Rs 44 Crore Customs Evasion Exposed: In a case that’s got the business world buzzing, the Bombay High Court recently granted anticipatory bail in a high-profile ₹44 crore customs duty evasion case linked to walnut imports. The case revolves around allegations that a group of individuals and businesses tried to dodge customs duties by misdeclaring the price of Inshell Walnuts imported into India. This alleged scam raises serious questions about the integrity of the country’s trade practices and the enforcement of customs laws. To help you better understand the scope and impact of this case, we’ll break down everything from the basic facts to what the legal outcome means for businesses and the Indian import-export sector. We’ll also explore the key aspects of the case, the court’s decision, and what steps are involved in dealing with customs duty violations like this.

Rs 44 Crore Customs Evasion Exposed

The ₹44 crore customs duty evasion case might sound like a small blip in the grand scheme of things, but it’s a reminder that even small-scale fraud can have serious consequences. For businesses, it underscores the importance of compliance with all customs regulations. For consumers, it’s a wake-up call about the value of honesty in trade and the importance of protecting national revenues. As we move forward, the Indian government will likely continue to crack down on trade fraud, using cases like this as examples of how customs violations can be caught and punished. The Bombay High Court’s decision to grant anticipatory bail is a clear example of how the legal system works to balance fairness with the need for enforcement. So, next time you’re looking to import goods or start a business in India, remember: transparency and honesty aren’t just good business practices—they’re legal necessities.

| Topic | Details |

|---|---|

| Customs Duty Evasion Amount | ₹44 Crore |

| Imports Involved | Undervalued Inshell Walnuts imported through Nhava-Sheva Port |

| Primary Individuals | Dipakkumar Dharamsinhbhai Kakadiya, Sneh Deepakbhai Kakadiya |

| Legal Sections Involved | Sections 132 & 135 of the Customs Act, 1962 (related to misdeclaration and evasion of duties) |

| Court Decision | Bombay HC grants anticipatory bail with conditions, including a ₹5 crore deposit and video-recorded questioning |

| Investigating Agency | Directorate of Revenue Intelligence (DRI) |

| Compounding Application | Joint application filed to resolve without prosecution |

| Case Reference | DRI File No. DRI/MZU/F/INT-32/Enq 17/2025/RA No.485 of 2025 |

| Source for Official Updates | India Shipping News, Taxscan |

What’s All the Fuss About This Walnut Scandal?

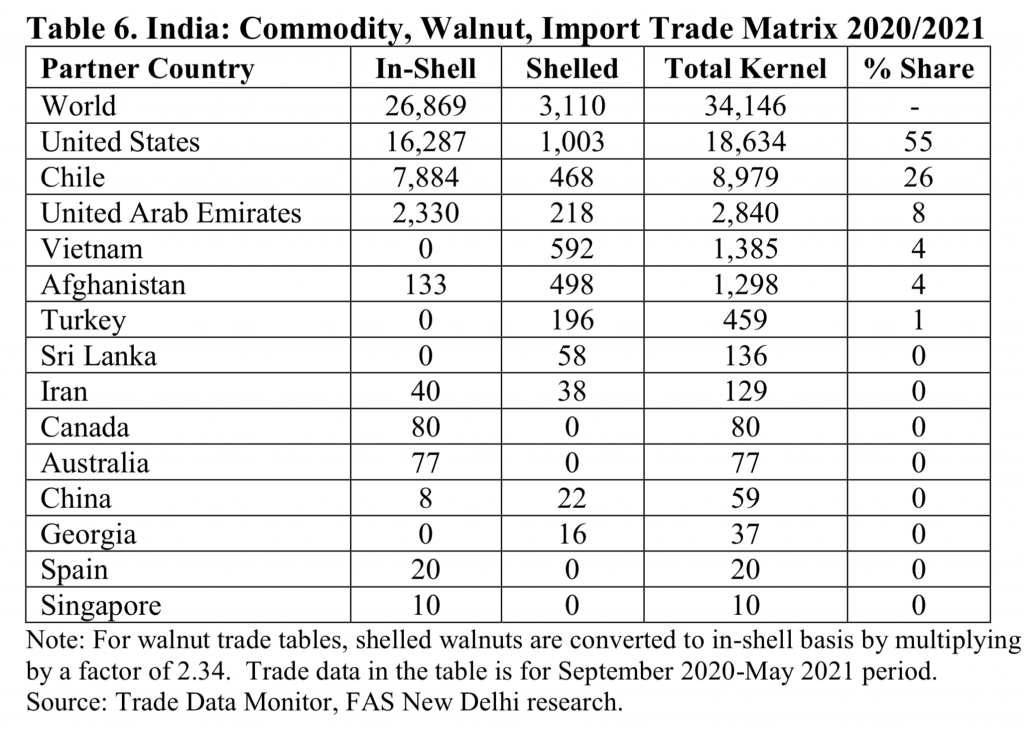

So, what’s the deal with walnuts and why is it making headlines? Well, the case involves walnut imports coming into India, specifically Inshell Walnuts, which are whole walnuts with their shells intact. The Directorate of Revenue Intelligence (DRI) has accused the importers of intentionally undervaluing the cost of these goods to lower the customs duties they would have to pay. This kind of manipulation is illegal and considered customs duty evasion.

The goods were shipped through the Nhava-Sheva Port, one of India’s busiest ports, and the misdeclaration was allegedly supported by fake invoices from Dubai-based suppliers. The actual invoices—revealed during the investigation—came from a Chile-based supplier, showing a much higher price. This means that the customs duties owed to the government were significantly reduced, leading to an estimated loss of over ₹44 crore in taxes.

Why Should We Care About This?

While you might think, “Oh, it’s just a bunch of walnuts,” the case has serious implications. First, the customs duty on imports is one of the ways that governments regulate trade and protect local businesses. When companies evade paying duties, it creates an uneven playing field for businesses that follow the rules.

Additionally, this case is part of a bigger problem—the fight against trade fraud. Customs evasion schemes like this are not only about one shipment or one company; they have a ripple effect on national revenues, trade policies, and enforcement practices. The ₹44 crore evasion from this case might just be one example, but it shows how large-scale fraud can hide under everyday business transactions.

The Legal Action: What Happened in Court?

Now, let’s dive into the legal side of things. When the DRI started investigating the matter, they found the false invoices and other discrepancies pointing to deliberate customs fraud. As a result, they filed charges against the suspects under Sections 132 and 135 of the Customs Act, 1962. These sections deal with misdeclaration and evasion of customs duties.

Here’s the kicker: The accused individuals, including Dipakkumar Dharamsinhbhai Kakadiya and Sneh Deepakbhai Kakadiya, didn’t exactly play ball with the investigation. Instead of cooperating with the DRI and responding to the summonses (requests to appear before authorities), they sought anticipatory bail from the Bombay High Court. Anticipatory bail is a legal provision where a person can apply for protection from arrest if they fear being arrested for a crime.

The Bombay High Court weighed the evidence and decided to grant anticipatory bail. However, this decision came with some strict conditions. The applicants were asked to deposit ₹5 crore within a week and comply with certain video-recorded questioning protocols. The court also ordered that any future interrogations be done in the presence of their lawyers, ensuring fairness.

Rs 44 Crore Customs Evasion Exposed: A Breakdown of the Legal Process

If you’re wondering how customs duty evasion works in legal terms, here’s a simple breakdown:

- Misdeclaration: The importer provides false or incomplete information about the goods they’re bringing into the country. In this case, the importers falsely declared the price of the walnuts to reduce the duty owed.

- Investigation: Authorities like the DRI investigate any discrepancies, using tools such as invoices, shipment records, and other documentation to uncover fraud.

- Charges: If fraud is confirmed, charges are laid under various sections of the Customs Act, 1962, including penalties, fines, and potentially criminal charges.

- Bail and Court Decisions: The accused may seek bail if they are facing arrest, and the court will evaluate factors such as the severity of the charges and their willingness to cooperate.

- Resolution or Prosecution: In some cases, businesses can seek to compound the offence (settle without prosecution) by paying a fine or restitution. The Bombay High Court’s decision in this case is an example of this kind of legal settlement.

Best Practices for Businesses to Avoid Customs Evasion

This case should serve as a stark reminder to businesses, especially those dealing with imports, of the importance of compliance with customs laws. To avoid finding yourself in similar legal hot water, here are some best practices businesses can follow:

- Honesty is the Best Policy: Always declare the accurate value of your imports. Any attempt to understate the value of goods is a violation of the law and can lead to massive fines and criminal charges.

- Work with Reputable Suppliers: Ensure that your suppliers provide genuine invoices that match the true cost of the goods being imported. Avoid using intermediaries who may have questionable business practices.

- Maintain Proper Documentation: Keep meticulous records of all shipments, including invoices, bills of lading, and payment receipts. Proper paperwork can help you avoid discrepancies during an audit or investigation.

- Consult with Experts: Importing goods, especially large shipments, can be tricky. If you’re unsure about the customs duties involved, consider working with a customs broker or legal expert who can help navigate the complexities.

- Proactively Settle Issues: If you realize there is a discrepancy in your declaration, it’s better to address it quickly. Compounding the offence and paying a fine might be a preferable option than facing a lengthy court case and potentially higher penalties.

Massive ₹62 Crore GST Evasion Scam Uncovered in Ludhiana—Two Arrested in Major Tax Fraud Bust!

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines

GST Collection Breaks ₹1.96 Lakh Crore Mark — But Why Is Net Growth Cooling?