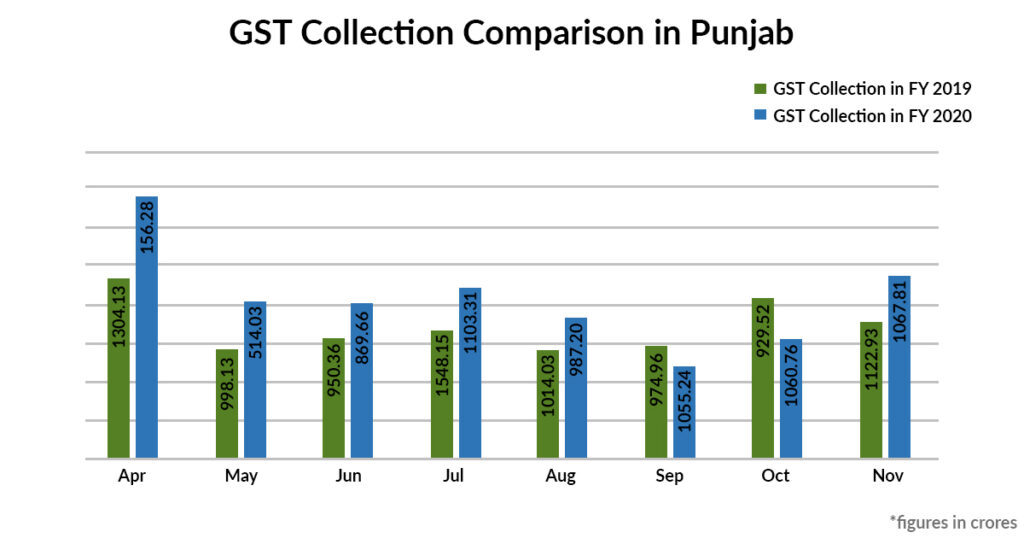

Punjab Achieves Staggering 32% GST Growth in July: In a remarkable financial milestone, Punjab has achieved a 32.08% year-on-year growth in its Goods and Services Tax (GST) revenue for July 2025. This impressive figure reflects the success of the state’s proactive tax policies, rigorous enforcement measures, and a business-friendly environment fostered by the Aam Aadmi Party (AAP) government. Finance Minister Harpal Singh Cheema revealed the growth, which now positions Punjab among the top performers in terms of GST revenue collection. Punjab’s GST revenue for July 2025 amounted to ₹2,357.78 crore, marking a sharp rise from ₹1,785.07 crore in July 2024. This surge not only signifies robust financial health but also indicates a solid fiscal trajectory for the state’s economy. The performance in July continues the upward trend in Punjab’s tax collection, which has been steadily increasing over the past few years. The consistent improvements demonstrate the state’s growing compliance with the GST system and its evolving fiscal management capabilities.

Punjab Achieves Staggering 32% GST Growth in July

Punjab’s 32% GST growth in July 2025 reflects a well-thought-out strategy to boost the state’s economic growth through effective tax collection, business-friendly policies, and strong enforcement mechanisms. The increased revenue not only supports the state’s financial health but also enables reinvestment into key sectors that will drive future growth. Businesses in Punjab should take advantage of the streamlined tax processes, ensuring timely compliance and leveraging government incentives to fuel their own growth. With continued focus on transparency, digitization, and policy reforms, Punjab is on track for sustained economic success.

| Key Data & Stats | Details |

|---|---|

| GST Growth (Year-on-Year) | 32.08% |

| GST Revenue (July 2025) | ₹2,357.78 crore |

| GST Revenue (July 2024) | ₹1,785.07 crore |

| Cumulative GST Revenue (FY 2025-26) | ₹9,188.18 crore |

| Increase in Cumulative Revenue | ₹2,025.36 crore (compared to last year) |

| SIPU Recovery (FY 2025-26) | ₹156.40 crore (including ₹57.43 crore from road checks) |

| GST Fraud Cases Uncovered | ₹2,620.80 crore in fake transactions, ₹296.32 crore tax evasion |

How Did Punjab Achieves Staggering 32% GST Growth in July?

1. Strategic Policy Changes and Financial Reforms

Punjab’s exceptional growth in GST revenue can be attributed to a combination of strategic policy changes, enhanced tax enforcement, and a business-friendly environment. Under the AAP government, Punjab has prioritized simplifying tax processes for businesses, ensuring better transparency and efficient tax administration.

The state government has worked to create an environment that encourages tax compliance while promoting the growth of small and medium-sized enterprises (SMEs). By introducing user-friendly digital tools and improving the overall ease of doing business, the government has succeeded in attracting a greater number of businesses into the formal tax framework.

2. The Role of SIPU in Boosting GST Revenue

Another key factor contributing to this growth is the State Investigation and Preventive Unit (SIPU), which has been actively involved in cracking down on tax evaders. The unit has recovered over ₹156.40 crore in penalties in the first quarter of the current financial year. The SIPU’s efforts include road checks and business inspections, which have yielded substantial recoveries.

Through rigorous checks, SIPU discovered major fraud cases, amounting to ₹2,620.80 crore in fake transactions and an estimated tax evasion of ₹296.32 crore. These actions demonstrate the government’s commitment to ensuring tax compliance and addressing fraudulent activities that undermine the state’s fiscal health.

The success of the SIPU in uncovering fraud also highlights the importance of continued vigilance in maintaining a fair tax system. Their ability to detect and prevent fraud plays an essential role in securing Punjab’s financial ecosystem and enhancing public trust in the government’s ability to manage tax revenues responsibly.

