Rajya Sabha Sends Back Manipur Budget Bill in Opposition’s Absence: If you’ve been following political news lately, you might have seen the headline “Rajya Sabha sends back Manipur Budget Bill in Opposition’s absence”. On the surface, it sounds like a dramatic, high-stakes rejection of a key financial measure. But here’s the thing — this was actually a normal part of India’s constitutional process for money bills. Of course, the situation wasn’t without drama. The Opposition wasn’t present for the final vote, which turned what is usually a procedural step into a political talking point. And that’s where this story gets interesting — part legal process, part political theater.

Rajya Sabha Sends Back Manipur Budget Bill in Opposition’s Absence

The Rajya Sabha’s “sending back” of Manipur’s budget and GST bills was routine constitutional business, not a political roadblock. Still, the absence of the Opposition turned it into a headline-grabbing moment. For citizens and professionals alike, it’s a reminder that understanding process is just as important as following politics. Knowing how bills move through Parliament helps cut through the noise — and in this case, ensures we see the event for what it was: a normal step in keeping a state’s finances moving.

| Point | Details |

|---|---|

| Event Date | August 11, 2025 |

| Bills Involved | Manipur Appropriation Bill, 2025 & Manipur GST (Amendment) Bill, 2025 |

| What Happened | Rajya Sabha returned both bills to Lok Sabha via voice vote |

| Reason for Opposition’s Absence | Protest march to Election Commission over Special Intensive Revision (SIR) |

| Constitutional Process | Money bills must be returned to Lok Sabha within 14 days; Rajya Sabha cannot amend them |

| Impact on Manipur | Budget funds released for 2025–26, GST changes implemented |

| Official Reference | Rajya Sabha Secretariat |

Breaking Down What Happened

On August 11, 2025, the Rajya Sabha — India’s upper house of Parliament — handled two important financial bills for Manipur:

- Manipur Appropriation Bill, 2025 – Authorizes the state government to withdraw and spend money from the Consolidated Fund of Manipur for the fiscal year 2025–26.

- Manipur GST (Amendment) Bill, 2025 – Updates the state’s Goods and Services Tax law to align with recent decisions of the national GST Council, replacing an earlier ordinance.

