SEBI Unveils Exclusive Delisting Framework: When the Securities and Exchange Board of India (SEBI) announced its exclusive delisting framework for public sector undertakings (PSUs), it wasn’t just another fine print update—it was a market-moving play. This reform could shape how investors, analysts, and even the government approach India’s capital markets for years to come. If you’re wondering, “What’s delisting, and why should I care?”—imagine it like this: a pro basketball team decides to stop selling season tickets and wants the stadium back for private games. That’s delisting—moving a company off the stock exchange and back into private hands.

SEBI Unveils Exclusive Delisting Framework

The SEBI exclusive delisting framework isn’t just another financial reform—it’s a market reset button. By introducing fixed-price delisting with a built-in premium, SEBI has struck a balance between efficiency, investor protection, and government strategy. For investors, it means less guesswork and more clarity. For the government, it’s a tool to accelerate disinvestment. And for India’s capital markets, it’s a step closer to global standards. In plain words: this is one of those times when a rulebook change actually matters—and it could shake up the market in a big way.

| Point | Details |

|---|---|

| New Rule | SEBI introduces fixed-price delisting for PSUs with 90%+ government holding |

| Who’s In | Public Sector Units (excluding banks, NBFCs, insurers) |

| Who’s Out | Private companies and financial institutions |

| Price Rule | Offer must be at least 15% above the floor price |

| Date of Approval | June 18, 2025, at SEBI’s 210th board meeting |

| Investor Protection | Unclaimed payments go into IEPF/SEBI Investor Fund after 7 years |

| Success Rate Context | Only 3 of 13 delisting offers succeeded in 2024 due to old rules |

| Official Source | SEBI Official Website |

What Does “Delisting” Mean?

Delisting is when a company removes its shares from the stock exchange. In simple terms:

- Listing = anyone can buy and sell shares in the open market.

- Delisting = the company or government buys back those shares, and trading stops.

For PSUs, delisting is often tied to disinvestment strategies—basically, how the Indian government trims down public ownership or restructures state-run enterprises.

Why SEBI Unveils Exclusive Delisting Framework Is a Big Deal?

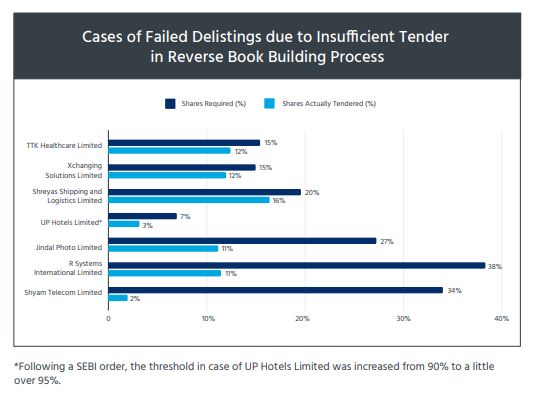

Before this change, companies had to go through Reverse Book Building (RBB). Think of it as a silent auction: investors would quote prices, and the company had to accept or reject. The issue? Too slow, often too expensive, and prone to failure.

Now SEBI says: “Skip the auction. Just set a clear price with a premium.”

Key features:

- Fixed-Price Delisting: A straightforward buyback offer instead of auctions.

- Premium Guarantee: At least 15% above the floor price.

- Investor Safety Net: Money owed to investors is safeguarded and transferred to IEPF if left unclaimed.

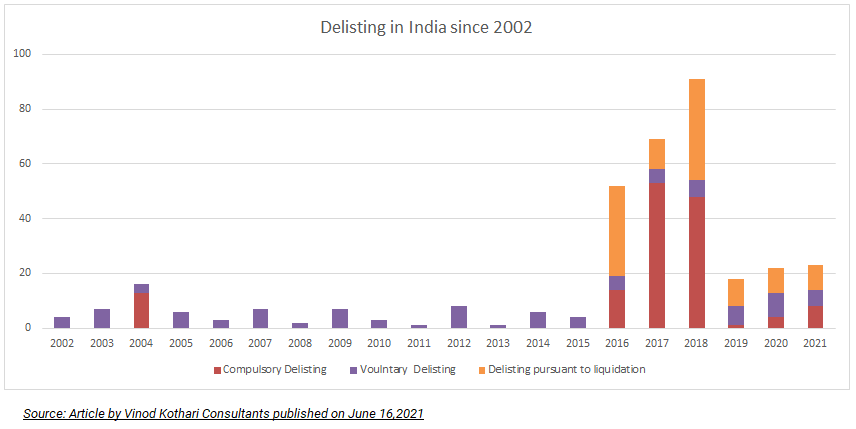

Historical Background: How We Got Here

SEBI has been tinkering with delisting rules for years.

