No GST Refund for Traders with Cancelled Registration: When it comes to taxes, even a minor slip can cost you big. That’s the harsh reality reinforced by a recent ruling from the Delhi High Court in India. In a landmark judgment, the court ruled that no GST refunds can be granted to traders if their GST registration has been cancelled, even if the cancellation was retrospective.

Sound like a technical detail? It’s not. This judgment has sparked serious concern across India’s exporter and MSME communities—and global partners, including businesses in the U.S., are watching closely. It’s a cautionary tale about regulatory compliance, procedural discipline, and the consequences of missing deadlines. Whether you’re a startup shipping goods abroad, a compliance officer at a multinational, or a small exporter navigating the GST maze, understanding this case could save you thousands—or even millions—in denied refunds.

No GST Refund for Traders with Cancelled Registration

The Delhi High Court’s decision delivers a clear message: if your GST registration isn’t active, your refund claim doesn’t stand a chance. Even if you’ve made legitimate exports or provided services abroad, the law requires compliance first, benefits later. For businesses across India—and for those globally who work with Indian vendors—this is a reminder: check your tax health regularly, respond to notices promptly, and never assume you’re compliant unless you’ve checked every box.

| Feature | Description |

|---|---|

| Topic | No GST Refund for Traders with Cancelled Registration |

| Jurisdiction | Delhi High Court, India |

| Main Judgment | Refunds not allowed unless GST registration is restored |

| Refund Amount in Case | ₹1.19 crore (approx. $143,000 USD) |

| Type of Exports | UAE and Uganda |

| Cancellation Date | Retrospectively from July 2018 |

| Affected Parties | Exporters, MSMEs, service providers, international buyers |

| Official Website | CBIC GST Portal |

What Happened in the Delhi HC Ruling: No GST Refund for Traders with Cancelled Registration

In August 2025, the Delhi High Court passed judgment in a case involving a registered trader whose GST registration was cancelled retrospectively from July 2018. Meanwhile, the business had exported goods and filed for a refund of ₹1.19 crore based on zero-rated export transactions.

However, the Customs Commissionerate contested the refund claim, asserting that the entity was found to be non-operational during inspections. Their physical premises couldn’t be verified, they hadn’t complied with filings, and their documents were incomplete or missing.

As a result, the Delhi HC ruled that until the GST registration is legally restored, the taxpayer cannot claim any refund—even if goods were shipped and the business had legitimate export invoices.

The judgment reads:

“When the GST registration itself has been cancelled in 2018, obviously, no refund can be granted till the said GST registration of the petitioner is restored.”

This decision has triggered immediate ripple effects across the Indian business community, especially exporters who rely on timely GST refunds to maintain working capital.

Why GST Registration Is So Critical?

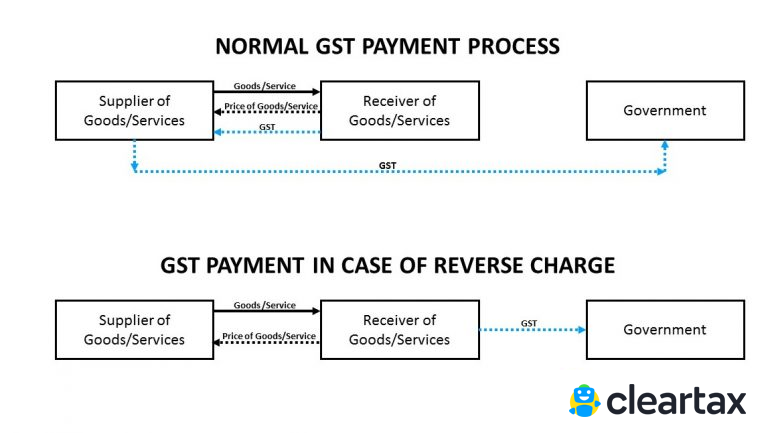

Let’s rewind a bit for clarity. GST (Goods and Services Tax) is India’s unified indirect tax system, replacing earlier levies like VAT, excise duty, and service tax. Businesses must register under GST if their turnover exceeds a specified limit or if they engage in interstate or export trade.

Here’s why a valid GSTIN (GST Identification Number) matters:

- It enables a business to collect GST legally.

- It allows them to claim Input Tax Credit (ITC) on purchases.

- It makes them eligible for GST refunds, especially in the case of exports, which are treated as zero-rated under GST law.

No valid GSTIN = no refund, no credit, no legal tax invoice.

For traders dealing internationally, especially those exporting goods or services, maintaining an active GST registration is absolutely non-negotiable.

How the Ruling Impacts Different Industries?

This ruling doesn’t just affect one company. It has implications across multiple sectors.

Exporters

Exporters routinely claim GST refunds under India’s zero-rated export mechanism. If their registration lapses—whether intentionally or not—they lose access to this liquidity, which can derail shipments and payment cycles.

MSMEs (Micro, Small, and Medium Enterprises)

Smaller businesses often face cash flow problems and may neglect timely return filings. If GST registration is cancelled due to non-compliance, they not only face penalties but now risk losing legitimate refunds as well.

Service Exporters

Freelancers, software developers, marketing agencies, and consulting firms offering services abroad are also impacted. GST refunds on export of services (like IT projects billed overseas) now hang in the balance unless their compliance is spot-on.

Importers and International Buyers

Even U.S.-based businesses importing from India should pay attention. If your Indian supplier’s GST registration is inactive or cancelled, it could mean shipment delays, customs issues, or invalid invoices on your books.

Step-by-Step Guide to Protecting Your Refund Rights

1. Stay GST Compliant Always

- File GSTR-1 and GSTR-3B monthly or quarterly, as applicable.

- Respond to Show Cause Notices (SCNs) from the GST department immediately.

- Keep your registered business premises accessible and valid.

Late filings are the number one cause of cancellation, and many times, businesses don’t even know they’ve been cancelled until they try to claim a refund.

2. Monitor Your Registration Status

Log into the GST portal regularly to check:

- Status of your registration

- Any pending notices

- Non-filing alerts or suspension warnings

3. Apply for Revocation Promptly If Cancelled

If your registration is cancelled—especially by the department—you must file a revocation request within 30 days (or as extended by notification).

Steps:

- File Form GST REG-21

- Attach required documents like:

- Last return filed

- Proof of business existence

- Justification for default

- Await department response

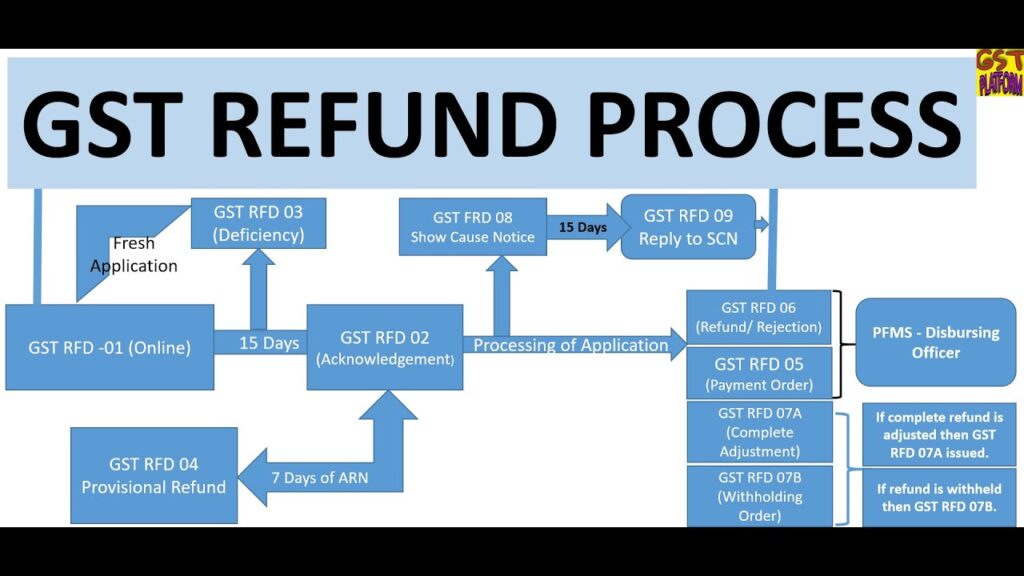

4. File Refund Claims After Restoration

Using Form RFD-01, you can claim a refund only after your registration is active again. Make sure:

- All returns are filed

- Refund period falls within the valid GST tenure

- Bank details are updated and verified on the portal

Real Data: How Many Refunds Are Affected?

According to India’s Ministry of Finance:

- Over ₹1.76 lakh crore (approx. $21.2 billion) was refunded to taxpayers in FY 2023-24.

- About 28-30% of refund claims are rejected, mainly due to documentation and compliance issues.

- Exporters account for nearly 45% of all GST refund claims.

A cancelled registration—especially unnoticed—can move a business from the “approved” to the “denied” pile instantly.

Similar Legal Rulings: Consistency Across Courts

This judgment aligns with multiple High Court precedents:

- Om Sai Traders v. Union of India (Gujarat HC, 2023) — Stayed retrospective cancellation due to lack of notice.

- Kritika Agarwal v. State of UP (Allahabad HC, 2022) — Found GST cancellation illegal where the show-cause notice didn’t mention retrospective intent.

These cases reinforce that:

- Authorities must issue clear, reasoned SCNs

- Taxpayers must respond on time

- Revocation isn’t a formality—it’s a legal requirement

Expert Insights

“Many small businesses assume that if they just pay off dues, the registration will reactivate automatically. But that’s not true. The law requires a formal revocation process—without which, the business remains non-existent in the GST system.”

— Anjali Taneja, GST Counsel, New Delhi

“American companies sourcing from India should ensure suppliers maintain active GST registration. It’s not just about refunds—it affects customs clearance, billing, and delivery timelines.”

— David R. Stone, International Trade Attorney, New York

Business Owner’s Checklist: Don’t Miss a Step

| Task | Action |

|---|---|

| Check GST Status | Use GST Portal |

| Respond to SCNs | Within deadlines with proper justification |

| Apply for Revocation | Form REG-21 within 30 days |

| File All Returns | GSTR-1, 3B, and Annual Returns |

| File Refund Claim | Only after registration is restored |

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling