No ITR Filing Required for These Senior Citizens in 2025: If you’re a senior citizen in India—or even someone living in the U.S. comparing global tax systems—there’s some welcome news. Starting 2025, some senior citizens in India won’t need to file an Income Tax Return (ITR) at all. This change is a result of Section 194P of the Income Tax Act, introduced to cut down the stress and complexity of annual filing for elderly taxpayers. If you’ve ever watched your grandparents shuffle through papers, worry about online logins, or get lost in tax jargon, you’ll understand why this move matters. The idea is simple: let the bank do the heavy lifting, while seniors enjoy their retirement without paperwork headaches. But not everyone qualifies. Let’s break it down clearly, step by step.

No ITR Filing Required for These Senior Citizens in 2025

Here’s the takeaway: In 2025, seniors aged 75 and above in India, with only pension and same-bank interest income, don’t need to file ITRs. Banks handle tax calculations and deductions under Section 194P. This is a thoughtful step to ease the compliance burden for older taxpayers. But remember, it isn’t a blanket exemption. If you have multiple income sources or special situations, you’ll still need to file. Families, advisors, and retirees themselves should double-check eligibility and use this provision wisely.

| Point | Details |

|---|---|

| Law Involved | Section 194P of the Income Tax Act (India) |

| Who Qualifies? | Resident senior citizens 75 years or older |

| Income Sources Allowed | Only pension + interest income from the same specified bank |

| Bank’s Role | Bank calculates taxable income, applies deductions, deducts TDS |

| Declaration Needed | Yes, declaration must be filed with the bank |

| Introduced | Finance Act, 2021 |

| Official Resource | Income Tax Department, Government of India |

Why This Rule Exists?

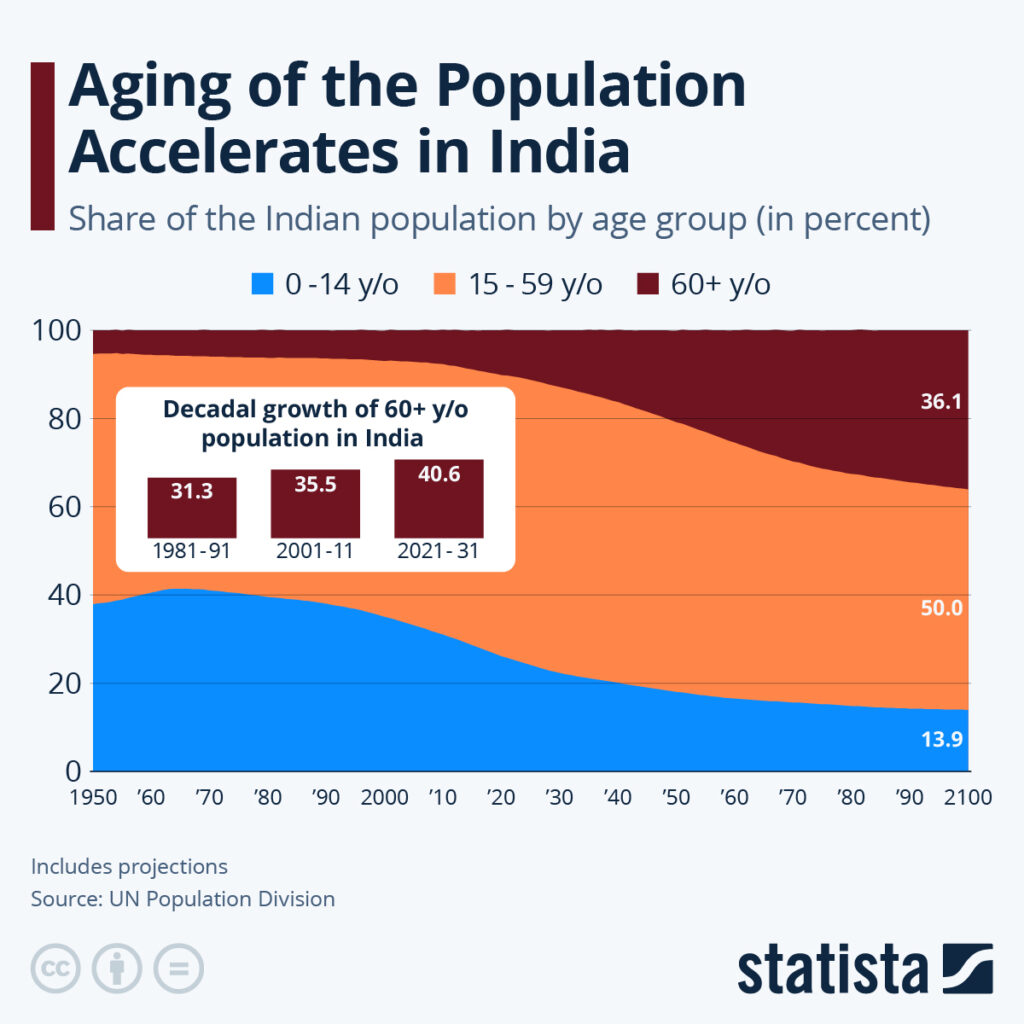

Filing an ITR isn’t rocket science, but for older adults it can feel like climbing Everest. According to India’s Ministry of Statistics, nearly 138 million Indians are above the age of 60. By 2050, that number is expected to double. With age, tasks like online filing, remembering passwords, or even reading fine print become real challenges.

