Quicker Appointment of GST Appellate Tribunal Benches: The Goods and Services Tax (GST) Appellate Tribunal (GSTAT) has long been a key part of India’s efforts to resolve tax-related disputes swiftly and effectively. Yet, despite the central government’s best efforts, the process of setting up these important tribunals has faced numerous hurdles, especially at the state level. Recently, a Parliamentary Standing Committee on Finance has raised its voice, demanding that the Ministry of Finance expedite the creation of GST Appellate Tribunal (GSTAT) benches across all Indian states. This article will dive deep into the issues that have delayed the establishment of GSTAT benches, the importance of these tribunals for both taxpayers and the country’s economy, and what the government can do to improve the situation. Whether you’re a professional in the finance world or a curious reader trying to understand the details of this topic, we’ve got you covered.

Quicker Appointment of GST Appellate Tribunal Benches

The establishment of GST Appellate Tribunal benches is a crucial step towards making India’s tax system more efficient and business-friendly. While progress has been made at the central level, delays at the state level are still holding back the system. The Parliamentary Standing Committee on Finance has rightly pointed out these issues, urging the Ministry of Finance to take swift action. For businesses and taxpayers alike, these delays mean prolonged disputes and uncertain outcomes. Therefore, it’s imperative for the government to prioritize the appointment of members and coordination between the state and central governments to ensure that GST Appellate Tribunals function efficiently. Only then can India move towards a more streamlined and effective tax system that benefits everyone.

| Key Topic | Details |

|---|---|

| What is GSTAT? | The GST Appellate Tribunal (GSTAT) is a quasi-judicial body established to hear disputes related to the Goods and Services Tax (GST). |

| Current Issues | The GSTAT benches are delayed due to problems with member appointments and coordination between the Ministry of Finance and state governments. |

| Impact on Taxpayers | The delay in appointing these benches leads to prolonged litigation, overburdening the judiciary and delaying taxpayer relief. |

| Parliamentary Panel Recommendations | The panel has urged the Ministry of Finance to speed up the process, coordinate with states, and ensure regular recruitment for long-term stability. |

