Noida Police Arrests Man for Creating Fake GST Invoices: Fraud cases are making headlines worldwide, and one such shocking case just unfolded in Noida, India. The Noida Police arrested a man for creating fake GST invoices worth ₹10 crore, an incident that not only exposes loopholes in corporate systems but also reminds us how financial fraud affects governments, businesses, and ordinary taxpayers. If you’re scratching your head wondering, “Wait, what’s a fake GST invoice and why does this matter to me?”—don’t worry. We’re going to break it down in plain English, using a conversational yet professional tone, with a dash of everyday American slang so the subject feels approachable to everyone, whether you’re a 10-year-old curious about scams or a business professional who needs the nitty-gritty details.

Noida Police Arrests Man for Creating Fake GST Invoices

The Noida Police’s arrest of a man for creating fake GST invoices worth ₹10 crore is a wake-up call for businesses and governments worldwide. Fraud isn’t just about numbers on paper—it drains economies, erodes trust, and hurts ordinary people. Whether you’re in India dealing with GST or in the U.S. filing IRS returns, the message is universal: stay vigilant, know the rules, and protect your financial systems.

| Detail | Information |

|---|---|

| Incident | Man arrested in Noida for creating fake GST invoices worth ₹10 crore |

| Accused | Abhinav Tyagi, ex-employee of a private firm |

| Fraudulent Gain | Wrongful input tax credit (ITC) claim of ₹1.8 crore |

| Evidence Seized | 4 mobile phones, 8 SIM cards, laptop, vehicle, GST documents |

| Legal Action | FIR filed under Bharatiya Nyaya Sanhita & IT Act |

| Status | Accused in judicial custody; accomplice still at large |

| Reference | Official GST Portal |

What Really Happened in Noida?

On September 6, 2025, the Cyber Police of Noida busted a financial fraud racket when they arrested Abhinav Tyagi, a former accounts employee. Using his insider knowledge and access to the company’s GST filing system, Tyagi allegedly created fake invoices worth ₹10 crore. These phony invoices were designed to fraudulently claim around ₹1.8 crore in Input Tax Credit (ITC)—a tax benefit usually meant to help businesses avoid paying tax twice.

Police seized multiple mobile phones, SIM cards, laptops, GST documents, and even a vehicle. Reports confirmed that Tyagi had an accomplice who is still absconding, making this case part of a larger fraud conspiracy. To paint you a picture, imagine if someone forged receipts at Walmart or Amazon and then claimed money back from the IRS—yeah, it’s that kind of scam, except in India’s tax system.