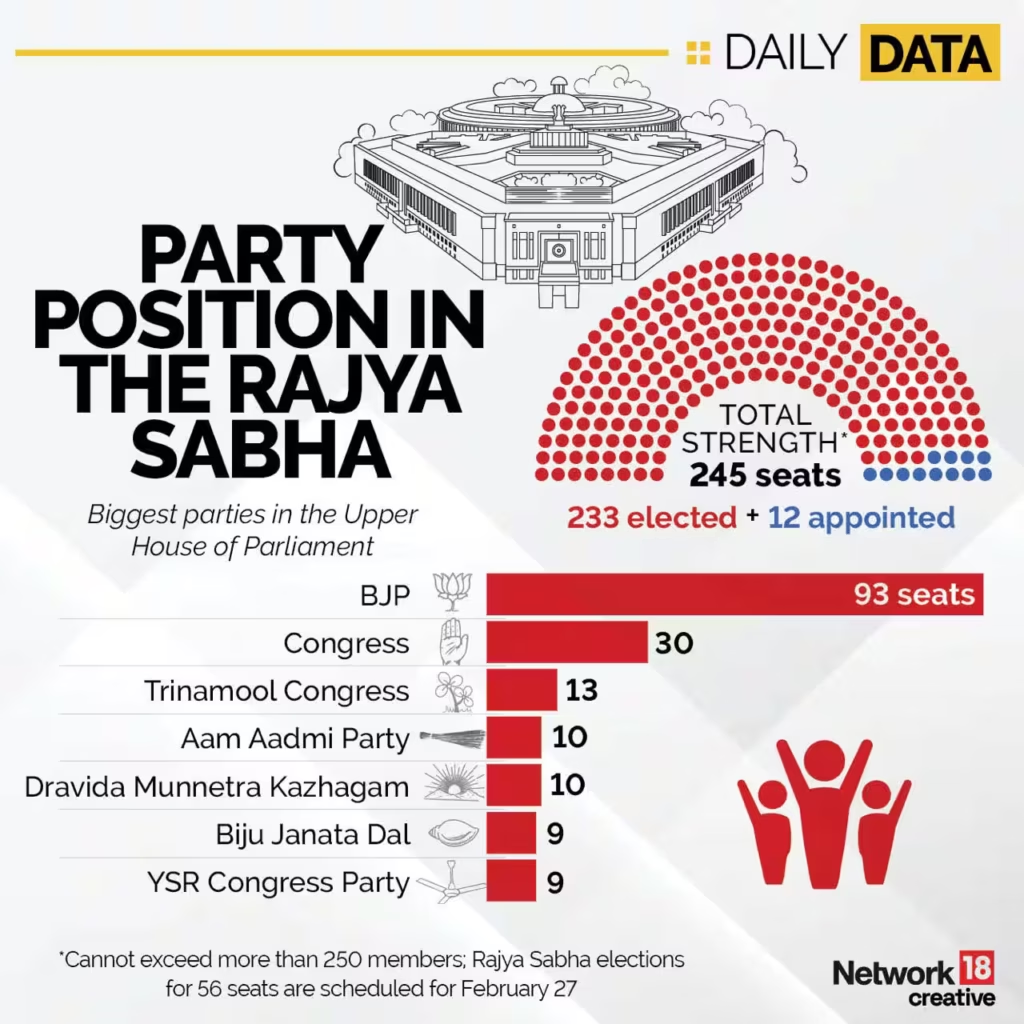

The twist? The Opposition wasn’t there for the final vote. They were outside marching toward the Election Commission, protesting a Special Intensive Revision (SIR) of the electoral rolls. Opposition parties claim the SIR process could be manipulated for political advantage, and they made their stand through a street protest.

Meanwhile, Finance Minister Nirmala Sitharaman proceeded with the bills inside the chamber, emphasizing their importance for Manipur’s economic stability and post-conflict rehabilitation.

Why This Matters — and Why It’s Not a “Rejection”

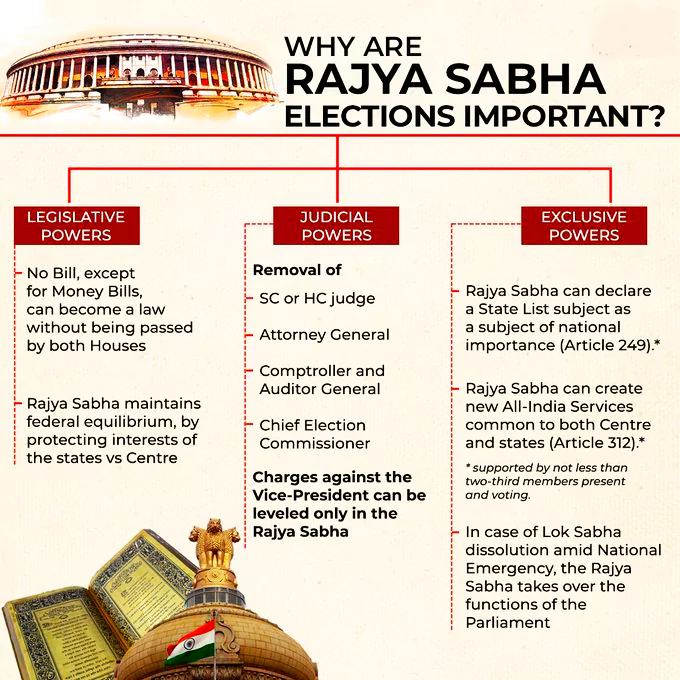

In India, money bills are treated differently from other legislation. The Constitution spells out that:

- They must originate in the Lok Sabha (the lower house).

- The Rajya Sabha cannot amend them — it can only offer non-binding recommendations.

- They must be returned within 14 days of receipt; if not, they’re automatically considered passed in their original form.

This means “sending back” a bill is not the same as rejecting it. In fact, it’s just part of the process. The absence of the Opposition didn’t prevent the bill’s passage; it just removed any chance for debate in the upper house.

The Political Drama

Opposition’s Walkout

Leader of Opposition Mallikarjun Kharge tried to raise the detention of MPs during the protest march inside the Rajya Sabha. The Chair ruled that this was unrelated to the bills under discussion, leading to frustration on the Opposition benches and an eventual walkout.

Government’s Counterargument

Nirmala Sitharaman criticized the move, pointing out that budgets are lifelines for states. She argued that political protests shouldn’t hold up legislation that directly impacts salaries, infrastructure, and welfare spending for millions.

GST Bill’s Real-World Impact

Aligning Manipur’s GST law with national standards ensures consistency for businesses and traders. Without it, companies operating in multiple states might face compliance headaches, and the state could risk delays in receiving its share of GST revenues.

