Real Estate Body Urges Government to Cap GST on Building Materials: In a bold move aimed at revitalizing India’s real estate sector, the National Real Estate Development Council (NAREDCO) has urged the Indian government to cap the Goods and Services Tax (GST) on all building materials at 18%. With construction costs spiraling and housing affordability hanging in the balance, this call has sparked conversations across boardrooms and job sites alike. Currently, GST rates for building materials vary wildly—ranging from 5% to a whopping 28%. That means for developers and homebuyers, the math isn’t just tricky; it’s expensive. NAREDCO believes a uniform 18% GST would not only simplify tax processes but also lower project costs, making homes more affordable for millions.

Real Estate Body Urges Government to Cap GST on Building Materials

This isn’t just about numbers and tax slabs. It’s about whether India can build faster, smarter, and more affordably. The GST system was meant to simplify things — not overburden essential sectors like housing. With elections on the horizon and housing affordability becoming a central issue, the time to act is now. NAREDCO’s demand to cap GST on building materials at 18% is not just reasonable — it’s necessary.

| Point | Details |

|---|---|

| Who | National Real Estate Development Council (NAREDCO) |

| What | Urges a GST cap of 18% on building materials |

| Why | To lower construction costs, boost affordability, and simplify tax processes |

| Current GST Rates | Vary between 5% to 28% depending on the material |

| High-Tax Materials | Cement, paint, tiles, sanitary ware (currently at 28%) |

| Event | 17th National Convention of NAREDCO, New Delhi |

| Official Website | NAREDCO India |

What’s the Fuss All About?

When NAREDCO’s president G Hari Babu spoke at the 17th National Convention, his message was loud and clear — real estate can’t bear the burden of high GST rates anymore. In a country where housing is a fundamental need, the financial pressure from high taxation on basic materials has become a major roadblock.

To put it into perspective, if you’re building a home or commercial property, materials like cement (28%), paint (28%), and tiles (28%) can form up to 40–50% of the total project cost. Without input tax credits for residential projects, that cost is passed on to the end buyer.

Economic Implications: A Lose-Lose Game

Developers lose:

- Higher upfront costs

- Reduced margins

- Risk of project delays due to tight cash flows

Consumers lose:

- Higher purchase prices

- Shrinking affordable housing inventory

Government loses:

- Slower housing adoption

- Reduced pace in urbanization

- Missed targets in schemes like Housing for All by 2022

GST Rates on Common Building Materials

| Material | GST Rate |

|---|---|

| Cement | 28% |

| Paints | 28% |

| Tiles | 28% |

| Steel | 18% |

| Bricks | 5–12% |

| Electrical fittings | 18% |

| Sanitary ware | 28% |

What NAREDCO Wants, Besides GST Rationalization

- Bring back Input Tax Credit (ITC) for residential and commercial leasing.

- Increase the affordable housing limit under GST from ₹45 lakh to ₹60 lakh.

- Introduce a uniform tax structure that avoids ambiguity and red tape.

- Offer special tax rebates for green buildings and sustainable projects.

- Develop a predictable, long-term GST roadmap to attract global investors.

