Opposition States Back GST Rate Cut: When it comes to taxes, the Goods and Services Tax (GST) is one of the most hotly debated topics in India today. Recently, opposition-ruled states announced their support for the proposed GST rate cut, but with a major condition: they want compensation from the Central government to cover the massive revenue losses that will follow. This is not just an accounting exercise—it’s about how states will pay salaries, fund welfare programs, and keep the wheels of governance turning. At its heart, the fight is about whether the benefits of cheaper goods for consumers will outweigh the fiscal squeeze for state governments. If you’ve ever watched American states fight with Washington D.C. over Medicaid or education funding, you’ll understand the tension here.

Opposition States Back GST Rate Cut

The battle over the GST rate cut and compensation is not just about tax math—it’s about balancing the promise of cheaper goods for consumers with the financial stability of states. Opposition states are not rejecting reform; they’re simply asking for guarantees that public services won’t collapse under the weight of revenue losses. As India moves toward becoming a $5 trillion economy, the way it handles this issue will signal whether reforms can be rolled out with both efficiency and fairness.

| Point | Details | Source |

|---|---|---|

| What’s happening | Opposition states support GST rate cut but demand compensation | Official GST Council Website |

| Proposed GST structure | 5% and 18% rates, with 40% on luxury/sin goods | Reuters |

| Estimated losses | ₹1.5–2 lakh crore per year | Economic Times |

| State examples | Kerala: ₹21,955 crore shortfall in 2024; Telangana: ₹7,000 crore hit expected | Times of India, Financial Express |

| Demands | Minimum 14% annual revenue growth guarantee for five years | Indian Express |

| Next step | GST Council meeting on Sept 3–4 | Indian Express |

What Exactly Is GST?

Think of GST (Goods and Services Tax) as India’s version of a national sales tax. Instead of every state imposing its own patchwork of taxes—like how different U.S. states have their own sales tax percentages—GST unified India under one umbrella.

Introduced in 2017, GST replaced taxes like service tax, excise duty, VAT, and entertainment tax. The idea was simple: streamline the system, reduce compliance headaches, and make India a single common market.

Before the proposed reform, GST had multiple slabs:

- 0% for essentials like fresh fruits and vegetables.

- 5% for items like packaged food, life-saving drugs.

- 12% for processed foods, mobile phones, and some appliances.

- 18% for most services and manufactured goods.

- 28% for luxury cars, air-conditioners, and “sin” goods like tobacco.

This multi-layered structure made compliance confusing and often led to disputes between the Centre and states.

A Little History: Why Compensation Was Promised

When GST was launched, states feared losing their autonomy over tax collection. To ease concerns, the Centre promised five years of compensation (2017–2022), ensuring states’ tax revenues would grow by at least 14% annually.

During COVID-19, when revenues tanked, the Centre even borrowed money on behalf of states to cover shortfalls. But once this window expired in June 2022, states were left exposed.

That’s why today’s debate feels familiar—states are essentially saying: “If you want us to accept lower GST rates, give us the same protection we had before.”

Why Are States Worried About the Rate Cut?

On the surface, a GST rate cut sounds like a win-win. Lower taxes should mean cheaper goods, happier customers, and perhaps more spending. But here’s the problem: tax cuts also mean states collect less money.

