Retail Sales Take a Hit This Festive Season: If you’ve been out shopping lately or scrolling through Flipkart, Amazon, or even your local mall, you’ve probably noticed something unusual: the festive buzz feels muted. Retail sales are slowing, and retailers across India are saying the same thing—people are waiting for GST cuts before they splurge. In a country where Diwali and Navratri aren’t just cultural festivals but also the biggest shopping events of the year, this dip is raising eyebrows. The big question is: are GST cuts really the culprit? The short answer: Yes, and the story goes deeper than you think.

Retail Sales Take a Hit This Festive Season

So, is the wait for GST cuts to blame for sluggish festive sales? Absolutely. Shoppers are too savvy to spend big today when tomorrow promises lower prices. But this isn’t a retail collapse—it’s simply a pause. Once the government confirms GST cuts, expect shopping carts to overflow, auto showrooms to fill, and retailers to see fireworks in sales numbers. For consumers, patience could mean big savings. For businesses, the trick is surviving the lull and gearing up for the boom.

| Point | Details |

|---|---|

| Main Issue | Festive retail sales slow as buyers delay purchases for GST rate cuts. |

| Impact Areas | High-value products—cars, ACs, TVs, washing machines. |

| Potential Price Cuts | 5–8% once reforms roll out. |

| Industry Impact | Short-term slump; long-term demand boost. |

| Market Outlook | 15–20% surge expected post-GST cut. (Official GST Council site) |

Why Retail Sales Take a Hit This Festive Season?

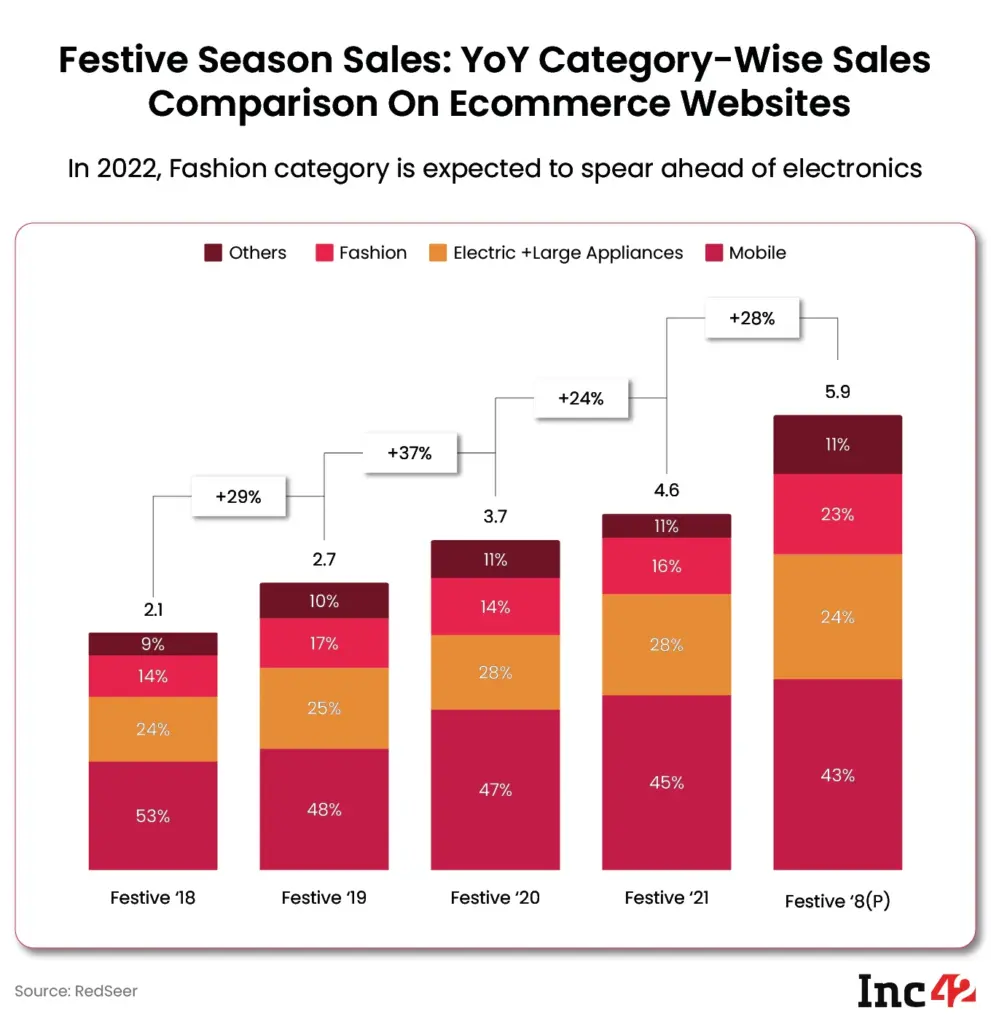

Festive seasons are normally India’s retail jackpot. In 2022, e-commerce alone raked in $5.5 billion in sales during Diwali week according to Reuters. Cars, smartphones, refrigerators, and even gold jewelry usually fly off the shelves.