3. Simplifying the Tax System for Businesses

Punjab’s focus on simplifying tax structures and enhancing accessibility for businesses has played a crucial role in fostering a more compliant business environment. The implementation of online GST registration portals, e-filing systems, and outreach programs has made it easier for businesses, especially small and medium enterprises (SMEs), to adhere to GST regulations.

One of the main advantages of digitizing tax processes is that businesses can now manage their compliance requirements from anywhere, without the need for lengthy paperwork or in-person visits to government offices. These innovations not only save time but also improve the accuracy of tax filings.

As a result, there has been a noticeable increase in the number of businesses registering for GST, which directly contributes to higher tax revenue. Punjab’s efforts to improve the accessibility and convenience of compliance have proven successful in making it easier for businesses to pay their fair share of taxes.

Understanding the Bigger Picture: Punjab’s Economy and GST Contribution

The GST system plays a pivotal role in driving the Indian economy, and Punjab is a prime example of how effective tax policies can stimulate growth. GST contributes significantly to the state’s overall financial health, allowing the government to reinvest in essential infrastructure, public welfare programs, and economic development projects.

Punjab, known for its robust agriculture, manufacturing, and services sectors, is experiencing a positive shift in how business operations are handled. The growth in GST revenue helps fund crucial sectors, such as education, healthcare, and transportation, all of which are vital to the state’s continued progress.

This increase in GST revenue is not only beneficial for the state’s immediate economic health but also ensures that Punjab will be better equipped to handle future economic challenges. The long-term impact of this growth includes more robust infrastructure, stronger welfare programs, and continued investment in the local economy.

State Government Initiatives to Strengthen GST Revenue Collection

The AAP government has rolled out a series of initiatives aimed at strengthening the GST collection system. These include:

- Digitizing tax filing processes to reduce human errors and ensure quicker processing times for refunds.

- Offering taxpayer education programs to help businesses understand and comply with GST regulations.

- Collaborating with various stakeholders to promote the ease of doing business within the state, encouraging both local and out-of-state entrepreneurs to operate within Punjab.

These initiatives demonstrate the government’s proactive approach to improving tax compliance and building a sustainable tax collection system. By adopting these measures, the Punjab government ensures that tax collection remains efficient and fair, while also supporting the growth of local businesses.

Long-Term Benefits of Consistent GST Growth

The consistent increase in GST revenue is expected to have several long-term benefits for the state:

- Infrastructure Development: A healthy tax revenue allows the government to fund large-scale infrastructure projects, such as roadways, hospitals, and educational institutions.

- Social Welfare: With better fiscal health, Punjab will have more resources to invest in social welfare programs, providing financial aid to the underprivileged sections of society.

- Economic Growth: The ripple effect of increased revenue will boost local businesses, attract more investments, and potentially lead to higher employment rates across various sectors.

The long-term impact of consistent GST growth means that Punjab can fund the development of public services and infrastructure, ultimately improving the quality of life for its citizens. As a result, the state is poised for sustained economic prosperity in the coming years.

Challenges Faced by Businesses and How the Government is Addressing Them

While the growth in GST revenue is encouraging, businesses still face challenges such as delayed GST refunds, complex compliance requirements, and frequent regulatory changes. The government has recognized these challenges and has made significant strides to address them:

- Automating processes for faster refunds.

- Introducing simplified tax forms and guides for easier compliance.

- Offering training programs for businesses to ensure that they understand the GST system thoroughly.

These measures are aimed at reducing friction for businesses and ensuring that they can focus on growth without being bogged down by administrative hassles.

Addressing Issues of Tax Evasion

While Punjab has been successful in curbing major instances of tax evasion, the government continues to work on more robust fraud detection systems. Technology is playing an increasing role in detecting suspicious activity and ensuring compliance. For example, AI-based software is now being used to spot discrepancies in transaction records, making it easier for authorities to detect fraud before it becomes a larger issue.

Business-Friendly Policies

To further promote economic growth, Punjab has launched several programs designed to make it easier for businesses to set up operations and thrive in the state. The Ease of Doing Business (EoDB) initiative has streamlined the process of registering businesses, applying for permits, and ensuring compliance with both state and national regulations. With these policies in place, businesses are encouraged to formalize their operations, which further contributes to the state’s tax revenue growth.

Comparing Punjab’s GST Growth to Other States

To understand the significance of Punjab’s 32% GST growth, it’s helpful to compare it with other top-performing states. Gujarat, Maharashtra, and Tamil Nadu are often seen as leaders in GST collections. However, Punjab’s growth trajectory is encouraging, especially considering that it has been a consistent performer over the last several years. This positions the state as a strong contender for continued economic prosperity.

A Close Look at GST Revenue Growth in Neighboring States

While Punjab has made significant strides, it is interesting to note how neighboring states are performing in terms of GST collections. States like Haryana and Himachal Pradesh have also reported strong growth rates, but Punjab’s 32% year-on-year growth places it among the leaders. This is a sign that Punjab’s policies are working, and it could set a model for other states to follow.

Testimonial from Local Businesses

Local entrepreneurs have noticed the positive effects of the state’s business-friendly initiatives. Take Simranjeet Singh, a small business owner in Amritsar, who says, “The introduction of online GST filing and quick refunds has made it easier for us to manage our business operations. The improved transparency and lower chances of audits have given us the confidence to scale our business.”

For many business owners in Punjab, the improved ease of doing business and the government’s focus on GST compliance have been crucial factors in helping them succeed.

GST Collections for July 2025: You Won’t Believe Which State Tops the List!