SEBI Drops Major Regulatory Update for Portfolio Managers: If you work in finance or even casually follow money matters, you’ve probably noticed headlines buzzing: SEBI drops major regulatory update for portfolio managers, and new disclosure norms could reshape the industry. Now, that’s a mouthful. But let’s break it down, piece by piece, so that even a curious 10-year-old (or a busy pro scanning on the train) can get what’s going on. The Securities and Exchange Board of India (SEBI)—basically India’s version of the SEC in the United States—just rolled out some game-changing rules for Portfolio Management Services (PMS). These updates zero in on transparency, investor protection, and streamlined compliance, all while trying to keep pace with a financial world that’s moving fast.

SEBI Drops Major Regulatory Update for Portfolio Managers

SEBI’s new disclosure norms for portfolio managers mark a turning point in India’s financial landscape. By enforcing mandatory disclosure documents, scrapping outdated templates, and consolidating rules into one master circular, SEBI is pushing PMS toward global best practices. For investors, this means smarter, safer choices with fewer surprises. For portfolio managers, it means tighter compliance, higher accountability, and—if they adapt well—greater credibility. Ultimately, these reforms reshape the PMS industry into a more transparent, trustworthy, and globally competitive sector.

| Aspect | Details |

|---|---|

| Regulation Issued | SEBI (Portfolio Managers) (Amendment) Regulations, 2025 |

| Effective Date | September 1, 2025 |

| Main Changes | Mandatory disclosure document before agreements, deletion of rigid Schedule V, clear reference to Schedule IV |

| Master Circular | Consolidated 39 old circulars, added monthly reporting, stricter governance norms |

| Industry Size | PMS AUM ~ INR 30 trillion ($360B) as of mid-2025 |

| Impact on Investors | More transparency, better risk awareness, standardized disclosures |

| Impact on PMS Firms | More compliance, new reporting obligations, flexibility in updates |

| Career Impact | Growth in compliance, risk, and advisory roles |

| Reference | Official SEBI Website |

Historical Background: How We Got Here

Portfolio Management Services have been part of India’s financial ecosystem since the 1990s, but the industry truly started gaining scale in the last two decades. SEBI introduced the first PMS regulations in 1993, mainly focusing on registration and minimum net worth. By the mid-2000s, PMS became a favored option for wealthy individuals seeking customized investment strategies beyond mutual funds.

A few milestones stand out:

- 2008: SEBI tightened norms after the global financial crisis, pushing for stronger investor safeguards.

- 2020: Minimum investment size was raised from INR 25 lakhs to INR 50 lakhs, signaling PMS as a product for high-net-worth investors.

- 2025: With PMS assets crossing INR 30 trillion, SEBI’s new amendments focus on standardization, disclosures, and compliance clarity.

This progression reflects SEBI’s philosophy: as markets grow, rules must evolve to protect investors and maintain confidence.

What Exactly Did SEBI Do?

The new rules are focused on disclosures and compliance, but their impact is wide-reaching.

- Mandatory Disclosure Documents: Portfolio managers must provide clients with a SEBI-specified Disclosure Document before signing any portfolio management agreement. This document includes details on fees, risks, past performance, and conflicts of interest. A Form C certificate also confirms that the investor has received and understood the disclosures.

- Elimination of Schedule V: Until now, firms followed a rigid model disclosure format (Schedule V). SEBI scrapped this, making disclosures more dynamic and adaptable to change.

- Streamlined Regulation Structure: Regulation 20 and Regulation 22 now reference Schedule IV, reducing regulatory ambiguity.

- Master Circular Issued in July 2025: SEBI compiled 39 earlier circulars into one comprehensive circular. This covers reporting requirements, operational norms, cybersecurity, fee illustrations, and investor grievance redressal.

Why SEBI Drops Major Regulatory Update for Portfolio Managers Matter?

Transparency is the lifeblood of trust in financial markets. Without standardized disclosures, investors may be blindsided by hidden fees or one-sided contracts.

For example, before these rules, two PMS providers might show performance in completely different ways—making it nearly impossible for investors to compare. Now, with uniform disclosure formats and mandatory fee illustrations, an investor can line up three providers and easily see who offers better risk-adjusted returns.

The move also reduces legal gray areas. For portfolio managers, having a clear compliance roadmap makes life easier, even if reporting burdens increase.

Global Comparison: How India Stacks Up

This isn’t happening in a vacuum. Regulators worldwide are pushing for stricter disclosure and governance standards.

- United States: The SEC mandates investment advisers to file Form ADV, which must be shared with clients. It details services, strategies, fees, conflicts, and disciplinary history.

- European Union: Under MiFID II, asset managers must provide investors with a full breakdown of costs and demonstrate that the service is suitable for the client’s profile.

- India Post-2025: By enforcing disclosure documents and streamlining compliance, India is aligning PMS regulations closer to these global standards, making it easier for international investors to trust Indian portfolio managers.

The Numbers Behind PMS

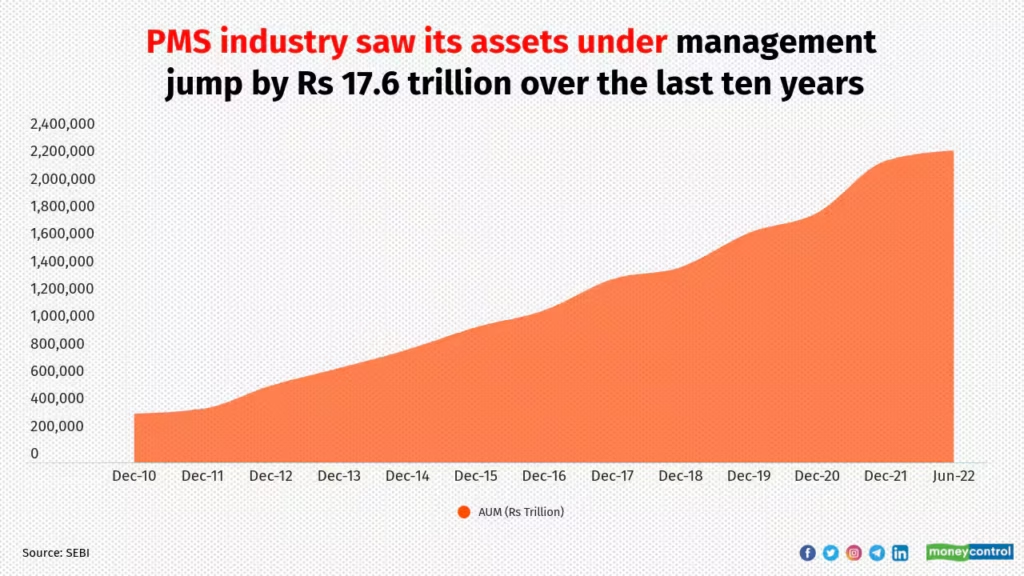

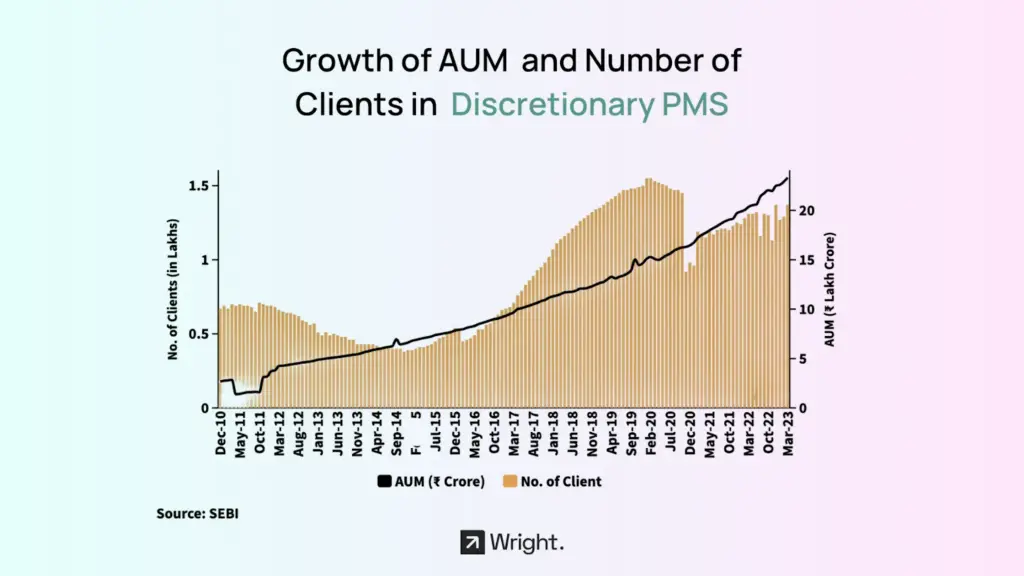

The PMS industry in India has been expanding rapidly:

- Total PMS AUM crossed INR 30 trillion in 2025, compared to INR 12 trillion in 2020.

- The number of registered portfolio managers stands at over 400 as of mid-2025.

- HNIs (High Net Worth Individuals) are the largest investor base, but family offices and corporates are increasingly active participants.

Compared to mutual funds, which manage over INR 60 trillion, PMS is smaller but growing at a faster clip. These reforms could accelerate that growth by boosting investor confidence.

Breaking Down the Changes: Step-By-Step

Step 1: Mandatory Disclosure Before Signing

Think of it like buying a house. You wouldn’t sign without reading the inspection report. Similarly, PMS providers must now show investors a full “investment inspection report” before contracts are finalized.

Step 2: Flexibility in Updates

By eliminating Schedule V, SEBI allows disclosures to evolve without waiting for years-long regulatory amendments. This makes the system nimble, adapting to market shifts.

Step 3: Consolidated Master Circular

Instead of navigating dozens of circulars, PMS firms now follow one consolidated document. This improves compliance and reduces the risk of oversight.

Step 4: Enhanced Governance

- Monthly reports to SEBI with client-level data.

- Stricter cybersecurity mandates.

- Fee disclosures with illustrations based on high watermark models.

- Tighter restrictions on related-party transactions.

Opportunities and Challenges for PMS Firms

Large PMS houses—often subsidiaries of banks or financial conglomerates—have the resources to adapt quickly. For them, the new rules could actually be an advantage, since standardized disclosures will highlight their scale and credibility.

Smaller firms, however, may feel the pinch. Increased compliance costs and reporting requirements could eat into margins. Some may need to invest in technology or partner with compliance specialists to stay afloat.

The silver lining? Investors may prefer regulated, transparent firms, so those who adapt successfully could see inflows rise.

Impact on Careers in Finance

The reforms will reshape career opportunities in the PMS space.

- Compliance Officers and Legal Experts: Firms will need professionals who can interpret and implement SEBI’s requirements.

- Technology Specialists: With reporting moving online, cybersecurity and data specialists will be in demand.

- Financial Advisors: Explaining disclosures and comparing PMS products will be a core responsibility for advisors.

In short, compliance is no longer a back-office function—it’s center stage.

Real-Life Case Studies

Case 1: A mid-sized PMS in Bengaluru managing INR 500 crore struggles with compliance costs. They invest in a cloud-based compliance platform, which automates reporting. The firm initially bears higher costs but gains new clients who value transparency.

Case 2: A wealthy investor in Delhi compares two PMS providers. Thanks to standardized disclosure documents, she notices one charges higher performance fees with no high watermark protection. She chooses the more investor-friendly option, saving herself lakhs in unnecessary costs.

These examples illustrate how the rules directly affect real firms and investors.

Investor Checklist Under New Rules

- Read the disclosure document fully.

- Check fees with the watermark model illustrations.

- Compare providers side by side using standardized data.

- Ask about cybersecurity frameworks.

- Review the firm’s history of investor complaints.

Future Outlook

The PMS industry is likely to see:

- Increased inflows from HNIs and NRIs as confidence rises.

- More technology-driven compliance, such as AI-based reporting tools.

- A possible wave of consolidation, with smaller firms merging or partnering to meet compliance standards.

- Tighter global integration, as Indian PMS players position themselves alongside global wealth managers.

SBI Takes Action: NCLT Admits Application for CIRP Over Rs. 25.75 Cr Financial Assistance

Never Broke, Always Ahead: These 11 Daily Habits Separate the Financially Free from the Rest

SEBI Scraps ₹10,000 Minimum for Mutual Fund Distributor Transaction Charges