Punjab & Haryana HC Grants Bail to Accused of Scamming Rs. 1.33 Crore: The Punjab and Haryana High Court’s recent decision to grant bail to an individual accused of scamming ₹1.33 crore by posing as a Customs officer has stirred a wider conversation about the growing prevalence of fraud and cybercrime. In this particular case, the accused managed to deceive an elderly advocate into transferring a significant amount of money by impersonating officials from the Customs Department, the Bombay Police, and the Central Bureau of Investigation (CBI). This article delves into the details of the case, the legal process involved, and offers practical advice on how to avoid falling victim to such scams in the future.

Punjab & Haryana HC Grants Bail to Accused of Scamming Rs. 1.33 Crore

The decision to grant bail to Anoop, despite his involvement in a significant fraud case, serves as a reminder of how serious impersonation scams can be. While the legal process must ensure fairness, this case also underscores the importance of vigilance in protecting ourselves from fraud. As scams continue to evolve, awareness, cautiousness, and prompt action are key to avoiding becoming a victim.

| Key Data | Details |

|---|---|

| Accused Name | Anoop alias Anup |

| Fraud Amount | ₹1.33 Crore |

| Victim | 78-year-old Advocate |

| Court Decision | Bail Granted |

| Impersonation Method | Posing as Customs & CBI officers |

| Legal Arguments | Alleged false implication, six months in custody |

| Link to Official Court Resources | Taxscan |

The Scam: A Detailed Look

On November 19, 2024, the victim, an elderly advocate, received a WhatsApp call that set the stage for a scam. The caller claimed to be from the Bombay Customs Department and informed him that a parcel connected to him had been flagged for containing illegal narcotics. To make the scam seem more legitimate, the caller transferred the call to another individual pretending to be a police officer from Bombay, and later to a supposed CBI official.

The scammer played on the victim’s fears and created a sense of urgency by alleging that a fraudulent financial transaction of ₹32 crore had been linked to the victim’s name. The victim was told that his immediate cooperation was necessary to prevent legal consequences.

The fraudsters instructed the victim to liquidate his fixed deposits and transfer the funds to a bank account under the CBI Court’s name for investigation. Trusting these individuals, the victim transferred ₹1.33 crore from his and his wife’s accounts between November 19 and 26, 2024.

The scam unraveled only after the victim realized the fraud and reported it to the police. The authorities soon traced ₹5 lakh of the transferred amount to Anoop’s bank account, which led to his arrest. While Anoop wasn’t named in the original FIR, he was arrested based on the financial trail linking him to the scam.

Why This Case Is Significant?