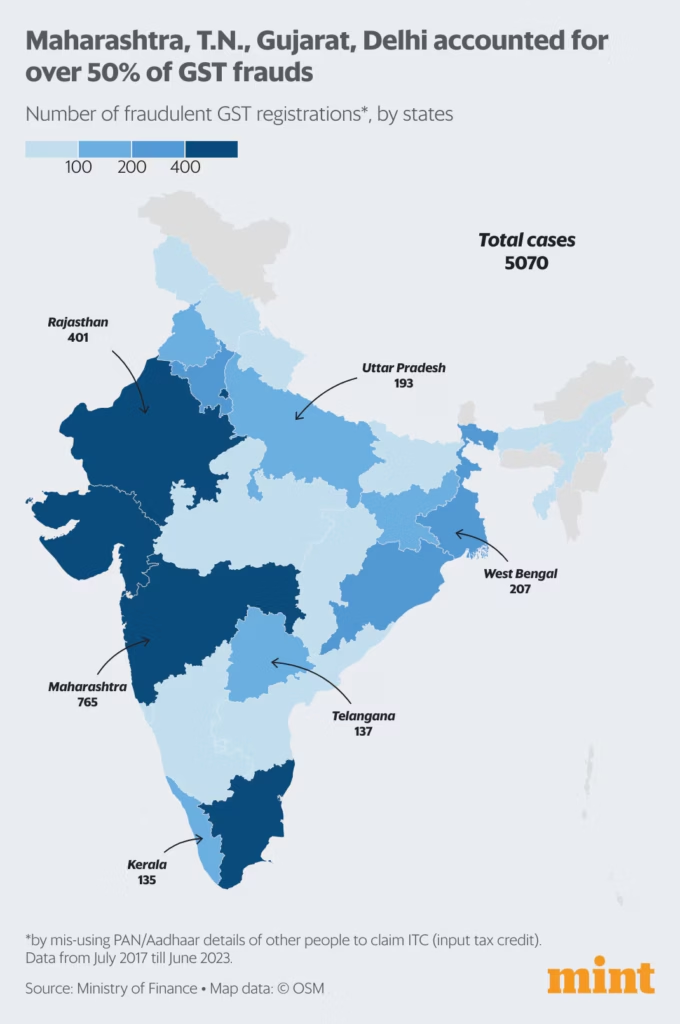

Historical Context: GST Fraud in India

This isn’t the first time GST fraud has hit the headlines. Since the launch of GST in India in 2017, fake invoices have become a common tool for fraudsters. According to data from the Central Board of Indirect Taxes and Customs (CBIC), authorities detected over 21,000 cases of fake GST invoices between 2018 and 2023, amounting to ₹1.35 lakh crore in fraud.

One infamous case occurred in 2021 when investigators unearthed a ₹4,521 crore fake invoice scam in Delhi involving multiple shell companies. Another in Gujarat exposed over ₹700 crore worth of fraudulent tax credits being claimed by bogus firms.

These cases show a pattern—fraudsters exploit weaknesses in compliance and monitoring, often using fake companies, bogus transactions, or insider access.

Why Noida Police Arrests Man for Creating Fake GST Invoices Case Matters Globally?

Even if you’re reading this from the U.S., you might be wondering: “Why should I care about some scam in India?” Here’s the deal—fraud is a global problem.

- In the U.S., the IRS loses nearly $441 billion annually due to tax fraud and evasion.

- During the COVID-19 pandemic, Paycheck Protection Program (PPP) fraud alone cost taxpayers $200 billion.

- In Europe, VAT fraud costs the EU nearly €93 billion every year, according to the European Commission.

The playbook is the same everywhere—fake paperwork, identity theft, and exploiting loopholes. And in every case, honest taxpayers and businesses pay the price.

Breaking Down GST Fraud (Made Simple)

Let’s unpack the jargon so it’s easy enough for a 10-year-old:

- GST (Goods and Services Tax): Like sales tax in the U.S., but applied across India on most goods and services.

- Invoice: A bill. Like when you buy sneakers at Nike, the receipt is your invoice.

- Fake Invoice: A fake receipt for something that never happened—like saying you bought 100 pairs of Jordans when you didn’t.

- Input Tax Credit (ITC): Businesses can claim back the tax they already paid on purchases. Fraudsters create fake invoices to claim refunds they’re not entitled to.

In this case, Tyagi used company data and tech tools to generate false paperwork, claiming benefits that never existed.

How the Fraud Was Executed?

According to police reports:

- Tyagi misused his access to GST filing portals.

- He fabricated invoices showing fake business transactions.

- Using these invoices, he filed fraudulent tax returns.

- He claimed around ₹1.8 crore in ITC refunds.

- Investigators seized phones, SIMs, laptops, and supporting documents that proved the manipulation.

Authorities believe the fraud was pre-planned and part of a network of fraudulent operators.