But this year, it feels different. Showrooms look quieter. Online carts are filled, but “Buy Now” buttons remain untouched. The reason is simple: buyers are holding out for possible GST cuts.

Imagine this: a family planning to buy a new SUV worth ₹12 lakh could save ₹50,000–₹80,000 if tax rates drop. That’s enough to fund a family vacation—or pay school fees for a year. Who wouldn’t wait?

A Look Back: GST Changes & Retail Demand

This isn’t India’s first brush with GST-driven uncertainty. In 2017, when GST was first introduced, retail took a hit for two quarters as consumers adjusted. By 2018, however, demand bounced back stronger, aided by tax rationalization in some categories.

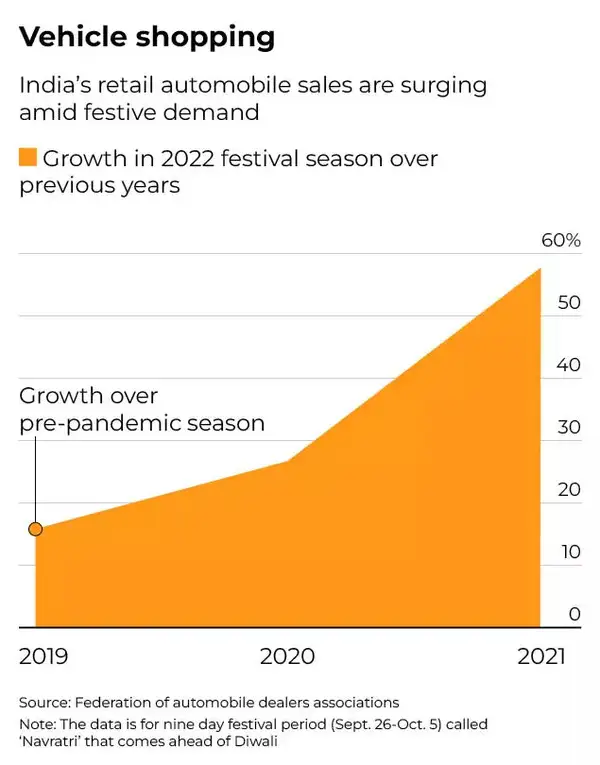

Similarly, in 2019, when corporate tax rates were slashed, auto and consumer durable sales rose within a quarter. In fact, auto sales climbed by nearly 8% in Q4 2019 after months of sluggish growth.

The pattern is clear: tax cuts delay purchases in the short run but boost them sharply once implemented.

Consumer Psychology: Why People Delay Purchases

To really get this, let’s look at consumer psychology:

- Anchoring effect – When shoppers hear prices will drop, the current price suddenly feels inflated.

- Herd behavior – If friends and neighbors are holding off, others do the same.

- FOMO (Fear of Missing Out) – Nobody wants to be the person who buys a washing machine today and finds it cheaper tomorrow.

This psychology explains why big-ticket purchases are hit hardest. Essentials like groceries and clothing keep moving, but cars and electronics are parked until GST clarity comes.

Regional Differences: Who’s Waiting and Who’s Buying

Interestingly, the impact isn’t uniform across India.

- Urban centers like Delhi, Mumbai, and Bangalore are seeing sharp slowdowns in high-ticket categories because buyers there are more tax-savvy and quick to respond to price signals.

- Smaller towns and semi-urban areas are less affected. For many families in Tier-2 and Tier-3 cities, festival shopping is about tradition—jewelry for weddings, clothes for ceremonies, and essentials—less about waiting for savings on electronics.

- South India has seen relatively steady sales in gold and jewelry thanks to cultural customs during Onam and Dussehra.

This uneven slowdown tells us that GST cuts will likely trigger a bigger rebound in metros compared to smaller towns.

The Government’s Role and Policy Roadmap

While consumers and retailers wait anxiously, the spotlight is now on the government and the GST Council. After all, the timing of tax cuts—and their communication—can make or break this festive season.

Why Timing Matters?

If GST rate cuts are announced well before Diwali, retailers get enough time to adjust pricing, manage inventory, and launch attractive promotions. A late announcement, however, risks losing the entire festive cycle, as buyers may continue waiting instead of spending during the peak season.

