Nomura Predicts 10% Jump in Car Demand: When it comes to cars in India, taxes matter almost as much as torque and mileage. Recently, global brokerage firm Nomura Holdings Inc. dropped a bold prediction: if India slashes the Goods and Services Tax (GST) on vehicles, the country could witness a 15–20% surge in car demand. Some headlines have simplified that into “10% jump,” but here’s the truth: Nomura’s estimate is even bigger, hinting at a real game-changer for India’s auto sector.

Nomura Predicts 10% Jump in Car Demand

Nomura’s prediction isn’t a wild guess—it’s based on solid trends. A 10% GST cut could drive car demand up by 15–20%, saving buyers thousands and lifting automakers into their next growth cycle. History shows India responds strongly to tax relief, and with reforms on the horizon, the Diwali season of 2025 could turn into a Black Friday-style car-buying fest. For now, the smart move is to wait—because this time, patience literally pays.

| Topic | Details |

|---|---|

| Prediction by | Nomura Holdings Inc. |

| Expected demand growth | 15–20% if GST is cut by 10% |

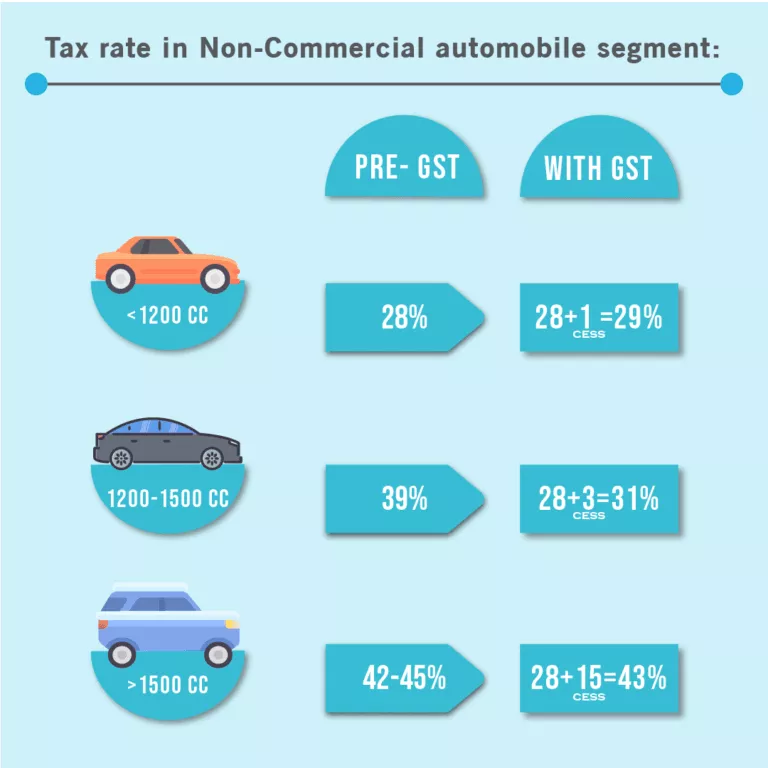

| Current GST on cars | 28% + cess on certain vehicles |

| Proposed GST reform | Two slabs: 5% & 18% (small car GST from 28% → 18%) |

| Timeline | Likely announcement before Diwali 2025 |

| Consumer savings | Up to ₹70,000 on small cars like Maruti Swift |

| Stock market impact | Auto stocks gained nearly ₹1 lakh crore in market value |

| Industry feedback | Automakers and dealers strongly in favor |

| Source | Reuters |

Why GST Cuts Matter So Much?

The 28% GST rate on cars makes Indian vehicles among the most heavily taxed in the world. Add extra “cess” on SUVs and luxury cars, and it’s no wonder Indian households stretch their budgets thin just to afford a set of wheels.

Nomura argues that even a 10% GST reduction could finally give middle-class buyers a real shot at ownership. And if that happens, showrooms from Delhi to Chennai could see crowds like never before.

Consumer Savings: A Real-World Example

Let’s take one of India’s most popular hatchbacks, the Maruti Suzuki Swift:

- Ex-showroom price: ~₹7 lakh

- Current GST (28%): ~₹1.96 lakh tax

- Proposed GST (18%): ~₹1.26 lakh tax

- Direct savings: ~₹70,000

That’s a vacation, a semester’s tuition, or six months’ worth of fuel for an average family. No wonder buyers are holding their breath for the government’s decision.

