Retrospective Penalties in CENVAT Credit Dispute: Navigating the world of taxes can feel like walking through a maze, especially when it comes to complex systems like CENVAT Credit. CENVAT Credit (Central Value Added Tax) allows businesses to claim credits on taxes paid during the production process, essentially ensuring that they don’t end up paying taxes on taxes. But the rules around CENVAT can get tricky, and even more so when penalties are involved.

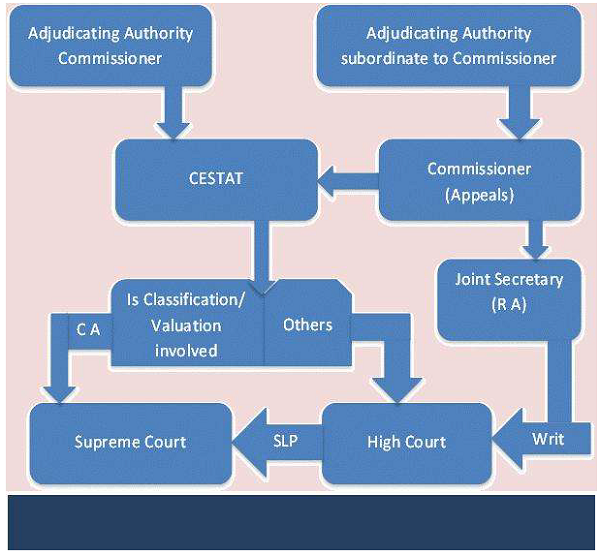

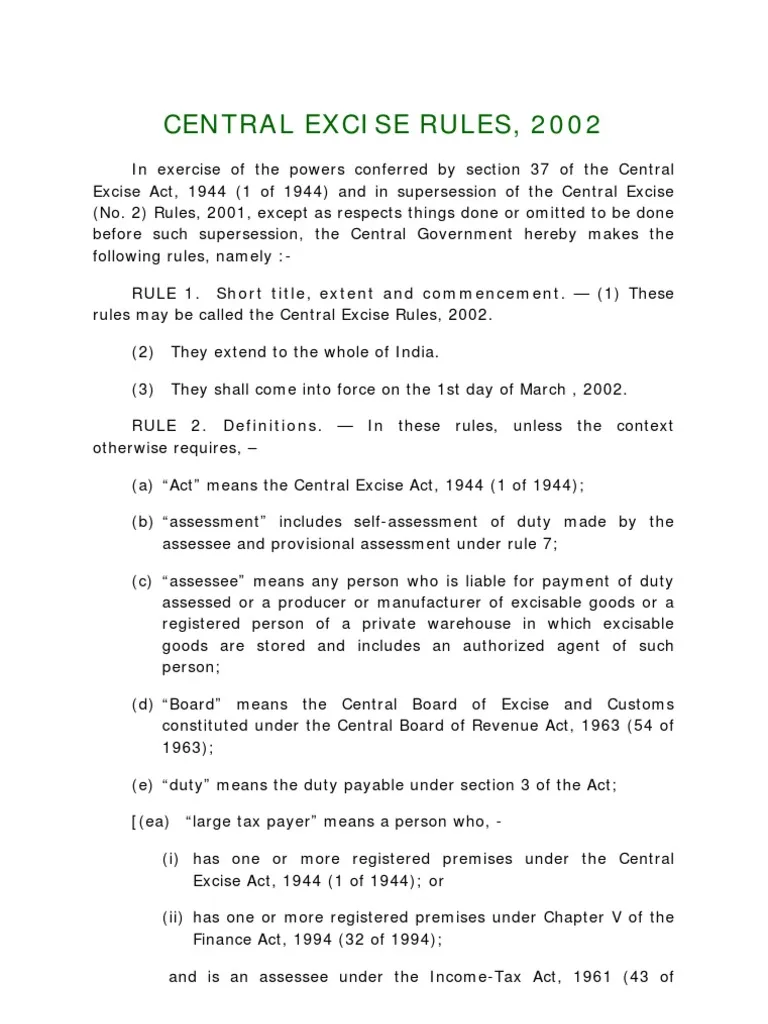

A recent ruling from the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has given businesses a much-needed sense of relief. The Tribunal’s landmark decision addresses whether retrospective penalties could be applied in CENVAT credit disputes, especially concerning Rule 26(2) of the Central Excise Rules, 2002. In this article, we’ll break down what the ruling means for businesses, the tax implications, and how you can use this judgment to protect your interests. Whether you’re a business owner, accountant, or tax professional, this guide will help you understand the legal landscape and give you actionable insights.

Retrospective Penalties in CENVAT Credit Dispute

The CESTAT ruling on retrospective penalties in CENVAT credit disputes is a crucial development for businesses across India. By clarifying that penal provisions cannot be applied retrospectively, the Tribunal has ensured fairness and protection for taxpayers. Businesses now have a clearer path forward when dealing with CENVAT credit disputes and can seek justice if they’ve been unfairly penalized for actions that took place before 2007. This decision serves as a reminder to stay updated with tax laws and regulations, ensuring that your business remains compliant and shielded from unjust penalties. If you’re involved in a CENVAT credit dispute, consulting with a tax expert can help you navigate the process more effectively.

| Key Topic | Details |

|---|---|

| Main Issue | CENVAT credit dispute involving retrospective penalties. |

| CESTAT Ruling | Penal provisions under Rule 26(2) cannot be applied retrospectively to actions before March 2007. |

| Impact on Taxpayers | Retrospective penalties cannot be enforced for actions that occurred prior to 2007. |

| Significance of the Ruling | This ruling sets a precedent for future cases, ensuring clarity on retrospective application. |

| Official Source | LegalEra and TaxScan |

| Taxpayers Affected | Companies involved in CENVAT credit disputes during 2001–2004 could benefit from this ruling. |

| Potential Outcomes | Future tax disputes involving retrospective penalties may see favorable outcomes for taxpayers. |

Understanding the CENVAT Credit System

Before diving into the specifics of the ruling, it’s helpful to understand CENVAT Credit and its role in the tax landscape.

