Shopkeeper Receives ₹141 Crore Tax Notice: When headlines scream that a shopkeeper received a ₹141 crore (around $17 million USD) tax notice, most of us chuckle in disbelief. How could a man running a small candy store in rural India suddenly owe millions in taxes? But here’s the twist: this wasn’t a mistake in math—it was a chilling case of identity theft and PAN misuse. This story matters far beyond India’s borders. Whether you’re a teenager curious about how fraud works or a professional tracking your finances, you’ll find lessons here on how identity misuse can wreck lives, careers, and credit scores. Let’s break it down step by step.

Shopkeeper Receives ₹141 Crore Tax Notice

The story of Sudhir Kumar and his ₹141 crore tax notice isn’t just a bizarre headline—it’s a warning bell. Identity theft is global, ruthless, and capable of hitting anyone, from a shopkeeper in Khurja to a tech executive in New York. The bottom line? Guard your PAN or SSN like it’s gold. Monitor your records, act fast on suspicious activity, and stay informed. Because once fraudsters take control of your identity, the financial and emotional costs can be devastating.

| Topic | Details |

|---|---|

| Incident | Shopkeeper in Uttar Pradesh, India received a ₹141 crore tax notice for sales he never made. |

| Cause | Misuse of PAN (Permanent Account Number) by fraudsters to register six fake companies. |

| Victim’s Actual Income | Just ₹10,000–₹12,000/month ($120–$150 USD). |

| Impact | False tax liabilities, ruined peace of mind, and legal troubles. |

| Prevention | Link PAN with Aadhaar, check Form 26AS, monitor credit, report fraud early. |

| Official Reference | Income Tax Department of India |

The Story: From Candy Shop to Crores

Meet Sudhir Kumar, also known as Sudhir Gupta, from Khurja, Uttar Pradesh. A man who runs a tiny sweet shop, earning a modest ₹10,000–₹12,000 a month (about $120–$150).

Suddenly, he was slapped with a ₹141 crore tax notice. The notice alleged that he had made sales worth ₹1,41,38,47,126 during 2021–2023. To put that in perspective, that’s like accusing your neighborhood lemonade stand of out-earning Walmart overnight.

The truth? Fraudsters had allegedly stolen his PAN (Permanent Account Number) and Aadhaar card, then used them to create six shell companies in Delhi. These ghost businesses filed fake returns and transactions, leaving Sudhir responsible for taxes on money he never earned.

This wasn’t the first time, either. Back in 2022, Sudhir faced a similar situation and reported it to authorities. Despite filing complaints and clarifications, the fraud continued. His latest notice arrived in July 2025, dragging him into another legal and financial nightmare.

What Is PAN and Why It’s Crucial?

A PAN card in India is like a Social Security Number (SSN) in the United States. It’s a unique alphanumeric code issued by the Income Tax Department, and it is tied to:

- Tax filings

- Bank accounts

- Employment records

- Government benefits

- High-value transactions

If a fraudster misuses your PAN (or SSN), they can open businesses, apply for loans, launder money, or even file false tax returns in your name. You could suddenly be facing debts, lawsuits, or even criminal accusations for activities you never touched.

How PAN Misuse Can Wreck Your Life?

Here are the key dangers Sudhir’s case highlights:

Huge Tax Demands

Fraudsters can run fake companies under your ID, generating massive sales and profits on paper. Tax authorities will then chase you for payment.

Credit Score Collapse

Loans and credit cards opened in your name destroy your financial credibility. Your credit score can tank overnight, making it impossible to get a car loan, mortgage, or even a phone plan.

Legal Trouble

Victims like Sudhir must file police reports, deal with tax authorities, and defend themselves in court. In the United States, victims often face IRS audits and lengthy disputes.

Emotional and Mental Toll

It’s not just numbers on a page—it’s sleepless nights, panic attacks, and constant stress for you and your family. Identity theft drains peace of mind.

Expert Insights On Shopkeeper Receives ₹141 Crore Tax Notice

Financial and legal experts worldwide agree on one thing: proactive monitoring is your best defense.

