NRI Students With Foreign Investments or Bank Accounts: If you’re an NRI student studying overseas, chances are you’ve got a lot on your plate — lectures, assignments, part-time jobs, maybe a few investments, and a foreign bank account or two. But here’s the thing: your financial life back in India doesn’t just disappear when you board that international flight.

The Indian Income Tax Department has clear rules about how Non-Resident Indians (NRIs) — including students — should handle income, foreign bank accounts, and investments. These rules exist to track cross-border money flows, prevent tax evasion, and comply with global agreements like FATCA (U.S.) and CRS (OECD countries). Even if you think, “I’m just a student, I don’t need to worry,” the law says otherwise. If you slip up, you could face penalties in India, your host country, or both. Let’s break it down step-by-step so you know exactly what to do — and what not to do.

NRI Students With Foreign Investments or Bank Accounts

Being an NRI student is exciting — new country, new opportunities — but tax rules don’t take a vacation. By knowing your residency status, understanding which income is taxable, and complying with both Indian and host country laws, you can avoid costly mistakes. A little preparation now means fewer surprises later — and more peace of mind to focus on what really matters: your studies and your future.

| Point | Details | Source/Reference |

|---|---|---|

| Who’s an NRI? | Stays in India for less than 182 days in a financial year (with exceptions) | Income Tax Dept |

| Taxable Income | Only income earned or accrued in India (rent, salary in India, Indian investments) | HSBC NRI Tax Guide |

| Foreign Bank Accounts | Not reported in Indian ITR unless claiming refund without Indian account or receiving Indian income directly abroad | Economic Times |

| Double Taxation Relief | DTAA avoids being taxed twice on the same income | CBDT |

| U.S. FBAR Rule | Must report foreign accounts if combined value > $10,000/year | IRS.gov |

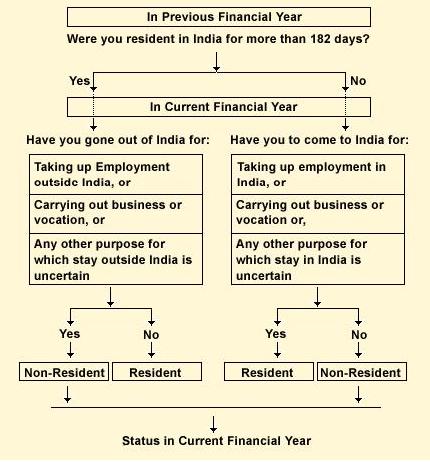

How to Know If You’re an NRI?

Your residential status determines your tax obligations. Under Section 6 of the Income Tax Act, you are an NRI if:

- You’re in India for less than 182 days in a financial year, OR

- You meet certain conditions about days spent in India over the previous four years.

Example: Ananya moves to Australia in July 2024 for a two-year MBA. She comes back to India for 30 days in December. She’s clearly an NRI for FY 2024–25.

