PIB Warns Against Fake Emails Claiming Free e-PAN Card Download: If you’ve spotted an email in your inbox screaming “Free e-PAN card download!”, you’re not alone. The Press Information Bureau (PIB) has issued a serious warning: these emails are fake and part of a larger phishing scam. Fraudsters are pretending to be the Indian Income Tax Department to trick people into sharing sensitive details like PAN, Aadhaar, or banking information. In simple terms, it’s a digital con. Scammers dangle a tempting bait — “download your free e-PAN instantly” — and wait for someone to bite. And once they do, the consequences can be long-lasting and damaging.

PIB Warns Against Fake Emails Claiming Free e-PAN Card Download

The PIB’s warning about fake e-PAN emails is a timely reminder of the dangers lurking online. Scammers are getting more sophisticated, but so can we. By sticking to official portals, recognizing the red flags, reporting scams, and practicing strong cyber hygiene, individuals and businesses can stay safe. In today’s digital world, one rule stands above all: if it sounds too good to be true, it probably is. Stay alert, stay skeptical, and protect your identity.

| Point | Details |

|---|---|

| Warning Issued By | Press Information Bureau (PIB), August 2025 |

| Scam Type | Fake emails claiming free e-PAN card downloads |

| Target | Indian taxpayers receiving phishing emails |

| Danger Signs | Suspicious email addresses, urgent subject lines, shady links, malware |

| Reporting Email IDs | webmanager@incometax.gov.in, incident@cert-in.org.in |

| Stat Snapshot | 80% of phishing attacks in India originate via email (CERT-In 2024 Report) |

What is an e-PAN and Why is it Important?

The PAN (Permanent Account Number) card is one of India’s most important identification documents. It’s required for filing taxes, opening a bank account, investing in stocks, or even buying property. In recent years, the government introduced the e-PAN, a digitally signed version, to make life easier.

The e-PAN carries the same validity as a physical PAN and can be instantly downloaded for official use. Its digital convenience, however, has made it an attractive target for cybercriminals. Just like scammers worldwide impersonate banks or delivery companies, they’re now using the lure of a “free e-PAN” to trick people.

Why Scammers Target e-PAN?

Scammers target PAN cards because of the wealth of sensitive information they hold. With your PAN, Aadhaar, and linked phone number, fraudsters can:

- Apply for loans in your name.

- Create fake bank accounts.

- Commit financial frauds and leave you with the liability.

- Sell your details on the dark web to other criminals.

According to a 2024 CERT-In report, more than 65,000 phishing incidents were reported in India, with a large percentage involving fake tax or banking communications. The growth of digital adoption has made such scams lucrative.

Real-Life Case Studies Of PIB Warns Against Fake Emails Claiming Free e-PAN Card Download

One Mumbai-based professional received a flashy email offering a “PAN 2.0 upgrade.” Thinking it was official, he entered his details on the linked site. Days later, fraudulent credit card applications were made in his name.

In another instance reported in Bengaluru, retirees received phishing emails claiming urgent PAN updates were required to avoid fines. Many entered their banking details, leading to unauthorized withdrawals.

These stories underline one truth: phishing scams can hit anyone, from tech-savvy professionals to elderly retirees.

How Phishing Scams Work?

Most phishing scams follow a simple playbook:

- The Bait: An email designed to look official, often carrying government logos.

- The Hook: A link claiming to take you to the e-PAN download page.

- The Trap: A fake website mimicking government portals.

- The Catch: Users enter sensitive details, which are harvested by scammers.

- The Payoff: Stolen data is used for identity theft, fraud, or sold online.

It’s not rocket science, but it’s highly effective.

Signs of a Fake e-PAN Email

Spotting a fake email is like noticing a knock-off sports jersey. It may look authentic, but the small details give it away. Common red flags include:

- Suspicious sender IDs not ending in official domains like

@incometax.gov.inor@nic.in. - Generic greetings like “Dear User” instead of your actual name.

- Poor grammar, spelling errors, and awkward formatting.

- Urgent subject lines like “Immediate Action Required” or “Last Chance.”

- Links that redirect to non-government websites when you hover over them.

Official Way to Download Your e-PAN

The good news is that downloading your e-PAN securely is simple if you use the official portals.

Step 1: Visit the Website

- NSDL Portal: www.tin-nsdl.com

- UTIITSL Portal: www.pan.utiitsl.com

Step 2: Authenticate

Enter your PAN, Aadhaar-linked mobile number, and verify via OTP.

Step 3: Download

Download your e-PAN in PDF format. It is password-protected, usually with your date of birth.

