RC Bhargava Sounds Alarm at Maruti AGM: The question on everyone’s mind at the Maruti Suzuki Annual General Meeting (AGM) was simple yet powerful: “Can a lower GST bring India’s car market back to life?”At 90 years old, R.C. Bhargava, the legendary chairman of Maruti Suzuki, didn’t hold back. Speaking with the clarity of someone who’s seen India’s auto industry rise, struggle, and reinvent itself, Bhargava urged the government to slash GST on small cars from 28% to 18%. His message was clear—lower taxes could put cars back within reach for millions of middle-class families, give the auto industry a much-needed push, and safeguard jobs across the sector.

RC Bhargava Sounds Alarm at Maruti AGM

R.C. Bhargava’s call at the Maruti AGM is more than just corporate lobbying. It’s a wake-up call for policymakers: high taxes are choking India’s car market. Cutting GST on small cars could give millions of families affordable mobility, create jobs, and lift the entire economy. But to truly future-proof the industry, India must balance affordability with sustainability—supporting EV adoption, strengthening infrastructure, and ensuring that the dream of car ownership remains alive for generations to come.

| Aspect | Details |

|---|---|

| Who Spoke | R.C. Bhargava, Chairman of Maruti Suzuki |

| Event | Maruti Suzuki 44th Annual General Meeting |

| Main Proposal | Cut GST on small cars from 28% → 18% |

| Why It Matters | Could revive demand, create jobs, and boost affordability |

| Global Context | India facing 50% U.S. tariffs on exports (as of Aug 27, 2025) |

| Potential Savings | ~10% drop in small car prices if GST cut passes |

| Industry Risk | May slow EV adoption if ICE cars become cheaper |

| Official Reference | Government of India GST Portal |

Why Is Bhargava Ringing the Alarm Bell?

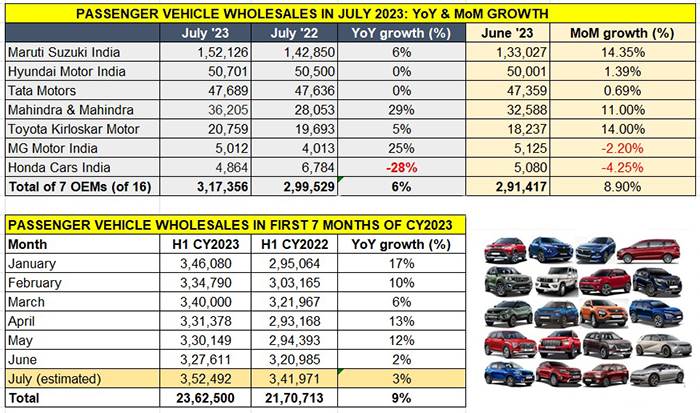

For decades, small cars have been India’s sweet spot. They gave millions of families their first taste of freedom on four wheels. But lately, sales are sputtering. Rising safety regulations, tighter emissions rules, and higher input costs have pushed entry-level car prices up by 30-40% in the past decade.

On the flip side, India’s young buyers are skipping the small car step entirely—jumping straight from two-wheelers to SUVs. The result? Small cars, once the heart of the market, now make up less than 30% of sales, compared to over 50% just a few years ago.

The GST Story: Why 28% Is Hurting Buyers

When the Goods and Services Tax (GST) was rolled out in 2017, cars—big or small—were hit with the highest bracket: 28%, plus cesses on luxury or SUV models. While this made sense for high-end cars, applying the same rate to budget hatchbacks priced under ₹6 lakh felt like a raw deal.

Bhargava argues that cutting GST to 18% for small cars could:

- Boost affordability – Lower sticker prices mean more first-time buyers.

- Revive demand – Analysts predict a 10-12% spike in sales, especially during festivals like Diwali.

- Protect jobs – The auto sector supports over 37 million jobs in India, both directly and indirectly.

- Enhance competitiveness – India could once again become the small-car capital of the world.

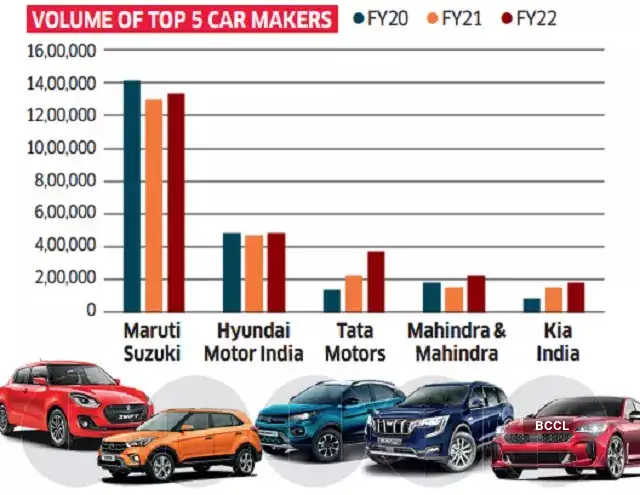

A Look Back: Maruti’s Small Car Revolution

If you grew up in India, chances are your family’s first car was a Maruti 800 or its successors. Launched in 1983, it transformed mobility in India—cheap, reliable, and iconic.

Bhargava played a central role in that revolution. At the time, India’s roads were dominated by bulky Ambassadors and Fiats. Maruti broke that mold and gave families affordable access to personal mobility. Today, his appeal is essentially: “Don’t let history slip away. Small cars are part of India’s identity.”

