Punjab Finance Minister Calls for Safeguards in GST Reform: When the Punjab Finance Minister Harpal Singh Cheema recently called for safeguards in the Goods and Services Tax (GST) reform, it wasn’t just another headline in the papers. His statement spotlighted one of the most important debates in India’s economic policy: how to balance national-level tax reforms with protecting the financial independence of states. Cheema has warned that if GST reforms—particularly rate rationalisation—are pushed through without adequate safeguards, states like Punjab could face serious fiscal crises. That means not enough money for schools, hospitals, farmers, or even basic infrastructure. In simple terms: when the government tinkers with GST without planning for the states, ordinary citizens feel the squeeze.

And if you’re an American reader, think about it like this: imagine Washington suddenly takes over state sales taxes, promises to cover any shortfall for five years, and then walks away—leaving California, Texas, or New York with massive budget holes. You’d expect governors to raise a fuss. That’s exactly what’s happening in India right now.

Punjab Finance Minister Calls for Safeguards in GST Reform

The Punjab Finance Minister’s call for safeguards in GST reform is more than just a local concern. It represents a wider battle over fiscal fairness, federal balance, and social equity. With billions at stake, the outcome of this debate will shape not only state budgets but also India’s economic stability and attractiveness to global investors.

| Topic | Details |

|---|---|

| Main Concern | Punjab FM Harpal Singh Cheema warns that GST reforms without safeguards will hit state revenues. |

| Revenue Loss | Punjab alone has lost about ₹1.11 lakh crore ($13.3 billion) since GST’s launch in 2017. |

| Pending Compensation | Nearly ₹50,000 crore ($6 billion) still unrecovered by Punjab. |

| States’ Demands | Five-year compensation extension, sin/luxury goods levy, and guaranteed 14% annual revenue growth baseline. |

| Federal Impact | Risk of weakening India’s federal balance and states’ fiscal autonomy. |

| Official Reference | GST Council Official Website |

GST in India: A Quick Refresher

Launched in July 2017, the Goods and Services Tax replaced a tangled web of central and state taxes. Before GST, every state had its own sales taxes, entry levies, and duties, making it incredibly hard for businesses to operate across India. For example, a truck carrying goods from Delhi to Chennai had to stop at multiple state borders to pay different taxes.

GST simplified this by creating a single, nationwide tax system. Businesses now file under one framework, and goods move more freely. For companies, this was a game-changer. But for states, it meant giving up their tax independence.

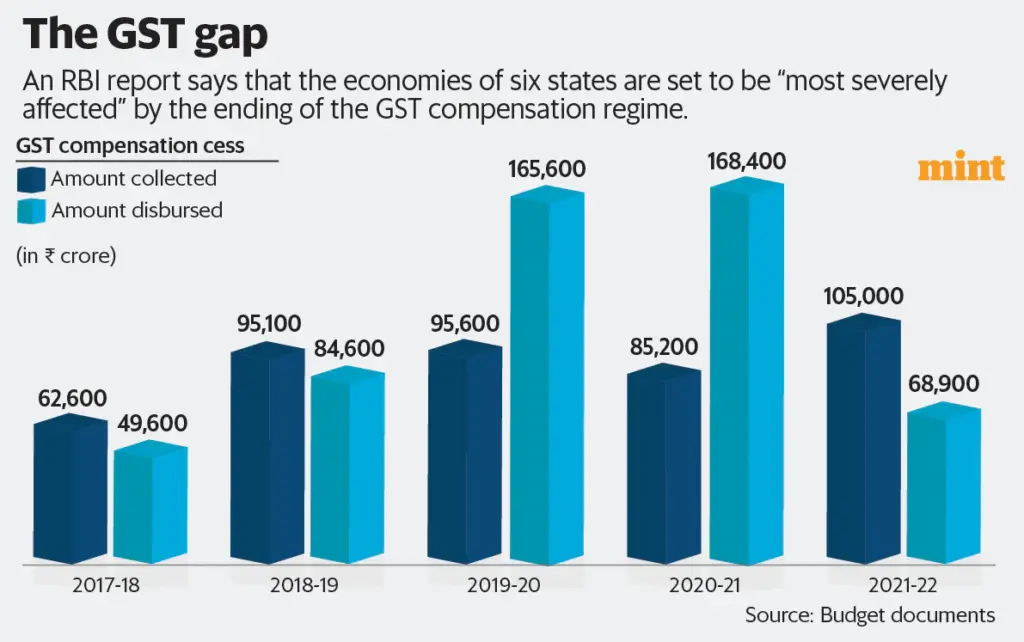

The central government sweetened the deal by promising a five-year compensation plan, covering any revenue shortfalls with funds raised from a special GST compensation cess. That period ended in 2022, and since then states have been left to fend for themselves.

Why Punjab Finance Minister Calls for Safeguards in GST Reform?

Punjab has been one of the hardest-hit states under GST.

- Revenue Hole: Since 2017, the state has lost around ₹1.11 lakh crore ($13.3 billion).

- Partial Relief: Compensation covered about ₹60,000 crore ($7.2 billion).

- Unmet Gap: Nearly ₹50,000 crore ($6 billion) remains unrecovered.

This gap has huge implications. Punjab’s economy is already stretched, with high debt levels and a reliance on agriculture. Less money means fewer resources for:

- Funding free healthcare schemes.

- Paying teachers and maintaining schools.

- Supporting farmers with subsidies.

- Building much-needed rural infrastructure.

Cheema has warned that unless safeguards are introduced, Punjab could face a financial crunch that directly hurts citizens.