A Look Back: Past Tax Cuts and Sales Trends

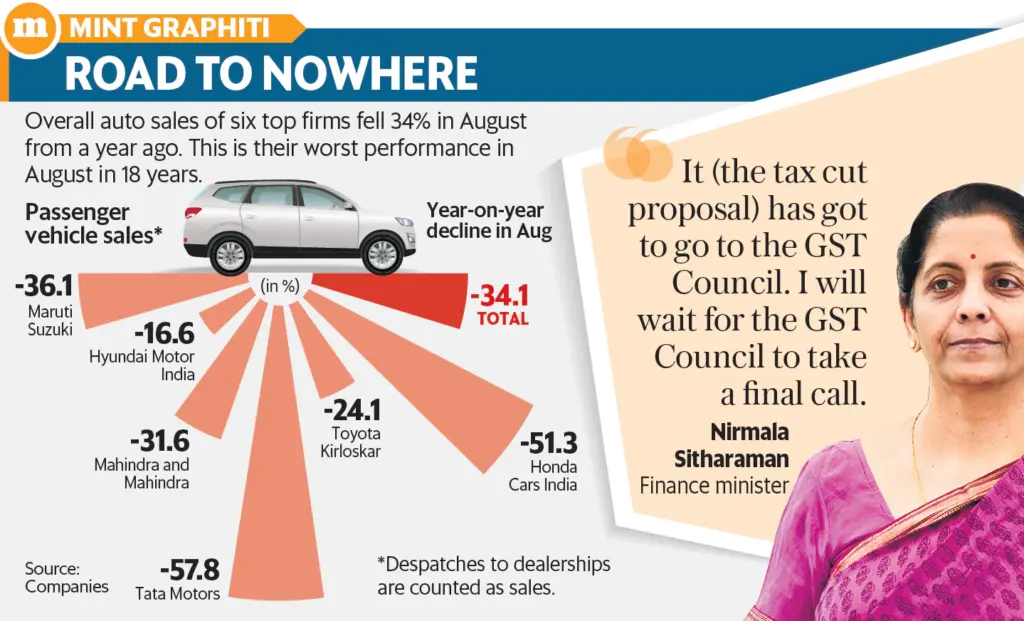

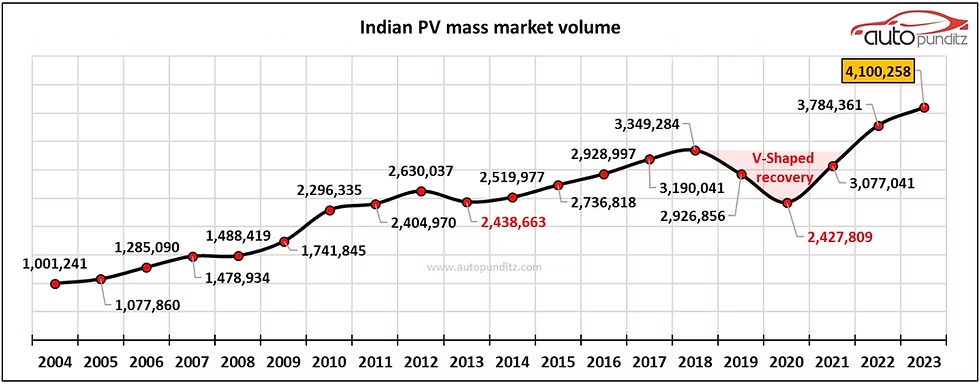

India’s car sales history proves one thing: lower taxes drive higher demand.

- 2008 Global Financial Crisis: The government cut excise duty on small cars to spur demand, and sales picked up almost instantly.

- 2017 GST Rollout: At first, automakers struggled with compliance, but as GST replaced multiple state taxes, small cars became more affordable, boosting volumes.

- COVID-19 Lockdowns (2020–21): Even temporary reductions in road tax by states like Karnataka led to spikes in local sales.

Nomura’s forecast builds on this track record: affordability fuels growth, period.

Why Indian Consumers React Strongly to Price Cuts?

