Proposed GST Removal on Term Life Insurance: When you hear the phrase “Proposed GST Removal on Term Life Insurance”, it may sound like yet another technical tax tweak. But for millions of young families in India, this proposal could be a turning point for household budgets and long-term security. Term life insurance isn’t a luxury product—it’s a safety net that ensures your family is financially protected if the unthinkable happens. Right now, however, that protection comes with an extra 18% tax burden in the form of GST.

The Indian government is considering removing this 18% Goods and Services Tax (GST) on term life insurance and health insurance premiums. If this proposal gets approved, it will directly reduce policy costs, make coverage more affordable, and potentially increase the number of families opting for insurance protection. For households trying to juggle everything from loan EMIs and childcare to medical expenses and retirement planning, this shift could mean real financial breathing room.

Proposed GST Removal on Term Life Insurance

The proposed GST removal on term life insurance could be a game-changer for young families in India. By reducing the cost of coverage, it encourages early adoption, improves affordability, and brings India in line with global practices. While the potential loss of ITC for insurers may reduce the overall benefit slightly, households still stand to gain significantly. For families balancing the demands of today with the uncertainties of tomorrow, this reform could be a welcome relief and a step toward stronger financial security.

| Point | Details |

|---|---|

| Proposal | Exemption of 18% GST on term life and health insurance premiums |

| Why it matters | Direct savings for policyholders, making coverage cheaper and boosting adoption |

| Financial Impact | Example: A ₹15,000 annual premium currently costs ₹17,700 with GST; without GST = ₹15,000 |

| Long-term Savings | Families could save ₹60,000–₹75,000 over a 25–30 year policy |

| Potential Catch | Insurers may lose Input Tax Credit (ITC) and raise base premiums |

| Expected Decision | GST Council to review proposal in September 2025 |

| Official Portal | GST Council Official Website |

How We Got Here: GST and Insurance

When India rolled out the Goods and Services Tax in July 2017, insurance premiums were slotted into the 18% bracket. The logic was simple: financial services were categorized alongside other taxable services. But this came at a cost.

For a basic term life policy costing ₹10,000 annually, the total outgo immediately rose to ₹11,800. Families who were already hesitant about buying coverage suddenly faced an additional expense. While insurance is a necessity, this tax added friction, especially for younger, middle-income households.

Industry analysts have long argued that insurance should be treated as an essential financial good rather than a taxable service. After all, it’s about social security and financial protection, not discretionary spending. The new proposal is a recognition of that reality.

Real-Life Impact: The Family Example

Consider Rohan and Priya, both 32, with a child starting primary school. They buy a ₹1 crore term plan at a base premium of ₹15,000 annually.

- With GST: They currently pay ₹17,700 per year. Over 30 years, this totals ₹5,31,000.

- Without GST: The premium would remain at ₹15,000 per year. Over 30 years, this totals ₹4,50,000.

That’s ₹81,000 in lifetime savings, not counting the opportunity to invest that money elsewhere. If they invested that annual savings in a mutual fund at 10% annual growth, they could build a corpus of nearly ₹1.3 lakh—all from money that would otherwise have gone to taxes.

Why Proposed GST Removal on Term Life Insurance Matters for Young Families?

Cheaper Protection

Scrapping GST means the policy you already thought was affordable becomes even easier on your wallet. Families will have more room in the budget for essentials and investments.

Boosts Early Adoption

Life insurance is cheapest when purchased young. By removing GST, the government reduces barriers for first-time buyers, encouraging people in their 20s and early 30s to get coverage earlier.

Encourages Responsible Saving

Instead of paying taxes, families can redirect money toward education funds, emergency reserves, or retirement accounts. This supports broader financial health.

