Patna Man Arrested in ₹1 Crore Cyber Fraud Case in Lucknow: Cybercrime isn’t just a headline anymore—it’s something that’s creeping into the daily lives of ordinary people. Recently, a Patna man was arrested in Lucknow in a ₹1 crore cyber fraud case, a shocking story that reminds us of just how sophisticated online scams have become. This isn’t just about one arrest; it’s about how cybercriminals operate, why people get trapped, and what we can do to fight back.

Patna Man Arrested in ₹1 Crore Cyber Fraud Case in Lucknow

The Patna man’s arrest in Lucknow for a ₹1 crore cyber fraud case is more than just a crime story—it’s a warning. Cybercriminals are clever, organized, and dangerous. But with the right awareness, verification, and reporting, individuals and businesses can fight back. The digital economy offers endless opportunities, but also endless traps. The takeaway? Trust but verify, act fast, and never let urgency override common sense.

| Point | Details |

|---|---|

| Incident | Patna man arrested in Lucknow for ₹1 crore cyber fraud case |

| Victim Loss | Businessman cheated out of more than ₹1 crore |

| Accused | Rahul Kumar, 33, allegedly opened bank accounts for fraudsters |

| Fraud Method | Fake franchise & dealership websites advertised via Google/social media |

| Legal Action | Booked under Bharatiya Nyaya Sanhita (BNS) & Section 66D of IT Act |

| Police Action | Cyber Crime police seized devices, pursuing other gang members |

| Reference | Lucknow Police Official Website |

What Really Happened?

The accused, Rahul Kumar from Patna, was caught by the Lucknow Cyber Crime Police after a local businessman lodged a complaint of being duped out of over ₹1 crore. The fraudsters set up polished websites promoting dealership and franchise opportunities, complete with logos, brochures, and online ads.

Victims were told to pay hefty sums as “registration fees” and “security deposits.” Rahul Kumar’s role was to open bank accounts under his name, using Aadhaar and PAN cards. Although he wasn’t the mastermind, his cooperation was crucial in funneling the stolen funds.

Police have seized his phone and are now hunting other members of the gang.

Why This Case Matters?

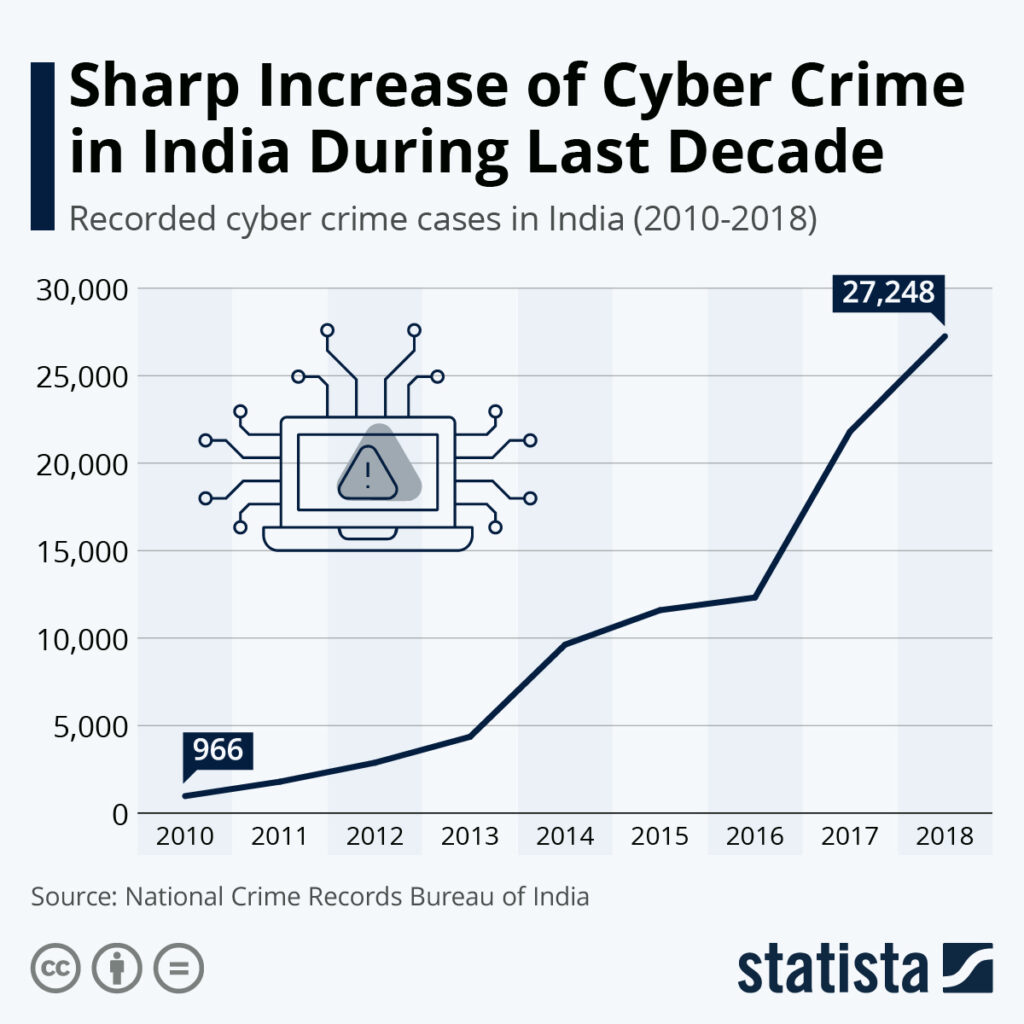

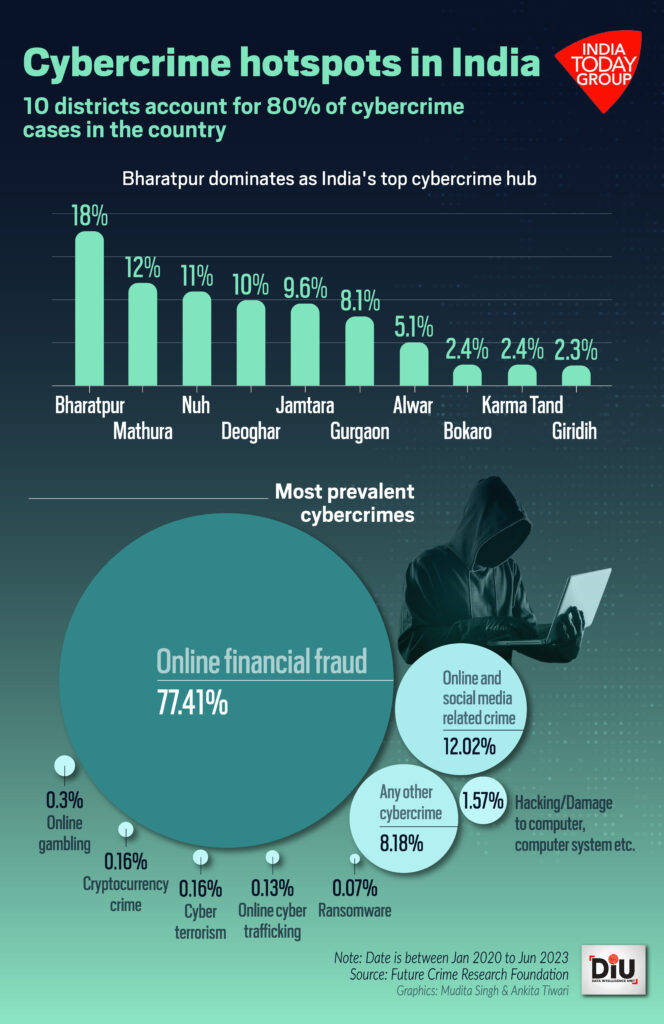

This isn’t just about one con. It highlights a broader global wave of cyber fraud.

- In India, cybercrime cases rose 24% in 2023, with over 65,000 cases registered, according to the National Crime Records Bureau (NCRB).

- In the U.S., the FBI Internet Crime Complaint Center (IC3) reported losses of more than $12.5 billion in 2023.

- Globally, the World Economic Forum ranked cybercrime as one of the top 5 risks to the global economy in 2024.

This case matters because it shows how scammers mix technology, psychology, and exploitation of vulnerable people to steal life savings.

How Cyber Fraud Gangs Operate?

Cybercriminals don’t act randomly. Their operations resemble startups—organized, scalable, and ruthless.

- Fake Branding

Fraudsters design websites that look professional. They often clone real companies or invent fake ones. - Online Visibility

Using Google Ads and social media campaigns, scammers make sure victims searching “car dealership franchise” or “business investment” see their offers first. - Urgency and Pressure

Victims are told: “Pay today, or lose the deal.” This creates panic-driven decisions. - Recruiting Middlemen

People like Rahul, often desperate for money, are hired to open bank accounts. They act as “money mules”—helping launder money while keeping masterminds in the shadows. - Exit Strategy

Once the money is collected, websites are shut down, phone numbers vanish, and social media accounts are deleted.

Historical Context of Patna Man Arrested in ₹1 Crore Cyber Fraud Case in Lucknow

Cyber fraud isn’t new, but it has evolved.

- Early 2000s (India): Email lottery scams promising millions if victims shared banking details.

- 2010s: Phishing scams through fake bank websites and OTP fraud during the rise of mobile banking.

- 2020s: Sophisticated franchise, crypto, and investment frauds using artificial intelligence (AI) and deepfakes.

Globally, scams have shifted from Nigerian Prince emails to highly believable fake investment platforms.

Laws Governing Cyber Fraud

In India:

- Section 66D of IT Act, 2000 – Punishes cheating by impersonation using computers. Jail term up to 3 years plus a fine.

- Bharatiya Nyaya Sanhita (BNS) – Replaces IPC with stricter cybercrime penalties.

- Cybercrime Helpline (1930) – Victims can report fraud and freeze transactions quickly.

In the USA:

- Wire Fraud (18 U.S.C. § 1343) – Punishable with up to 20 years in prison.

- Computer Fraud and Abuse Act (CFAA) – Covers hacking and online impersonation.

- Federal Trade Commission (FTC) – Regulates fraud reporting at FTC Report Fraud.

Both countries stress reporting scams quickly, as funds can often be frozen before withdrawal.

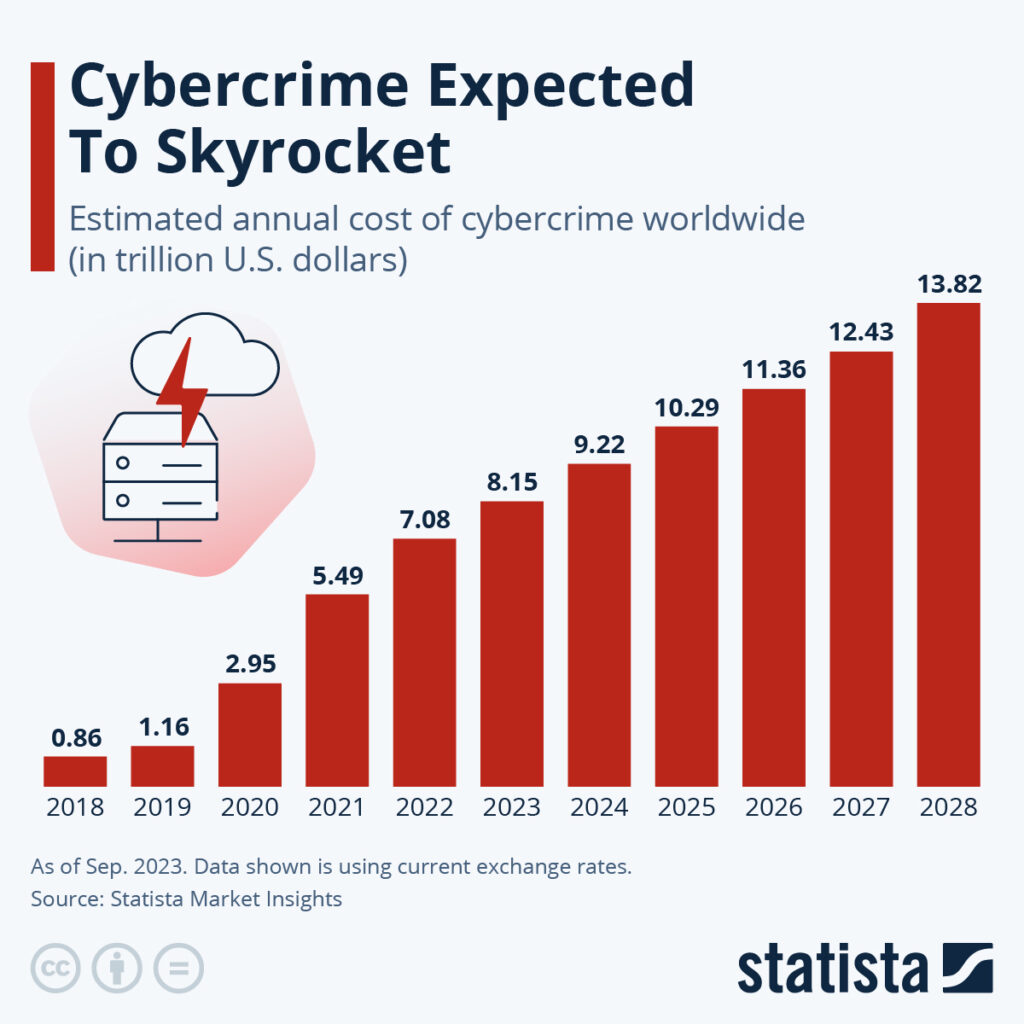

Economic Impact of Cyber Fraud

Cybercrime is no longer just about individual losses; it’s a national economic concern.

- India’s Reserve Bank of India (RBI) reported ₹1,250 crore lost to online fraud in FY 2023.

- According to Cybersecurity Ventures, global losses from cybercrime are projected to hit $10.5 trillion annually by 2025.

- Small and medium businesses suffer the most, as they lack the security infrastructure of larger corporations.

This ₹1 crore fraud case in Lucknow is a micro example of a trillion-dollar global problem.

How Victims Can Recover Money?

Many victims assume money lost is gone forever. That’s not always true. Here’s a step-by-step recovery process:

- Report Immediately – Call 1930 in India or file a report at cybercrime.gov.in.

- Notify Bank – Request an immediate freeze of the fraudulent transaction.

- File FIR – Lodge a police complaint under IT Act provisions.

- Track Complaint – Follow up regularly; recovery depends on speed.

- Legal Recourse – Victims may pursue civil cases for compensation if funds aren’t recovered.

Practical Guide: Staying Safe from Cyber Fraud

- Verify Before You Trust

Use MCA India to check company registration. In the U.S., use Better Business Bureau. - Look for Red Flags

- Too-good-to-be-true offers

- Pressure to pay quickly

- Demands for payments to personal accounts

- Secure Your Transactions

Always use corporate bank accounts for payments. Avoid UPI transfers to individuals unless verified. - Protect Your Identity

Don’t share Aadhaar, PAN, or SSN casually. Fraudsters build fake firms on stolen identities. - Educate and Train Employees

Businesses must conduct cybersecurity awareness sessions regularly.

Expert Insights

“The biggest tool scammers use is urgency. If someone is rushing you to transfer money, step back. That’s your warning sign.” – Rajesh Kumar, Cybersecurity Consultant.

“Anyone can be scammed. It’s not about intelligence, it’s about psychology. Even CEOs have lost millions.” – FBI IC3 Annual Report 2023.

Case Study: Global Comparison

- India: Franchise frauds, UPI payment scams.

- USA: Business Email Compromise (BEC) costing over $3 billion annually.

- Europe: Crypto scams—fake trading apps stealing billions.

In 2023, the FTC in the U.S. uncovered a $23 million franchise scam in Florida involving fake vending machine businesses. The playbook was nearly identical to the Lucknow case.

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

₹50 Crore GST Fraud Busted In Mumbai – Two Directors Arrested In Mega Scam

GST Crackdown in Aligarh: 11 Fake Firms Hit With Notices in Major Fraud Probe