Real Estate Body Pushes for Relief: The National Real Estate Development Council (NAREDCO) is stepping up in a big way, calling on the Indian government to cap the Goods and Services Tax (GST) on building materials at 18%. That’s a bold ask — but also a timely one, made during the 17th NAREDCO National Convention held in New Delhi on August 3, 2025. Led by NAREDCO President G. Hari Babu, the council also urged reforms that could change the way India builds homes and offices: restoring Input Tax Credit (ITC) for commercial projects, and raising the affordable housing cap from ₹45 lakh to ₹60 lakh for 1% GST eligibility. This isn’t just an industry wish list — it’s a smart policy blueprint with the potential to reduce costs, simplify taxation, and improve housing supply. Whether you’re a buyer, builder, investor, or policymaker, the effects could ripple far and wide.

Real Estate Body Pushes for Relief

Real Estate Body Pushes for Relief: NAREDCO Urges GST Cap on Building Materials at 18% isn’t just a lobbying pitch — it’s a well-timed appeal to fix a deeply flawed tax design. By capping GST at 18%, restoring ITC for commercial builds, and modernizing affordable housing thresholds, the industry seeks to reignite growth, affordability, and investment. While the path forward requires government cooperation, the momentum from developers, economists, and urban planners is hard to ignore. If the GST Council greenlights these asks, 2026 could usher in a real estate revival that touches every rung of the economic ladder — from first-time buyers to institutional investors.

| Key Highlights | Details |

|---|---|

| GST Proposal | Cap building material GST at 18%, down from 28% on items like cement and paint |

| ITC Reform | Enable Input Tax Credit (ITC) for commercial and mixed-use real estate |

| Affordable Housing Cap | Increase limit from ₹45 lakh to ₹60 lakh for 1% GST eligibility |

| Savings Estimate | Cost reduction of ₹3–5 crore on ₹100 crore projects |

| NAREDCO Convention | Announced August 3, 2025, New Delhi |

| Official Source | NAREDCO Official Website |

Why Real Estate Body Pushes for Relief Matters?

For years, the real estate sector — which contributes over 7% to India’s GDP and employs more than 5 crore people — has been facing a tax imbalance.

Here’s the issue:

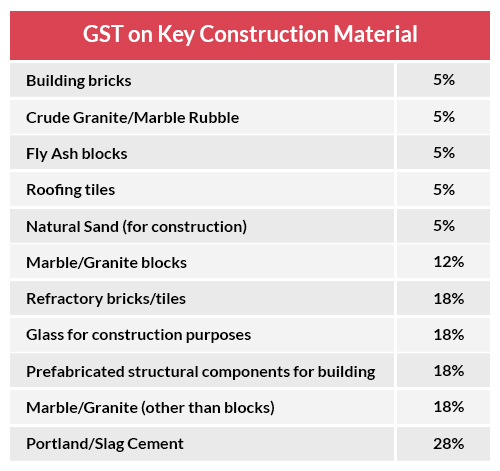

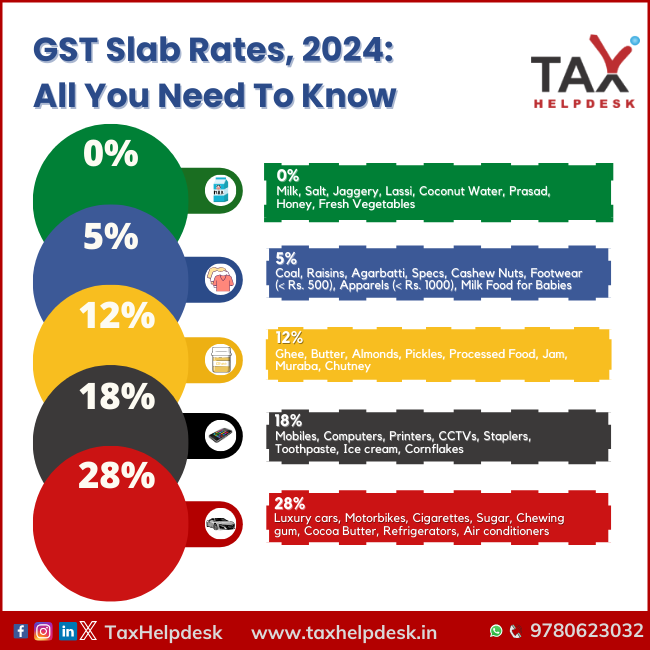

- Most construction materials like cement, paints, adhesives, and tiles attract a steep 28% GST.

- Meanwhile, finished housing units (especially under affordable housing schemes) attract 1–5% GST, with no ability to claim input tax credit (ITC).

This creates a scenario where developers end up absorbing unrecoverable tax on their biggest costs — and often pass those on to buyers.

By capping GST at 18%, the industry argues it can:

- Lower construction costs by 5–10%

- Improve housing affordability

- Simplify GST compliance

- Encourage faster project completion and financing

What is NAREDCO Asking For? A Step-by-Step Breakdown

Step 1: Cap GST on Inputs at 18%

The biggest pain point is cement, which is taxed at 28% — higher than luxury cars. NAREDCO wants:

- Cement, paint, steel, tiles, wires, and pipes to fall under 18% GST

- A uniform slab that reduces ambiguity in contracts and cost planning

- Relief from cascading tax effects due to ineligible ITC

Step 2: Restore Input Tax Credit (ITC) for Commercial Construction

Right now:

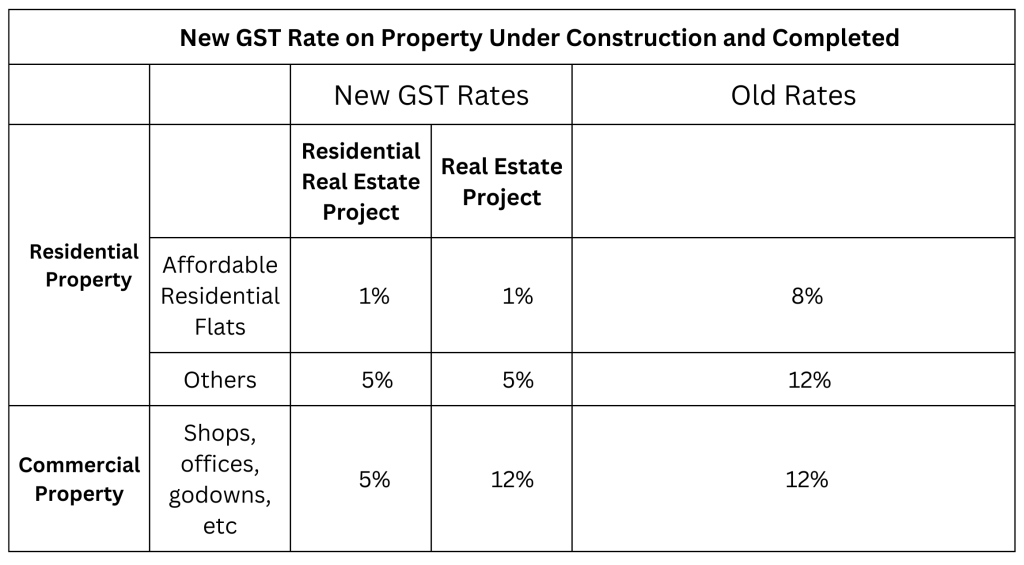

- Residential projects are taxed at 1% or 5% but ITC is disallowed

- Commercial construction (like malls, offices, warehouses) faces a similar issue under fixed-rate schemes

NAREDCO argues that restoring ITC:

- Eases cash flow for developers

- Reduces financing costs

- Encourages large-scale mixed-use and commercial infrastructure

Step 3: Raise Affordable Housing Cap from ₹45 Lakh to ₹60 Lakh

Current policy offers 1% GST on affordable housing units priced up to ₹45 lakh.

NAREDCO wants to raise this threshold to ₹60 lakh to:

- Reflect rising land and labor costs

- Accommodate urban and metro buyers

- Help more developers qualify for concessional rates

Industry Reactions & Expert Opinions

Experts across the board have welcomed the demands.

Anuj Puri, Chairman of Anarock Group, said:

“This will unlock cost savings, particularly for Tier-1 city developers where land prices eat a large part of the budget.”

Ashutosh Limaye, Head of Research at Nightingale Realty Insights, noted:

“ITC restoration is long overdue. The GST model was never meant to block input credit — that defeats the purpose of a value-added tax system.”

Even real estate startups and mid-sized developers, who often operate on tight margins, have expressed support. Industry forums have already started mobilizing to submit position papers to the GST Council ahead of its expected session later in FY26.

Let’s Break It Down with an Example

Case Study: ₹100 Crore Project

| Component | Current GST (28%) | Proposed GST (18%) |

|---|---|---|

| Input Cost (Materials) | ₹50 crore | ₹50 crore |

| GST Paid | ₹14 crore | ₹9 crore |

| Net Savings | — | ₹5 crore |

That ₹5 crore could be used to:

- Lower prices for buyers

- Add amenities

- Speed up construction

- Improve builder credit scores

Potential Challenges & Counterpoints

Revenue Concerns

The most obvious objection from the government: GST revenue loss. Estimates suggest a hit of ₹5,000–₹7,000 crore per year.

But NAREDCO argues this will be offset by:

- More registered developers (compliance boost)

- Faster home sales (transaction growth)

- Stronger economic activity in Tier-2 and Tier-3 markets

Anti-profiteering Enforcement

Critics worry developers may not pass cost savings to buyers. But India has a National Anti-Profiteering Authority (NAA) to monitor pricing abuse.

Builders who pocket the tax difference instead of reducing prices can face fines and reputational damage.

How Will This Affect Stakeholders?

Home Buyers

- Short-term: Expect more competitively priced homes.

- Mid-term: Expanded inventory in ₹40–60 lakh bracket.

- Long-term: Better quality at the same price due to cost flexibility.

Developers

- Reduced material tax burden

- Increased cash flow due to ITC on commercial projects

- Fewer pricing conflicts with vendors and subcontractors

Investors

- Higher project IRRs (Internal Rate of Return)

- Better ROI on commercial real estate

- Confidence in regulatory predictability

Long-Term Impact on Real Estate Sector

If implemented, these reforms could:

- Unlock over ₹20,000 crore in liquidity across the industry in 2–3 years

- Encourage mid-tier and small developers to enter affordable housing

- Create synergy between PMAY (Pradhan Mantri Awas Yojana) and private sector players

- Align with India’s 2030 Housing for All Vision and Smart City goals

Government’s Position: What’s Next?

As of now, there’s no official response from the Finance Ministry or the GST Council. However:

- The next GST Council meeting is expected in late Q4 FY26 (Dec 2025–Jan 2026)

- Budget 2026 may also reflect real estate inputs based on the Council’s recommendations

- Any GST change must pass by majority vote among Center and State representatives

The ball is in the government’s court. And the clock is ticking, with developers and buyers closely watching.

West Bengal’s GST Revenue Soars 12% in July

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge