September 2025 Tax Calendar: September 2025 has arrived, and with it comes a critical checkpoint for taxpayers across India. This month is packed with important income tax deadlines that can directly affect your finances, refunds, and even potential penalties. Whether you’re a salaried employee, freelancer, small business owner, or investor, knowing these dates is essential to avoid last-minute stress and unnecessary fines. With multiple updates in tax rules, extended filing timelines, and changing compliance requirements, staying informed has never been more important. Missing just one key deadline can lead to hefty late fees, blocked refunds, and additional tax liabilities. That’s why we’ve created this comprehensive guide—to simplify the entire September 2025 tax calendar for you.

We’ll walk you through the most crucial filing dates, payment schedules, and planning tips, along with practical strategies to manage your taxes smoothly. Think of this as your one-stop handbook to navigate September’s deadlines confidently and keep your financial plans on track.

September 2025 Tax Calendar

September 2025’s tax trail doesn’t have to be rocky:

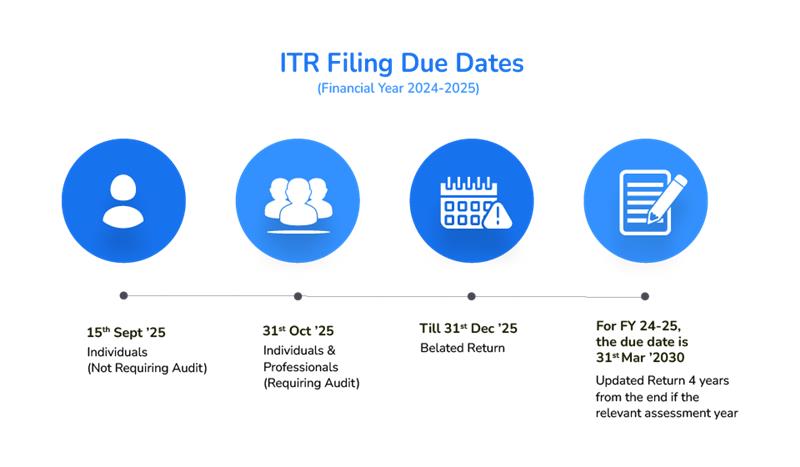

- File your ITR by 15 Sept if you’re not audited

- Audited folks—first get the audit report (by 30 Sept), then file by 31 Oct

- If you slip, file belated by 31 Dec; ITR-U till Mar 2030 for fixes

- Pay your advance tax on time, gather your docs, and don’t rush—stay steady

- Plan ahead, automate alerts, and keep your financial fire blazing bright

Easy enough for a 10-year-old, deep enough for pros—this trail map gives both clarity and confidence. Walk it strong.

| Topic | Why It Matters | Important Dates |

|---|---|---|

| ITR Filing (Non-Audit) | Last safe day to file for most folks without penalty | 15 Sept 2025 |

| Advance/Self-Assessment Tax | Pay late—interest stacks up fast (Sections 234A/B/C) | 31 July 2025 (deadline) |

| Form 16 Download | Must for salaried folks; summary of your TDS | Aug–Sep 2025 |

| Document Gathering | Smooth filing needs all your papers ready | Now to mid-Sept |

| Belated Return (with penalty) | Late? You can still file, but there’s a cost | By 31 Dec 2025 |

| Updated Return (ITR-U) | Fix mistakes or file way later—but extra tax applies | Up to Mar 2030 |

| Refund Interest Opportunity | File later, get slightly more interest on your return | Depends on filing & processing |

Why September 2025 Tax Calendar Deadlines Matter — Plain & Powerful

1. The September 15 Window—Your Breather

The CBDT extended the ITR deadline from July 31 to September 15, 2025, for non-audit cases. That includes salaried earners, pensioners, freelancers—the majority of individual taxpayers. This extension is a welcome pause sparked by delays in ITR form updates and tax tool rollouts. So use the extra time, but don’t let it lull you into delay.

