Retroactive Application of Amended Benami Property Act’s Section 5: If you’ve ever watched a courtroom drama and thought, “Man, that’s intense,” the real-life legal showdown over the Benami Property Act’s Section 5 might just top your binge list. This month, the Supreme Court of India is gearing up to decide whether the amended law—designed to catch hidden property ownership—can be applied retroactively to deals made before the 2016 changes kicked in. That’s like a referee calling a foul in a game that ended years ago—only here, the stakes are people’s homes, investments, and millions of dollars in property value. And it’s not just the folks directly involved who are watching—lawyers, tax officials, and investors across the country are following this one closely.

Retroactive Application of Amended Benami Property Act’s Section 5

The Supreme Court’s upcoming decision on whether Section 5 of the amended Benami Property Act applies retroactively could reshape property law enforcement in India. It’s a battle between the drive to root out hidden ownership and the need to preserve fairness in the legal system. For anyone connected to property ownership—whether you’re an investor, homeowner, or policymaker—the outcome will influence not just legal strategy but how safe past deals really are.

| Point | Details |

|---|---|

| Hearing Date | August 11, 2025 |

| Law in Question | Prohibition of Benami Property Transactions Act, 1988 – Amended in 2016 |

| Key Section | Section 5 – Confiscation of benami property |

| Past Ruling | 2022 Supreme Court said Section 5 applies only prospectively |

| Govt Position | Wants Section 5 to apply retrospectively |

| Potential Impact | Could reopen or quash hundreds of cases worth billions |

| Official Reference | Supreme Court of India |

A Quick Refresher: What’s the Benami Property Act?

The original Benami Transactions (Prohibition) Act, 1988 was India’s answer to property deals done in someone else’s name to hide the real owner—often to dodge taxes, launder money, or stash black money in real estate. The word benami literally means “without name” in Hindi.

When first passed, the Act banned such deals and allowed for confiscation, but it was vague and lacked teeth. Enforcement was minimal, and for decades, it was a bit like having a “No Trespassing” sign without a fence—it looked official but didn’t stop much.

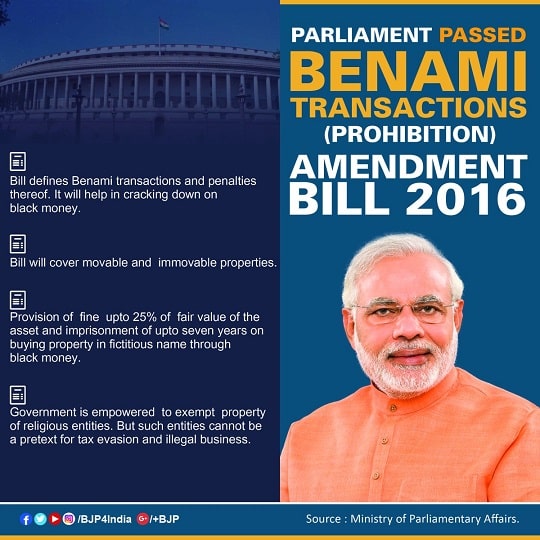

That changed in 2016 when the government rolled out a major amendment:

- Clearer definitions of benami transactions

- Stiffer penalties, including jail time

- The introduction of Section 5, which gives authorities the power to confiscate benami property without paying compensation

Why Retroactive Application of Amended Benami Property Act’s Section 5 Is the Muscle of the Law?

Section 5 is the real power punch—it lets the government take over benami property. No compensation, no half measures.

The 2016 amendment said Section 5 would be effective from October 25, 2016. The question now is whether it can also apply to shady deals from before that date.

Think of it like a baseball game: The umpire suddenly announces in the 9th inning that the rules from three seasons ago are back in play, and your team’s winning run was actually illegal back then. It’s that mix of surprise, frustration, and big consequences.

The Legal Tug-of-War So Far

2022 Supreme Court Ruling

In August 2022, a three-judge bench led by then Chief Justice N.V. Ramana ruled that Section 5 is prospective—meaning it can’t touch pre-2016 deals. This was rooted in Article 20(1) of the Indian Constitution, which says you can’t punish someone for something that wasn’t a crime when they did it.

The Court went further, stating that all criminal prosecution and confiscation proceedings for pre-2016 transactions had to be quashed. That instantly gave relief to many under investigation.

2024 Twist: Judgment Recalled

The central government wasn’t satisfied. In October 2024, the Supreme Court recalled the 2022 decision after a review petition argued that the ruling addressed constitutional issues that weren’t even argued during the hearing. This effectively hit the reset button and sent the case back for a full rehearing.

Now, a new bench will decide in August 2025 if Section 5’s confiscation powers can indeed reach into the past.

Historical Timeline

| Year | Event |

|---|---|

| 1988 | Original Benami Transactions (Prohibition) Act passed |

| 2016 | Major amendment adds confiscation powers under Section 5 |

| 2022 | Supreme Court rules Section 5 applies prospectively |

| 2024 | Supreme Court recalls 2022 judgment |

| 2025 | Fresh hearing set for August 11 |

Case Study: How Retroactive Application Could Play Out

Let’s make this concrete.

- In 2014, Priya buys a luxury apartment in her cousin’s name to keep it off official records.

- In 2019, tax authorities discover the deal.

- If Section 5 is applied retroactively, the government could confiscate the apartment under the 2016 law—even though the deal happened before it existed.

- If not, Priya might avoid seizure because, at the time of the purchase, the 2016 confiscation provision didn’t exist.

For the government, retroactive application means no one escapes just because they got in before the law changed. For property holders, it raises fairness and certainty concerns—especially for transactions that might have been legal then but are now frowned upon.

Why This Ruling Matters?

- For Tax Authorities: A retrospective ruling could reopen high-value cases and help recover untaxed wealth.

- For Real Estate: The decision could impact investor confidence and market transparency.

- For Businesses: Corporate holdings, trusts, and layered ownership structures could face scrutiny.

- For Citizens: Even family arrangements might be challenged if they resemble benami deals.

Expert Opinions

Legal scholars are split.

- Pro-Retrospective Side: Corruption shouldn’t have a statute of limitations; applying Section 5 retroactively ensures wrongdoers don’t get away due to timing.

- Against-Retrospective Side: It undermines the rule of law and violates the principle of legal certainty. Retroactive punishment risks creating fear among legitimate owners.

According to an analysis by the Economic Times, even some within the enforcement agencies are cautious, noting that an overly aggressive retrospective application could clog the courts and delay genuine cases.

International Perspective

In Pakistan and Bangladesh, similar laws exist, but retrospective application is rare due to constitutional challenges.

In the United States, the concept of “straw ownership” is targeted under fraud and money-laundering statutes. While civil forfeiture can sometimes look back several years, it’s typically tied to clear evidence of ongoing criminal activity.

This global pattern shows a balancing act: give governments the tools to tackle hidden ownership without trampling on due process.

Practical Advice While Waiting for the Verdict

If you own or deal in property in India, here are some steps to safeguard yourself:

- Review Your Records – Ensure your property titles, deeds, and payments clearly show the real owner.

- Avoid Informal Ownership – Common in the past, risky today.

- Consult Legal Counsel – If you think a past transaction might raise flags, get advice now rather than after a notice arrives.

- Monitor Legal Updates – The Supreme Court’s cause list can give you hearing dates and developments.

- Document Intent Clearly – If you hold property for a family member for legitimate reasons, put it in writing and register the arrangement.