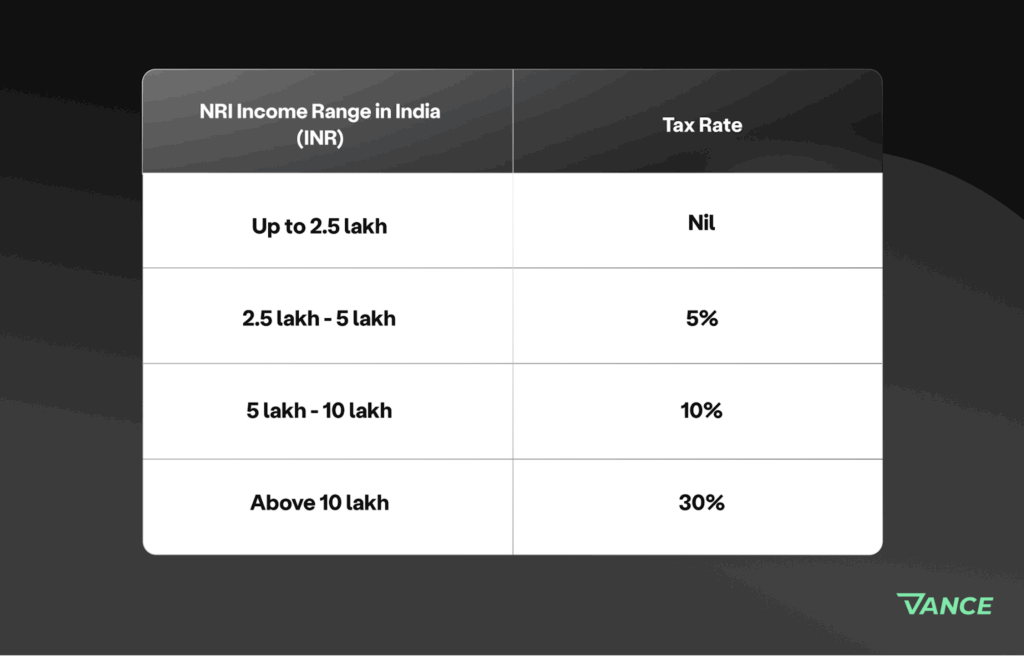

What Income Is Taxed in India?

India taxes only income that is earned or accrues in India for NRIs. This includes:

- Rent from Indian property

- Salary for work done in India

- Interest from Indian bank accounts or fixed deposits

- Capital gains from Indian stocks, bonds, or mutual funds

Foreign-sourced income — like your part-time job in the U.S. or interest from an overseas bank account — is not taxed in India if you qualify as an NRI.

NRI Students With Foreign Investments or Bank Accounts

In most cases, you do not need to declare your foreign bank accounts in India’s ITR forms. Exceptions include:

- If you’re claiming a refund but don’t have an Indian bank account.

- If you receive Indian income directly in a foreign account.

However, other countries often require disclosure. The U.S., for instance, requires FBAR filing if your foreign accounts total more than $10,000 at any point in the year.

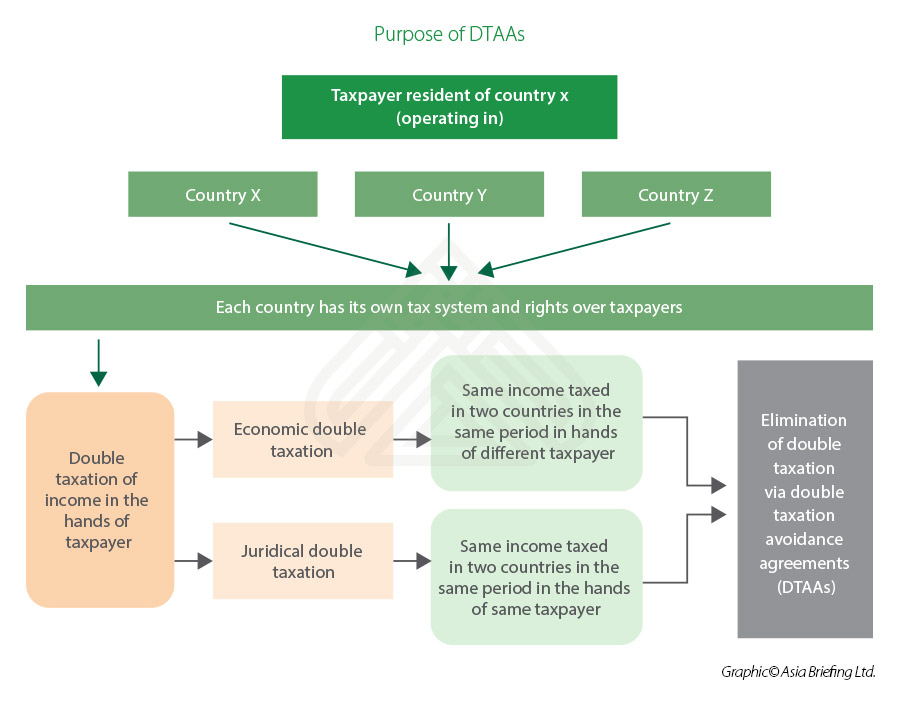

Understanding DTAA (Double Taxation Avoidance Agreement)

India has tax treaties with over 80 countries, including major student destinations like the U.S., U.K., Australia, and Canada. DTAA ensures you don’t pay tax twice on the same income.

Example: Rahul, studying in the U.K., earns rent from his flat in Bengaluru. He pays Indian tax on that rent but can avoid U.K. tax on it by showing proof under DTAA rules.

Recent Changes for NRI Mutual Fund Investors

From April 1, 2025, capital gains rules for mutual funds are changing. The holding period for long-term vs. short-term gains is being revised, and TDS for NRIs will apply at different rates for equity and debt funds. This means your net redemption amount could be lower if you don’t plan carefully.

Extra Rules for Popular Study Destinations

United States

- FBAR if foreign accounts exceed $10,000 aggregate.

- Form 8938 (FATCA) for foreign financial assets over IRS thresholds.

United Kingdom

- HMRC may tax worldwide income if you’re considered a U.K. resident.

- Certain Indian incomes may need to be declared under the “arising basis” of taxation.

Australia

- Australian Tax Office may require reporting of worldwide income if you’re a tax resident.

- DTAA with India prevents double taxation but requires filing in both countries.

Canada

- Canadian tax residents are taxed on worldwide income, including Indian FDs and rental income.

Gulf Countries

- No personal income tax, but Indian tax rules still apply for Indian income.

Step 7: Filing Your Indian ITR as an NRI

- Check your residency status.

- Identify India-sourced income.

- Choose the right ITR form — usually ITR-2 or ITR-3.

- Gather documents: bank interest statements, rent agreements, TDS certificates, capital gains reports.

- File online via Income Tax e-Filing Portal.

- Verify via Aadhaar OTP, EVC, or signed ITR-V form.

Common Mistakes NRI Students Make

- Not converting savings accounts to NRO/NRE accounts.

- Forgetting to file ITR for Indian income.

- Paying tax twice by not using DTAA benefits.

- Not maintaining financial records for six years.

Penalties and Consequences

- India: Penalty up to ₹5,000 for late filing (Section 234F), interest on unpaid tax, and possible prosecution.

- U.S. FBAR: $10,000 per non-willful violation; higher for willful cases.

- U.K.: Up to 200% of unpaid tax for non-disclosure of foreign income.

Myth-Busting NRI Tax Rules

Myth 1: Students are exempt from Indian tax laws.

Fact: NRI status applies regardless of student or professional status.

Myth 2: If I pay tax abroad, I don’t need to pay in India.

Fact: DTAA helps, but India still taxes Indian-sourced income.

Myth 3: Small amounts are ignored.

Fact: Even ₹1 earned in India can be taxable.

Case Studies

Case 1: U.S. Student

Priya in New York earns $15,000/year at a campus job, has an Indian FD earning ₹60,000 interest, and rents out her Delhi apartment. Her U.S. income is taxed only in the U.S.; Indian income is taxed in India, with DTAA credit applied in her U.S. return.

Case 2: Gulf Student

Ahmed in Dubai earns nothing abroad but has a mutual fund in India. Gains are taxed in India at applicable capital gains rates.

Annual Compliance Checklist for NRI Students

- Check NRI status annually.

- Convert Indian accounts to NRO/NRE.

- File Indian ITR if Indian income exists.

- Keep proof of foreign tax paid.

- Review DTAA benefits.

- Report foreign assets in host country.

Tax-Saving Tips for NRI Students

- Claim deductions under Section 80C (PPF, ELSS, NPS).

- Use Section 80D for health insurance.

- Optimize timing of visits to India to maintain NRI status.

- Consider NRE deposits for tax-free interest in India.

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Big Win for Bus Services: CESTAT Grants Service Tax Exemption for Employee & School Transport