PM Modi’s GST 2.0 Reform Explained: If you’ve been following global economic headlines, chances are you’ve seen buzz around PM Modi’s GST 2.0 reform in India. Now, some might ask: why should people outside India care about another country’s tax policy? The answer is simple: India is one of the world’s fastest-growing major economies, and its taxation system affects global trade, foreign investment, multinational corporations, and ordinary consumers alike. Think of it like a big software update on your phone. India’s tax system—much like an app—needed a reboot. The new Goods and Services Tax (GST) 2.0 promises fewer glitches, more user-friendly rules, and smoother operations for everyone from a roadside vendor in Mumbai to a Fortune 500 company in New York sourcing goods from India.

PM Modi’s GST 2.0 Reform Explained

PM Modi’s GST 2.0 reform is a bold step toward simplifying India’s tax system, cutting costs for consumers, and boosting economic growth. While the benefits are clear—cheaper essentials, easier compliance, and stronger investor confidence—the challenge lies in protecting state revenues. If India balances both sides effectively, GST 2.0 won’t just be a domestic win but a global signal of India’s rise as a reliable economic powerhouse.

| Point | Details |

|---|---|

| What is GST 2.0? | India’s revamp of its Goods and Services Tax system |

| Key Change | Simplification from 4 slabs (5%, 12%, 18%, 28%) to 2 main slabs (5% and 18%) plus 40% for luxury/sin goods |

| Impact on Consumers | Cheaper essentials like medicines, education tools, and food; ~10% price cuts on cement, electronics, and small cars |

| Impact on Economy | Potential demand surge of ₹5.3 lakh crore (~$64B), about 1.6% of India’s GDP |

| Impact on Businesses | Pre-filled returns, simplified compliance for startups, reduced litigation |

| Challenges | States could lose ₹1.5–2 lakh crore annually in tax revenues |

| Official Reference | GST Council, India |

GST 1.0: The Backstory

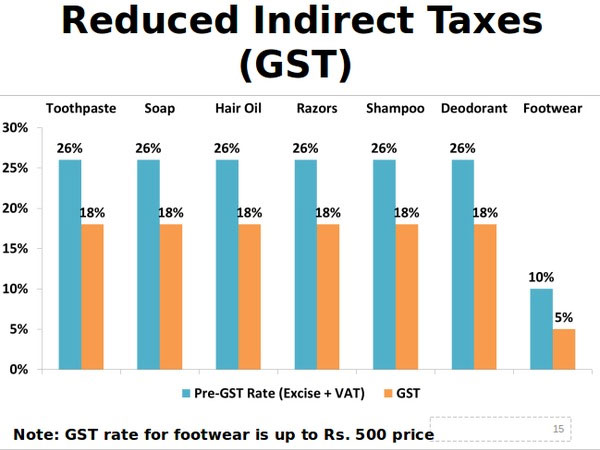

The first version of GST, launched in 2017, was one of India’s boldest economic reforms. It aimed to unify the nation’s fragmented tax system, replacing a messy patchwork of state and federal levies. Instead of each state having different rules—like sales tax in New York versus Texas in the U.S.—India wanted a single, nationwide system.

At first, GST 1.0 delivered:

- It streamlined interstate trade.

- It reduced the cascading effect of “tax on tax.”

- It boosted formalization of businesses.

But the cracks soon showed. Multiple tax slabs created confusion, with bizarre disputes over items like biscuits versus cookies. Small businesses complained of endless paperwork. State governments worried about shrinking revenues. Clearly, while the foundation was strong, the system needed a major upgrade. Enter GST 2.0.

A Simpler, More Predictable Tax System

One of the biggest headaches in GST 1.0 was its four-tier tax slab system: 5%, 12%, 18%, and 28%. Add in special cesses on luxury goods, and you had a recipe for confusion. Businesses often ended up in court just to argue over classifications.

GST 2.0 cleans this up with:

- 5% slab for essentials.

- 18% slab for most goods and services.