Global Comparisons: How Others Do It

India’s tax policy looks harsh when compared globally.

- Japan’s Kei Cars – These tiny, ultra-efficient cars enjoy lower taxes, registration fees, and insurance premiums. They make up nearly 40% of sales in Japan, thanks to government support.

- United States – While there’s no GST, the U.S. uses subsidies differently. EV buyers get federal tax credits up to $7,500, making clean cars more affordable.

- Europe – Several EU nations offer reduced VAT on EVs or eco-friendly cars. During COVID-19, Germany temporarily cut VAT on cars to stimulate sales.

Compared to these strategies, India’s flat 28% GST is a blunt instrument that fails to distinguish between affordable family cars and luxury imports.

The U.S. Tariff Cloud

Bhargava’s warning wasn’t just about domestic taxes. Just one day before the AGM, the United States slapped 50% tariffs on several Indian exports. While cars weren’t the primary target, the move raised alarms for India’s entire manufacturing sector.

His words carried a patriotic punch: “India must not give in to any kind of bullying.” But he also noted the ripple effect—if exporters suffer, consumers lose spending power. And when wallets tighten, big-ticket buys like cars are the first to get postponed.

RC Bhargava Sounds Alarm at Maruti AGM: Can Lower GST Save the Auto Market?

The short answer: Yes, but only in the short run.

Immediate Impact

- Price relief – Imagine a ₹5.5 lakh hatchback suddenly costing ₹5 lakh. For many families, that’s the difference between “maybe later” and “let’s book it now.”

- Festive surge – Diwali is just weeks away, and buyers are already waiting to see if the cut goes through. Auto dealers expect a wave of purchases if prices drop.

Long-Term Challenges

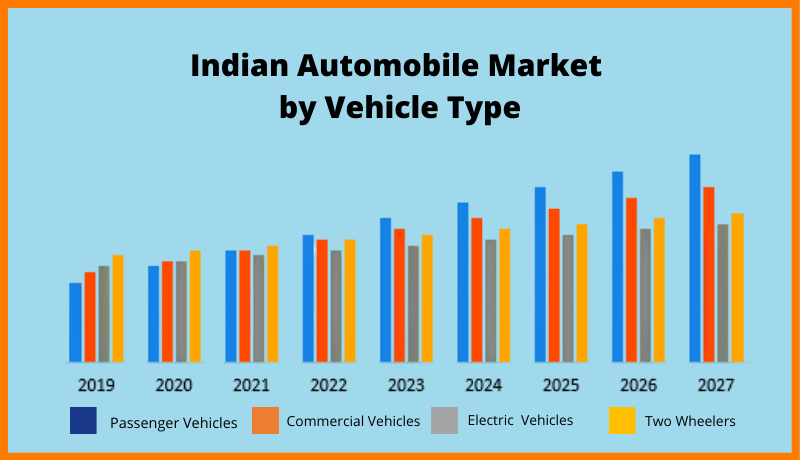

- SUV obsession – Indians see SUVs as aspirational. In 2024, SUVs accounted for nearly 50% of sales, up from just 20% a decade ago.

- EV adoption – Cheaper ICE cars could undercut EVs, slowing India’s target of 30% EV penetration by 2030.

- Infrastructure stress – More cars on already choked roads could mean worsening traffic and pollution.

Consumer Psychology: Why Indians Love SUVs

While affordability matters, status and aspiration play a bigger role in modern buying. SUVs signal success. They offer higher ground clearance, more road presence, and a feeling of safety. Even if small cars get cheaper, many urban buyers may still stretch their budgets for SUVs.

Expert Voices

- Auto Dealers say showroom footfalls jump whenever tax cuts or discounts are announced. “Even a ₹30,000 drop can sway first-time buyers,” noted a Delhi-based dealer.

- Economists argue that simplifying the GST system into two slabs (5% and 18%) while putting luxury cars at 40% could stimulate demand without hurting revenue.

- Environmentalists worry that prioritizing ICE cars over EVs could derail climate goals, urging the government to balance affordability with green incentives.

Policy Roadmap: Beyond GST

Bhargava’s call is a wake-up call, but tax cuts alone can’t future-proof the industry. Policymakers need a broader strategy:

- Scrappage Policy – Incentivize people to replace old, polluting cars with new, safer ones.

- EV Charging Infra – Build widespread charging stations to ease adoption.

- Green Financing – Offer lower interest rates for EV loans.

- Local Manufacturing Boost – Incentivize domestic EV and hybrid production to reduce costs.

- Public Transport Synergy – Balance car ownership with investments in metro, buses, and shared mobility.

Breaking It Down: What It Means for You

For first-time buyers, a GST cut could save ₹40,000–₹60,000 on popular small cars. For investors, auto stocks may stay bullish, especially Maruti Suzuki, Tata Motors, and Hyundai. For EV buyers, incentives and lower running costs still make electric cars attractive, but the GST cut may shift the short-term balance toward ICE vehicles.

Actionable Checklist

- Wait for the GST Council’s official decision before finalizing purchases.

- Compare financing deals—tax savings won’t help if interest rates are high.

- Consider resale value—revived demand could improve depreciation rates.

- Think long-term—urban drivers may still benefit more from EVs.

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

Insurance Stocks Surge on GST Exemption Talk – Should Investors Buy In Now?