Selling Inherited Property or Land: If you’ve recently thought about selling inherited property or land, chances are your first question was: “How much tax am I going to owe the IRS?” It’s a fair concern. Real estate is often a family’s largest asset, and when you inherit a home, farmland, or vacant land, the rules can feel overwhelming. The good news is that with some smart planning, you can legally cut down your capital gains tax bill—sometimes even to zero. Whether you’re dealing with a single-family house in the suburbs, inherited farmland in the Midwest, or a city rental property, the key is understanding how the stepped-up basis rule and capital gains tax laws work in the United States. This article breaks it down step by step, in clear, practical language that anyone can follow.

Selling Inherited Property or Land

Selling inherited property or land doesn’t have to be a tax headache. Thanks to the stepped-up basis rule, many Americans pay far less in capital gains tax than they expect. Combine that with smart strategies like 1031 exchanges, installment sales, or living in the home before selling, and your tax bill could shrink dramatically. Every inheritance situation is unique. The best move is to consult with a trusted CPA, estate planner, or tax attorney. With the right guidance, you can protect your inheritance, keep more money in your pocket, and carry forward your family’s legacy without unnecessary stress.

| Point | Details |

|---|---|

| Inheritance itself isn’t taxed | No federal inheritance tax; estate tax applies only for estates above $13.61M in 2024 |

| Capital gains apply only when sold | Based on stepped-up basis (property value reset to date-of-death market value) |

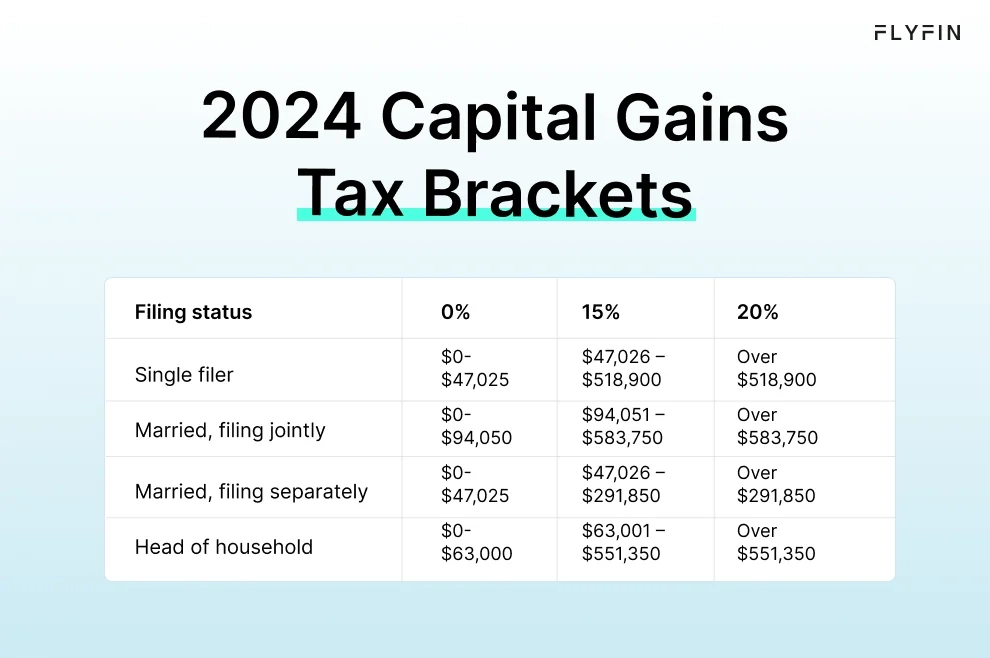

| Federal capital gains tax rates | 0%, 15%, or 20%, depending on income (IRS.gov) |

| State taxes vary | Some states tax heavily (CA, NJ, OR); others have no income tax (TX, FL) |

| Smart strategies | Live in the home, use 1031 exchange, installment sales, tax-loss harvesting, or estate planning |

| Big picture | U.S. households expected to transfer $84 trillion in wealth by 2045 (Federal Reserve) |

Why This Topic Matters?

According to the Federal Reserve, nearly $84 trillion in wealth will be transferred in the U.S. by 2045, and real estate is a major part of that inheritance. Millions of Americans inherit property each year, and many are unsure of the tax consequences. Without the right knowledge, families often make costly mistakes—sometimes selling too quickly, failing to get proper appraisals, or overpaying on taxes.

What is the Stepped-Up Basis Rule?

The stepped-up basis rule is one of the most powerful tax benefits for heirs. It means that when you inherit property, the cost basis resets to the fair market value at the time of the original owner’s death.

