Orissa HC Delivers Major Ruling on Delayed GST Appeals: In a significant legal development, the Orissa High Court (HC) has made a landmark decision regarding delayed GST appeals. This ruling has important implications for businesses, tax professionals, and anyone involved in the Goods and Services Tax (GST) system. But as with most legal decisions, there’s a crucial catch that could affect your path forward. Let’s dive into the details of this ruling, break it down for clarity, and offer practical advice to help you navigate this evolving landscape.

Orissa HC Delivers Major Ruling on Delayed GST Appeals

The Orissa High Court’s ruling on delayed GST appeals is a critical reminder of the importance of following legal processes and timelines. While it provides relief for taxpayers facing delays, it also underscores that legal procedures must be respected. By ensuring the 10% pre-deposit is made within a week, taxpayers can proceed with their appeals and have their cases heard, even in the absence of a functioning Appellate Tribunal. For businesses and tax professionals, this ruling highlights the importance of staying informed and prepared. Understanding your rights and obligations under the GST Act is key to navigating challenges like these. Make sure you meet all deadlines, prepare your appeal properly, and meet any pre-deposit requirements to give yourself the best chance of success.

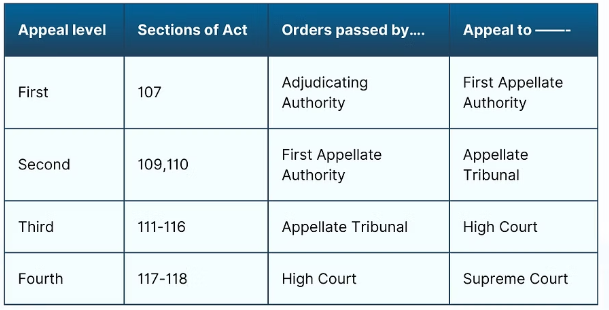

| Topic | Details |

|---|---|

| Case | Chandrakanta Parida v. State of Odisha |

| Issue | Delayed GST appeal filing |

| Key Ruling | High Court grants conditional relief, requiring 10% tax deposit within a week |

| Pre-Deposit Requirement | 10% of the disputed tax must be deposited for appeal to be heard |

| Court’s Stance | Statutory conditions must be met even in writ proceedings |

| Outcome for Taxpayers | Must meet the deposit requirement to proceed with appeal |

| Official Reference | TaxScan Article |

Understanding the Orissa HC’s Ruling on GST Appeals

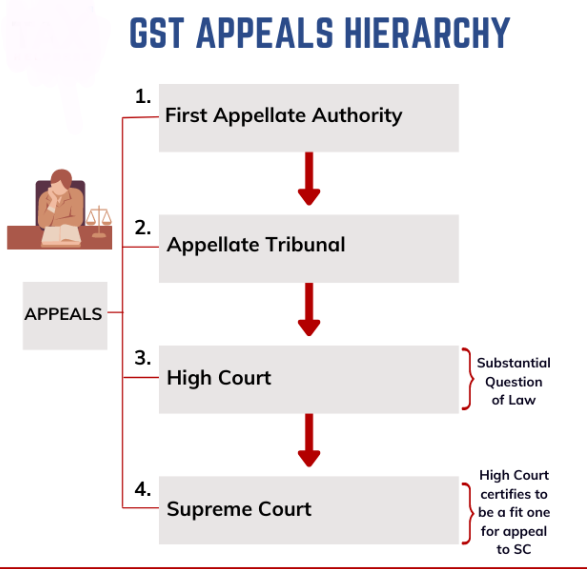

The Orissa High Court recently heard a case where a taxpayer, Chandrakanta Parida, found his appeal dismissed due to it being filed beyond the stipulated time frame under Section 107 of the CGST and OGST Acts. For many businesses, this is a common frustration—appeals are time-bound, and any delay can seem like a brick wall.

However, the Court ruled in favor of the petitioner, granting a conditional relief. This means that while the taxpayer was allowed to file the appeal despite the delay, there was a catch: a pre-deposit of 10% of the disputed tax had to be made within a week of the ruling.

This ruling is noteworthy for a few reasons. First, it shows that the Court is willing to provide relief to taxpayers in difficult situations, but it also reaffirms that legal procedures cannot be ignored. If you’re facing similar issues, this case gives you a potential path forward—but only if you follow the rules laid out by the Court.

The Pre-Deposit Rule: What Does It Mean for You?

What is a Pre-Deposit?

