Pinarayi Vijayan Sounds the Alarm: If you’ve been following India’s tax debates, you’ll know the latest headline: Pinarayi Vijayan, Kerala’s Chief Minister, has sounded a major alarm that states are losing huge revenue under GST (Goods and Services Tax). He’s even asked Prime Minister Narendra Modi for urgent intervention before state budgets collapse. This isn’t just politics—it’s a financial crisis that could impact millions of citizens, welfare programs, and businesses. Let’s break it down in plain English: clear enough for a kid, detailed enough for a policy expert.

Pinarayi Vijayan Sounds the Alarm

Pinarayi Vijayan’s alarm is more than politics—it’s a fiscal SOS. States like Kerala and Karnataka face billions in losses that could cripple welfare and public services. Without compensation, India risks turning GST into a burden rather than a reform. The big question now: will PM Modi step in with solutions, or will states be forced to fend for themselves? The answer will shape India’s federal finances for years to come.

| Topic | Details |

|---|---|

| Revenue Loss in Kerala | Projected ₹8,000–9,000 crore shortfall due to GST rate revisions |

| Welfare Schemes at Risk | Programs like LIFE housing scheme & free insurance for 42 lakh families in Kerala |

| National Concern | Karnataka also estimates ₹15,000 crore loss |

| CM’s Request | Vijayan urged PM Modi to ensure compensation for states |

| Historical Note | GST compensation deal ended in 2022 |

| Official Reference | GST Council Official Website |

GST 101: A Quick Refresher

The Goods and Services Tax (GST) was introduced in 2017 as one of India’s boldest economic reforms. It replaced a jungle of central and state taxes with a unified tax system. Before GST, each state imposed its own sales tax, octroi, entry tax, and entertainment tax, creating roadblocks for businesses.

The goal was simple: “One Nation, One Tax”. By removing barriers between states, GST promised easier trade, reduced corruption, and greater transparency.

But there was a big compromise. States had to surrender their independent taxing powers, which they had used for decades to raise local revenue. In return, the Center promised five years of compensation for any losses. That deal expired in June 2022. Since then, states have been on their own—and now the cracks are showing.

Kerala’s Financial Nightmare

Kerala’s economy is already under stress, with high spending on welfare and healthcare. Now, the looming GST rate cuts could trigger an ₹8,000–9,000 crore shortfall annually.

What’s at stake?

- LIFE Mission Housing: Provides free housing for low-income families. Thousands of projects could stall if funding dries up.

- Karunya Health Insurance: Covers 42 lakh families, protecting them from medical bankruptcy. Without funds, hospital bills could spiral for millions.

- Education, pensions, and salaries: State government employees, including teachers and healthcare workers, could face delayed payments.

Kerala’s finance minister, K. N. Balagopal, described this crisis as “the worst impact on public finances since Independence.”

Think of it like running a household where your paycheck suddenly drops by 25%. For a family, that might mean skipping vacations. For a state, it means canceling programs that save lives.

