Should States Get Compensated for GST Reform Losses: The big question making waves across India’s economic and political landscape right now is: “Should states get compensated for GST reform losses?” This debate isn’t just about numbers on a spreadsheet. It’s about trust between the Centre and states, how India manages fiscal federalism, and whether the country can pull off one of the most ambitious tax reforms in the world without leaving some states stranded.

When the Goods and Services Tax (GST) was introduced in July 2017, it was hailed as a landmark reform. India moved from a complicated patchwork of state-level and central taxes to a unified system. The promise was clear: simplification, transparency, and economic efficiency. But as with any big reform, not everyone benefits equally, and some states argue they are losing out—big time.

Should States Get Compensated for GST Reform Losses

So, should states get compensated for GST reform losses? The answer is yes—at least in the near future. While the Centre is right that simplification will help India’s economy in the long run, the immediate pain for states is undeniable. Without compensation, states risk cutting essential spending on healthcare, education, and infrastructure. A balanced solution is the way forward: continue compensation temporarily, share revenue from sin goods, and design a fairer distribution formula. Only then can India achieve the twin goals of simplification and fairness in its tax system.

| Topic | Details |

|---|---|

| What’s the debate? | States say GST reforms will cause revenue losses; Centre says reforms boost efficiency long-term. |

| Karnataka’s position | Warns of a ₹15,000 crore shortfall if reforms pass. |

| Kerala’s position | Reported a ₹21,955 crore revenue loss in 2023; expects another ₹8,000–10,000 crore shortfall this year. |

| Punjab’s position | Demands ₹60,000 crore citing unpaid dues and GST shortfalls. |

| Total estimated impact | Experts project state revenue losses could reach ₹1.8–2 lakh crore annually. |

| Official GST resources | Government GST Portal |

A Quick Flashback: How GST Came to Be

Before GST, India had a messy mix of Value Added Tax (VAT), excise duty, service tax, octroi, and local entry taxes. Businesses often paid “tax on tax” as goods moved from one state to another. For instance, a truck carrying electronics from Tamil Nadu to Delhi would face multiple levies, increasing both paperwork and costs.

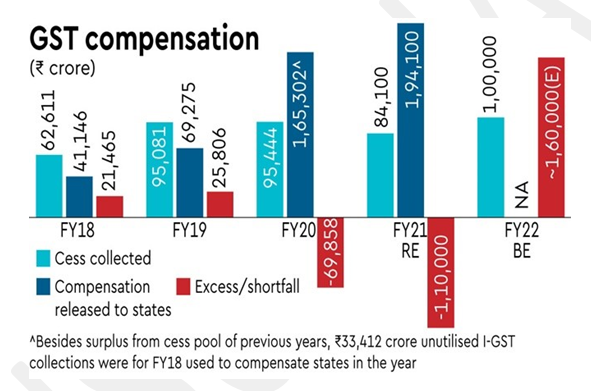

GST promised to clean that up. Instead of separate state and central taxes, one tax would apply nationwide. But because states feared losing their independent tax powers, the Centre offered them a sweetener: a five-year compensation deal.

This deal guaranteed 14% annual revenue growth from their 2015–16 base, funded by a special GST Compensation Cess levied on luxury and sin goods. If states fell short, the Centre made up the difference. That arrangement expired in June 2022, and ever since, the argument has been: what next?

Why States Are Nervous Now?

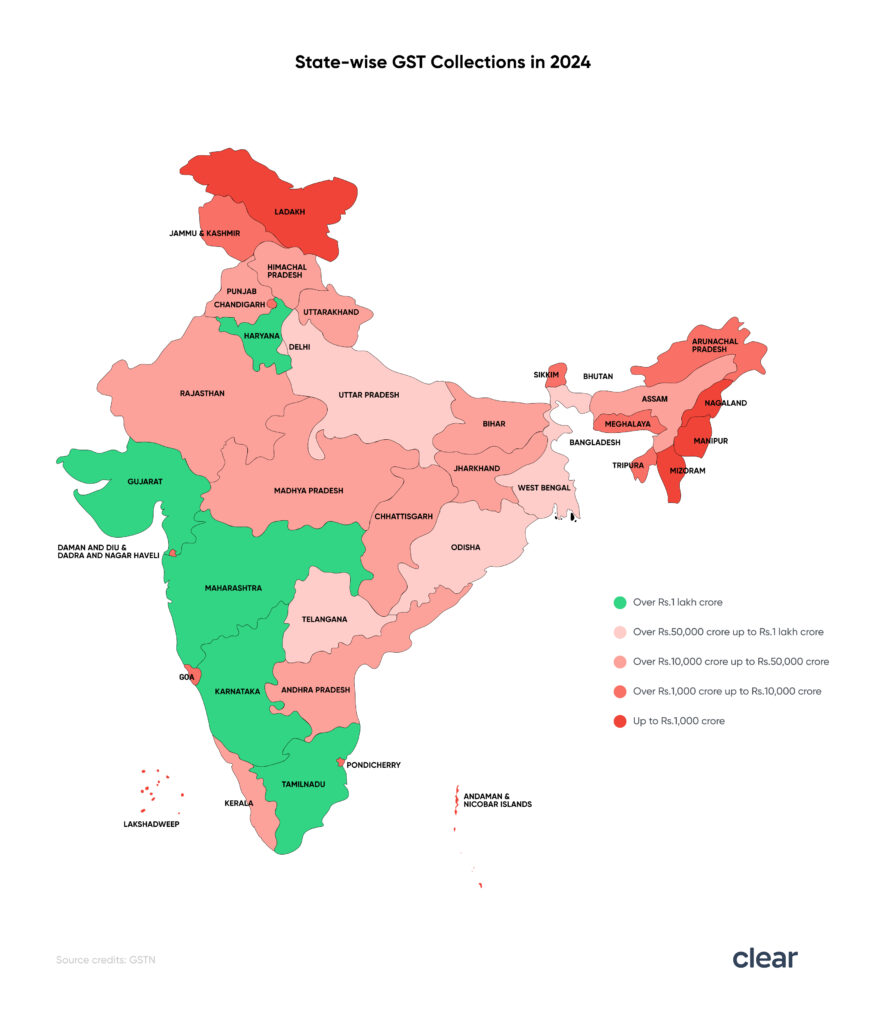

Karnataka’s Case

Karnataka, home to India’s tech capital Bengaluru, has warned that proposed reforms like slab simplification could lead to ₹15,000 crore in lost revenue. The state argues that while simplification may help businesses long-term, the immediate fiscal shock could derail social programs and infrastructure projects.

Kerala’s Case

Kerala’s situation is even more dire. In 2023, it reported a ₹21,955 crore loss under GST, and this year expects another ₹8,000–10,000 crore gap. The state has long complained that GST stripped away its flexibility to tax alcohol, petroleum, and other key revenue sources. Its finance minister, K.N. Balagopal, has already declared that this will be raised at the September 2025 GST Council meeting.

Punjab’s Case

Punjab is demanding ₹60,000 crore from the Centre, including ₹50,000 crore in unpaid GST compensation and additional funds for rural development. According to Punjab officials, their cumulative loss under GST is ₹1.11 lakh crore, while only ₹1.26 lakh crore was promised in compensation. The mismatch has left the state heavily dependent on loans and central transfers.

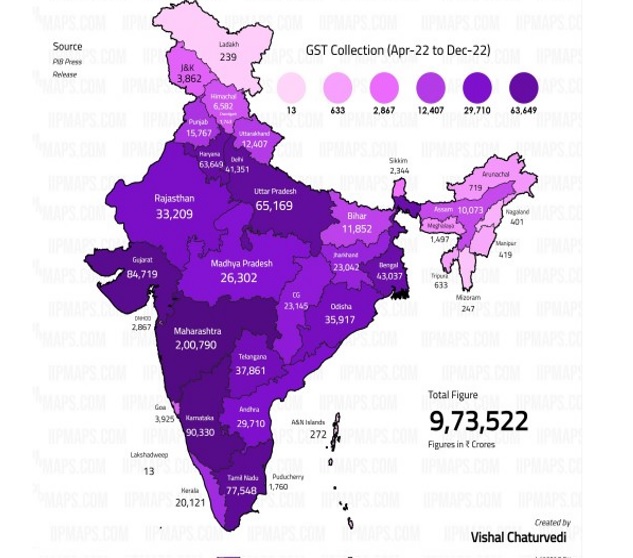

The Bigger Picture: What the Numbers Say

According to estimates cited by Economic Times, reforms like rate rationalisation could cost states ₹1.8–2 lakh crore per year.