Improves National Coverage

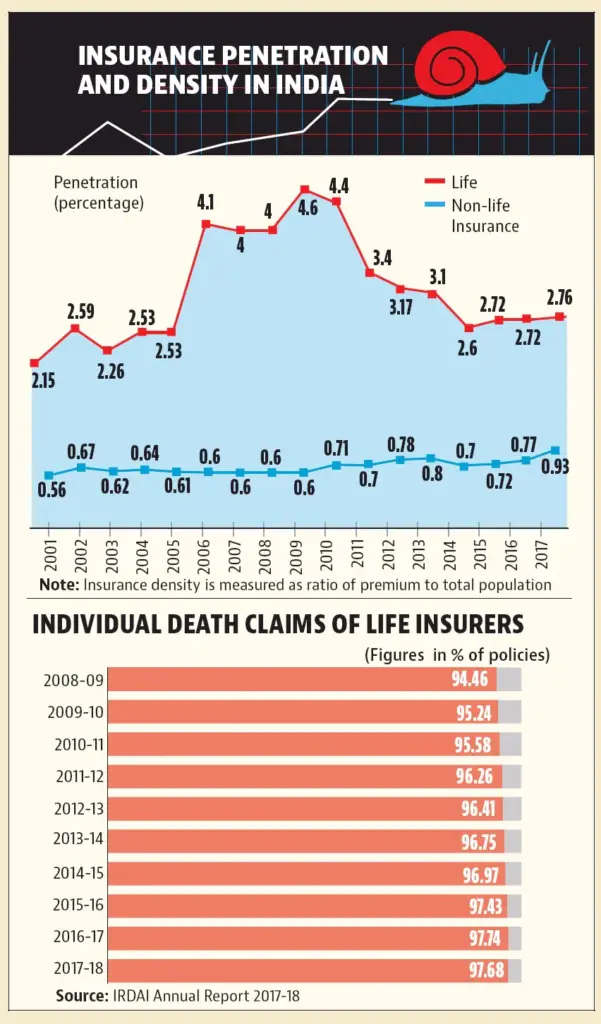

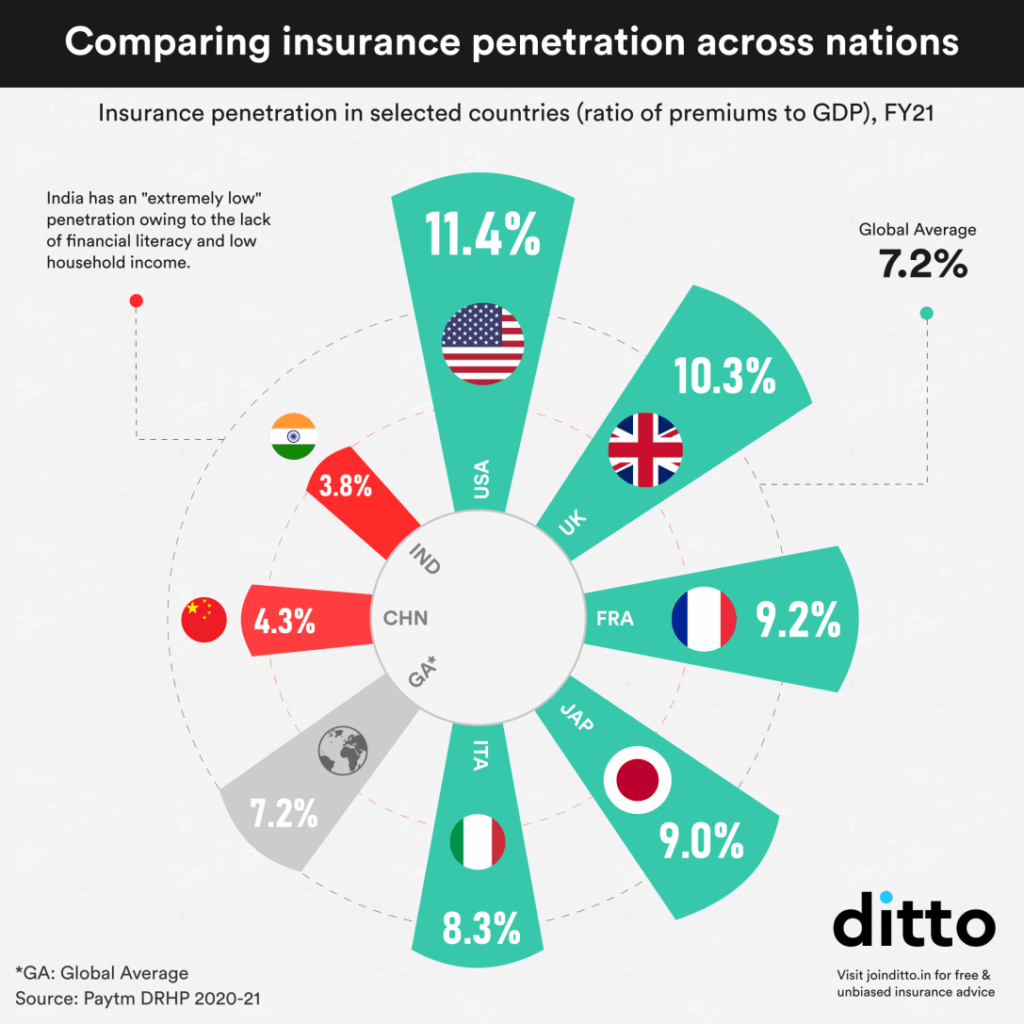

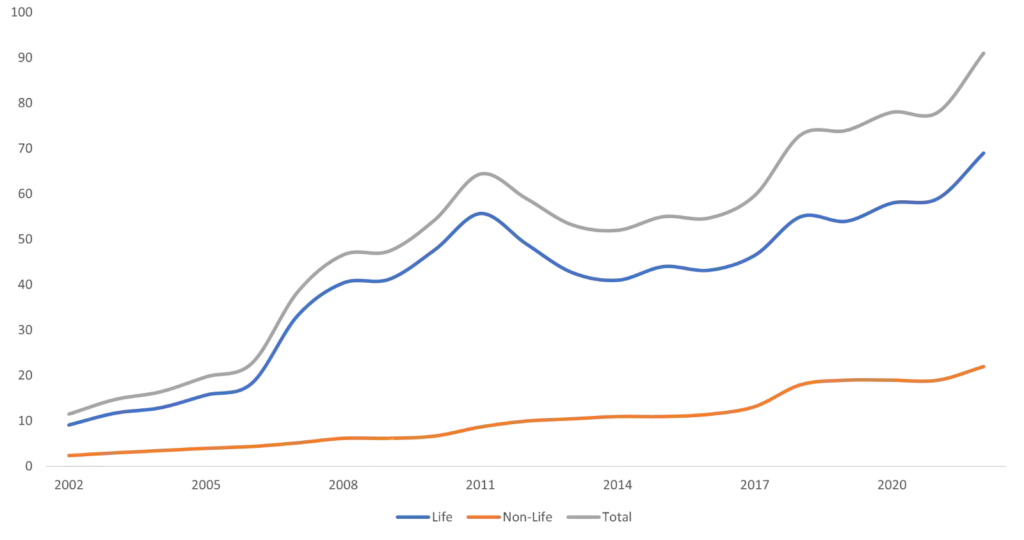

India’s insurance penetration remains low at 3.2% of GDP, compared to a global average of 7%. Removing GST can help expand coverage to millions more households, aligning India with international norms.

The Catch: Input Tax Credit

While the headline benefit is appealing, there is a catch. Under the current system, insurers can claim Input Tax Credit (ITC) on business expenses—rent, salaries, advertising, and digital tools. If insurance premiums become GST-exempt, insurers lose this benefit.

Without ITC, insurers may face higher operational costs. To offset this, they might increase the base premium, reducing some of the benefits of GST removal. However, experts still believe the net savings for families will remain positive, especially for pure term plans where GST currently applies to the full premium.

International Comparisons

Looking globally, India’s move would not be unusual.

- In the United States, life insurance premiums are not taxed, making coverage accessible and widespread.

- In the United Kingdom, life insurance is exempt from Value Added Tax (VAT).

- In Singapore, insurance is also exempt from Goods and Services Tax, contributing to higher penetration rates of over 7.5% of GDP.

India’s decision would therefore align with international best practices and support its goal of “insurance for all.”

Pros and Cons of GST Removal

Pros

- Lower premiums and direct family savings

- Encourages more people to buy insurance earlier

- Strengthens financial protection for households

- Brings India closer to global standards

Cons

- Insurers may increase base premiums due to ITC loss