2. Audit Cases—No Extra Time

If your accounts need auditing—like businesses, professionals, or trusts—you’re on a tighter trail. Get your audit report by 30 September, then your ITR by 31 October 2025. No skipping steps—your audit forms pave the way for filing, so get them ready early.

3. Late But Not Lost—What “Belated” Means

Missed September 15? You can still file a belated return by December 31, 2025, but expect a late fee under Section 234F—and no ability to carry forward losses. It’s a second-chance pass, but not a free ride.

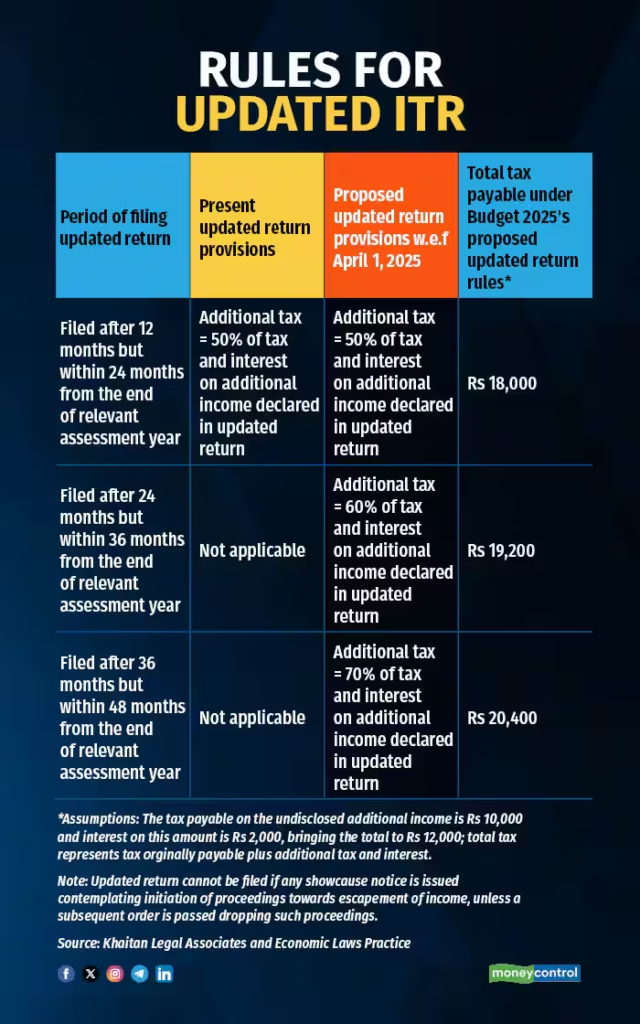

4. Oops—I Need to Fix That? Use ITR-U

Budget 2025 brought in ITR-U, your late-save ticket. You can revise or file missed returns up to 4 years (until March 2030), but you’ll owe extra tax (60–70 %) on top—so choose wisely whether to use it.

5. Pay Your Tax Triangles—Advance/Self-Assessment

Even with filing breathing room, tax payments don’t wait. If your self-assessment or advance tax is late, interest kicks in under sections 234A, 234B, and 234C. Section 234C, for instance, penalizes you 1% per month if each installment isn’t met—those add up fast! Tip: Pay early if possible to avoid the heat.

6. Late Filing Might Fill Your Piggy Bank—but Dang, It’s Taxable

Filing late adds interest to your refund, but it’s not bonus money—it’s compensation. And guess what? That interest itself is taxable. So, appreciate the pause—but play smart to avoid compounding headaches.

7. Documentation Is Your Trail Map

Gather:

- Form 16 (employer-provided)

- Form 26AS (TDS & tax credits)

- Annual Info Statement (AIS)

- Investment proofs (PPF, LIC, ELSS)

- Bank interest statements

- PAN & Aadhaar

Missing just one piece can derail your filing—so round up everything early, especially since the form now wants deeper details on everything from HRA to landlord info.