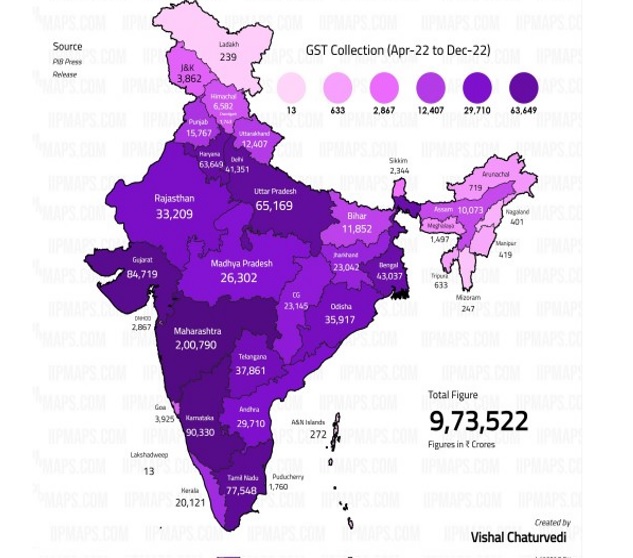

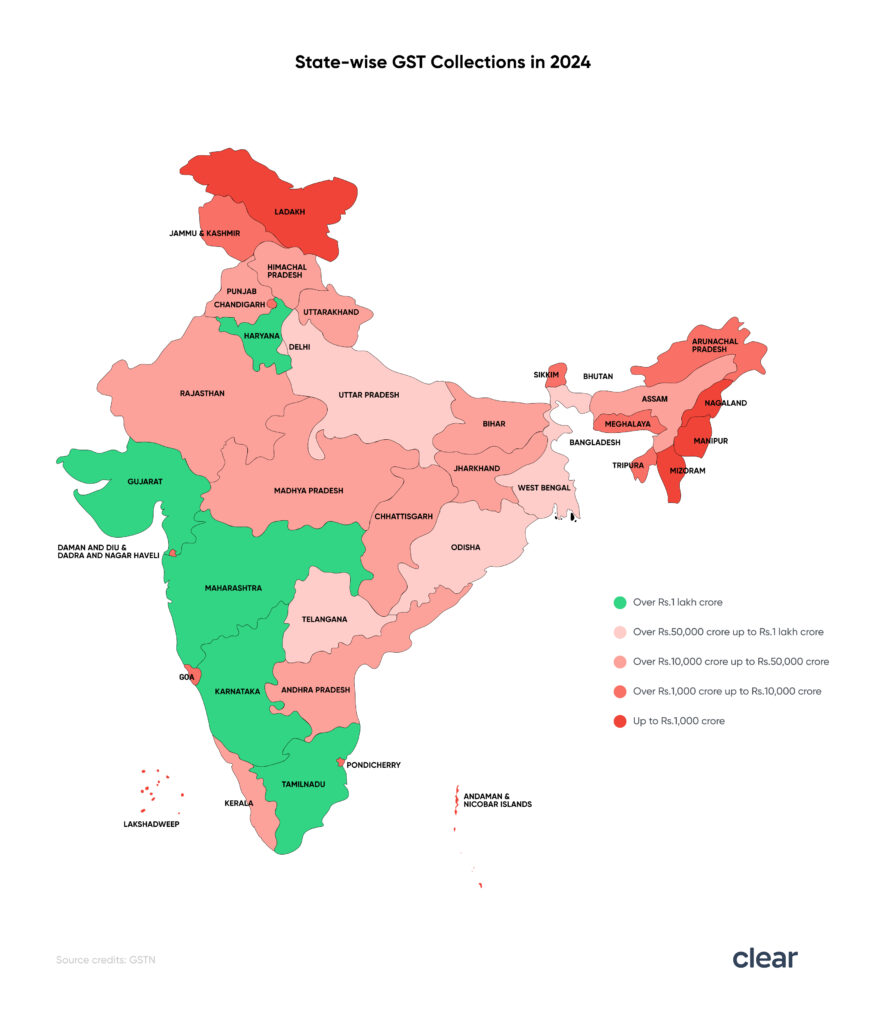

- Kerala reported a ₹21,955 crore revenue shortfall in 2024, and expects another ₹8,000–10,000 crore gap this year. With 95% of its budget tied up in paying salaries and pensions, that’s a fiscal cliff.

- Telangana says it could lose ₹7,000 crore, about 15% of its GST revenue, directly affecting its social welfare schemes.

Imagine if California or New York suddenly lost 20% of its tax revenue. It’d have to either borrow more, raise other taxes, or cut essential programs. That’s the stress Indian states are under.