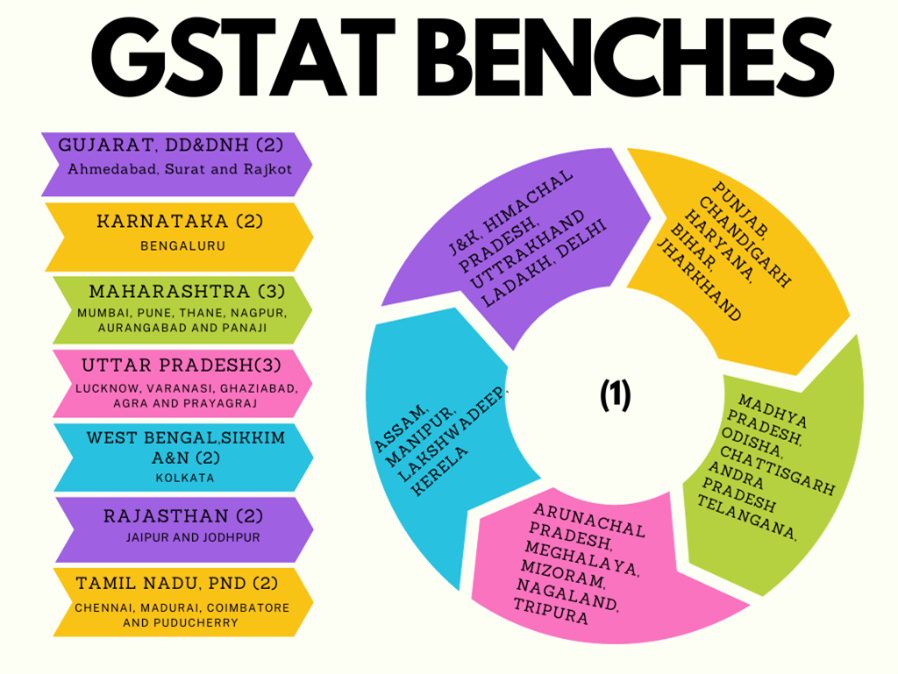

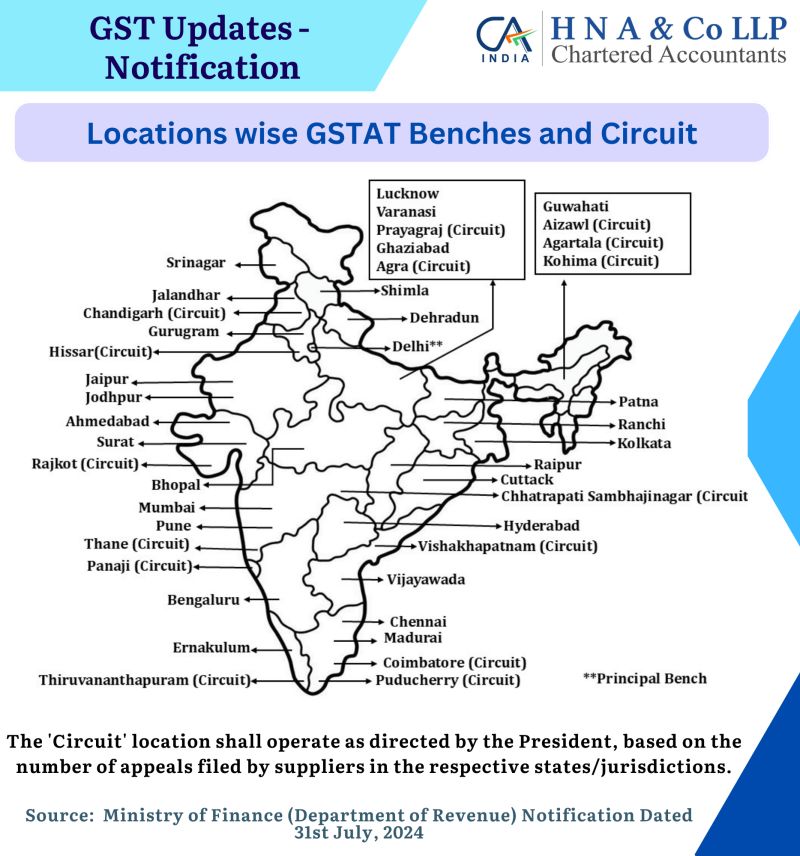

| Next Steps | Central government has already appointed judicial and technical members for the Principal Bench in New Delhi and 31 state benches. |

| Official Sources | NDTV Profit and Business Standard provide more detailed information. |

What is the GST Appellate Tribunal?

The Goods and Services Tax Appellate Tribunal (GSTAT) is a key player in India’s tax dispute resolution system. Think of it as a “court” for GST-related issues, but with a special focus on matters related to the country’s indirect tax system. It is designed to be a faster and more efficient way of resolving disputes between taxpayers and the government, helping businesses avoid getting stuck in lengthy legal battles.

When businesses or individuals disagree with the GST authorities about how taxes should be levied or the penalties they should pay, the GSTAT serves as the body to resolve these disputes. The creation of GSTAT was part of the government’s goal to streamline tax processes and create a user-friendly tax system that boosts business operations without being bogged down by endless legalities.

The Current State of GSTAT

While the central government has made considerable progress in setting up GST Appellate Tribunals, the actual operationalization of these tribunals has been slow, especially in states. The delay stems from issues like delays in appointing members, lack of coordination between the Ministry of Finance and state governments, and a backlog of cases waiting to be addressed.

The Parliamentary Panel’s Demand Quicker Appointment of GST Appellate Tribunal Benches

A Parliamentary Standing Committee on Finance has recently taken the matter into its own hands, demanding that the government take immediate steps to ensure that GST Appellate Tribunal benches are established and become operational without any further delays. The committee is particularly concerned about the appointment of Technical Members (State) and the lack of action from several state governments in sending the necessary recommendations.

These delays are not just administrative hiccups; they have a direct impact on the GST dispute resolution process. Businesses and taxpayers often find themselves stuck in legal limbo, which can lead to prolonged litigation, overburdened high courts, and untimely relief for those seeking justice.

Why is GSTAT Important for India?

You might wonder, “Why is the GST Appellate Tribunal such a big deal?” Well, imagine you run a small business, and you receive a tax notice from the government. You believe that the tax authorities are mistaken, but if there’s no easy way to resolve the issue quickly, it could lead to a lot of stress and even financial loss. That’s where GSTAT comes in – it helps clear these disputes quickly and fairly.

Without a fully functioning GSTAT, taxpayers face delays in resolving disputes, and the high courts become overwhelmed with cases that could easily be handled by the tribunal. This not only causes delays but also creates unnecessary pressure on the judicial system.

Why Are These Delays Happening?

The main reason behind the delays is the appointment of members to the tribunals. The committee has pointed out that there has been a lack of coordination between the Ministry of Finance and state governments, with only a handful of states having made the necessary appointments. This results in a lack of quorum, which prevents the benches from being fully operational.

For example, only a few states, including Uttar Pradesh, Odisha, Gujarat, Bihar, and Maharashtra, have forwarded their recommendations for appointing members to the tribunals. Until all the states do so, the full network of GSTAT benches cannot be set up.

Global Context: How Do Other Countries Handle Tax Disputes?

India’s GST Appellate Tribunal system is not unique. Many countries have similar mechanisms in place to handle tax-related disputes. In the United States, for example, the U.S. Tax Court plays a role similar to that of GSTAT by offering taxpayers an avenue to challenge decisions made by the IRS. However, unlike India, the U.S. Tax Court benefits from a more streamlined appointment process and a more efficient resolution system.

Another example comes from the European Union (EU), where tax dispute resolution systems are often integrated into broader judicial frameworks. The EU’s European Court of Justice (ECJ) handles disputes related to indirect taxes, and member countries have their own national tribunals to resolve issues efficiently. These systems are not perfect but offer a good example of how multiple levels of authority can work together to resolve tax-related issues quickly.

The Role of Technology in GSTAT

One area where GSTAT could be improved is by integrating more advanced technology into the dispute resolution process. Artificial intelligence (AI) and machine learning (ML) could be used to assist in sorting cases, helping to prioritize more urgent matters and speeding up the review process.

Additionally, the use of online portals and digital platforms could make it easier for taxpayers to submit documents, track the progress of their cases, and receive updates in real-time. This would significantly reduce paperwork, improve transparency, and make the process more accessible to people who may not have the resources to navigate the traditional legal system.

How Can This Impact You?

If you’re a business owner, or even an individual taxpayer, these delays can affect you. GST appeals could take years to resolve, which can result in financial strain or uncertainty for businesses. If a company is wrongly charged a penalty or tax, it’s in their best interest to resolve the matter as quickly as possible. Without an efficient GST Appellate Tribunal system, the process becomes sluggish, impacting businesses and individuals alike.

For instance, imagine a scenario where a small business owner disputes a GST assessment made by the tax authorities. The dispute could drag on for months or even years, leaving the business owner unsure of their financial future and unable to plan for the next steps. These prolonged delays ultimately harm the economy by discouraging investment and slowing down economic growth.

Parliamentary Recommendations for Speedier Appointments

The Parliamentary Standing Committee on Finance has made a number of key recommendations to speed up the process of establishing the GST Appellate Tribunal benches:

- Active Coordination with State Governments: The committee has urged the Ministry of Finance to step up efforts and work closely with state governments to ensure that the necessary appointments are made on time. This includes setting up Search-cum-Selection Committees and speeding up the process of sending recommendations.

- Regular Recruitment of Members: To ensure that the GSTAT functions smoothly, the committee has emphasized the need for regular recruitment of members. This will ensure that there are enough qualified individuals to run the tribunals efficiently.

- Streamlining the Appointments Process: The committee also recommends that the government establish a clear, streamlined process to appoint members, so that future delays are avoided.

What Are the Next Steps?

The central government has already appointed judicial and technical members to the Principal Bench in New Delhi, along with 31 state benches across the country. However, the state-level delays remain a big roadblock. The Parliamentary Panel’s recommendation now pushes for faster action in overcoming these bottlenecks and ensuring that GSTAT can function at full capacity.

What Can Businesses Do?

If you are a business owner or a professional in the field, it’s important to stay informed about the developments related to GSTAT. You can:

- Monitor Government Announcements: Keep an eye on official announcements regarding the formation of new GSTAT benches and the appointment of members.

- Work with Legal Advisors: If you’re facing a GST-related dispute, consult with a tax professional or legal advisor to better understand how the delays might impact your case.

- Push for Change: Consider working with industry groups and associations to push for faster resolutions of GST disputes at the state and national levels.

“We Can’t Afford This”: Thozhi Hostel Residents Crushed by Sudden GST-Powered Rent Hike

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

No GST Refund for Traders with Cancelled Registration—Delhi HC’s Ruling Shakes Business Community