Step-by-Step Guide—Trail Markers to File Right

Step 1 – Gather Documents

Start with Form 16, 26AS, investment receipts, bank interest, AIS, proof of deductions, PAN, and Aadhaar. The new ITR is detailed, so cover every base.

Step 2 – Log in to the Income Tax e-filing Portal

Use your PAN, reset password if needed, and authenticate via Aadhaar or OTP. Get ready to file.

Step 3 – Choose the Right ITR Form

- ITR-1 = Salaried with no business or capital gains

- ITR-2 = With investments or capital gains

- ITR-3 / ITR-4 = Business or professional income

Step 4 – Fill In Your Income & Deductions

Carefully enter your salary, bank interest, investment deductions, and donations. Cross-check with 26AS and AIS to avoid mismatch noise.

Step 5 – Review & Submit

Use the preview feature to double-check every figure. Mismatches can lead to notices or letdowns, so don’t rush.

Step 6 – e-Verify Immediately

Use Aadhaar OTP, net-banking, or other means—it’s your digital signature and locks things in.

Step 7 – Track Your Refund or Status

Go to your taxpayer dashboard: see if your return’s accepted, if there’s refund pending, or if interest is due on filing delays.

New Section: Tax Planning for FY 2025–26

This is your prep lodge—ideas to build smarter habits for the next round.

- Maximize Deductions Early

Lock in max Section 80C (₹1.5 lakh), 80D for health insurance, and NPS contributions. Start now, so you’re not rushing later. - Plan Advance Tax in Installments

Don’t wait till March. Pay 15% by Jun 15, 45% by Sep 15, 75% by Dec 15, and full by Mar 15. It avoids 234C interest and stays tidy. - Use Tax-Efficient Investments

Consider ELSS for tax water—quick lock-in with potential for growth. Or HRA planning, PPF top-up, etc. - Stay Audit-Smart

If your business grows near audit threshold, get your books ready and consult a CA early. - Automate Reminders

Set alerts for key deadlines: advance tax dates, filing window, audit report date. Keep your tax year on track.

How to Avoid Penalties & Late Fees in September 2025?

One of the biggest mistakes taxpayers make is missing critical deadlines. The Income Tax Department imposes strict penalties and late fees for delayed filings, unpaid taxes, or incomplete submissions. The good news? With a little planning, you can avoid these extra costs altogether.

1. File Your Returns on Time

- The ITR filing deadline for non-audited accounts is 15th September 2025.

- Filing even a single day late can trigger penalties under Section 234F.

- For individuals with taxable income above ₹5,00,000, the late fee can go up to ₹5,000.

- For income below ₹5,00,000, the late fee may still reach ₹1,000.

2. Pay Advance Tax in Installments

If your total annual tax liability exceeds ₹10,000, you must pay advance tax in four installments:

- 15th June

- 15th September

- 15th December

- 15th March

Failing to pay on time may lead to interest under Sections 234B and 234C.

3. Avoid Interest on Refund Delays

Did you know that delaying your ITR also delays your refund processing?

For example, if you’re owed ₹25,000 but miss the deadline, you might wait weeks or months longer to receive it. Filing early ensures faster processing.

4. Cross-Check Details Before Submitting

Common errors like mismatched income figures, incorrect bank details, or missing deductions can result in IT notices and delays. Always:

- Match Form 16 and 26AS carefully.

- Validate all investment proofs.

- Double-check bank account numbers for refunds.

5. Use the Tax Portal’s Pre-Filled Data

The Income Tax e-filing portal now provides pre-filled income and deduction details. Leveraging this feature minimizes mistakes and saves time.

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

ITR Filing FY 2024-25: 8 Must-Have Documents for AY 2025-26

Major Corporate Default: NCLT Admits Insolvency Petition Due to ₹98 Crore Loan Non-Payment