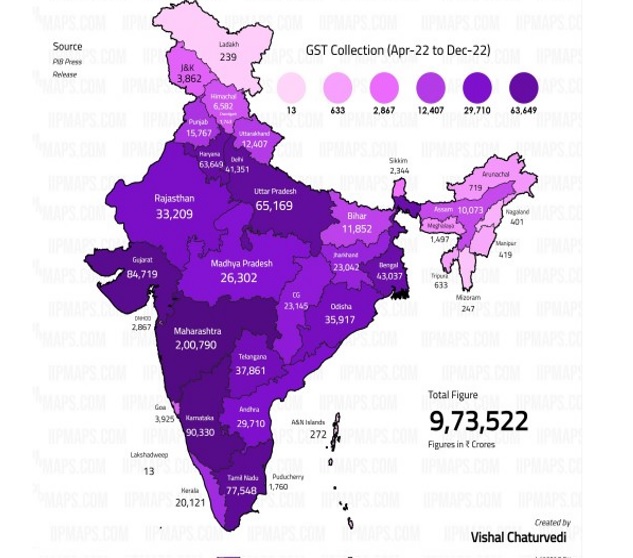

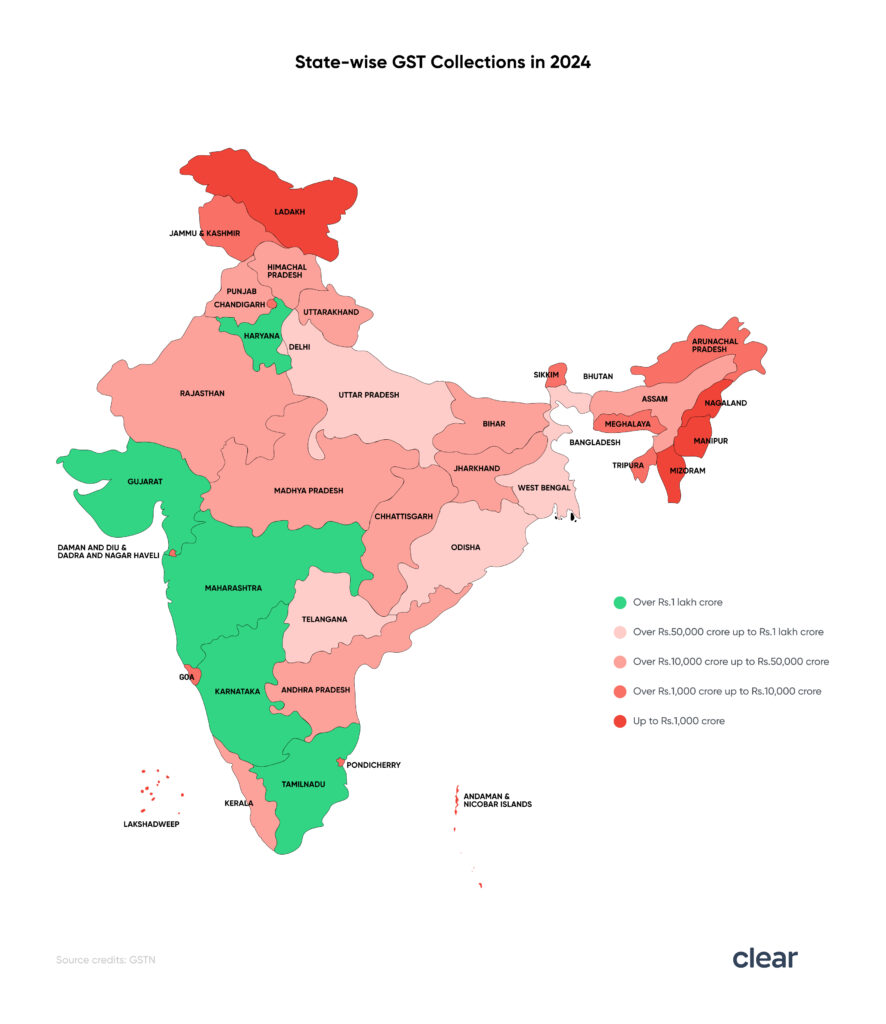

The Ripple Effect Across India

Kerala is not the only one sounding the alarm. Karnataka, one of India’s richest states, estimates a ₹15,000 crore loss. Punjab, Rajasthan, and West Bengal are also quietly anxious.

This issue isn’t political—it’s systemic. Every state relies heavily on GST revenue. Unlike the Center, states can’t print money. Their borrowing capacity is capped by law, leaving them little room to maneuver.

If GST rate cuts go ahead without compensation:

- Social programs could be slashed.

- Infrastructure projects like roads, bridges, and schools may face delays.

- Business uncertainty could rise, with states scrambling to raise revenue through other means.

GST and Small Businesses: A Silent Victim

It’s not just state governments feeling the heat. Small and medium-sized businesses (SMEs) are stuck in the middle.

- Frequent rate changes mean they must constantly update billing software and accounting systems.

- Compliance costs are high—small traders often spend a big chunk of income on GST filing and audits.

- Uncertainty around taxes makes planning difficult for startups and exporters.

For example, a small textile exporter in Tamil Nadu may benefit if GST is cut on yarn, but if the state slashes subsidies due to lost revenue, electricity or transport costs may rise—cancelling out the benefit.

Lessons from Global Tax Systems

India’s GST challenge isn’t unique. Other countries have wrestled with federal-state revenue sharing too.

- United States: States depend on federal grants for Medicaid, infrastructure, and disaster relief. When Washington delays, states cut services. It’s the same math Kerala faces.

- Canada: Uses a federal equalization program to ensure poorer provinces get fair funding. This avoids big gaps between rich and poor regions.

- Australia: Distributes GST revenue across states through a formula that ensures smaller states survive.

India could learn from these systems—especially Canada’s model, which balances equity and efficiency.

Expert Opinions On Pinarayi Vijayan Sounds the Alarm

Economists and think tanks are warning of the storm ahead:

- Rathin Roy, former advisor to the Finance Ministry, said: “GST has turned into a straitjacket for states. Without reform, it could undermine India’s federal balance.”

- India Ratings & Research noted that many states’ debt levels are at unsustainable levels, worsened by falling GST revenue.

- The National Institute of Public Finance and Policy (NIPFP) recommends extending the compensation period by at least five years.

Possible Solutions

There’s no magic bullet, but here are some possible fixes:

- Reintroduce GST Compensation Fund

Extend the expired compensation mechanism for another five years, giving states breathing room. - Increase Borrowing Limits for States

Allow states to raise more loans, especially during crises. - Selective Rate Cuts

Reduce GST on essentials like food and medicine, but keep rates on luxury goods high to protect revenue. - Dual Taxation on Premium Goods

Give states limited powers to levy surcharges on items like alcohol, tobacco, and luxury cars.

What Happens Next?

Two scenarios could play out:

- If PM Modi Intervenes: States may receive temporary relief, welfare programs continue, and the GST Council works toward a long-term formula. This could stabilize finances and calm markets.

- If Nothing Changes: States will cut back programs, delay salaries, and raise user fees. Citizens may see fewer benefits and higher hidden costs. Political tensions between states and the Center could also spike.

Practical Advice

For businesses:

- Track GST Council updates closely.

- Keep accounting systems flexible for quick rate changes.

- Plan cash flow with tax uncertainty in mind.

For citizens:

- Don’t be fooled by short-term price drops. Lower GST doesn’t always mean savings if welfare cuts follow.

- Pay attention to your state’s budget announcements—they will reveal where cuts may happen.

- Voice concerns through civil society and local representatives. Public pressure can push governments to act.

FM Sitharaman Clears the Air on GST Issue for Apartment Associations—What You Need to Know

GST Structure Simplified – Key Changes Explained

GST Overhaul Ahead Of Diwali – Relief For Consumers, Risk For Revenue