Historical Context: Money Bills in India

The limited role of the Rajya Sabha in financial matters has been in place since India adopted its Constitution in 1950. The reasoning is that the government of the day — which must have majority support in the Lok Sabha — should have a clear path to implement its fiscal policies without upper house gridlock.

One notable case was the Aadhaar Bill of 2016. Although it had significant policy implications beyond finance, it was introduced as a money bill, limiting the Rajya Sabha’s powers. The move was controversial but upheld under constitutional provisions.

This structure is similar to certain “supply bill” procedures in other parliamentary democracies like the UK and Australia.

Impact on Manipur’s Economy

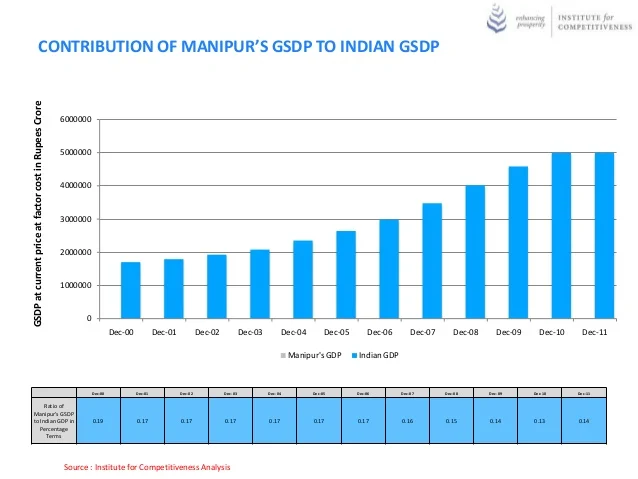

According to the Manipur Budget 2025–26, the state’s planned expenditure is ₹32,000 crore (around $3.8 billion USD). This includes:

- ₹8,500 crore for infrastructure projects — roads, bridges, and rural development.

- ₹5,200 crore for education and healthcare.

- ₹4,000 crore for agriculture and rural development programs.

- ₹1,200 crore for rehabilitation and resettlement programs after recent ethnic unrest.

The GST amendment also plays a role in sustaining Manipur’s revenue stream. In 2024–25, GST collections accounted for about 28% of the state’s total income, making smooth tax administration critical.

Comparing to the U.S. Process

For readers familiar with the U.S. system, imagine the House of Representatives (Lok Sabha) passing a budget bill and sending it to the Senate (Rajya Sabha). Now imagine the Senate can’t change the bill — it can only say, “Looks fine” or make suggestions that the House can ignore. That’s how money bills work in India.

Unlike in the U.S., where budget bills can be blocked, amended, or delayed in the Senate, India’s design avoids such financial deadlocks — though political grandstanding is still common.

Step-by-Step Guide to Understanding Rajya Sabha Sends Back Manipur Budget Bill in Opposition’s Absence

- Origination – All money bills must be introduced in the Lok Sabha.

- Passage in Lok Sabha – Simple majority is required.

- Transmission to Rajya Sabha – Sent for review within two days.

- Optional Recommendations – Rajya Sabha may suggest changes.

- Final Decision by Lok Sabha – It may accept or reject those suggestions.

- Presidential Assent – After approval, the bill is signed into law by the President.

Expert Perspectives

Dr. Ananya Prasad, Professor of Constitutional Law at JNU, explains:

“The Rajya Sabha’s role in money bills is intentionally limited. The aim is efficiency in financial matters, not confrontation.”

Policy analyst Ravi Menon notes:

“While the Opposition’s protest was symbolic, it had no procedural impact. But in politics, optics often overshadow legislative substance.”

Data Snapshot: Manipur Budget 2025–26

| Category | Allocation | % of Total Budget |

|---|---|---|

| Infrastructure | ₹8,500 crore | 26.5% |

| Education & Health | ₹5,200 crore | 16.25% |

| Agriculture & Rural Dev. | ₹4,000 crore | 12.5% |

| Welfare & Rehabilitation | ₹1,200 crore | 3.75% |

| Other Expenditure | ₹13,100 crore | 41% |

How You Can Stay Informed?

- Read Parliamentary Bulletins – Available on the Rajya Sabha website.

- Follow PRS Legislative Research – Summaries and bill tracking at prsindia.org.

- Attend Local Meetings – State assemblies sometimes hold public sessions on budgets.

- Ask Your Representative – MPs and MLAs are accountable for explaining their positions.

AP Government Launches ₹5 Crore Thrift Fund to Offset GST for Handlooms

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Supreme Court Denies Plea Challenging GST ECL Blocking Relief