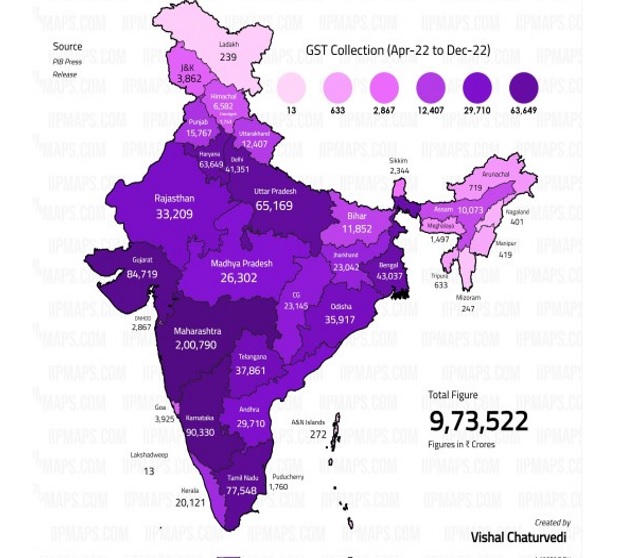

Impact on the Economy and Society

Here’s why fraud like this matters beyond corporate walls:

- Government Revenue Loss: India lost over ₹1.35 lakh crore in GST fraud since 2018. Money meant for roads, schools, and healthcare gets siphoned away.

- Higher Taxes: When revenue dips, governments compensate by raising taxes on honest taxpayers.

- Business Trust: Fraud cases scare investors, disrupt markets, and reduce trust in financial systems.

- Consumer Impact: Costs trickle down. Less government revenue means weaker infrastructure, reduced subsidies, or higher consumer taxes.

According to the World Bank, tax fraud slows economic growth and widens inequality.

Government Crackdowns and Reforms

To combat rising GST fraud, India’s government has introduced several measures:

- E-Invoicing System: All businesses above a certain turnover must generate electronic invoices validated by the GST portal.

- AI and Analytics: CBIC uses AI tools to detect suspicious invoice patterns.

- Blocking ITC: Businesses flagged for irregularities face restrictions on claiming tax credits.

- GSTN Data Sharing: Cross-verification between GST, customs, and income tax databases to catch fake entities.

These reforms have reduced fraud cases, but as seen in Noida, insider misuse remains a big challenge.

Lessons for Businesses: Don’t Let This Happen to You

If you’re a business owner, accountant, or professional, here are some practical steps to prevent GST fraud (and similar tax scams in the U.S.):

Step-by-Step Fraud Prevention Guide

Step 1: Tighten Internal Controls

- Restrict portal access.

- Use two-factor authentication.

- Rotate passwords regularly.

Step 2: Conduct Regular Audits

- Monthly invoice reviews.

- Third-party audits at least annually.

Step 3: Use Technology Wisely

- Fraud detection software.

- AI-powered analytics to flag unusual invoices.

Step 4: Train and Monitor Employees

- Workshops on compliance.

- Encourage whistleblowing.

Step 5: Stay Updated on Laws

- Follow official updates on GST.gov.in.

- In the U.S., use IRS.gov.

The Legal Fallout

The Noida Police charged Tyagi under the Bharatiya Nyaya Sanhita and the Information Technology Act. He is currently in judicial custody.

In India, GST fraud penalties include:

- 100% of the tax evaded as fine.

- Up to 5 years in prison.

In the U.S., penalties for tax fraud include:

- Fines up to $250,000.

- Jail time up to 5 years.

Expert Opinions

Experts emphasize that fraud like this often starts internally. A KPMG survey found that 75% of fraud globally involves insiders.

A tax consultant quoted in The Economic Times explained:

“Technology is a double-edged sword. Businesses must balance digital adoption with strict internal monitoring.”

Real-World Examples of Similar Scams

- U.S. PPP Loan Fraud (2020–21): Fraudulent claims cost $200 billion.

- Credit Card Fraud Worldwide: Millions lose money annually to identity theft.

- VAT Fraud in Europe: Criminal networks exploit cross-border loopholes.

The message is clear: loopholes attract fraudsters everywhere.

Fake Invoice Scam: DGGI Detects ₹43 Crore GST Evasion