Omni Bus Owners Cry Foul Over Alleged Illegal Tax Collection in Tamil Nadu: When Omni Bus Owners cry foul over alleged illegal tax collection in Tamil Nadu, it’s not just a headline—it’s a story that cuts deep into how business owners, drivers, and everyday passengers deal with rules, enforcement, and sometimes exploitation. Imagine this: you pay your road taxes on time, keep your papers clean, follow every regulation, and still, you’re stopped and told, “Hey, there’s a special tax you’ve got to pay if you want to keep moving.” That’s exactly the claim Omni bus operators are making today. And the issue isn’t small—it affects thousands of passengers, dozens of operators, and the wider economy of Tamil Nadu, one of India’s busiest travel hubs.

Omni Bus Owners Cry Foul Over Alleged Illegal Tax Collection

The controversy over illegal “special tax” collections from Omni bus operators in Tamil Nadu highlights a bigger issue: the gap between law and enforcement. Operators are already burdened with high legal taxes, yet face harassment that raises costs, delays travel, and damages public trust. For Tamil Nadu, this is not just a transport story—it’s about governance, transparency, and protecting livelihoods. For global readers, it’s a reminder: whenever rules are unclear or ignored, corruption thrives. The solution lies in strong oversight, digital systems, and a firm commitment to fair business practices.

| Topic | Details |

|---|---|

| Issue | Alleged illegal collection of a “special tax” from Omni bus operators in Tamil Nadu. |

| Tax Burden | Operators already pay ₹90,000 every 3 months in central road taxes, plus state-level seating capacity taxes. |

| Extra Charges | Demands of ₹20,000 – ₹1,00,000 as “special tax,” especially during festivals and holidays. |

| Impact | Delays at toll gates, driver harassment, mental stress, and disruption of travel services. |

| Response | Complaints raised with Transport Minister and Commissioner; threat of protests in Chennai. |

| Legal Context | Prior Madras High Court rulings prohibit such collections, but reports say enforcement is weak. |

| Source | The New Indian Express |

What’s Happening in Tamil Nadu?

Omni buses in India are the backbone of intercity travel. Think of them like Greyhound buses in the U.S.—they connect big metros with smaller towns, often filling in when trains or government buses are overcrowded. During peak seasons like Diwali, Pongal, and summer vacations, these buses are often the only way for families to travel.

The problem? Operators are claiming that while they already pay heavy taxes to both central and state governments, they’re being forced to pay additional, illegal “special taxes.” These charges are not officially listed anywhere in government records, but they’re allegedly being demanded by certain enforcement officers at checkpoints and toll plazas.

Historical Context

This is not the first time such allegations have surfaced. Over the years, Tamil Nadu bus operators have had multiple face-offs with authorities:

- 2018: Omni bus operators protested skyrocketing fuel prices and threatened strikes during holidays.

- 2020–21: During the COVID-19 lockdown, the government attempted to collect taxes despite buses not operating. The Madras High Court stepped in to provide relief to operators.

- Festival Seasons (every year): Associations often report harassment and extra charges under the guise of “checks” or “penalties.”

This shows a pattern: whenever passenger demand spikes, so do the reported instances of harassment and unofficial collections.

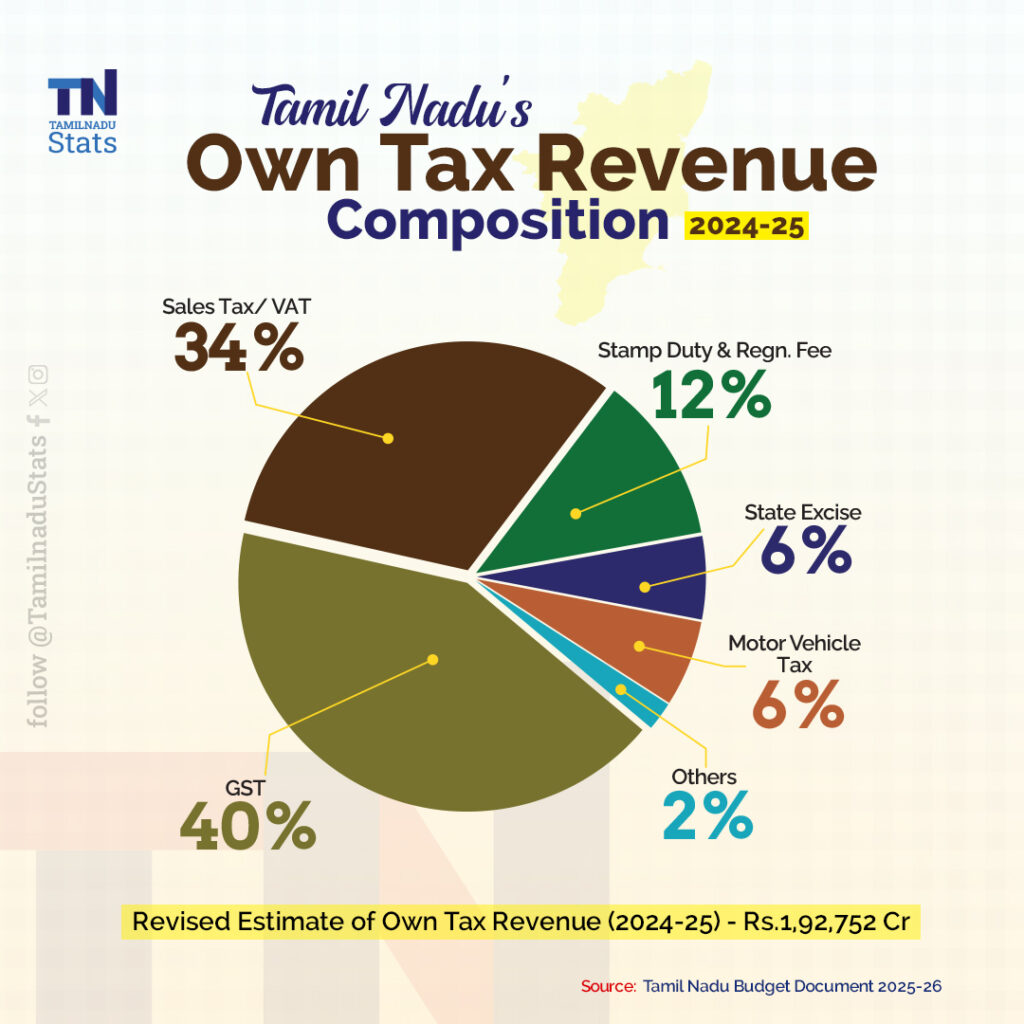

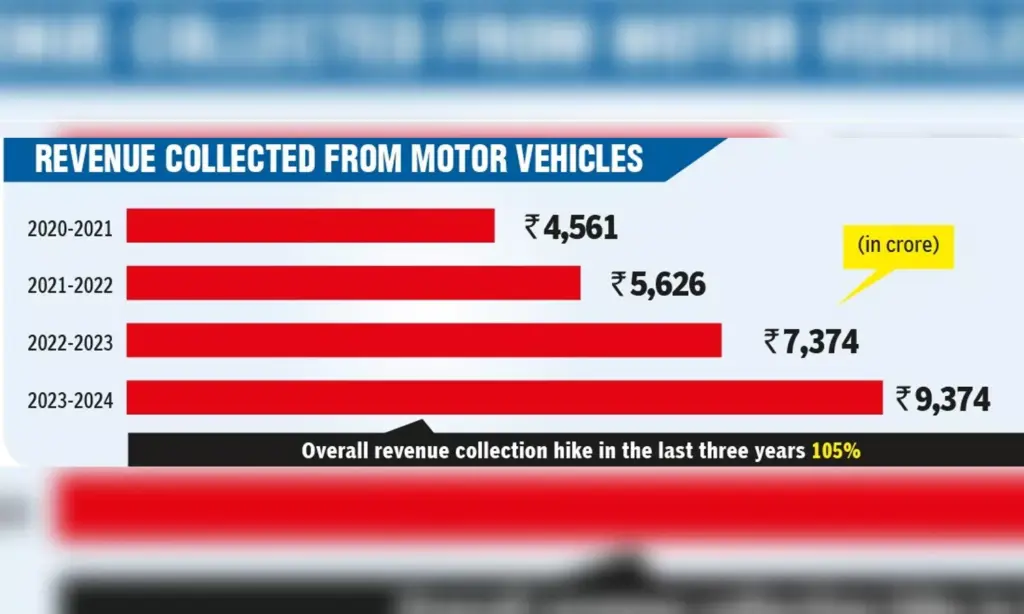

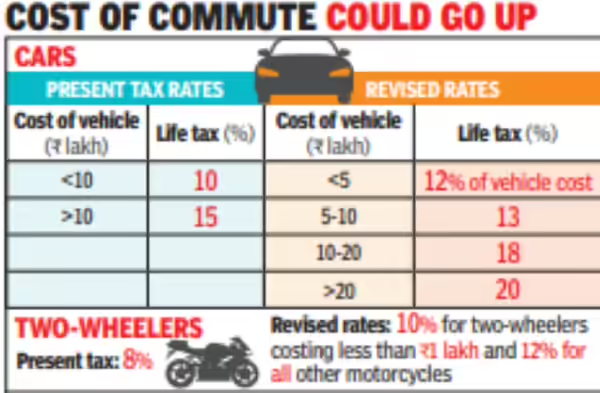

How Big Are the Official Taxes?

To understand the frustration, let’s break down the numbers:

- Central Road Tax: About ₹90,000 every three months (roughly $1,075), depending on bus size.

- State-Level Seating Capacity Tax: States charge operators based on the number of seats on each bus.

- Permit Fees: Additional costs for interstate or all-India permits.

Now add in insurance, maintenance, fuel (which in India can cost around ₹100 per liter, or $4.80 per gallon), driver salaries, and loan repayments for buses that often cost ₹80 lakh ($96,000+) or more. Margins are already thin.

So when a so-called “special tax” of ₹20,000–₹1,00,000 gets demanded, it’s not pocket change—it’s a major financial blow.

Harassment at Toll Gates

Operators and drivers report that harassment often looks like this:

- Long Checks: Inspectors hold buses at checkpoints for hours under the excuse of “paperwork inspection.”

- Threats: Drivers are told they could face suspension, penalties, or even impoundment of their vehicle.

- Festive Season Pressure: When demand is highest and buses are fully booked, operators are more likely to pay just to avoid delays, since keeping hundreds of passengers waiting is not an option.

This creates mental stress for drivers and disrupts schedules, leading to late arrivals and angry passengers.

How Other Regions Do It?

Comparisons highlight how Tamil Nadu’s system lags:

- United States: The FMCSA (Federal Motor Carrier Safety Administration) enforces clear rules, and payments are centralized through digital systems. Surprise “extra” charges are practically unheard of.

- Europe: Countries like Germany use electronic toll collection linked directly to vehicle registrations, making off-the-book charges nearly impossible.

- Other Indian States: While corruption isn’t absent, states like Karnataka and Kerala have fewer organized reports of systematic “special tax” collections.

This contrast shows that digital transparency and centralized enforcement are key to preventing corruption.

Impact on the Economy and Society

- Passenger Costs: Operators pass these illegal expenses to customers, raising ticket prices by 20–30%.

- Tourism: Tamil Nadu, home to UNESCO heritage sites like Mahabalipuram and hill stations like Ooty, depends on affordable transport. Rising costs and unreliable services hurt tourism revenue.

- Employment: Bus companies employ thousands of drivers, cleaners, and office staff. If profits fall, jobs are at risk.

- Public Trust: When court orders are ignored, faith in governance declines. Businesses feel the system is stacked against them.

Expert Voices

- A. Pandiyan, association founder, has openly accused officials of harassment and illegal collections, stating: “We pay every tax required by law. These demands are nothing but extortion. If the government doesn’t act, we will take this protest to Chennai.”

- R. Gajalakshmi, Transport Commissioner, acknowledged the complaints and promised an inquiry.

- Legal Experts: Lawyers argue that ignoring High Court rulings could be grounds for contempt of court, urging operators to take the legal route.

Action Plan for Operators

Step 1: Stay Documented

Keep receipts, digital payment records, and even video proof where possible.

Step 2: File Written Complaints

Approach the transport department with formal letters instead of only verbal objections.

Step 3: Leverage Media

The issue only came to the spotlight after local newspapers picked it up. Media pressure works.

Step 4: Legal Recourse

If officials continue despite High Court rulings, operators should file contempt petitions.

Step 5: Push for Digital Enforcement

Industry associations can lobby for centralized digital toll and tax systems.

Omni Bus Owners Cry Foul Over Alleged Illegal Tax Collection: Lessons for Global Business Owners

Even if you’re running a trucking fleet in Texas or a logistics startup in California, this case offers universal lessons:

- Know your rights and obligations. Don’t let vague “rules” intimidate you.

- Organize as an industry. Associations give power to challenge unfair practices.

- Digitize payments. Transparency reduces space for corruption.

- Use media and legal channels. Silence only allows exploitation to grow.

Net Direct Tax Collection Drops 4% – Should You Worry About FY26?

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth

How India’s Broken Tax System Is Crippling the Circular Economy Revolution