- 40% slab for luxury and sin goods like alcohol, tobacco, and high-end cars.

This clarity means fewer disputes and more predictability. For example, building materials like cement and bricks, previously taxed at different rates, now fall into a single slab. That makes construction projects easier to budget and plan.

Compared with international systems, India now looks more like the European Union’s VAT model, where most goods fall under standard or reduced rates, and fewer exceptions exist.

Cheaper Prices for Consumers

For everyday Indians, GST 2.0 is designed to ease the cost of living. Essentials like medicines, school supplies, agricultural tools, and renewable energy equipment are now cheaper. Even consumer durables such as refrigerators, air conditioners, and small cars will see price drops of around 8–10%.

Examples:

- A bag of cement priced at ₹400 could drop to about ₹360.

- A compact car costing ₹10 lakh might become ₹50,000–₹75,000 cheaper.

This is not just good news for Indian households but also for international buyers. U.S. builders importing Indian cement, or companies sourcing manufactured goods from India, will directly benefit from these cuts.

Demand Surge and Economic Growth

Cheaper goods usually equal higher demand. India’s economy relies heavily on domestic consumption, which contributes about 60% of its GDP. By lowering prices, GST 2.0 is expected to unleash a consumption boom worth ₹5.3 lakh crore ($64B)—a direct 1.6% boost to GDP, according to research from India’s State Bank of India.

The sectors most likely to gain:

- Automobiles, especially small cars and electric vehicles.

- Consumer durables, including TVs, washing machines, and air conditioners.

- Housing and infrastructure, thanks to lower construction material costs.

Financial markets are already reacting. Shares of companies like Maruti Suzuki and consumer appliance makers jumped after the announcement, signaling strong investor confidence.

PM Modi’s GST 2.0 Reform Explained: Easing the Burden on Businesses

GST 2.0 is not just about rate cuts; it also tackles structural pain points for businesses.

Key reforms include:

- Pre-filled returns to reduce filing errors and save time.

- Simplified registrations to help startups and micro-businesses get off the ground quickly.

- Faster refunds, crucial for exporters who previously faced months of delays.

- Elimination of inverted duty structures, where raw materials were taxed higher than finished goods.

For small and medium enterprises (SMEs), these changes mean lower compliance costs and less litigation. For foreign companies, especially U.S. firms sourcing from India, this translates to smoother contracts and fewer supply chain bottlenecks.

