Sasikala Paid Rs 450 Crore In Old Notes To Buy Sugar Mill: When the Central Bureau of Investigation (CBI) makes headlines, it usually signals a storm. This time, the eye of that storm is V.K. Sasikala, once one of the most influential figures in Tamil Nadu politics. According to recent allegations, she paid a staggering ₹450 crore in demonetized notes to purchase a sugar mill during India’s historic 2016 demonetization. If this claim is proven true, it is not just another corruption scandal. It cuts to the heart of India’s political economy and the challenges of enforcing sweeping reforms in a country where money, power, and politics often intertwine.

Sasikala Paid Rs 450 Crore In Old Notes To Buy Sugar Mill

The allegation that V.K. Sasikala paid ₹450 crore in demonetized notes to buy a sugar mill isn’t just about one leader or one factory. It is a symbol of how corruption can bend even the strictest financial reforms. For India, it raises painful questions: Did demonetization really curb black money? Or did it merely punish ordinary citizens while the powerful found loopholes? For global readers, the lesson is clear: money laundering, whether through sugar mills in Tamil Nadu or real estate in New York, is a universal challenge. Transparency, accountability, and vigilance are the only antidotes.

| Aspect | Details |

|---|---|

| Main Allegation | Sasikala paid ₹450 crore in demonetized notes to buy a sugar mill in 2016 |

| Investigating Agency | Central Bureau of Investigation (CBI) |

| Property Location | Kancheepuram, Tamil Nadu |

| Connection | Linked to ₹120 crore bank fraud involving Indian Overseas Bank (IOB) |

| FIR Filed | July 2025, after Madras High Court order in June 2025 |

| Current Status | Sasikala identified as “beneficial owner” but not formally accused yet |

| Reference | CBI Official Website |

A Quick Flashback: Who is V.K. Sasikala?

Sasikala Natarajan, better known simply as Sasikala, is no stranger to controversy. For decades, she was the closest aide to J. Jayalalithaa, the charismatic Chief Minister of Tamil Nadu. Their relationship went beyond politics—Sasikala was seen as Jayalalithaa’s confidante, advisor, and gatekeeper.

When Jayalalithaa passed away in 2016, Sasikala attempted to step into her shoes, angling for the Chief Minister’s chair. But fate intervened. In 2017, she was convicted in a disproportionate assets case and spent four years in prison. Even so, her influence lingers. For many in Tamil Nadu, her name still carries weight—sometimes admiration, often suspicion.

Setting the Stage: India’s Demonetization

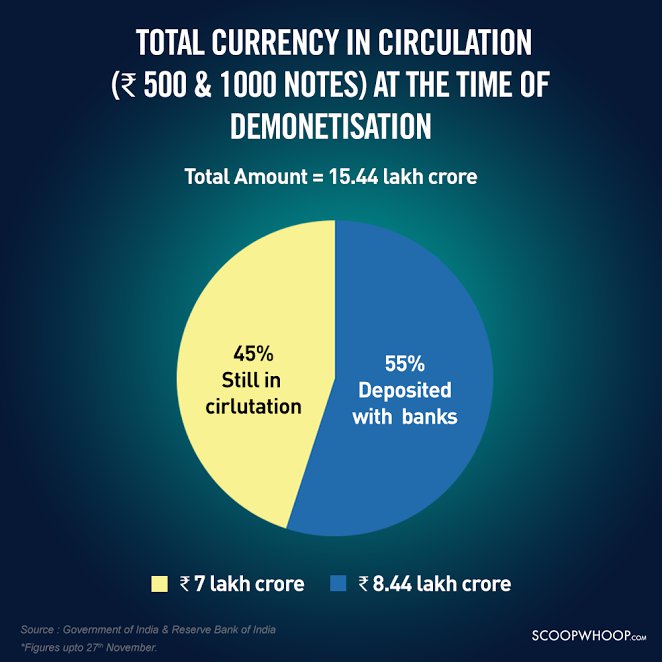

In November 2016, Prime Minister Narendra Modi stunned the nation with an announcement that ₹500 and ₹1,000 notes were no longer legal tender. Overnight, 86% of India’s currency in circulation turned into worthless paper—unless deposited or exchanged through strict banking channels.