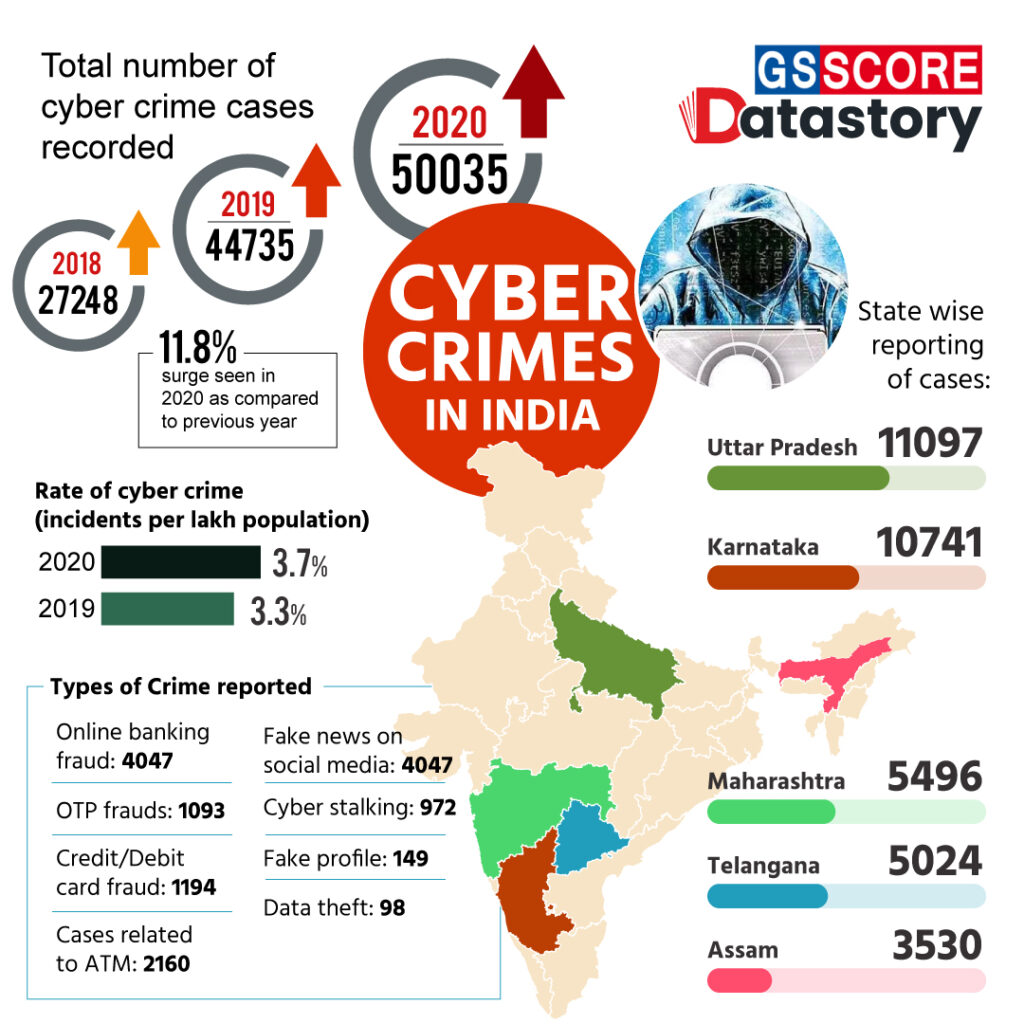

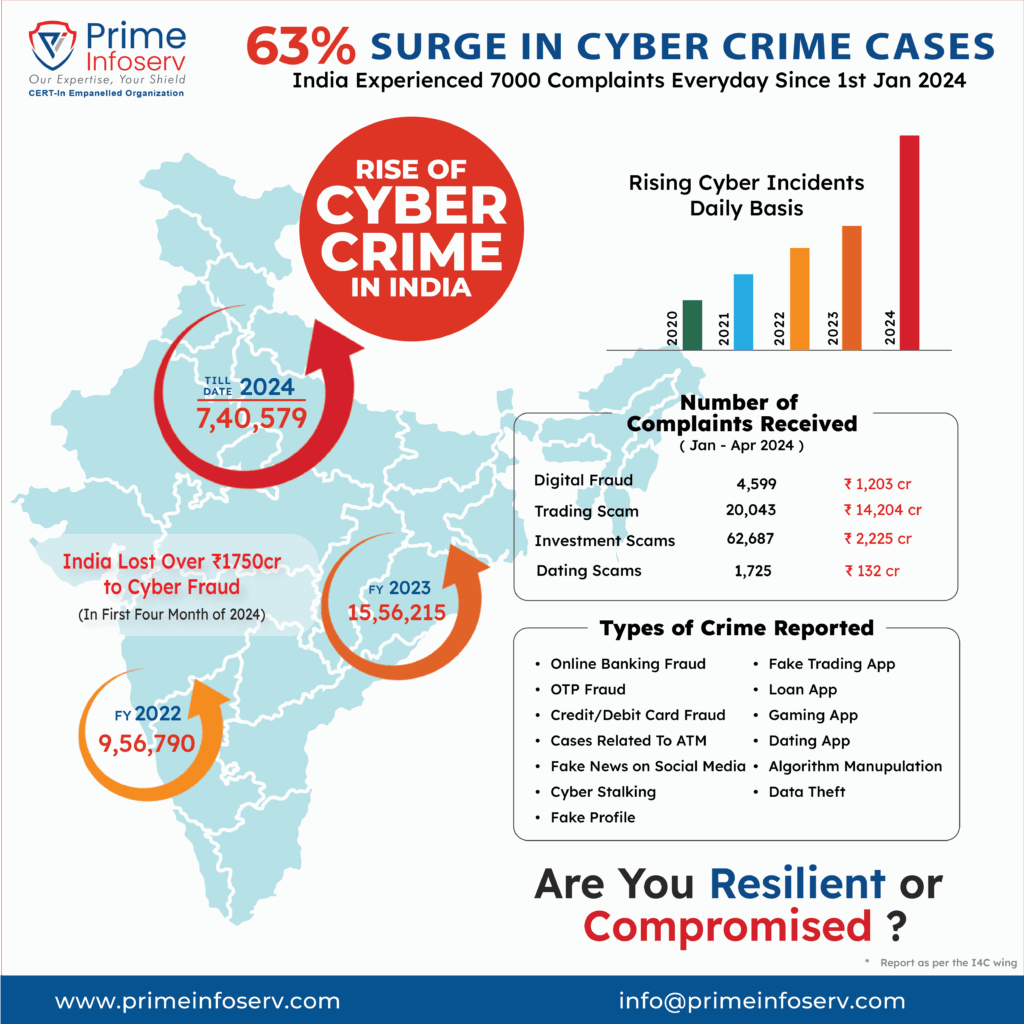

This case highlights the growing sophistication of fraud tactics used by criminals in the digital era. Scammers are now increasingly impersonating trusted authorities such as law enforcement and government officials to exploit individuals. The fact that an elderly person, who may not have been as familiar with modern scams, was targeted is a stark reminder of how vulnerable some sections of the population are. Furthermore, this case emphasizes the critical need for increased awareness and caution when dealing with unsolicited calls or requests for financial assistance.

How Punjab & Haryana HC Grants Bail to Accused of Scamming Rs. 1.33 Crore: Step-by-Step Breakdown

To understand the situation better, let’s break down how this scam unfolded:

- The Initial Call: The scammer impersonates a Customs official, claiming that a parcel linked to the victim contained narcotics, immediately creating a sense of danger.

- Transfer to “Law Enforcement”: The call is “transferred” to a so-called police officer and later a CBI official. This tactic was meant to give the victim a sense of legitimacy and authority.

- Fraudulent Financial Allegations: The scammers tell the victim that a ₹32 crore financial fraud is connected to them. They falsely claim that the only way to avoid legal trouble is to cooperate and transfer funds to a specific bank account.

- Bank Transfers: The victim is instructed to liquidate his fixed deposits and send the money to the scammers’ account. The scammers paint the transfer as a verification step for the investigation.

- The Realization: After transferring the funds, the victim realizes he’s been scammed and contacts the authorities. By then, the fraud had already occurred.

Understanding the Legal Process: What Happens After an Arrest?

After the fraud was reported, the police traced a portion of the funds to Anoop’s bank account, which led to his arrest. His defense team argued that he had been falsely implicated in the case. They emphasized that he had already been in police custody for over six months and that continued detention would cause harm to him and his family.

The Punjab and Haryana High Court ruled on the matter, stating that pre-trial detention should not serve as a form of punishment. While there was evidence connecting Anoop to the scam, the court considered that he had already spent six months in custody and granted him bail, provided he continued to cooperate with the investigation.