Example:

- Your parents bought a house in 1985 for $75,000.

- When you inherit it in 2024, the property is worth $400,000.

- If you sell for $420,000, you are only taxed on the $20,000 difference—not the $345,000 appreciation since the 1980s.

This rule exists to prevent families from being forced to sell properties just to cover massive tax bills. While lawmakers sometimes discuss removing it, as of 2025, it remains fully in place.

Federal Capital Gains Tax Rates

The IRS taxes capital gains differently depending on your income. For inherited property, the gain is always considered long-term, even if you sell it immediately after inheriting.

In 2024:

- 0% if income up to $47,025 (single) or $94,050 (married filing jointly)

- 15% if income up to $518,900 (single) or $583,750 (married filing jointly)

- 20% if income above those thresholds

For high-net-worth individuals, an additional 3.8% Net Investment Income Tax may apply.

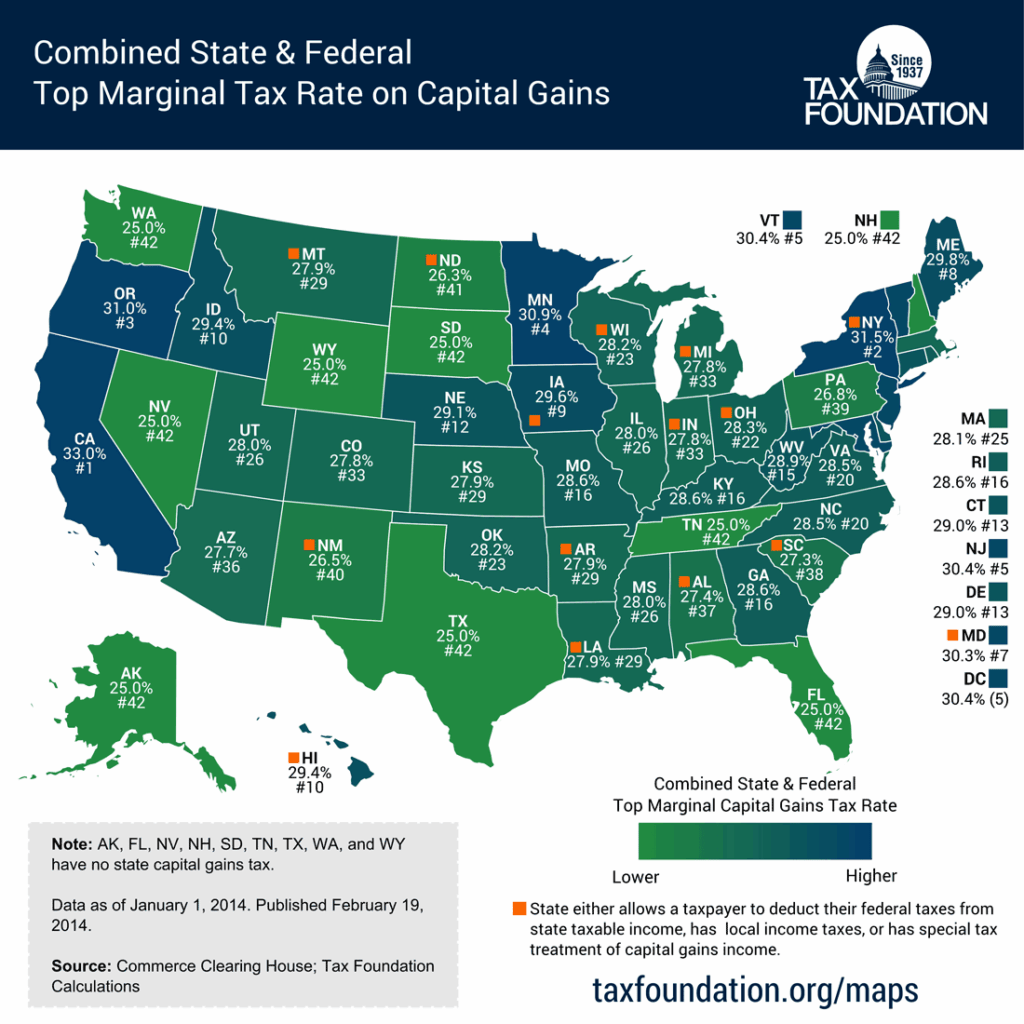

State-Level Tax Differences

In addition to federal taxes, state rules matter:

- California, Oregon, and New Jersey tax capital gains as ordinary income.

- Florida, Texas, and Washington have no state income tax, meaning no state capital gains.

- A few states, like Pennsylvania and Nebraska, still levy inheritance taxes.

Always consult your state’s Department of Revenue for specific rules.

Smart Ways to Reduce Capital Gains Tax

Live in the Property (Home Sale Exclusion)

If you make the inherited property your primary residence for at least two of the last five years, you can exclude up to $250,000 (single) or $500,000 (married) of gain from tax.

Use a 1031 Exchange

For inherited investment properties, a 1031 exchange allows you to sell and reinvest in another property without paying immediate taxes. The tax is deferred until you sell the replacement property.

Installment Sales

By selling property through an installment agreement, you spread payments over several years. This strategy can keep you in a lower income bracket and reduce annual tax liability.

Tax-Loss Harvesting

If you have investments that lost money, you can use those losses to offset gains from the inherited property sale.

Estate Planning Ahead of Time

Parents or grandparents can use trusts, gifting strategies, or life estates to minimize future tax burdens for heirs.

Real-Life Case Studies

Case 1: Urban Home Sale

Maya inherits a townhouse in New York valued at $800,000. She sells it within six months for $810,000. Because of stepped-up basis, she pays tax only on $10,000. At 15% rate, her tax is $1,500.

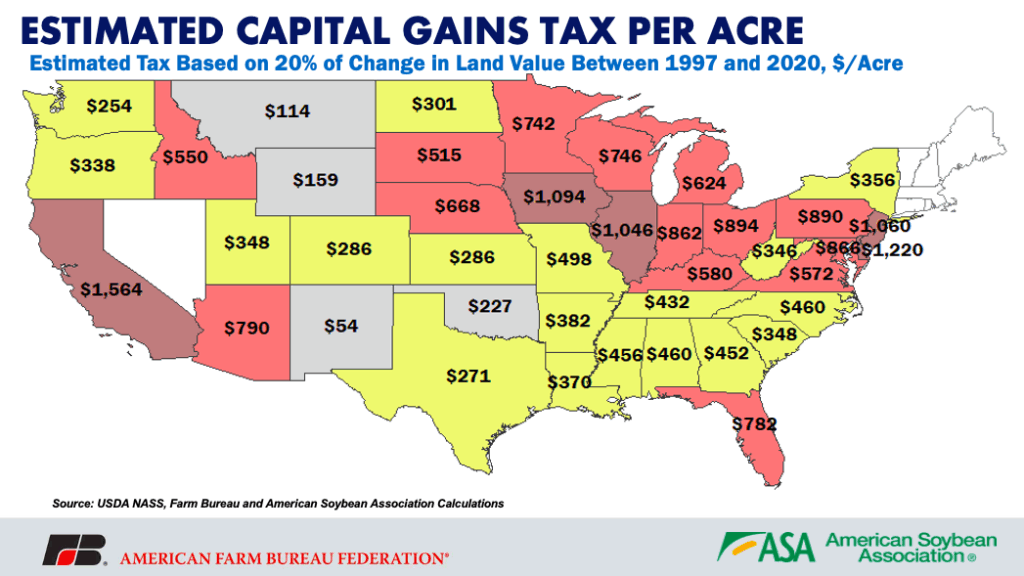

Case 2: Farmland Inheritance

David inherits 100 acres in Iowa worth $1.5 million. Instead of selling outright, he does a 1031 exchange, moving the value into a portfolio of rental properties. Result: no immediate tax due, and he builds long-term income streams.

Case 3: Primary Residence Strategy

Carla inherits her parents’ home in Arizona worth $350,000. She lives there for two years, then sells for $420,000. Because she qualifies for the home sale exclusion, she pays zero capital gains tax on the $70,000 profit.

Common Mistakes to Avoid If You’re Selling Inherited Property or Land

- Not obtaining a professional appraisal at inheritance (needed for IRS proof of stepped-up basis).

- Selling too quickly without considering primary residence exclusions.

- Forgetting about state-level taxes, which can be significant.

- Skipping professional advice—rules differ across states and situations.

Estate Planning Insights

For families looking ahead, there are ways to set things up to minimize taxes for heirs:

- Revocable living trusts simplify transfers and avoid probate.

- Life estates allow parents to remain in the home while ensuring stepped-up basis for heirs.

- Annual gifting lets property owners gradually transfer portions of value, though basis rules differ for gifts.

Proper planning avoids confusion, fights among heirs, and unnecessary tax burdens.

Property Tax Shock? Madurai Corporation Submits Action Plan to High Court

36 Shops Sealed in Indore – Property Tax Non-Payment Crackdown Intensifies

Earning Rent but Also Paying Rent? Here’s What New and Old Tax Regimes Say