- Indian Tax Professionals: Advise checking Form 26AS and Annual Information Statement (AIS) regularly on the income tax portal to spot suspicious entries.

- U.S. Cybersecurity Experts: Recommend freezing your credit with major bureaus—Equifax, Experian, and TransUnion—if you suspect misuse of your SSN.

- Lawyers: Stress the importance of filing police reports quickly. Documenting fraud shows good faith and protects you legally.

Practical Guide: How to Protect Yourself

Here’s a step-by-step guide you can follow, whether you’re protecting a PAN in India or an SSN in the U.S.

Step 1: Link PAN with Aadhaar (India)

In India, linking PAN with Aadhaar is mandatory. It adds an extra verification layer and reduces the chance of duplicate or fake entries.

Step 2: Monitor Your Credit Reports

- India: Get your report from agencies like CIBIL.

- United States: Access your free annual report at AnnualCreditReport.com.

Step 3: Watch Your Tax Records

- India: Log into the portal and download your Form 26AS and AIS.

- United States: Request IRS account transcripts to track filings against your SSN.

Step 4: Mask or Redact Documents

When sharing your PAN or SSN, redact parts of the number. For example, XXXXX1234 instead of the full code.

Step 5: File Complaints Early

- India: Lodge an FIR at your local police station, notify the Income Tax Department, and file through cybercrime.gov.in.

- United States: Report identity theft at FTC’s IdentityTheft.gov and notify the IRS.

Real-World Comparisons

This isn’t just an Indian issue—it’s a global epidemic.

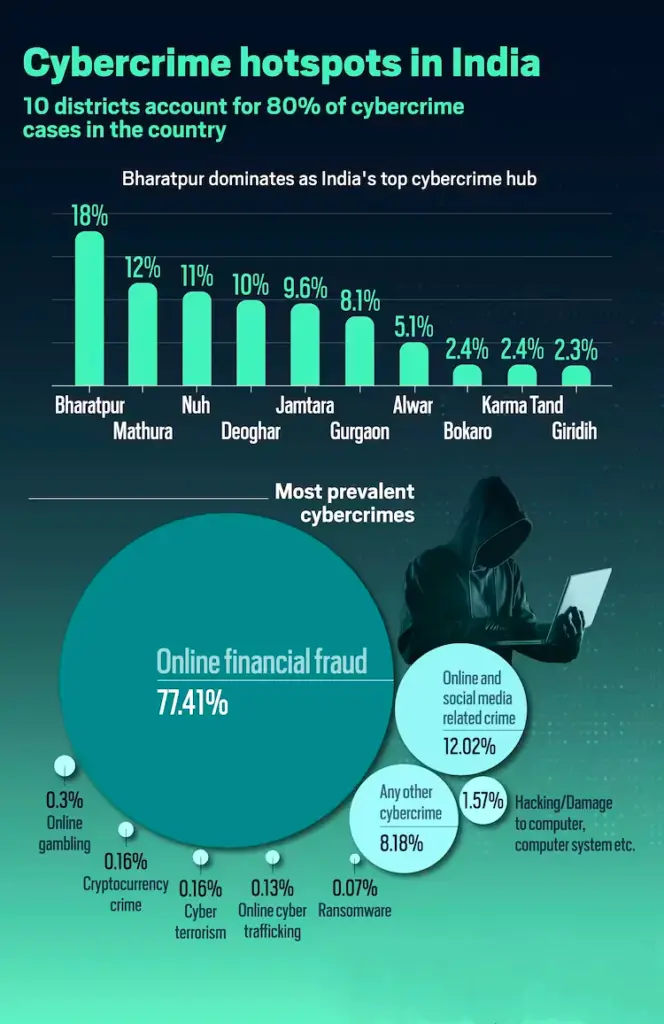

- India: Cases of PAN misuse have risen with digitization, especially targeting less tech-savvy populations.

- United States: The Federal Trade Commission recorded over 1.1 million identity theft complaints in 2022. Tax-related fraud remains a top category.