This ruling underscores the importance of ensuring that the legal system does not become punitive before a trial. It also highlights the burden of proof required to hold an individual in custody for extended periods.

How to Protect Yourself from Scams Like This?

Scams like the one in this case are more common than you might think. Fortunately, there are several steps you can take to protect yourself and your loved ones from falling prey to such schemes.

1. Be Cautious of Unsolicited Calls

If you receive an unsolicited call from someone claiming to be from a government agency, law enforcement, or the Customs Department, it’s essential to be skeptical. The government will never ask you to make financial transfers or disclose personal details over the phone.

2. Don’t Act on Urgency

Scammers often create a sense of urgency to pressure you into making quick decisions. Whether it’s a “limited-time offer” or a supposed emergency, take a step back before responding.

3. Verify the Source

If the caller claims to be from a reputable organization, such as the CBI or Customs Department, ask for their details and call back using an official number you find online. Do not use the contact information provided by the caller.

4. Consult Trusted Individuals

If you are ever in doubt, consult with a trusted family member, friend, or legal advisor before taking any action. Fraudsters often target individuals who are isolated or unfamiliar with modern fraud tactics.

5. Report Suspicious Activity Immediately

If you suspect you’ve been targeted by scammers, contact your bank immediately and freeze your accounts. Report the incident to the authorities as soon as possible to minimize any damage.

Practical Steps to Safeguard Against Cyber Frauds

In addition to the basic advice above, here are some more specific steps you can take to protect yourself in the digital age:

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your banking and email accounts to add an extra layer of security.

- Monitor Your Financial Statements: Regularly review your bank statements to spot any unusual transactions. Early detection can help prevent further loss.

- Use Strong Passwords: Avoid using easily guessable passwords. A strong, unique password is your first line of defense against unauthorized access.

- Install Antivirus Software: Ensure that your devices are equipped with up-to-date antivirus software to prevent malware and phishing attacks.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

GST Fraud on the Rise: Towed Vehicles and Issued E-Way Bills—What the Authorities Are Hiding!