A pre-deposit is a mandatory upfront payment of a portion of the disputed tax amount that you are appealing against. The pre-deposit requirement is part of the GST Act to prevent frivolous appeals and ensure that the taxpayer has a genuine interest in pursuing the case.

For this particular case, the Orissa High Court stated that the petitioner must deposit 10% of the disputed tax within seven days in order for their appeal to be heard.

Now, you might be thinking: “What if I don’t have the cash for this deposit?” Here’s where it gets tricky. The court made it clear that even though the Appellate Tribunal under Section 112 is not yet operational (this Tribunal is responsible for hearing GST-related appeals), taxpayers cannot simply skip the legal process because they’re facing delays in the system.

Why is the Pre-Deposit Necessary?

The pre-deposit is there to ensure that taxpayers are not abusing the system and to show they’re serious about their appeal. In simple terms, the government wants to see that you’re not just stalling for time or trying to avoid paying taxes.

Without this deposit, the appeal cannot proceed, even if your case has merit. The good news is that the amount deposited isn’t lost—if the appeal is decided in your favor, you can get it back. This way, the government ensures that businesses aren’t making frivolous appeals, while still allowing the system to operate in a fair and balanced way.

Why Is This Ruling Important for Taxpayers?

This ruling has far-reaching consequences for taxpayers. Here’s why:

- Clarity in the Face of Delays

The ruling highlights that, even though there are delays in the functioning of the Appellate Tribunal, taxpayers can still seek relief through the courts, provided they meet the legal conditions, such as the pre-deposit requirement. - Encouragement for Serious Taxpayers

The Court has reinforced that a genuine interest in pursuing the case must be demonstrated. By enforcing the pre-deposit rule, the Court is ensuring that only those with a legitimate reason for their delay can seek redress. - Safeguarding Against Abuse of the System

The pre-deposit is an effective way to prevent unnecessary delays and misuse of the appeal system. This ensures that taxpayers are held accountable for their actions while still providing an avenue for genuine cases to be heard. - Relief Despite Technical Hurdles

If you’ve been impacted by the non-functioning of the Appellate Tribunal, this ruling signals that you still have options available. While you must meet the statutory requirements, the Court’s ruling allows for appeals to proceed in the absence of the Tribunal, making the judicial process more accessible.

How to Navigate This Situation: Orissa HC Delivers Major Ruling on Delayed GST Appeals

If you find yourself in a situation similar to that of Chandrakanta Parida, here’s a breakdown of what you need to do:

Step 1: Understand the Legal Framework

Before proceeding with your appeal, understand the GST Act provisions. These laws dictate the timelines for appeals and the conditions that must be met. Familiarize yourself with Section 107 and Section 112, which outline the appeal process and the pre-deposit requirements.

Step 2: Prepare Your Appeal

Even if you’re filing after the prescribed deadline, prepare your appeal carefully. This includes compiling all necessary documents, evidence, and a clear explanation of why the tax was disputed in the first place. Having strong supporting documents will help your case.

Step 3: Make the Pre-Deposit

Once you’re ready to file, ensure that you make the 10% pre-deposit. This is crucial. The Court will not entertain your case without this deposit. You must make the payment to the State Government, and ensure you keep proof of the transaction.

Step 4: File Your Appeal

After completing the deposit, file your appeal with the appropriate authorities. If the Appellate Tribunal is still not operational, this can be done through the High Court. Remember, the timeline is tight. Delays will result in the dismissal of your case.

Step 5: Follow Up

Stay on top of your case. After filing the appeal, follow up with the Court or relevant authorities. If any additional documents or information are required, provide them promptly.

Key Considerations for Taxpayers Facing Similar Situations

If you’re facing delays in filing your GST appeal, consider the following tips:

- Act Fast: The clock is ticking. Delays beyond the prescribed timelines can result in the rejection of your appeal. Once the pre-deposit is made, don’t waste time.

- Document Everything: Proper documentation is crucial in any legal process. Ensure that you have all the necessary records, including tax invoices, payment receipts, and prior communication with tax authorities.

- Seek Legal Advice: If you’re unsure about how to proceed, it’s wise to consult with a tax expert or legal professional. They can help ensure that your appeal is filed correctly and that you meet all requirements.

- Stay Updated: Legal processes, especially those involving GST, are constantly evolving. Keep yourself informed about any updates, changes in law, or operational issues, such as the current status of the Appellate Tribunal.

Gauhati HC Rules GST SCN Invalid Without Personal Hearing Date

Crores Lost, No One Watching? UP’s GST Growth Tanks as Fake Firms Multiply

How to Add or Edit Bank Details on GST Portal Without Errors—Full Process Explained