Additional Context: The Enforcement Mechanism

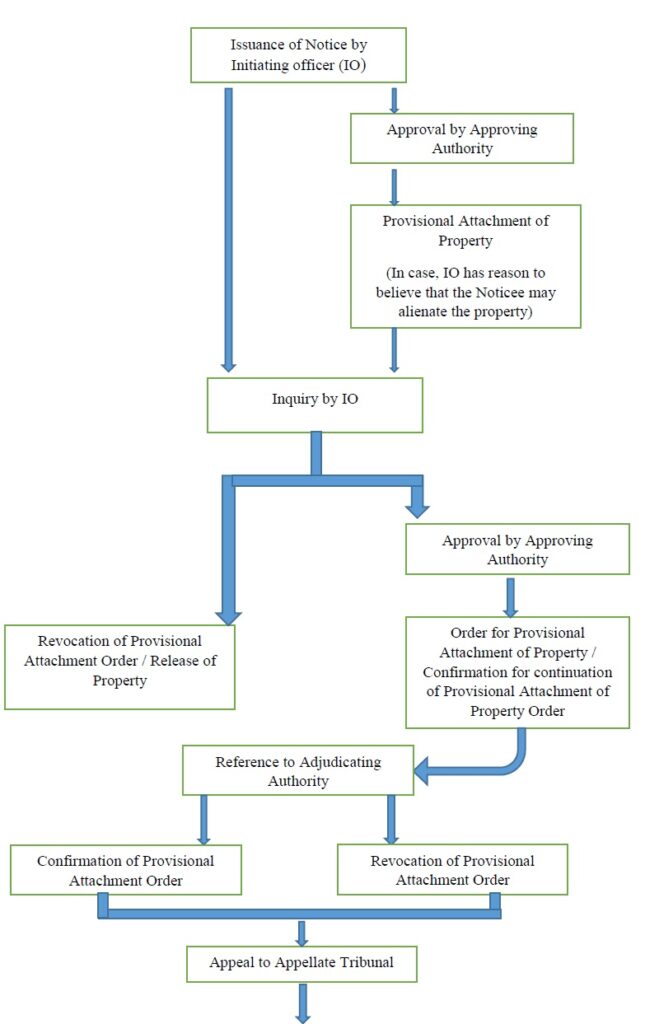

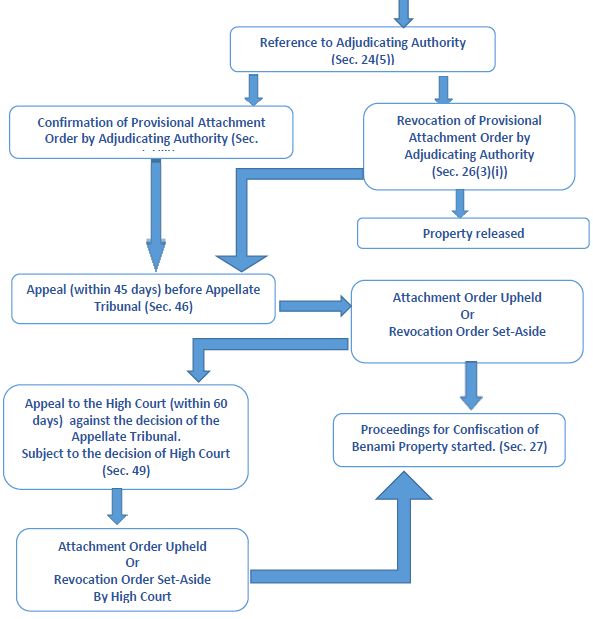

Under the amended Act, a designated Initiating Officer can provisionally attach suspected benami property, followed by adjudication by an Adjudicating Authority. Appeals go to an Appellate Tribunal, and ultimately to the High Court.

If Section 5 is applied retrospectively, this process could be triggered for thousands of old transactions, significantly increasing the workload for these bodies.

Supreme Court Sides with Businesses: GST Refund Rejection Overturned in Landmark Ruling

Big Win for Taxpayers: Supreme Court Dismisses SLP Against GST Order on ECL Blocking

Supreme Court Set to Decide on 28% GST for Online Gaming—The Verdict That Could Change the Industry!