Unlike in the U.S. where financing is flexible, Indian car buyers are extremely price-sensitive. A difference of even ₹50,000 can make or break a purchase decision.

For many middle-class families, a car isn’t just transport—it’s a status symbol and milestone purchase. This means tax relief could push fence-sitters to finally book their first four-wheeler.

What Automakers and Dealers Are Saying

Industry leaders have been vocal:

- SIAM (Society of Indian Automobile Manufacturers): “Lower GST will help affordability and accelerate mobility.”

- FADA (Federation of Automobile Dealers Associations): “India has just 30 cars per 1,000 people, versus 800 in the U.S.—there’s huge untapped demand.”

With such low ownership levels, the impact of tax cuts could be massive.

Market Already Smelling Opportunity

As soon as whispers of GST cuts hit the press:

- Auto stocks like Maruti Suzuki, Mahindra & Mahindra, Tata Motors, and Hyundai-linked suppliers soared to record highs.

- According to Livemint, Nifty Auto stocks gained nearly ₹1 lakh crore in value within days.

- Insurance companies also jumped, since lower GST on premiums could mean more policy sales.

Clearly, markets believe this isn’t just talk—it’s the start of a new auto upcycle.

Risks and Caveats

Of course, tax cuts come with strings attached:

- Government revenue hit – Auto taxes form a big slice of GST collections. Cutting rates means less money in the short term.

- Luxury buyers unaffected – The focus is on hatchbacks and compact cars, not SUVs or high-end imports.

- EV transition conflict – Lowering taxes on petrol and diesel cars could clash with India’s EV ambitions.

Balancing affordability and sustainability will be tricky for policymakers.

Global Comparison: India vs. U.S. and Europe

- India: 28% GST (among the world’s highest).

- U.S.: Sales tax varies by state, usually 6–10%.

- Europe: VAT between 19–25%, but governments offset costs with generous EV subsidies.

This makes India’s auto market relatively expensive, even though per-capita income is lower. A tax cut could help bridge that affordability gap.

Regional Impact: Who Benefits the Most?

Expect the biggest boom in:

- Tier-2 and Tier-3 cities: First-time buyers dominate these markets.

- Metro suburbs: Many families still rely on two-wheelers, but affordability could push them into entry-level cars.

- Northern states: Car ownership is often linked with status, so demand could skyrocket.

By contrast, luxury-heavy metros like Delhi and Mumbai may not see much change.

Impact on the Used-Car Market

While most conversations about GST cuts focus on new vehicles, the ripple effect on the used-car market could be equally significant. India’s pre-owned car industry is booming, with sales volumes nearly matching new car sales in recent years. If GST on new cars drops, two things may happen:

- Price Realignment – As new cars become more affordable, used-car prices may adjust downward to remain attractive. This could benefit buyers looking for budget-friendly options.

- Faster Upgrade Cycles – Existing car owners may be more motivated to trade in their old vehicles for new ones if price gaps shrink. This would increase supply in the used-car market, giving first-time buyers more choices.

According to industry reports, India’s used-car market is expected to cross 7 million units by 2026, driven by affordability and digital platforms. A GST cut on new vehicles may accelerate this trend, creating a “win-win” scenario where both new and used-car buyers benefit.

Long-Term Outlook: Beyond Just Tax Cuts

Nomura’s prediction isn’t just about cars today—it’s about shaping India’s mobility future:

- Volume boost → more profits → more investment in EV development.

- Cheaper cars mean faster rural adoption, improving connectivity and economic growth.

- Higher ownership creates demand for fuel, insurance, loans, and after-sales services—supporting multiple industries.

So while critics argue this slows down EV adoption, it may actually help automakers fund their green transition.

Practical Advice for Indian Car Buyers

Thinking of buying a car in 2025? Here’s the playbook:

- Wait until Diwali 2025 – The GST Council is expected to announce reforms by then.

- Target small cars/compact SUVs – These will see the biggest price drops.

- Factor in insurance – Lower GST also means cheaper policies.

- Negotiate finance – With lower EMIs, banks may offer better deals.

- Compare across brands – Budget-friendly automakers like Maruti may pass benefits faster than premium brands.

Patience could save you anywhere between ₹50,000–₹1 lakh.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash