Online Gaming Income FY25: If you’ve been raking in winnings from online gaming in FY25, you need to pay close attention to how taxes, TDS rules, and ITR reporting work this year. Whether you’re crushing it on Dream11, hitting jackpots on poker apps, or casually playing online rummy, the Indian Income Tax Department wants its share of your winnings. This might sound confusing at first, but don’t worry. Think of this as your all-in-one guide that breaks things down into simple steps, real-life examples, professional insights, and legal clarity. Even a 10-year-old gamer could follow along, while finance pros will appreciate the statutory references and international comparisons.

Online Gaming Income FY25

Online gaming in FY25 is fun, but the taxman is serious. With a flat 30% tax rate, strict TDS rules, and mandatory ITR reporting, compliance is no longer optional. Treat your gaming income like any other professional income—keep records, file returns on time, and stay transparent. Doing so not only saves you from penalties but also builds financial credibility for loans, visas, and investments.

| Aspect | Details (FY 2024-25) |

|---|---|

| Tax Rate on Online Gaming | Flat 30% under Section 115BBJ (no deductions, no exemptions) |

| TDS Rule | 30% TDS under Section 194BA, deducted at withdrawal or year-end |

| Net Winnings Formula | Withdrawals – (Opening Balance + Non-taxable Deposits) |

| Loss Treatment | Cannot be offset against other income or carried forward |

| ITR Filing | Mandatory even if you earned ₹10; report under Income from Other Sources |

| Common ITR Forms | ITR-2 (no business income), ITR-3/4 (if professional or business income) |

| Deadline | July 31, 2025 (for most taxpayers) |

| Official Resource | Income Tax e-Filing Portal |

Background: Why Online Gaming is Taxed Strictly

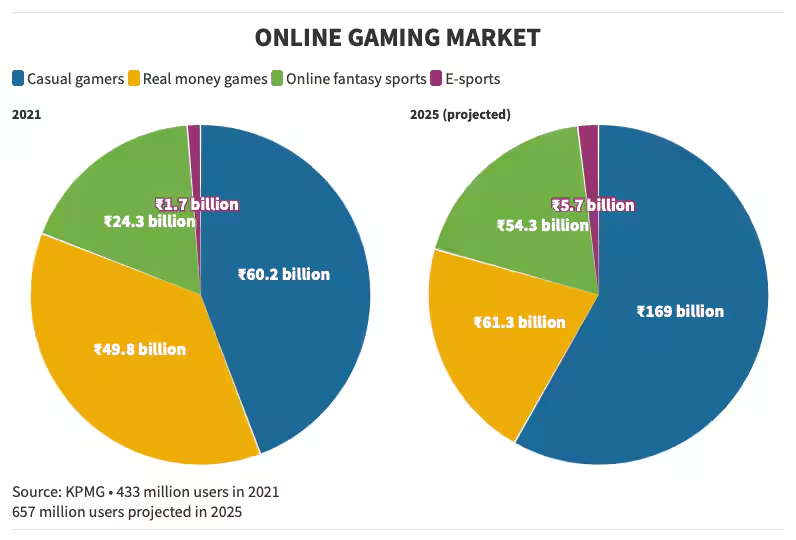

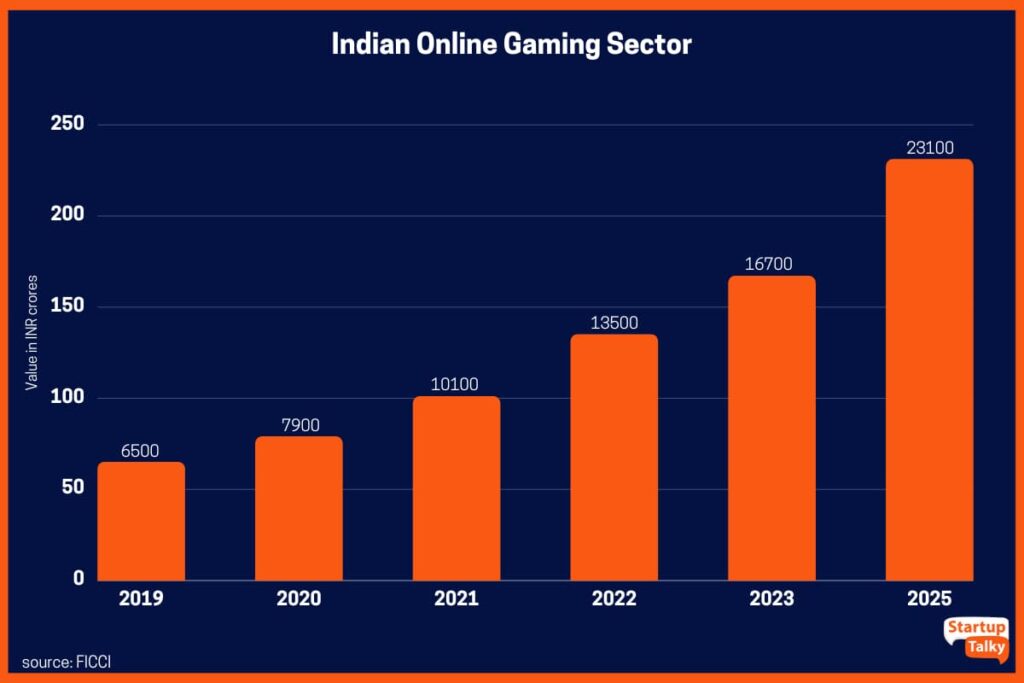

Online gaming is not just fun anymore; it’s a booming industry. According to KPMG India, the Indian online gaming market is expected to touch $8.6 billion by FY27. With such growth, the government recognized the need to regulate and tax winnings transparently.