Balancing Growth and Revenue

The government also faces a dilemma. Cutting GST boosts consumer demand, but it also reduces short-term tax collections. Policymakers must balance stimulating growth with keeping fiscal revenues steady. According to Finance Ministry data, GST contributes nearly 30% of India’s total tax revenue—a sizable chunk the government can’t afford to lose without careful planning.

Possible Scenarios Ahead

- Immediate Cut Before Diwali: Best case for retail; sales could jump 15–20%.

- Post-Diwali Cut: Demand revival delayed; festive sales remain weak.

- Gradual Category-Wise Cuts: Focused relief for automobiles and appliances first, essentials later.

What This Means for Consumers and Businesses?

For shoppers, it means staying alert to official announcements and planning big purchases accordingly. For businesses, it underscores the importance of policy monitoring as part of their strategy. Aligning sales campaigns with government timelines can spell the difference between losses and windfalls.

Case Study: The Singh Family’s Dilemma

Take the Singh family from Delhi. They were ready to buy a new hybrid SUV this festive season. But after news broke that GST cuts on automobiles might be coming, they decided to hold off. “Why spend ₹15 lakh today if it might be ₹14 lakh next month?” Mr. Singh told Times of India.

Multiply that hesitation across tens of thousands of families, and you can see why auto showrooms are reporting fewer bookings and rising cancellations.

How Retailers Are Responding?

Retailers aren’t sitting idle. Many are rolling out strategies to keep customers engaged even during the lull:

- GST Shield Offers: Some brands promise to refund the difference if GST cuts lower prices after purchase.

- Flexible EMIs: Banks and retailers are promoting no-cost EMIs to reduce upfront pain for buyers.

- Inventory Management: Retailers are delaying bulk orders to avoid overstocking at pre-cut prices.

- Marketing Adjustments: Ads are shifting tone from “festive rush” to “festive savings soon.”

E-commerce platforms like Amazon and Flipkart are taking a different route. Instead of pushing aggressive discounts early, they’re stocking up for a delayed shopping boom in October.

Expert Insights: What Analysts Say

Economists and market experts are unanimous: GST uncertainty is a short-term speed bump.

- According to ICRA Research, “Consumer durables could see a volume recovery of 12–15% in Q3 if GST cuts materialize.”

- Market strategist Sneha Poddar told Economic Times that “auto and consumer discretionary stocks are poised for a sharp re-rating once reforms kick in.”

- Retail associations warn that if GST cuts are delayed beyond Diwali, the industry risks losing an entire festive cycle.

Global Comparisons: Tax Cuts & Shopping Behavior

India’s not alone in this pattern. Globally, tax policy shifts often reshape shopping trends:

- In the U.S., states hosting “sales tax holidays” see retail spending spike 30–40% on items like laptops, clothes, and school supplies.

- In Europe, when the UK temporarily cut VAT in 2008 during the financial crisis, consumer spending jumped by 1.2% in a single quarter.

- In Japan, when a sales tax hike was announced in 2014, consumers rushed purchases before the increase, only to pull back sharply afterward.

These examples confirm that tax adjustments always ripple through consumer demand.

Professional Impact: Retail Jobs & Industry Outlook

This GST-driven slowdown isn’t just about sales—it affects people too.

- Retail jobs: Temporary festive hiring has slowed this year. Many malls and stores are holding back seasonal recruits until GST clarity.

- Supply chain: Logistics firms are seeing slower shipments of electronics and cars, though essentials remain steady.

- Marketing professionals: Ad budgets are shifting toward October–November campaigns, meaning agencies are delaying rollouts.

- Investors: Consumer discretionary and FMCG stocks are under watch. Analysts expect a strong rebound, but timing matters.

Practical Tips for Consumers

Here’s how to navigate this unusual season:

1. Buying a Car or Appliance?

Wait. If you’re not in an emergency, waiting a few weeks could save thousands.

2. Shopping Electronics?

Urgent replacements? Go ahead. Non-essential upgrades? Hold back.

3. Buying Gold, Clothes, or Essentials?

No GST cuts expected—buy as usual.

4. For Businesses

Keep promotions flexible. Highlight trust with price protection deals. Avoid heavy stocking until reforms are clear.

The Numbers That Matter

- 5–7% expected price drop on mid-range appliances.

- 7–8% drop likely on premium appliances and cars.

- 15–20% projected surge in e-commerce sales post-GST cut.

- $100 billion at stake in India’s annual festive retail market.

₹500 Crore GST Scam Busted in Guwahati, Four Held

Supreme Court Halts ₹273.5 Crore GST Demand Against Patanjali

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penaltie