Historical Context: Where It All Began

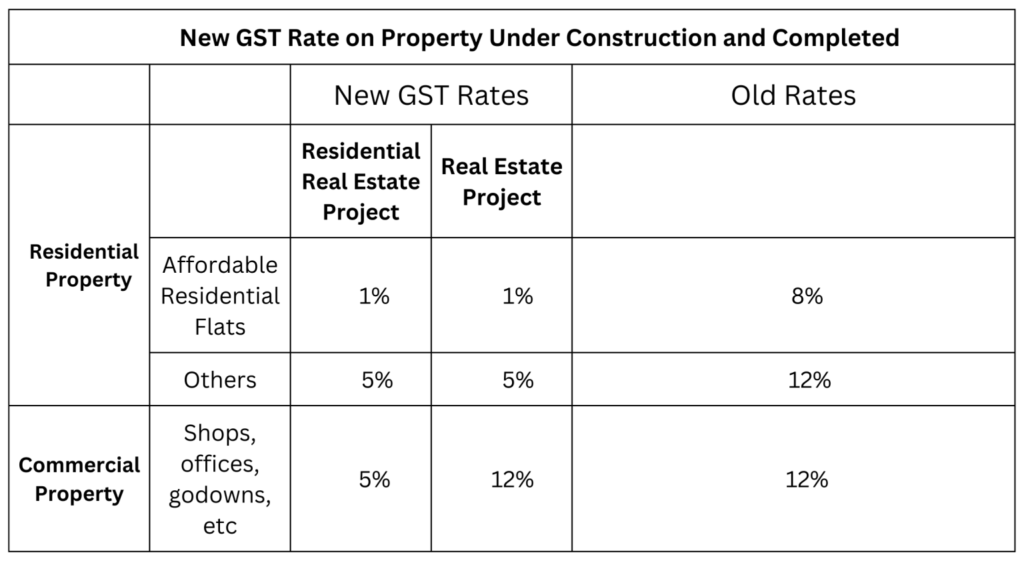

When GST was introduced in 2017, it was hailed as a “one nation, one tax” reform. But for the real estate sector, it became a complicated affair. While commercial properties enjoy input tax credits, residential projects do not. That means developers building affordable or mid-income homes pay tax on materials but can’t claim it back — making homes more expensive.

Several trade bodies including CREDAI and ASSOCHAM have been lobbying for rationalization since 2018, with little success. In 2019, the GST Council lowered the rate for affordable housing to 1%, but it also removed ITC, nullifying much of the gain.

How GST Is Calculated on a Housing Project?

Here’s a simplified breakdown of how GST inflates a typical housing project:

- Cement: ₹400 per bag × 28% GST = ₹112 tax per bag

- Paint and tiles: similar markup due to 28% rate

- No input credit means all this tax gets bundled into the final sale price

Result? For a 1,000 sq ft apartment, this could add ₹3–4 lakh just in embedded tax.

Impact on Employment and Economic Growth

Real estate is India’s second-largest employer after agriculture and contributes nearly 7% of the country’s GDP. When construction slows due to high costs, jobs are lost across the value chain — from daily wage laborers to architects and structural engineers.

A more affordable tax structure would:

- Stimulate stalled projects

- Create millions of new jobs

- Boost allied industries like cement, paint, plumbing, and home furnishings

How Real Estate Body Urges Government to Cap GST on Building Materials Impacts You — Real Talk

If you’re a homebuyer:

- A lower GST means a more affordable flat or house.

- Better transparency in pricing.

- Faster completion of housing projects.

If you’re a developer:

- Lower input costs.

- Smoother project budgeting.

- Higher buyer interest and improved market sentiment.

If you’re an investor or policymaker:

- Better ROI from streamlined construction cycles.

- Higher employment in the sector.

- A real shot at hitting national housing goals.

International Comparison: What Do Other Countries Do?

- USA: Tax rates vary by state but materials are generally taxed between 4–10%. Many states offer tax exemptions for residential construction.

- UK: VAT is at 20% for building materials, but reduced to 5% for residential renovations and energy-saving materials.

- Canada: GST is 5% nationwide, but provinces add their own tax. There are partial rebates for housing projects under a certain value.

Compared to these benchmarks, India’s 28% GST on cement and other essentials is among the highest globally.

What’s the Government’s Response?

Finance Ministry officials argue that cutting GST on cement alone would cost ₹13,000 crore annually in tax revenue. However, real estate experts counter that reduced rates will expand the tax base by reviving stalled projects and increasing volume.

A senior GST Council member recently stated that “rate rationalization is under active consideration” and may be taken up in the October 2025 council meeting. If approved, it could set the stage for long-term tax reform across infrastructure and manufacturing sectors.

State-Level Differences in Construction Policy

It’s worth noting that while GST is governed nationally, each state has its own stamp duty and registration charges — further complicating the real estate taxation matrix.

For example:

- Maharashtra levies up to 6% stamp duty

- Karnataka offers concessions for women buyers

- Delhi NCR has varying charges based on plot size

By capping GST at 18%, it creates at least one area of national uniformity that developers can count on.

Long-Term Policy Outlook

Experts believe GST reform is inevitable. With the push for urbanization, smart cities, and green housing, the current tax framework is outdated. Future reforms could include:

- Reintroduction of input tax credit for all real estate types

- Differentiated GST rates for sustainable or energy-efficient projects

- Lower GST on first homes and self-occupied properties

- A special exemption category for low-income and rural housing

Expert Opinions

“A flat 18% GST will provide the breathing room needed by the housing industry. It’s time to align tax policy with development goals.” — Anuj Puri, Chairman, ANAROCK Group

“We need a clear, consistent tax policy. The current structure is overly complex and hurts affordability.” — Dr. Niranjan Hiranandani, Past President, NAREDCO

“Reducing GST doesn’t mean reducing revenue — it means increasing participation. A vibrant real estate market is a bigger tax base.” — Shishir Baijal, Chairman & MD, Knight Frank India

West Bengal’s GST Revenue Soars 12% in July

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%

Groundbreaking High Court Ruling on GST and Expat Employee Secondments—What It Means for Businesses!