The government realized that if an elderly taxpayer has only straightforward income sources—like pensions and fixed interest—forcing them to file a return every year is unnecessary. Section 194P shifts responsibility from the individual to the bank, making tax compliance smoother.

Who Qualifies and Who Doesn’t

The exemption isn’t for everyone. To qualify:

- You must be 75 years or older.

- You must be a resident taxpayer in India.

- Your income must come only from two sources:

- Pension

- Interest income from the same bank where your pension is credited.

- You must give a written declaration to that bank.

If any of these conditions are not met, you must still file an ITR.

Examples:

- Mr. Kumar, 76, receives ₹50,000 per month as pension and ₹8,000 annually as FD interest from the same State Bank of India branch. He qualifies.

- Mrs. Fernandes, 80, receives her pension from Canara Bank but has an FD with HDFC Bank. She does not qualify because the interest is from a different bank.

- Mr. Singh, 79, earns pension and bank interest but also rental income from a property in Delhi. He must still file an ITR.

Section 194P Explained

Section 194P was brought in under the Finance Act 2021. It applies to “specified banks,” which are larger government-notified banks capable of handling tax compliance.

Here’s how it works:

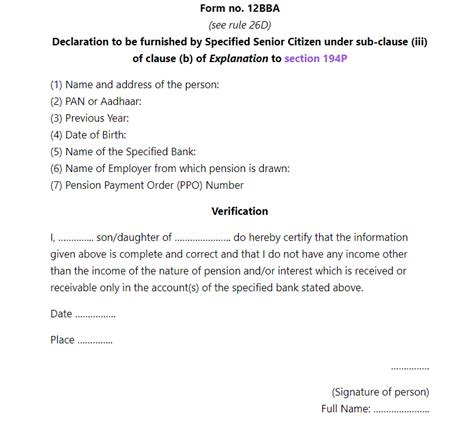

- The senior citizen submits a declaration form to the bank.

- The bank computes total taxable income.

- It applies all relevant deductions (such as under Section 80C for investments or Section 80D for medical insurance).

- It deducts TDS before crediting the pension and interest.

- Since the tax is already settled, the senior is exempt from filing an ITR.

This approach is unique because, unlike in the U.S., where seniors still file tax returns but get higher standard deductions, India’s system actually removes the filing requirement for eligible seniors.

Step-by-Step Guide for No ITR Filing Required for These Senior Citizens in 2025

Step 1: Verify Eligibility

Confirm age, residency, and income sources.

Step 2: Collect Documents

You’ll need your pension slip, bank account details, and proof of eligible deductions (like investments, insurance, etc.).

Step 3: Submit Declaration Form

Ask your bank for the Section 194P declaration form. Fill it out honestly and accurately.

Step 4: Bank Handles Tax

The bank calculates your taxable income and deducts TDS accordingly.

Step 5: Keep Records

Even if you don’t file an ITR, maintain a copy of your declaration and bank statements for future proof.

Historical Context: How We Got Here

Tax rules for senior citizens have been evolving.

- Before 2011: Seniors had the same basic exemption limit as younger taxpayers.

- 2011: Exemption limits increased—₹2.5 lakh for ages 60–79, ₹5 lakh for those above 80.

- 2021: Section 194P introduced, removing the filing requirement entirely for certain seniors.

This shows a steady trend toward making life easier for older taxpayers.

Why Only Specified Banks?

Not all banks have the infrastructure to handle tax compliance. Specified banks are usually larger institutions like State Bank of India, Punjab National Bank, or other notified institutions. Always confirm with your bank whether they’re on the official list published by the Income Tax Department.

Common Mistakes to Avoid

- Using multiple banks for pension and interest. Consolidate to one bank.

- Forgetting to submit the declaration. Without it, you’re back to ITR filing.

- Hiding extra income. The exemption doesn’t cover rental, capital gains, or foreign income.

- Assuming NRIs qualify. They don’t. This is only for resident Indians.

Professional Tips

- For tax consultants: Advise elderly clients to consolidate income sources into one specified bank.

- For family caregivers: Check that your parents’ FDs are in the same bank where they get their pension.

- For retirees: Even if you qualify, filing ITR voluntarily can help if you want to claim refunds, secure loans, or apply for visas.

ITR-6 Excel Utility Released – Check If You Need to File This Year

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

Case Study: Life Without Paperwork

Mr. and Mrs. Gupta, both in their late 70s, live in Lucknow. Before Section 194P, they relied on a local accountant to file their ITR every year. With their pension and small savings interest, they owed very little tax, but the process stressed them out.

In 2025, they consolidated all accounts with SBI, filed their declaration, and now don’t need to think about returns anymore. Their children, who live abroad, also feel relieved knowing their parents’ taxes are handled seamlessly.

Benefits of This Rule

- Peace of mind for seniors.

- Reduced errors in tax filing.

- Lower costs, since no accountant or tax consultant is needed.

- Simpler compliance for banks and government.

When Filing an ITR Still Makes Sense

Even if you qualify for exemption, consider filing if:

- You expect a refund.

- You want an official income record for financial purposes.

- You’re planning international travel that requires proof of income.

- You want to avoid disputes with the tax department in the future.

Comparison: India vs U.S.

- India (2025): Seniors 75+ with only pension and same-bank interest income don’t need to file ITR (Section 194P).

- U.S.: Seniors always file returns, but those over 65 get higher standard deductions—$1,500 extra for each spouse in joint filing or $1,850 for single filers (IRS, 2024).

Both systems aim to reduce burdens, but India goes a step further by eliminating filing for eligible seniors.