- Benefits are smaller for ULIPs and endowment plans, where only the risk component is taxed

- Government could lose a source of tax revenue

Step-by-Step Guide for Families

- Review Your Coverage: Ensure you have life insurance worth at least 10–15 times your annual income.

- Compare Policies: Term plans are more cost-effective and stand to benefit the most from GST removal.

- Don’t Delay Coverage: Buy now to lock in age-based premiums, which only rise over time.

- Watch for Announcements: Keep track of the GST Council’s decision in September 2025.

- Reallocate Savings: If premiums fall, reinvest the difference in systematic investment plans or emergency funds.

Professional Insights

Financial planners suggest that the key is not waiting for the policy change to buy insurance. Since premiums are age-linked, waiting just two or three years can make policies significantly more expensive, even if GST is removed.

Economists note that while the government may lose tax revenue in the short term, the long-term benefits of higher insurance adoption—such as greater household stability and reduced reliance on state welfare—could outweigh the costs.

Insurers, on the other hand, have mixed feelings. Some welcome the broader adoption this reform could bring, while others worry about shrinking margins if ITC benefits disappear.

Action Checklist

- Buy coverage as soon as possible to lock in low premiums.

- Track updates from the GST Council and your insurer.

- Plan where you’ll redirect your GST savings—don’t let it slip into unplanned spending.

- Consult a financial advisor for tailored strategies that combine insurance with investment.

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

FADA Issues Advisory On Excess Inventory Amid GST Uncertainty