To put that in perspective, that’s nearly equivalent to India’s entire annual defense pension bill or the Union Ministry of Education’s yearly budget. For states, these aren’t just abstract losses—they represent hospitals, teacher salaries, farm subsidies, and public sector wages.

Breaking Down GST Reforms

What’s Changing?

Currently, GST has four main slabs—5%, 12%, 18%, and 28%—plus a special 40% for luxury items. The Centre is proposing to simplify this to two slabs: likely 5% and 18%, while keeping a luxury tax for sin goods like tobacco.

Why Simplify?

- Multiple slabs create confusion for businesses.

- Court cases often arise over classification (is a chocolate-covered biscuit a “chocolate” at 18% or a “biscuit” at 12%?).

- A simpler structure reduces compliance costs and improves transparency.

Who Wins and Who Loses?

- Businesses gain from easier compliance and fewer disputes.

- Consumers may pay less for essentials, but mid-range items might become costlier.

- States lose revenue in the short term if high-tax items shift into lower slabs.

How Other Countries Handle This?

India isn’t the first country to wrestle with federal tax sharing.

- United States: No federal GST or VAT exists. States independently levy their own sales taxes, ranging from 0% in Delaware to over 7% in Tennessee. This protects state autonomy but creates a patchwork system.

- Canada: Operates both federal GST (5%) and provincial sales taxes (PST). Some provinces harmonize them into HST, while others run separate systems. Compensation disputes still occur but are more predictable.

- Australia: Has a 10% federal GST, and all collections are distributed to states based on a formula reviewed annually by the Commonwealth Grants Commission. This ensures that even smaller states aren’t disadvantaged.

India’s challenge lies in striking a middle ground—balancing uniformity with fairness.

What States Get Compensated for GST Reform Losses Means for Citizens?

While the debate sounds like high-level politics, the effects are felt in everyday life.

- Food & Essentials: Items like rice and flour could become cheaper under lower slabs.

- Electronics & Household Goods: Items earlier taxed at 12% may move into 18%, raising prices.

- Online Shopping: E-commerce firms may need to adjust pricing and compliance, affecting discounts.

- Fuel & Tobacco: Largely outside GST, but new levies could increase tobacco prices.

- Small Businesses: Less compliance burden, but uncertainty during transition.

Expert Opinions

- NIPFP (National Institute of Public Finance and Policy): Has recommended extending compensation for another 3–5 years to help states adjust.

- IMF (International Monetary Fund): Praised GST as a reform that boosted compliance, but warned of fiscal imbalances unless compensation issues are resolved.

- Economists: Argue that while short-term losses are real, long-term benefits include wider tax nets and better revenue buoyancy.

GST Reform Under UPA And NDA – Impact On GDP Growth Explained

Could a 15% GST Actually Help Young Australians? The Surprising Argument for Reform

GST Rate Rejig to Benefit Farmers and Middle Class – FM Sitharaman Outlines Reform Gains

Possible Solutions

- Extend Compensation Cess: Continue until at least 2026 or until states stabilize.

- Revenue Sharing: Allocate a fixed share of sin taxes (like tobacco, coal, and luxury cars) to states.

- Transitional Grants: Provide special grants to heavily impacted states like Kerala and Punjab.

- Performance Incentives: States that improve GST compliance could be rewarded with additional transfers.

- Hybrid System: Allow states limited rights to levy surcharges on specific goods to plug revenue gaps.

The Political Angle

This isn’t just economics—it’s politics. With several state elections due in 2025 and the general election in 2029 looming, states are using GST losses as a rallying cry. The Centre, meanwhile, wants to push reforms to boost growth and ease of doing business.

If no compromise is reached, expect sharp confrontations in the next GST Council meeting on September 3–4, 2025.

Practical Takeaways

- For Businesses: Prepare for slab changes and adjust pricing strategies accordingly.

- For Professionals & Students: This debate is a live case study in fiscal federalism.

- For Citizens: Expect some price swings but also smoother tax systems long-term.