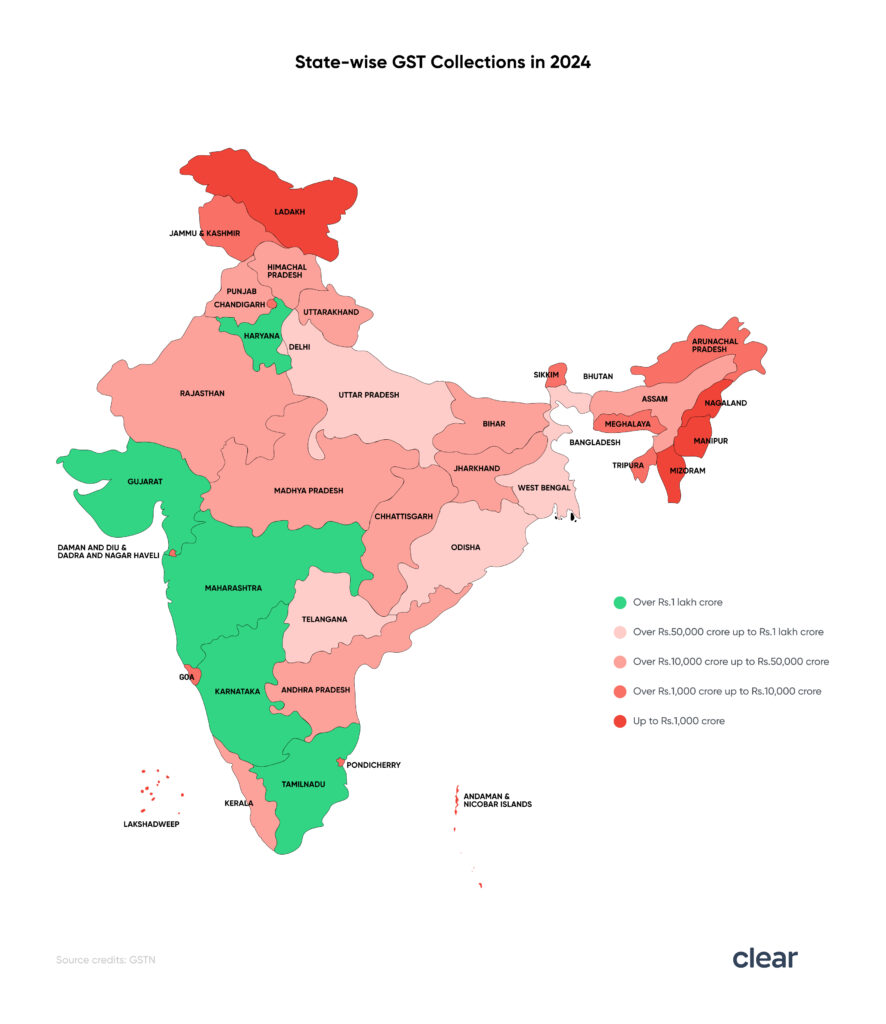

The Big Concern: State Revenues

While consumers and businesses cheer, state governments are worried. By slashing GST slabs, states could lose between ₹1.5–2 lakh crore annually in revenue.

For example:

- Telangana projects a revenue hit of about ₹7,000 crore, nearly 15% of its GST income.

- Jharkhand expects to lose about ₹2,000 crore annually.

Without adequate compensation from the federal government, states may have to cut funding for healthcare, infrastructure, and social welfare programs. Opposition-led states have already raised the alarm, demanding either an extension of the GST compensation cess or new levies on luxury goods to plug the gap.

This balancing act—public relief versus state finances—is the most delicate part of GST 2.0.

Expert Opinions and Global Comparisons

Economists and global institutions have largely welcomed the reform.

- World Bank: Simplification of GST could boost India’s GDP growth by 0.5–1% annually.

- IMF: Praised the reform for making India a more attractive investment destination.

- Arvind Subramanian, India’s former Chief Economic Adviser, noted that fewer slabs reduce classification disputes and litigation, freeing up courts and businesses alike.

Globally, India is now closer to advanced tax systems like the EU’s VAT or Australia’s GST, both of which have fewer slabs and simpler compliance mechanisms. For investors comparing emerging markets, India now looks more transparent and predictable.

Practical Advice: How to Prepare

For Consumers:

- Expect lower prices on essentials, housing materials, and appliances.

- Watch for retailers taking time to adjust prices—shop around to ensure savings are passed on.

For Businesses:

- Update accounting software and ERP systems to reflect new slabs.

- Revisit contracts and supplier agreements for compliance with GST 2.0.

- Train finance teams on simplified filing processes.

- Exporters should prepare for faster refunds and plan cash flow accordingly.

For Investors:

- Look closely at consumer goods, auto, and construction sectors for growth opportunities.

- Monitor state-level politics, as compensation disputes could delay full implementation.

Looking Ahead: India’s Big Picture

GST 2.0 is part of a larger economic roadmap. The Modi government aims to make India a $5 trillion economy and a global manufacturing hub.

By simplifying taxes and cutting red tape, India signals to global investors that it’s serious about reforms. This could:

- Encourage foreign companies to expand operations in India.

- Strengthen domestic consumption as a stable growth driver.

- Reduce corruption and loopholes in the tax system.

If implemented smoothly, GST 2.0 could serve as a model for other emerging economies struggling with fragmented tax structures.

FADA Issues Advisory On Excess Inventory Amid GST Uncertainty

GST 2.0 to Replace All Slabs With One Tax Rate – Here’s What It Means for You

Congress Warns GST 2.0 Could Crush Growth Unless One Big Change Is Made