Breaking Down the New GST Proposal

The Centre wants to simplify GST into just two slabs:

- 5% for essentials

- 18% for most goods and services

- 40% for luxury and sin goods

This would replace the current multi-rate system, making things cleaner. But states argue this shift could reduce their annual revenues by 15–20%, translating to a loss of ₹1.5–2 lakh crore nationwide.

Why Opposition States Back GST Rate Cut?

Opposition states are not rejecting reform. They’re saying: “We’ll play ball, but don’t leave us broke.” Their demands include:

- Five-Year Compensation

A guarantee of 14% revenue growth per year. - Special Levy on Sin Goods

A surcharge on items like liquor and tobacco, with 100% of proceeds going to states. - Centre-Backed Loans

If revenues fall short, the Centre should borrow and cover the gap. - Anti-Profiteering Measures

Ensure businesses don’t hoard the benefits of rate cuts without passing them to consumers.

The Political Angle

The debate is not just economic; it’s deeply political.

- Opposition States: Kerala, Tamil Nadu, Punjab, Telangana, and West Bengal argue that without compensation, they’ll be forced to slash programs and anger voters.

- Ruling Party States: BJP-led states are quieter but face the same dilemma. They may support the Centre publicly while quietly lobbying for safety nets.

This dynamic makes the September GST Council meeting a potential political showdown.

International Comparison: How Others Do It

India isn’t the first country to struggle with balancing central and state revenues.

- United States: Each state sets its own sales tax. The federal government doesn’t impose a national sales tax, which preserves state autonomy. Imagine if Washington suddenly mandated a single sales tax across all states—uproar would be guaranteed.

- European Union: EU members follow a broad VAT system, but each country sets its own rate. There’s flexibility, unlike India’s centralized GST.

India’s centralized model means states are more dependent on the Centre, which explains their caution.

How This Affects Everyday People?

Here’s what this really means for citizens:

- Short-term win: GST cuts mean lower prices for essentials like food, clothing, and services.

- Long-term risk: If states lose revenue, they might hike local taxes, increase service fees, or cut welfare schemes.

For example:

- A shopkeeper in Delhi may have to update billing systems to reflect lower GST.

- A consumer may save ₹50 on a monthly grocery bill.

- But a state government might have to delay building a hospital because of reduced revenue.

Expert Opinions

- KN Balagopal (Kerala Finance Minister): “Without a proper compensation framework, states like ours will face an unprecedented crisis.”

- Economists: While simplification is welcome, they stress that reforms without fiscal cushions risk destabilizing state economies.

- Business Leaders: Chambers like FICCI and CII argue for stability and clarity to encourage investment.

Long-Term Economic Implications

If states don’t get compensated, several risks emerge:

- Borrowing Surge: States may borrow more, pushing up interest costs.

- Inflationary Pressures: If local taxes rise, consumer prices could go up again, negating GST cuts.

- Credit Ratings: India’s fiscal credibility could take a hit if state deficits balloon.

- Investor Sentiment: Businesses crave stability; prolonged tax disputes may spook investors.

On the flip side, if handled well, GST simplification could make India’s tax system one of the most efficient among emerging economies—key for its $5 trillion economy goal.

New GST Rates Likely By Dussehra – Govt Prepares For Revenue Shortfall

Nomura Predicts 10% Jump in Car Demand If GST Rate Is Cut- Check Details

Coimbatore Trade Bodies Petition CM Against State GST Harassment

Future Outlook

The September 3–4 GST Council meeting is pivotal. Two paths lie ahead:

- Centre Agrees to Compensation: Reform moves forward, consumers benefit, and states stay solvent.

- Centre Refuses: Expect political fireworks, possible legal battles, and delays in rollout.

Practical Advice for Businesses and Citizens

- Stay Updated: Follow GST Council updates.

- Be Transparent: Businesses should pass on GST cuts to customers to build goodwill.

- Plan for Change: Professionals in finance and law should prepare clients for both outcomes.

- Watch State Budgets: Citizens should keep an eye on whether states hike other taxes to plug gaps.