Before FY23, winnings were taxed under the same provisions as lotteries and horse races. But with millions of new users joining online fantasy sports, poker apps, and real-money games, lawmakers introduced specific provisions through the Union Budget 2023. These included:

- Section 115BBJ: Flat 30% tax on winnings.

- Section 194BA: Mandatory TDS deduction by platforms.

- Rule 133: Formula for calculating net winnings.

FY25 marks the first full year of strict implementation, meaning every player—from casual college students to professional eSports athletes—is covered.

Tax Rate Explained: Section 115BBJ

The most important thing to know: all net winnings are taxed at a flat 30%.

Example 1:

- Deposit: ₹5,000

- Withdrawal: ₹15,000

- Net winnings = ₹10,000

- Tax = ₹3,000

Example 2:

- Deposit: ₹1,000

- Withdrawal: ₹900

- Net winnings = Nil (no tax applies, as you lost money).

Unlike salary income, you cannot claim deductions under Section 80C, medical allowances, or HRA. Gaming income is treated separately, much like lottery or betting income.

TDS Rules: Section 194BA

Gaming platforms like Dream11, RummyCircle, PokerBaazi, and MPL have become tax collectors. They are required by law to deduct 30% TDS on net winnings either:

- At the time of withdrawal, or

- At the end of the financial year (March 31), whichever is earlier.

This ensures the government gets its tax cut before the money reaches your account.

Pro Tip: Always download your Form 16A (TDS certificate) from the platform at the end of the year. It helps you claim credit for taxes already deducted.

How to Report Online Gaming Income FY25 in ITR?

When filing your ITR for AY 2025-26:

- Report winnings under “Income from Other Sources”.

- Use Form 26AS or Annual Information Statement (AIS) to cross-check TDS details.

- If excess TDS has been deducted, claim a refund.

Which form should you choose?

- ITR-2: For salaried individuals with gaming income.

- ITR-3/4: For professional gamers or influencers whose income includes sponsorships, advertisements, and gaming.

For betting/gambling income, use profession code 21009.

Global Comparison: How Other Countries Handle Gaming Taxes

- United States: Winnings over $600 are reported to the IRS using Form W-2G. The tax rate can go up to 37%, depending on total income.

- United Kingdom: Gambling winnings are completely tax-free. The government taxes the operators instead.

- Australia: Professional players pay tax, but casual gamers don’t.

India’s flat 30% rate with mandatory TDS is one of the strictest regimes globally.

Casual Gamers vs. Pro Gamers: Who’s Impacted More?

Casual gamers: Even small winnings are taxable. For example, if you win ₹500, platforms deduct TDS if applicable, and you still must file returns if total TDS exceeds ₹25,000.

Professional gamers: If you stream games, play tournaments, or earn sponsorships, your income falls under business/profession. You must file ITR-3 or ITR-4, and in some cases, pay advance tax.

Case Study:

- A salaried employee wins ₹1,00,000 from online fantasy sports.

- TDS of ₹30,000 is deducted by the platform.

- He must file ITR-2, declare winnings under “Other Sources,” and claim TDS credit.

No Loss Offsets Allowed

A common misconception is that gaming losses can be adjusted against winnings. That’s false.

If you win ₹50,000 in poker and lose ₹40,000 in rummy, your taxable income is ₹50,000, not ₹10,000.

Losses cannot be carried forward to future years either.

Step-by-Step Guide to Filing ITR for Gaming Income

Step 1: Gather documents – gaming platform statements, Form 16A, Form 26AS, and AIS.

Step 2: Calculate net winnings using Rule 133’s formula:

Net Winnings = Withdrawals – (Opening Balance + Non-taxable Deposits).

Step 3: Enter in ITR – go to Income from Other Sources and declare winnings.

Step 4: Adjust TDS – input TDS entries in Schedule TDS.

Step 5: Submit and verify – file before July 31, 2025. Verify through Aadhaar OTP, Netbanking, or by sending a signed ITR-V.

Legal Consequences of Non-Compliance

Ignoring gaming income can land you in trouble:

- Penalty under Section 234F: ₹1,000 to ₹5,000 for late filing.

- Interest under Sections 234A/B/C: Payable on unpaid tax.

- Prosecution under Section 276CC: For deliberate non-filing (up to 7 years imprisonment in extreme cases).

Even small winnings not reported can trigger mismatch notices through AIS, since platforms directly report your activity to the tax department.

Tax Planning Tips for Gamers

- Set aside 30% upfront: Helps avoid cash-flow shocks at year-end.

- Keep detailed records: Maintain screenshots, transaction logs, and TDS certificates.

- Claim refunds: Many casual gamers overpay through TDS and later get refunds.

- Use professional help: Chartered accountants can guide pro gamers on GST, sponsorship income, and international tax issues.

- Avoid splitting accounts: Trying to hide winnings through multiple accounts can trigger compliance checks.

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

ITR 2025 Filing Guide – Why Students and Unemployed Must Not Skip It

Online Gaming Bill Explained – What Changes for Players and Advertisers

The Bigger Picture: Online Gaming as a Career

The online gaming industry in India is no longer a hobby—it’s a legitimate career path. With eSports tournaments, streaming, brand collaborations, and sponsorships, professional players can earn lakhs annually.

According to NITI Aayog’s report, over 400 million Indians play online games. The sector contributes significantly to digital innovation and employment. By formalizing taxation, the government is indirectly legitimizing gaming as a profession, though at a high cost to players.