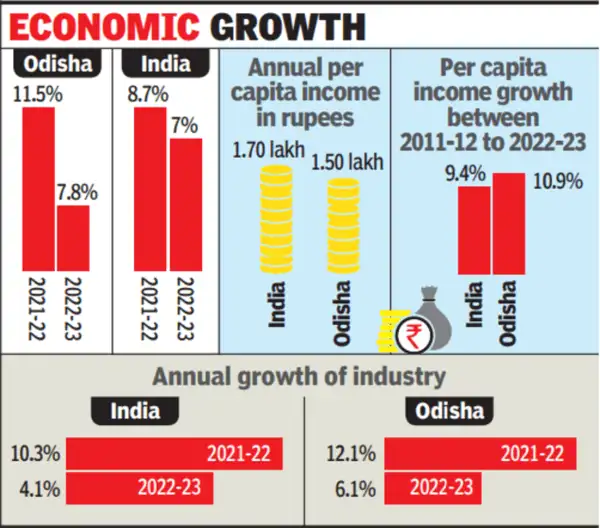

Odisha Rolls Out Major Policy Shifts: In a bold move to reshape its economic and developmental landscape, the Government of Odisha has rolled out major policy reforms targeting three high-impact areas: food processing, check dam irrigation, and GST (Goods and Services Tax) regulations. These changes, approved during the 23rd Cabinet meeting held on August 1, 2025, are poised to accelerate MSME investments, ensure water security for thousands of farmers, and tighten tax compliance in key sectors. Whether you’re an entrepreneur, a policy analyst, a small-town farmer, or just someone curious about how state reforms shape everyday life—this article breaks it all down step by step in a clear, conversational tone with professional insights you can trust. Let’s dive right in.

Odisha Rolls Out Major Policy Shifts

Odisha’s 2025 reform package is more than just administrative tweaks—it’s a strategic realignment toward faster approvals, better farming support, and fairer taxation. It puts the power of policy closer to the people, cuts through red tape, and builds a system that’s responsive and responsible. For food entrepreneurs, it means less paperwork and more opportunity. For farmers, it offers water security and multi-season farming. For honest businesses, it levels the playing field. With these reforms, Odisha isn’t just fixing old problems—it’s building a smarter, more inclusive future.

| Area | Change Introduced | Stats & Impact | Reference |

|---|---|---|---|

| Food Processing Policy | Decentralized fiscal incentive approval to district-level | Faster MSME subsidy disbursals; investment boost up to ₹50 crore | Odisha MSME Dept. |

| Check Dam Expansion | MATY-3.0 launched for 2025–30 | ₹2,738 crore investment; 6,842 check dams covered; 5 lakh+ farmers benefitted | Odisha WR Dept. |

| GST Reforms | Amended ITC rules & added track-and-trace compliance | Improved tax clarity; curb evasion in brick, sand, and pan masala industries | Odisha GST Portal |

Why Odisha Rolls Out Major Policy Shifts?

Over the past decade, Odisha has evolved from a traditionally agrarian economy to one with rising industrial activity, especially in minerals, steel, and food sectors. However, as with any fast-evolving state, the benefits of growth haven’t reached everyone.

Several systemic bottlenecks have held back potential growth:

- Delays in MSME incentives due to centralization

- Vulnerable irrigation systems in rain-fed regions

- Persistent tax evasion in industries like mining, pan masala, and construction materials

To address these issues and make governance more responsive and future-ready, Odisha’s latest cabinet reshuffle prioritized policy changes with long-term socio-economic benefits.

Food Processing Policy Reform — Local Control, Faster Approvals

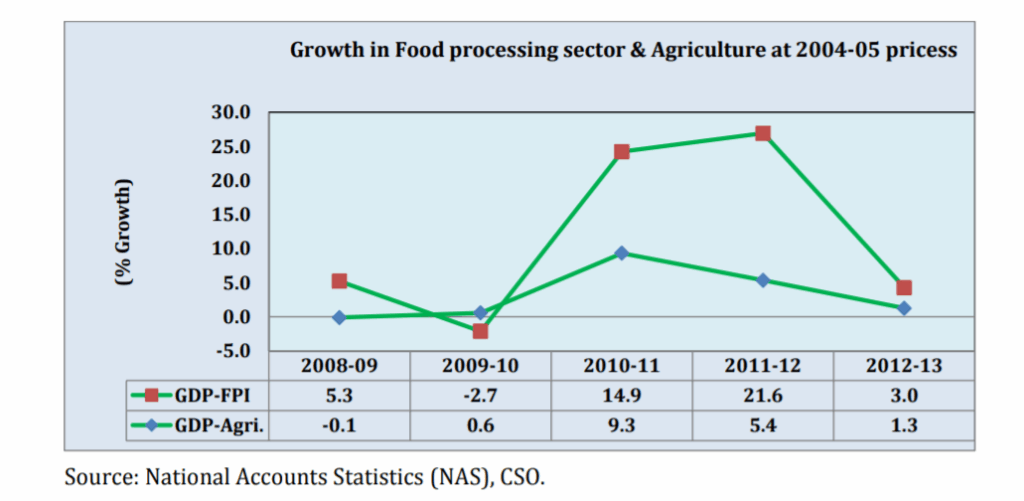

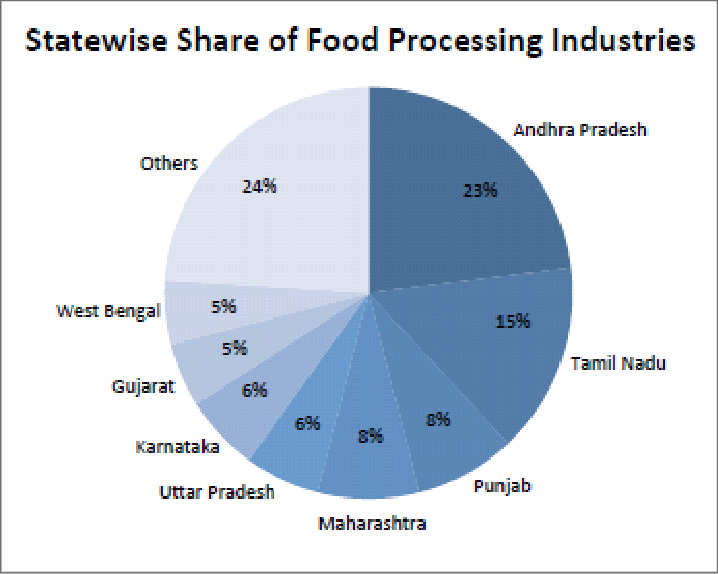

India’s food processing industry is among the fastest-growing globally. In states like Odisha, where agriculture employs over 60% of the population, expanding food processing is a game-changer. It creates local jobs, reduces post-harvest loss, and adds value before goods hit the market.

What Changed?

Under the old system (Food Processing Policy 2016, updated in 2022), financial incentives for units were routed through three centralized committees:

- State Level Committee (SLC): Projects above ₹1 crore

- State Level Empowered Committee (SLEC): ₹25 lakh to ₹1 crore

- State Level Decision Committee (SDLC): Below ₹25 lakh

Now, the process has been decentralized as follows:

| Committee | Chaired By | Approval Limit |

|---|---|---|

| District-Level Committee | District Collector | Up to ₹1 crore |

| SDLC | Director of Industries | ₹1–₹10 crore |

| SLEC | MSME Secretary | ₹10–₹50 crore |

This change is significant. For example, a tribal woman entrepreneur in Koraput setting up a ₹75 lakh millet flour unit can now get her subsidy cleared within the district—no need to chase files in the capital.

Why It Matters?

- Speed: Subsidy approvals are expected to go from 4–6 months to 2–3 weeks.

- Accessibility: First-time entrepreneurs from rural regions now have better access to capital.

- Growth: The state estimates a 25% jump in food processing unit registrations over the next 2 years.

According to the Ministry of Food Processing Industries (MoFPI), Odisha processed only 6% of its agricultural output in 2022. With this new model, that number could double by 2027.

Real-World Impact

In 2023, delays in approving a cold storage facility in Rayagada led to the spoilage of over 80 tons of tomatoes. Under the new framework, similar ventures can get quicker support and avoid such losses.

MATY 3.0 — Check Dams for Climate Resilience and Farmer Security

In Odisha, agriculture is a gamble when rainfall goes rogue. To help farmers weather the climate storm, the state launched MATY (Mukhyamantri Adibandha Tiyari Yojana) in 2015. After two successful phases, MATY 3.0 has arrived with a bigger budget and a bolder vision.

What’s Included?

The MATY 3.0 (2025–30) program focuses on improving local water retention through the construction and renovation of small-scale check dams.

Key deliverables:

- 3,313 new check dams

- 3,529 old check dams renovated

- 57,525 hectares of additional irrigated land

- 41,713 hectares of restored, previously non-functional land

Budget allocation: ₹2,738 crore

Implementation window: FY 2025–26 to 2029–30

Why It Matters?

- More Crops Per Year: Check dams help enable Rabi crops in areas that could only support Kharif (monsoon) cropping before.

- Groundwater Recharge: Small dams reduce runoff and raise the local water table.

- Drinking Water Access: Stored water benefits over 1.2 million people across rural villages.

According to a CGWB report, check dams can reduce irrigation dependency on groundwater by up to 30%.

Practical Example

In Balangir district, a 2022 check dam turned a parched zone into a greenbelt. Farmers shifted from mono-crop paddy to high-value vegetables, tripling their income within two seasons.

Implementation Tips for Farmers

- Propose a site via your Gram Panchayat or BDO

- Community-led projects get faster approvals

- NGOs can co-develop with farmer-producer groups

GST Reforms — Clean Up the System, Catch the Dodgers

Let’s be honest: tax rules can get technical. But this new GST overhaul isn’t just a numbers game—it’s about restoring fairness to the system.

What Changed?

- ITC (Input Tax Credit) Clarification:

- Amended from “plant or machinery” to “plant and machinery” to prevent misuse.

- Aligns with the 2025 amendment to Section 17(5)(d) of the Central GST Act.

This closes a long-standing legal gap that businesses used to claim credit on real estate-based ‘plant’ infrastructure like office buildings disguised as manufacturing plants.

- Track & Trace Enforcement:

- Mandatory GPS tracking and record-keeping for pan masala, bricks, and sand industries.

- Aims to control under-invoicing and illegal sales.

- Return Filing Simplification:

- Businesses can now proportionally reverse ITC if credit notes are issued—streamlining paperwork and saving time.

Why It Matters?

- Increased Revenue: Odisha lost over ₹800 crore in suspected tax evasion from sand and brick operations last year.

- Fair Play: Registered businesses that play by the book will no longer be undercut by illegal operators.

- Improved Data: Real-time tracking improves enforcement and planning.

According to GST Council data, states that implemented similar enforcement saw up to a 15% increase in monthly returns filed in high-risk sectors.

Punjab Achieves Staggering 32% GST Growth in July—Finance Minister Harpal Singh Cheema Reveals

GST Collections for July 2025: You Won’t Believe Which State Tops the List!

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!