- 2003: India first issued clear delisting guidelines.

- 2009–2010: Reverse Book Building was introduced, meant to empower minority shareholders.

- 2015: Rules tightened to ensure more transparency.

- 2024: Out of 13 delisting attempts, only 3 succeeded—clearly, the process wasn’t working.

India’s government has consistently struggled to meet disinvestment targets. For example, in FY 2024–25, the target was ₹51,000 crore, but receipts lagged far behind. SEBI’s new rules are meant to unclog this bottleneck.

Global Perspective: How Other Countries Do It

- United States: The SEC requires companies to file a Form 25 to delist. Most use a tender offer at a premium price. Shareholders get a clear deal.

- United Kingdom: Needs approval from 75% of voting shareholders. Heavy emphasis on investor protection.

- Japan: Companies often delist as part of restructuring, with fixed-price tenders similar to SEBI’s new rule.

India’s new framework now feels closer to global practices—simple, transparent, and investor-friendly.

Step-by-Step: How Delisting Works Under the New Rule

- Eligibility Check: Only PSUs where the government holds 90% or more.

- Floor Price Calculation: Take the highest of:

- 52-week VWAP,

- Highest acquisition in past 26 weeks,

- Valuation by two independent experts.

- Premium Add-On: Tack on 15% or more to the floor price.

- Offer Announcement: The fixed-price delisting offer is made public.

- Investor Exit: Shareholders can sell at that price.

- Safeguards: Any unpaid money is moved into IEPF after seven years.

Example in Action

Suppose PSU “X” has:

- Floor Price = ₹100

- SEBI Premium = 15%

Offer Price = ₹115

If you own 1,000 shares, you’d get ₹115,000. Compared to old rules where prices could collapse due to RBB complications, this model ensures certainty and speed.

How It Impacts the Market?

- Liquidity: Stocks of PSUs close to delisting may see short-term spikes as investors anticipate buyback premiums.

- Sentiment: More predictable rules = more investor confidence.

- Government Strategy: Easier exits mean faster disinvestment and cash flow into the economy.

- Corporate Governance: Fewer shareholders mean leaner management structures.

Investor Guide: How to Prepare for PSU Delisting

- Stay Alert: Track SEBI announcements and government divestment news.

- Don’t Rush: Wait for the official offer—selling early in panic could mean leaving money on the table.

- Review Taxes: Gains are subject to capital gains tax

- Diversify: Don’t park all your money in PSUs hoping for delisting windfalls. It’s a risky bet.

- Check Timelines: Offers are time-bound—missing deadlines could push your money into IEPF.

Professional Angle: Impact of SEBI Unveils Exclusive Delisting Framework on Careers

- Lawyers: More advisory roles, fewer litigation risks.

- Bankers: M&A teams will see an uptick in restructuring deals.

- Fund Managers: Need new strategies for PSU-heavy portfolios.

- Analysts: Required to build valuation models that reflect fixed-price mechanics instead of auction outcomes.

Risks & Criticism

While the framework is a leap forward, some challenges remain:

- Price Discovery Concerns: Without auctions, minority shareholders might argue they’re being lowballed.

- Exclusion of Private Firms: Right now, this rule is PSU-only. Private sector delistings remain stuck with RBB.

- Liquidity Risks Post-Delisting: Investors who hold out may find it hard to sell later.

Comparison: Old vs. New

| Feature | Old Rule (RBB) | New Rule (Fixed Price) |

|---|---|---|

| Method | Auction-style bidding | Fixed price with premium |

| Timeframe | Long, often failed | Faster, more predictable |

| Investor Safety | Moderate | Stronger with IEPF safeguards |

| Success Rate | Low (3/13 in 2024) | Expected to rise |

2025 Tax Slabs Revealed: Find Out How Much You’ll Really Pay

RC Bhargava Sounds Alarm at Maruti AGM: Can Lower GST Save India’s Car Market?

Shree Cement Stock in Focus – Income Tax Order Rectification Sparks Market Buzz