Step 4: Store Safely

Save the file in a secure folder and avoid sharing over unsecured apps or emails.

Cybersecurity Checklist for Professionals

For working professionals and businesses, phishing emails are not just a nuisance; they are a major risk. Here’s a practical checklist:

- Enable two-factor authentication (2FA) across all critical accounts.

- Use updated antivirus and firewall software.

- Train employees to recognize suspicious emails.

- Regularly back up important files to secure storage.

- Report phishing attempts promptly to IT departments.

Think of this as brushing your digital teeth: skip it, and you’ll pay later.

Reporting Suspicious Emails

If you suspect a phishing attempt, here’s a step-by-step guide:

- Do not click on any links.

- Take a screenshot of the email.

- Forward the email with headers to webmanager@incometax.gov.in and incident@cert-in.org.in.

- Delete the email from your inbox and trash folder.

- If you clicked on it, change your passwords immediately and inform your bank.

The Role of AI in Modern Phishing Scams

Phishing attacks today aren’t just spammy emails with bad grammar — they’re powered by artificial intelligence (AI), making them smarter and harder to detect. Scammers now use AI tools to personalize emails, making them sound more convincing. These emails may include your name, your recent tax filings, or even mimic the tone of government communication.

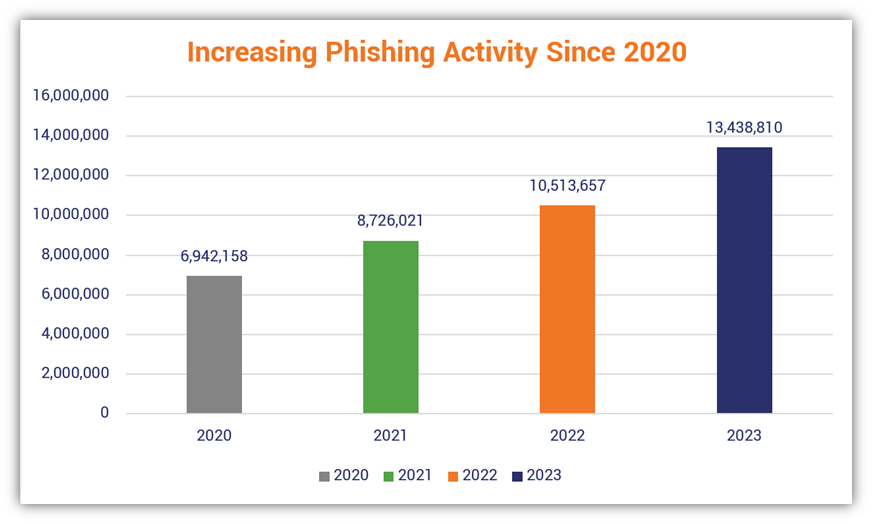

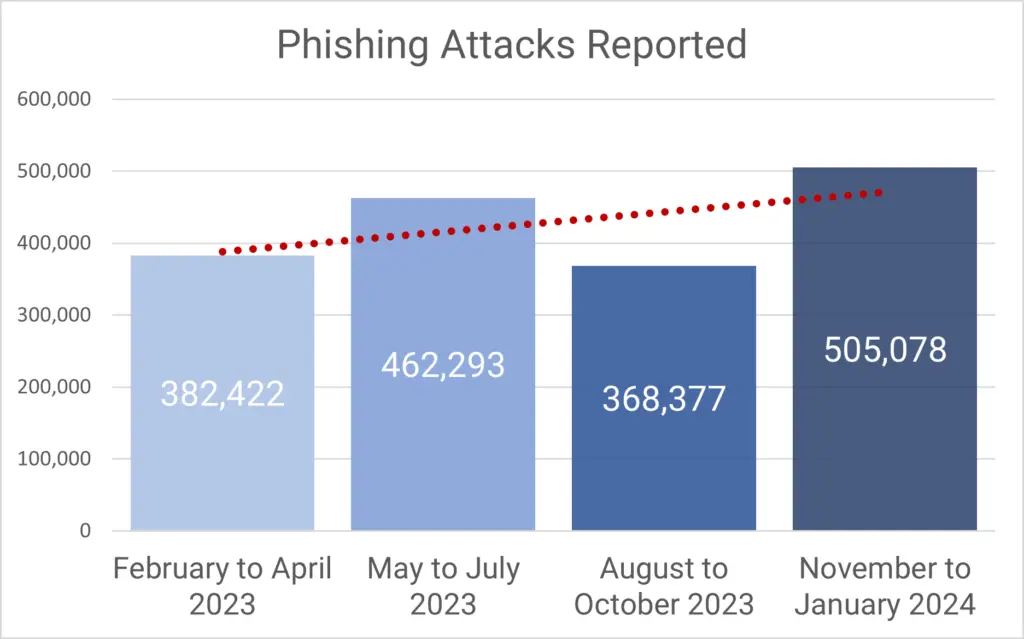

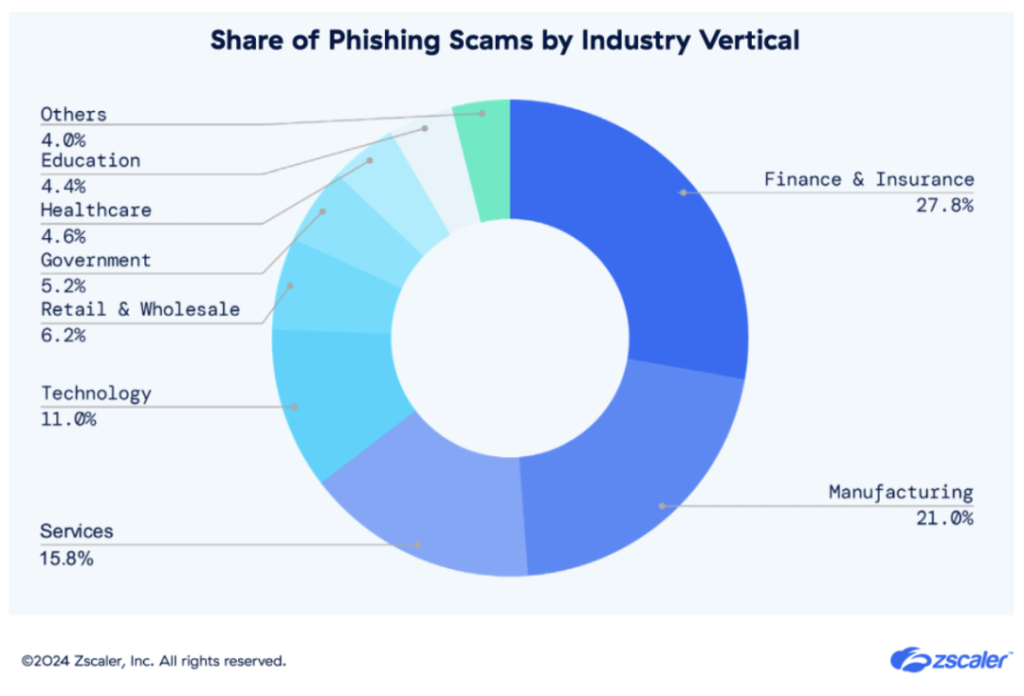

AI can even generate fake landing pages that look almost identical to the real Income Tax Department or NSDL websites. This level of sophistication tricks even experienced users. According to a 2024 report by Zscaler, AI-enabled phishing increased by over 58% year-over-year.