CENVAT Credit is a system that allows manufacturers and service providers to claim credit for taxes paid on inputs used in the manufacturing process. In other words, businesses can offset the taxes they’ve already paid on raw materials or services, avoiding double taxation. This mechanism ensures a fairer tax burden by only taxing the value added at each stage of production.

However, disputes often arise when there are questions around compliance or the interpretation of rules. The CENVAT Credit system is designed to encourage businesses to maintain proper records and follow prescribed processes. But like all tax rules, it’s not foolproof.

The Problem: Retrospective Penalties

In 2007, Rule 26(2) of the Central Excise Rules, 2002 was introduced. This rule empowers tax authorities to impose penalties in cases of CENVAT Credit abuse. The issue arose when tax authorities tried to apply this rule to transactions that took place before 2007. In other words, they wanted to retroactively apply penalties for actions that occurred before the rule existed.

CESTAT’s Judgment: A Turning Point

The recent ruling by CESTAT addressed this very issue. The CESTAT bench, consisting of Mr. P.K. Choudhary (Judicial Member) and Mr. Sanjiv Srivastava (Technical Member), concluded that penal provisions under Rule 26(2) cannot be applied to actions that took place before the rule came into effect in March 2007. In simpler terms, businesses cannot be penalized for activities that occurred before the law existed.

Why This Ruling Matters?

This decision has far-reaching implications. Here’s why it’s such a big deal:

- Clarity on Retrospective Application: One of the key takeaways from this ruling is that penal provisions cannot be applied retrospectively unless explicitly stated by law. This brings much-needed clarity for businesses who may have been penalized for actions that occurred in the past.

- Protection for Taxpayers: The ruling essentially protects businesses from unjust penalties. It ensures that tax authorities can’t slap fines on companies for violations that happened before certain rules were introduced.

- Legal Precedent: The ruling sets a precedent that will guide similar cases in the future. It sends a clear message to tax authorities that retrospective penalties cannot be enforced in the absence of an explicit law.

- Fairness in Taxation: At the heart of the ruling is the principle of fairness. It ensures that businesses will not face penalties for actions that were perfectly legal at the time but later deemed illegal by a law introduced after the fact.

Real-Life Case Studies: How This Ruling Can Help Businesses

Let’s bring this ruling to life with some real-world examples.

Case Study 1: A Manufacturer in Maharashtra

A company in Maharashtra was facing retrospective penalties for CENVAT credit violations that occurred between 2003 and 2005. Tax authorities tried to apply the 2007 Rule 26(2) provisions to impose heavy fines. The company appealed, citing the CESTAT ruling, arguing that penalties could not be applied retrospectively. Based on this judgment, the Tribunal ruled in favor of the company, removing the penalties and saving them millions in fines.

Case Study 2: A Service Provider in Delhi

A service provider in Delhi was also embroiled in a similar dispute. The authorities had claimed that the company had misused CENVAT credits between 2004 and 2006. When the business owner presented the CESTAT ruling, the tax authorities backed down, and the penalties were withdrawn.

These real-world cases highlight how this ruling can be used to defend businesses against retrospective penalties.

Implications for Specific Industries

Certain industries are more vulnerable to CENVAT credit disputes due to the nature of their operations. Manufacturing and service-based industries are often at the forefront of CENVAT-related issues. Here’s a breakdown of how this ruling can affect them:

- Manufacturing Industry: Manufacturers who deal with complex supply chains and multiple vendors are at higher risk of CENVAT credit disputes. For them, this ruling means they no longer have to fear retroactive penalties for past mistakes.

- Service Industry: Service providers who offer taxable services (like construction or telecommunications) can also benefit from this ruling. Many service providers may have been unknowingly penalized for improper credit claims made before 2007, and now they can seek redress.

- Small & Medium Enterprises (SMEs): Smaller businesses, often with fewer resources, are frequently unaware of evolving tax regulations. This ruling provides them a safeguard against unjust retrospective penalties, which can otherwise be crippling for SMEs.

Expert Opinions: Insights from Tax Professionals

We spoke with Ravi Singh, a senior tax consultant based in New Delhi, who shared his thoughts on the CESTAT ruling:

“This ruling brings much-needed clarity to businesses that were stuck in the web of retrospective penalty provisions. In India, the tax system is evolving rapidly, and it’s crucial that businesses stay ahead of these developments. The CESTAT judgment ensures that businesses can operate with confidence, knowing that they won’t be penalized for actions that happened before a law came into effect.”

How to Handle Retrospective Penalties in CENVAT Credit Dispute: A Step-by-Step Guide?

If you find yourself in a similar situation or are simply looking to stay ahead of potential disputes, follow these steps:

- Review Your CENVAT Credit Records: Ensure that your business has accurate and up-to-date records of CENVAT credits, including supporting invoices and documentation.

- Consult with a Tax Advisor: If you’ve been involved in any CENVAT credit disputes, it’s crucial to seek professional guidance from a tax expert who can assess the specifics of your case.

- File an Appeal: If you’ve been penalized retroactively for actions that occurred before 2007, use the CESTAT ruling as the basis for an appeal. Present the judgment as part of your defense.

- Stay Informed: Tax laws change frequently. Make sure to stay updated with legal rulings and amendments to stay compliant.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties