Online Gaming Bill Explained: The Online Gaming Bill, 2025 has become one of the hottest topics in India’s digital economy, with ripple effects across the globe. This legislation, approved by the Union Cabinet in August 2025, is not just another routine policy tweak—it’s a turning point for millions of players, advertisers, and gaming companies. At its core, the Bill aims to ban real-money online gaming while creating a framework to regulate e-sports and social gaming. That means popular fantasy sports, poker apps, and online rummy are effectively outlawed, while competitive video gaming and casual play remain legal but subject to oversight. If you’re a gamer, advertiser, or simply curious about how government policies shape the digital world, this breakdown will help you understand the full picture.

Online Gaming Bill Explained

The Online Gaming Bill, 2025 is a landmark shift in India’s approach to digital gaming. By banning real-money games outright, the government is prioritizing youth protection and fraud prevention over economic expansion. For players, it means a pivot away from fantasy sports and money-based card games toward safer e-sports and casual play. For advertisers, it represents a loss of one of the fastest-growing digital ad sectors. For the industry, it is both a setback and an opportunity—one door closing while another opens. Globally, the bill will be watched closely as countries balance the challenges of digital addiction, fraud, and economic growth. One thing is certain: in India, the online gaming landscape will never be the same.

| Aspect | Details |

|---|---|

| Introduced | Union Cabinet approved August 19, 2025 (Official Source) |

| Main Goal | Ban real-money gaming, regulate e-sports & social gaming |

| Who’s Affected | Players, advertisers, payment gateways, influencers |

| Penalties | Jail: up to 3 years; Fines: up to ₹1 crore for operators; ₹50 lakh for advertisers |

| Regulation | New authority (similar to a National Online Gaming Commission) will oversee platforms |

| Ad Rules | Explicit ban on promoting real-money games; influencers face liability |

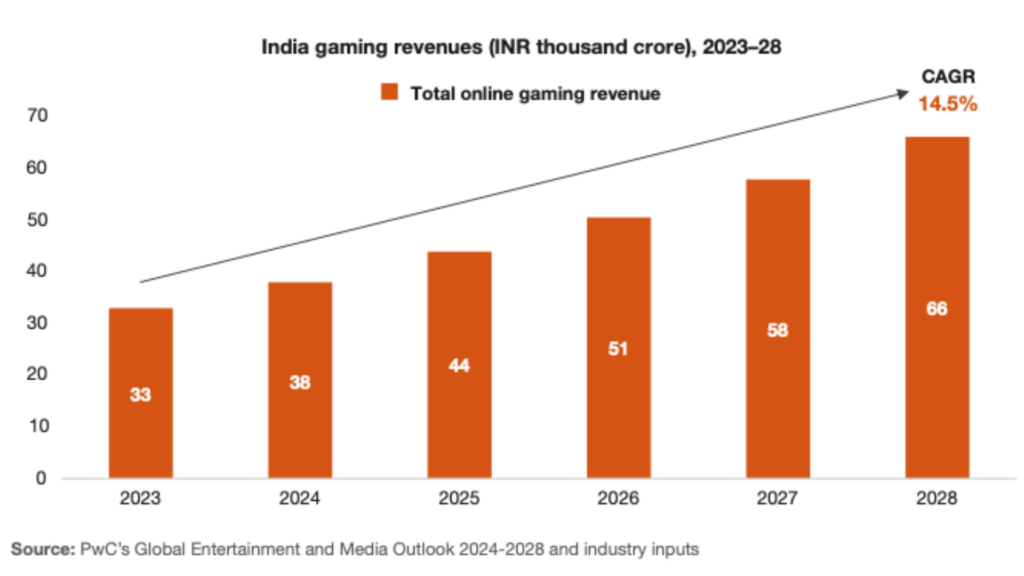

| Economic Stakes | $3B industry projected to hit $8.6B by 2027 now at risk |

Why the Bill Was Introduced?

The government outlined three key motivations behind the law:

- Addiction and Youth Protection – Policymakers cited multiple reports of teenagers losing money and time to addictive online betting apps. The Ministry of Electronics and IT highlighted cases of minors spending thousands of rupees without parental knowledge.

- Fraud Prevention – With no unified regulation, hundreds of unlicensed apps sprang up, some vanishing overnight with players’ deposits. The bill is designed to choke off these operators.

- Legal Clarity – Courts have long debated whether fantasy sports should be classified as games of skill or chance. The new law sidesteps the debate entirely by banning all forms of real-money games.

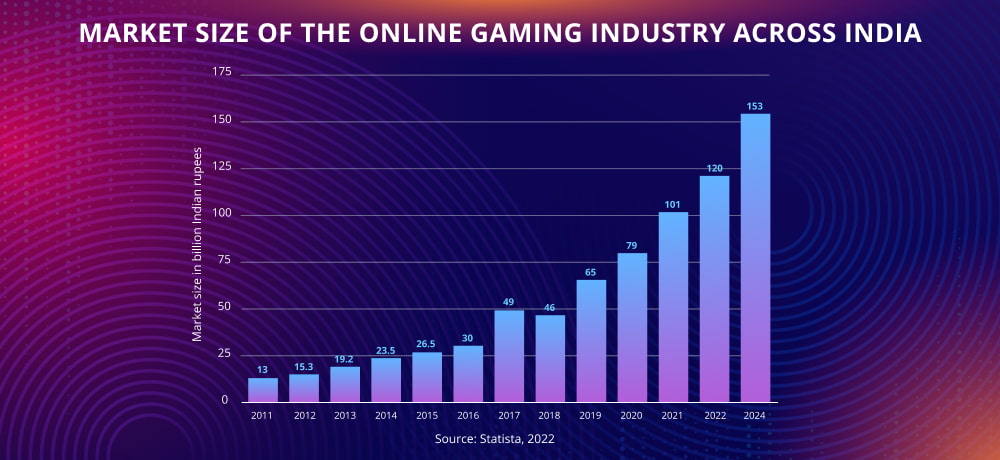

A KPMG report estimated the Indian online gaming sector was worth $3 billion in 2024, with fantasy sports and card games making up a major share. By targeting real-money games, the government has disrupted a fast-growing industry but argues it is acting in the public interest.

What Online Gaming Bill Means for Players?

For everyday players, the impact is dramatic.

What Stays Legal

- E-sports competitions like PUBG, Call of Duty, or FIFA tournaments.

- Casual social games such as Candy Crush, Among Us, and Clash of Clans.

- Subscription models where users pay to access premium features but don’t gamble.

What’s Banned

- Fantasy sports platforms like Dream11, MPL Fantasy, and others.

- Poker, rummy, and teen patti apps involving monetary stakes.

- Any hybrid game that mixes cash-based entry fees with skill-based outcomes.

Player-Level Consequences

While individual players are unlikely to be jailed, their transactions will be blocked. Banks, UPI services, and wallets like Paytm and Google Pay will be prohibited from processing payments linked to real-money gaming. This effectively cuts off access at the financial level.

What It Means for Advertisers?

For advertisers and marketing agencies, the bill is equally transformative.

- Complete Advertising Ban – Promoting or endorsing real-money games is illegal.

- Influencer Liability – Social media influencers who previously made big earnings by promoting fantasy leagues may now face jail time or fines.

- Revenue Shock – Online gaming firms spent over ₹5,000 crore (~$600 million) on advertising in FY 2023–24, according to Statista. That revenue source has evaporated.

This creates a vacuum in digital advertising. Broadcasters, publishers, and online platforms that relied heavily on gaming ads will need to pivot toward other sectors.

Legal and Enforcement Framework

The bill introduces one of the toughest enforcement regimes globally.

- New Regulator – A proposed National Online Gaming Commission will register and oversee e-sports and social gaming companies.

- Warrantless Powers – Authorities are empowered to conduct searches, seizures, and arrests in both physical and digital environments without prior warrants.

- Severe Penalties – Operating a banned platform can lead to up to 3 years in prison and fines of ₹1 crore. Advertisers face up to 2 years in prison and fines up to ₹50 lakh.

The law also gives regulators the right to override access controls, meaning they can bypass firewalls or private servers if they suspect violations.

Economic and Industry Impact

The consequences are far-reaching:

- Startup Disruption – India has been home to over 500 gaming startups, many of which raised millions in venture capital. These companies now face closure or forced business model pivots.

- Job Losses – The All India Gaming Federation projects 200,000+ direct and indirect jobs could vanish.

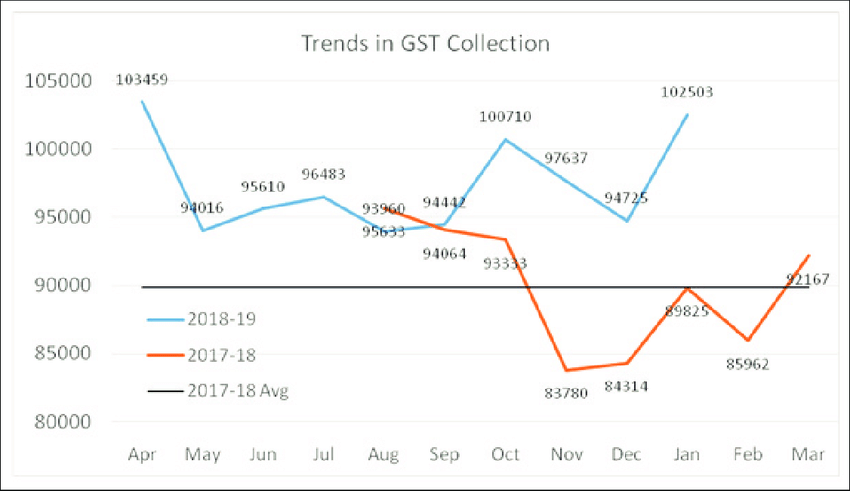

- Tax Losses – The government collected ₹2,200 crore in GST from online real-money games in 2024. That revenue stream is now gone.

- Shift to E-sports – With fantasy sports out, the focus may shift to organizing e-sports tournaments, which are still legal.

In the long run, the industry may rebuild around safer models like subscription gaming, streaming, and e-sports sponsorships.

How India’s Move Compares Globally?

India is not the first to regulate gaming, but its approach is among the strictest.

- United States – Online poker was banned federally in 2006 under UIGEA, though states have since legalized sports betting individually. Regulation is fragmented but generally favors taxation.

- China – Enforces strict limits on minors’ gaming hours and bans online gambling outright. India’s ban resembles China’s blanket approach.

- United Kingdom – Allows online gambling but under a heavy regulatory and taxation framework. Operators must comply with strict licensing conditions.

India has opted for prohibition rather than regulation, signaling a focus on social protection over industry growth.

Industry Reactions

Reactions have been divided along predictable lines:

- Gaming Startups – Leaders at Dream11 and MPL criticized the decision as “a death blow to innovation,” claiming India risks losing billions in investment.

- Advertisers – Agencies warn of a sudden advertising vacuum, as gaming ads were among the fastest-growing categories.

- Parents and Educators – Supportive, arguing that the bill will reduce addiction and protect young people from risky behavior.

- Policy Analysts – Some suggest the government may eventually return to a regulated model, similar to how the U.S. evolved sports betting regulation.

Players’ Perspectives

The player community is also split.

- Casual Gamers – Unaffected. Their free-to-play experiences continue.

- Fantasy League Fans – Upset. Many built communities and side incomes through fantasy sports competitions.

- Professional Gamers – Optimistic. With e-sports receiving legitimacy, there could be more sponsorships and organized leagues.

Practical Outlook and Future Opportunities

While real-money gaming is banned, other sectors may thrive.

- E-sports – Expect larger tournaments and sponsorship deals. India could become a hub for professional competitive gaming.

- AR/VR Gaming – With restrictions on betting, tech-driven entertainment like VR may gain traction.

- Subscription Services – Netflix-style gaming subscriptions could see rapid adoption.

- International Investment – Some investors may pull back, but others may back e-sports, casual gaming, and content platforms.

Step-by-Step Guide for Navigating the Change

For Players

- Stick to legal platforms to avoid scams.

- Explore e-sports competitions for legitimate play.

- Set time and money limits to practice safe gaming habits.

For Advertisers

- Redirect budgets toward e-sports sponsorships or consumer goods.

- Work with influencers who focus on legal gaming.

- Implement compliance systems to avoid accidental promotion of banned apps.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Caught Profiteering! Subway Franchise Penalized ₹5.45 Lakh for Withholding GST Rate Cut Benefits

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties