No GST on Compost Centers or Chennai’s Wet Waste Processing

The GST exemption for pure services related to composting and wet waste processing is more than just a tax break—it’s a policy nudge that incentivizes cleaner cities, greener businesses, and better compliance. If you’re a contractor or entrepreneur in the sanitation space, this is your opportunity to scale responsibly, profitably, and sustainably. Just remember: keep your service “pure,” work directly with a local authority, and stay compliant with SAC 99943 and Notification 12/2017.

| Topic | Details |

|---|---|

| Ruling Authority | Tamil Nadu Authority for Advance Ruling (AAR) |

| Date of Ruling | February 11, 2025 |

| Applicant | M/s Nellai Motors |

| Service Type | Maintenance of micro-compost centers and processing of wet waste |

| GST Classification | SAC 99943 – Waste Treatment and Disposal Services |

| GST Exemption Source | Serial No. 3 of Notification 12/2017 – Central Tax (Rate) |

| Applicable Conditions | Pure services, provided to a local authority, in relation to a municipal function |

| Statutory Backing | Article 243W and Twelfth Schedule of the Indian Constitution |

| Official Notification Link | www.cbic.gov.in |

What’s the Ruling About?

At the heart of the ruling is a simple yet powerful clarification: if you’re contracted by a municipal body like GCC to process wet waste or maintain composting centers, and you’re only supplying labor, supervision, and services (not goods), you don’t have to charge GST on your invoices.

In other words, the activity qualifies as a pure service under GST law—specifically under Serial No. 3 of Notification 12/2017-Central Tax (Rate). And that means zero GST liability.

This ruling gives clarity to thousands of vendors, contractors, and local bodies operating across India’s urban sanitation ecosystem.

The Nellai Motors Case: A Practical Example

M/s Nellai Motors had a contract with GCC to manage micro-compost centers in Chennai. They billed the civic body a fixed amount per ton of wet waste processed. They didn’t supply any physical goods or materials—just the manpower and operational oversight.

Since the agreement involved:

- Pure service (no goods sold),

- Performed for a local authority (Greater Chennai Corporation), and

- Related to a function under the Twelfth Schedule (solid waste management),

The AAR ruled that GST is not applicable to such services. This set a solid precedent and removed ambiguity for similar vendors across the country.

What Is a Pure Service?

According to GST law, a “pure service” is one where only labor, management, or technical service is provided—no transfer of goods is involved.

For example:

- Running a compost center with your own team? Pure service.

- Providing compost bags or equipment along with services? Not pure service.

If more than 25% of the value involves supply of goods, the exemption breaks. This is outlined in Notification 2/2018 – Central Tax (Rate).

What Is a Local Authority?

As per Section 2(69) of the CGST Act, a local authority includes:

- Municipal Corporations (like GCC),

- District Boards,

- Panchayats,

- Zilla Parishads,

- Any authority legally entrusted with municipal functions under Article 243W of the Constitution.

This is crucial: services must be provided directly to the local authority, not through subcontractors or private aggregators.

What Are Municipal Functions?

Refer to the Twelfth Schedule of the Indian Constitution. Functions include:

- Sanitation and waste management

- Public health

- Drainage

- Urban forestry

- Solid waste processing

If your work relates to these, and it’s rendered as a pure service to a local body, you qualify for GST exemption.

Legal and Notification References

- Serial No. 3, Notification No. 12/2017 – Central Tax (Rate): Exempts pure services to local authorities.

- Notification No. 2/2018 – Central Tax (Rate): Introduces limit on value of goods (≤ 25%) in such services.

- Article 243W of the Constitution: Lists functions of municipalities.

- GST SAC 99943: Covers “Waste Treatment and Disposal Services.”

A Win for Green India

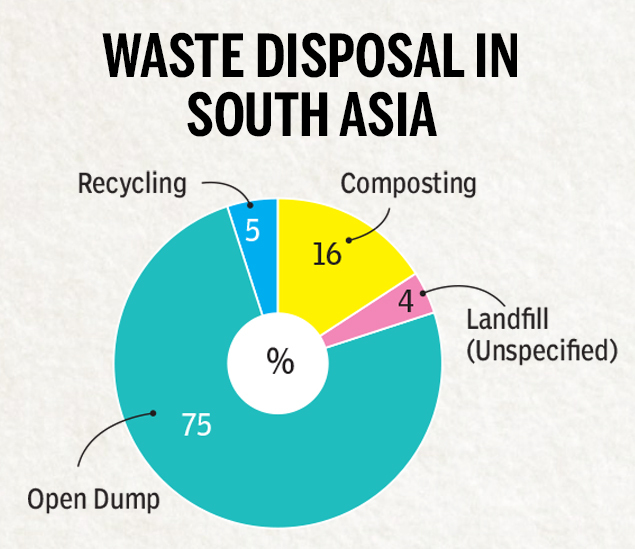

India generates over 62 million tons of municipal solid waste annually, and nearly 50% of it is organic (wet waste). Yet, less than 20% is currently composted.

The AAR ruling supports:

- Lower costs for municipalities

- Cleaner cities through proper composting

- Boosted income for small contractors

- Greater ease of doing eco-business

It’s a great example of taxation aligning with sustainability.

How to Qualify for No GST on Compost Centers or Chennai’s Wet Waste Processing – Step-by-Step

Step 1: Verify Your Client

Make sure you’re directly contracted by a local authority like a Municipal Corporation or Gram Panchayat.

Step 2: Review Your Scope

Your services must be pure—no sale or transfer of goods. No equipment, no compost bags, no resale materials.

Step 3: Use Correct SAC Code

Mention SAC 99943 in your invoice: Waste Treatment and Disposal Services.

Step 4: Reference the Exemption Clearly

Include the phrase:

“Service exempt under Serial No. 3 of Notification 12/2017 – Central Tax (Rate), as a pure service to a local authority.”

Step 5: Maintain Documents

Keep all agreements, performance reports, and correspondence ready in case of GST audit.

Who Stands to Benefit?

- Waste contractors: No output tax means higher margins or lower bids.

- Urban Local Bodies (ULBs): Reduced vendor costs with no input tax blockage.

- Green startups: Lower barriers to entry in composting and sanitation sectors.

- Accountants & GST Practitioners: Clearer guidelines for advisory and filings.

Common Risks and How to Avoid Them

| Risk | Impact | Solution |

|---|---|---|

| Supplying goods like compost | GST becomes applicable | Restructure contract or separate billing |

| Subcontracting through private firms | May disqualify exemption | Ensure contract is with local authority |

| Wrong SAC code used | Risk of penalties | Use SAC 99943 only |

| Lack of documentation | Disallowed exemption during audit | Maintain agreements, invoices, and correspondence |

Related Rulings

Several rulings echo the same logic:

- Jay Kay Trans (2022): Compost services to GCC exempt under similar facts.

- Sumeet Facilities Case: Denied exemption due to goods being involved and non-local authority recipient.

The GST ecosystem is evolving, but pure services to local bodies remain a protected category when aligned with municipal goals.

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

GST Portal to Be Down August 2–3 — Check Exact Hours Before Filing

Cabinet Greenlights Major GST Act Amendments—What These Changes Mean for Businesses and Consumers

What This Means for India’s Smart Cities Mission?

With over 100 smart cities underway, solid waste management remains a core focus. The ruling allows cities to scale up eco-projects affordably—and encourages vendors to participate without worrying about GST compliance headaches.

It aligns perfectly with:

- Swachh Bharat Mission (SBM) 2.0

- Circular Economy goals

- UN Sustainable Development Goal 11: Sustainable Cities and Communities