This means spotting scams is no longer just about looking for typos — you need to double-check every link, verify sender addresses, and always use official portals manually entered in your browser. Staying a step ahead of scammers now means being smarter than the tools they use.

India and Global Comparison

Phishing scams are not unique to India. In the United States, the Internal Revenue Service (IRS) has been battling tax-related scams for decades. Each year, thousands of Americans receive emails claiming to offer tax refunds or demand urgent payments.

In 2023 alone, the IRS reported over 100,000 phishing complaints. The similarity is striking: scammers use urgency, official-looking emails, and fear of penalties to trick taxpayers.

This global pattern shows that while technology evolves, the psychology behind scams remains the same.

The Cost of Falling Victim

The cost of phishing goes beyond money. Victims often face:

- Months of dealing with banks, credit bureaus, and police.

- Stress, anxiety, and reputational damage.

- Difficulty accessing loans or credit due to fraudulent records.

Globally, phishing scams caused losses of over $12.5 billion between 2018 and 2024, according to the FBI’s Internet Crime Complaint Center.

Pro Tips to Stay Safe

- Always double-check sender addresses.

- Never share PAN, Aadhaar, or banking details via email.

- Use strong, unique passwords and update them regularly.

- Cross-check urgent messages by visiting official government websites directly.

- Educate family members, especially seniors, who are more vulnerable to scams.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

India@100: Why Experts Say Fixing GST Could Unlock a Health Insurance Boom

India On the Edge of Crypto Tax Reform—What It Means for Your Digital Wallet