Opposition States Push Back

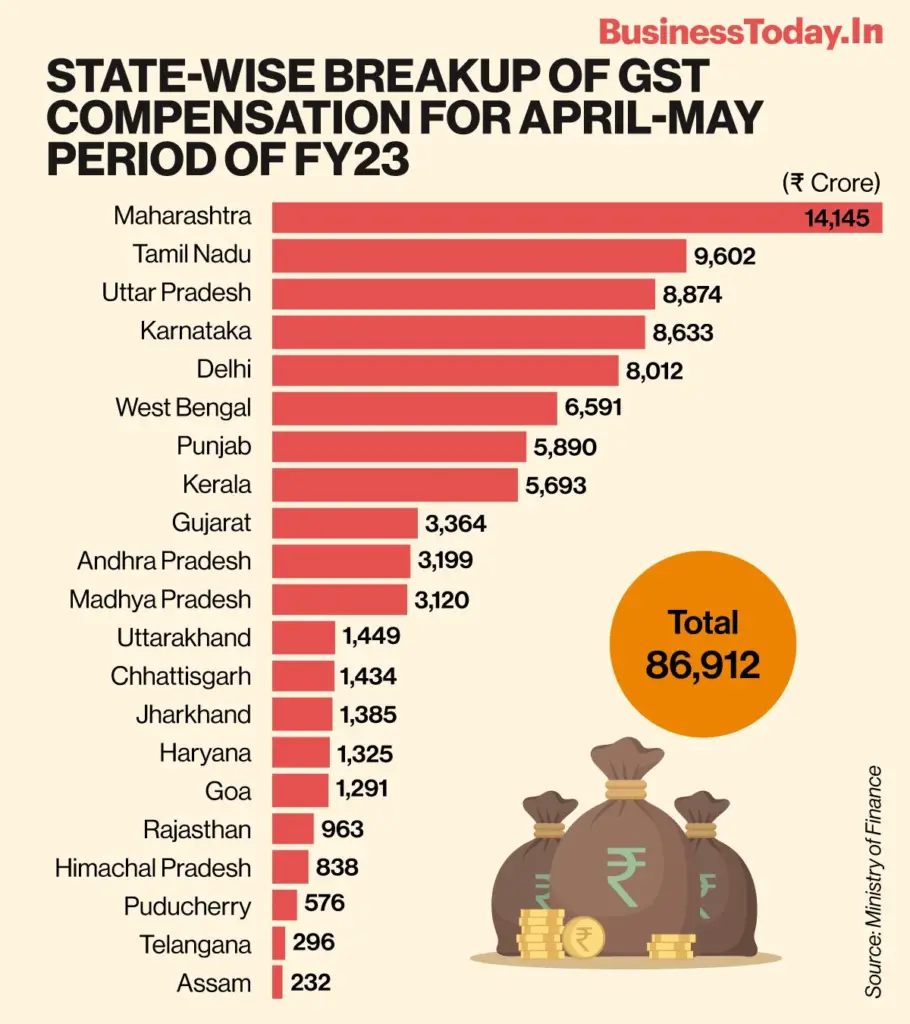

Punjab isn’t standing alone. A coalition of eight opposition-ruled states—including Karnataka, Kerala, Tamil Nadu, Telangana, Jharkhand, Himachal Pradesh, and West Bengal—has joined the call for safeguards.

Their demands include:

- Extending Compensation for Five More Years – So states can stabilize their revenues.

- Guaranteeing 14% Annual Growth – The original promise of GST compensation should be maintained.

- Imposing Sin and Luxury Levies – Taxes on alcohol, tobacco, and luxury cars, with funds going directly to the states.

- Borrowing Options – Allowing states to borrow against future GST receipts if revenues fall short.

Collectively, these states argue that without such measures, the Centre risks undermining the federal balance enshrined in India’s Constitution.

U.S. Parallels: A Federal vs. State Fight

This issue resonates strongly with Americans familiar with the tug-of-war between Washington and the states. Here’s the parallel:

- In the U.S., sales taxes are controlled by individual states. Imagine if Washington suddenly took that over and promised to make up for lost revenue.

- After five years, if Washington pulled back, states like California or New York could face billions in lost revenue. They’d either cut services or raise new taxes.

That’s essentially India’s situation. It’s a classic example of how centralization can clash with local autonomy.

Real-World Case Studies

Tamil Nadu

Known as India’s auto hub, Tamil Nadu’s economy thrives on manufacturing. If GST reforms reduce its revenue, it risks losing funds to support industrial infrastructure.

Karnataka

Home to Bengaluru, India’s “Silicon Valley,” Karnataka needs consistent revenue for tech parks, transportation, and housing. Shortfalls could mean delayed metro projects and weaker digital infrastructure.

Punjab

Already debt-ridden, Punjab’s agriculture-heavy economy relies heavily on state subsidies and welfare schemes. A ₹50,000 crore gap could cripple its ability to support farmers and rural families.

Expert Opinions

Fiscal experts are clear: ignoring state demands could have far-reaching consequences. According to The Economic Times, opposition states warn of a ₹2 lakh crore ($24 billion) annual shortfall if reforms proceed without safeguards. That’s nearly equal to the yearly budget of a U.S. state like New York.

Economists argue that a sin and luxury goods levy could strike a balance—helping states generate funds while discouraging unhealthy consumption patterns. Others warn that without reforms, states may turn to borrowing, increasing debt levels and hurting long-term growth.

What Happens If Safeguards Are Ignored?

- Higher Local Taxes: States may impose new cesses or duties, reversing the “one nation, one tax” vision.

- Cuts to Public Spending: Less money for welfare, healthcare, and infrastructure.

- Borrowing and Debt: States may borrow heavily, creating future repayment challenges.

- Investor Uncertainty: Businesses and global investors could see India as a riskier market.

Punjab Achieves Staggering 32% GST Growth in July—Finance Minister Harpal Singh Cheema Reveals

Punjab & Haryana HC Grants Bail to Accused of Scamming Rs. 1.33 Crore Posing as Customs Officer

GST Restructuring Debate – Why Experts Say It Could Hurt Federalism

What Happens If Safeguards Are Added?

- Revenue Stability: States can plan better and maintain essential services.

- Balanced Federalism: Centre and states share resources without conflict.

- Investor Confidence: Businesses benefit from a predictable tax regime.

- Social Impact: Citizens continue receiving vital services like education and healthcare.

Practical Advice for Businesses and Policymakers

- Track GST Council Decisions – Stay updated on reforms via the GST Council.

- Plan for Tax Flexibility – Budget for possible increases in sin and luxury levies.

- Engage with State Governments – Local-level policies may change even if national GST remains stable.

- Diversify Operations – Companies working across multiple states should prepare for uneven impacts.