The objectives were clear:

- Eliminate black money.

- Reduce corruption.

- Stop the circulation of fake currency.

- Cut off funding for illegal activities.

The reality, however, was mixed. According to the Reserve Bank of India (RBI), over 99% of demonetized notes eventually returned to banks. That raised a tough question: if almost all money came back into the system, how much black money was actually destroyed?

For everyday Indians, demonetization meant standing in endless lines, scrambling for cash to pay for food, medicine, and daily needs. For political elites and wealthy individuals, it triggered a rush to find loopholes, launder money, or stash wealth in assets.

The Allegation: Sasikala Paid Rs 450 Crore In Old Notes To Buy Sugar Mill

The CBI’s claim is shocking in scale. According to the investigation:

- Cash Payment: Sasikala allegedly handed over ₹450 crore in demonetized ₹500 and ₹1,000 notes to purchase the Kancheepuram sugar mill.

- Ownership Transfer: The deal was formalized through a Memorandum of Understanding (MoU) signed with the Patel family, the previous owners.

- Benami Cover: On paper, the factory was listed under other names, but Sasikala was identified as the beneficial owner.

- Investigative Raids: On August 12, 2025, CBI officials raided six locations across Tamil Nadu, seizing documents and evidence linked to the deal.

This alleged transaction wasn’t just bold—it openly flouted the very purpose of demonetization, which was meant to make such large cash transactions impossible.

The Role of Sugar Mills in Indian Politics

To outsiders, a sugar factory may seem like just another business. But in India, sugar mills are political powerhouses.

- They employ thousands of rural workers.

- They control sugarcane pricing, which directly affects millions of farmers.

- They often double as vote banks, with mill owners wielding influence in elections.

In Tamil Nadu, as in states like Maharashtra and Uttar Pradesh, controlling a sugar mill isn’t just an economic move—it’s a political strategy.

The Legal Framework

Benami Transactions Act

The Prohibition of Benami Property Transactions Act prohibits buying assets in someone else’s name to conceal true ownership. Violators face imprisonment and confiscation of property. In this case, the sugar mill is alleged to be a benami asset of Sasikala.

Demonetization Rules

Under demonetization, old notes could only be exchanged in limited amounts or deposited in banks with valid proof. Any attempt to use them in massive cash deals was unlawful.

Both these laws are at the center of the case against Sasikala.

Political and Public Fallout

The allegations have sparked intense debate across India:

- Opposition leaders say the scandal proves demonetization failed to curb corruption.

- Public sentiment reflects anger and betrayal—ordinary people suffered during demonetization while elites allegedly exploited it.

- Sasikala’s supporters argue the case is politically motivated, designed to tarnish her reputation ahead of elections.

This case could reshape Tamil Nadu politics once again, reopening old wounds in the AIADMK party and influencing upcoming electoral battles.

Global Parallels: Money Laundering Beyond India

The Sasikala case has echoes around the world. In the United States, regulators frequently uncover money laundering through real estate. High-value properties in New York, Miami, and Los Angeles are often purchased with cash through shell companies to hide true ownership.

One striking example: U.S. authorities launched investigations into all-cash luxury property deals after concerns that they were being used to launder foreign money. The tactic mirrors what Sasikala allegedly did—using banned currency to buy a politically strategic asset.

Sasikala’s ₹450 Crore Factory Linked to Massive Fraud Probe: Check Details

GST Sleuths Bust Electronics Firm in ₹5 Crore Tax Fraud

After SBI, Bank of India Also Labels Anil Ambani and RCom as Fraud

Practical Lessons: Protecting Yourself Against Fraud

While most of us aren’t dealing with ₹450 crore in cash, there are everyday lessons here:

- Be skeptical of large cash transactions—legit businesses rely on banks and digital transfers.

- Check ownership transparency—hidden beneficiaries are red flags.

- Know your rights—whether in India or the U.S., laws protect whistleblowers and those who report suspicious activity.

Financial awareness isn’t just for professionals. It protects ordinary people from getting caught in fraudulent schemes.