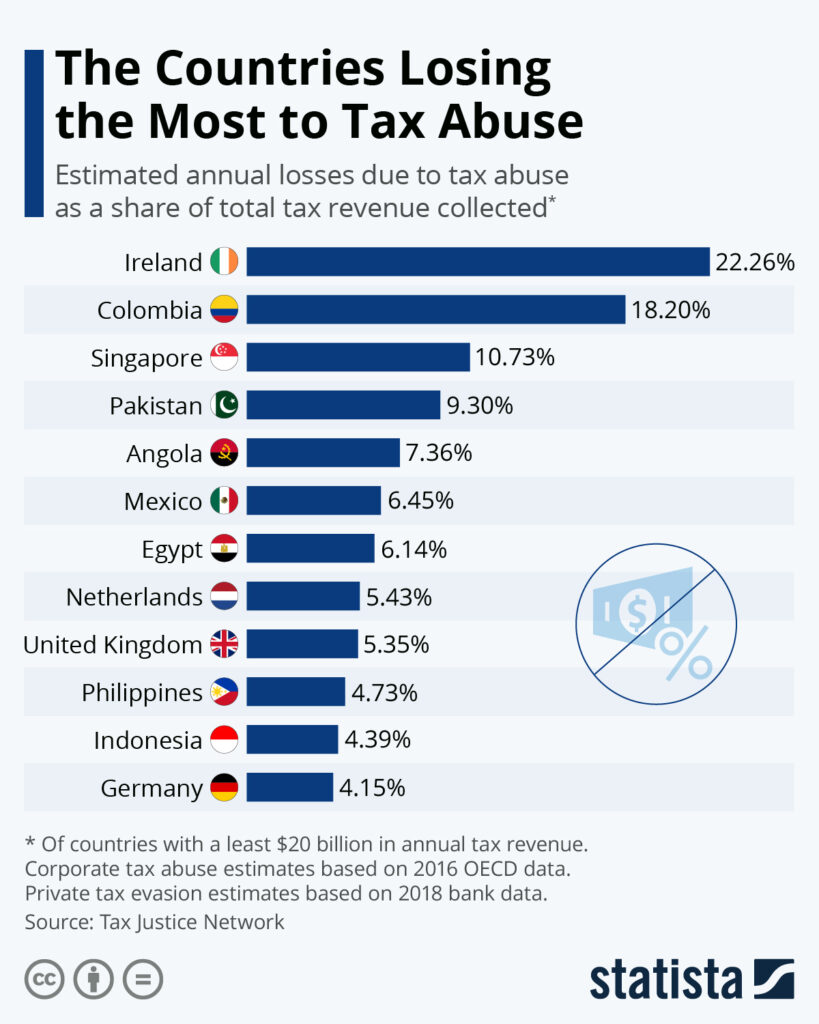

- Europe: Fraudsters manipulate VAT (Value Added Tax) systems for similar scams.

No matter the country, fraudsters use the same tricks: steal ID numbers, set up fake entities, and leave victims holding the bag.

Legal Rights and Remedies

In India

- File FIR under IPC sections for cheating and forgery.

- Approach the Income Tax Ombudsman if the department doesn’t resolve the issue.

- Report online fraud through the national cybercrime portal.

In the United States

- Dispute fraudulent credit with reporting bureaus.

- File IRS Form 14039 (Identity Theft Affidavit) if someone uses your SSN.

- Seek protection under the Fair Credit Reporting Act (FCRA), which ensures correction of false records.

Common Mistakes Victims Make

- Ignoring suspicious notices: Many people assume they’re spam until it’s too late.

- Not monitoring records: Most fraud is caught months or even years later.

- Oversharing documents: Sending full IDs over email or messaging apps makes you an easy target.

- Not filing complaints quickly: Delay in filing can make you legally responsible for some damages.

UP Shopkeeper Shocked by ₹1.41 Billion Income Tax Notice in Fraud Case

₹4 Crore Bank Fraud in Bhopal Exposed After Income Tax Notice Triggers Probe

Property Tax Shock? Madurai Corporation Submits Action Plan to High Court