Should Tax Crimes Lead to Citizenship Denaturalization: In the U.S., “Shocking Demand – Should Tax Crimes Lead to Citizenship Denaturalization?” isn’t just a hot legal topic—it’s a conversation touching on fairness, identity, and what it means to be American. Imagine working hard, buying a home, paying into Social Security, and proudly taking the oath of citizenship. Then suddenly—because of a tax crime—you’re told your U.S. citizenship might be stripped away. For millions of naturalized Americans, this question hits close to home. So, should tax crimes—like fraud, evasion, or underreporting income—be enough to revoke citizenship? Let’s explore the legal background, government policies, real-life cases, and practical steps so you fully understand this issue.

Should Tax Crimes Lead to Citizenship Denaturalization

So, should tax crimes lead to citizenship denaturalization? For supporters, it’s about honesty, accountability, and protecting America’s immigration system. For critics, it’s government overreach that risks punishing hardworking immigrants over mistakes in a complicated tax system. One thing is clear: the rules are changing. For naturalized citizens, tax compliance isn’t just about avoiding the IRS—it could protect your very identity as an American. Staying informed, filing honestly, and seeking professional help are now essential parts of safeguarding your citizenship.

| Topic | Details |

|---|---|

| Policy Shift | DOJ prioritizes denaturalization for certain crimes, including tax fraud |

| Who’s Affected | Naturalized citizens—about 23 million in the U.S. (Pew Research, 2023) |

| Legal Standard | Courts require “clear, convincing, and unequivocal evidence” (U.S. Supreme Court) |

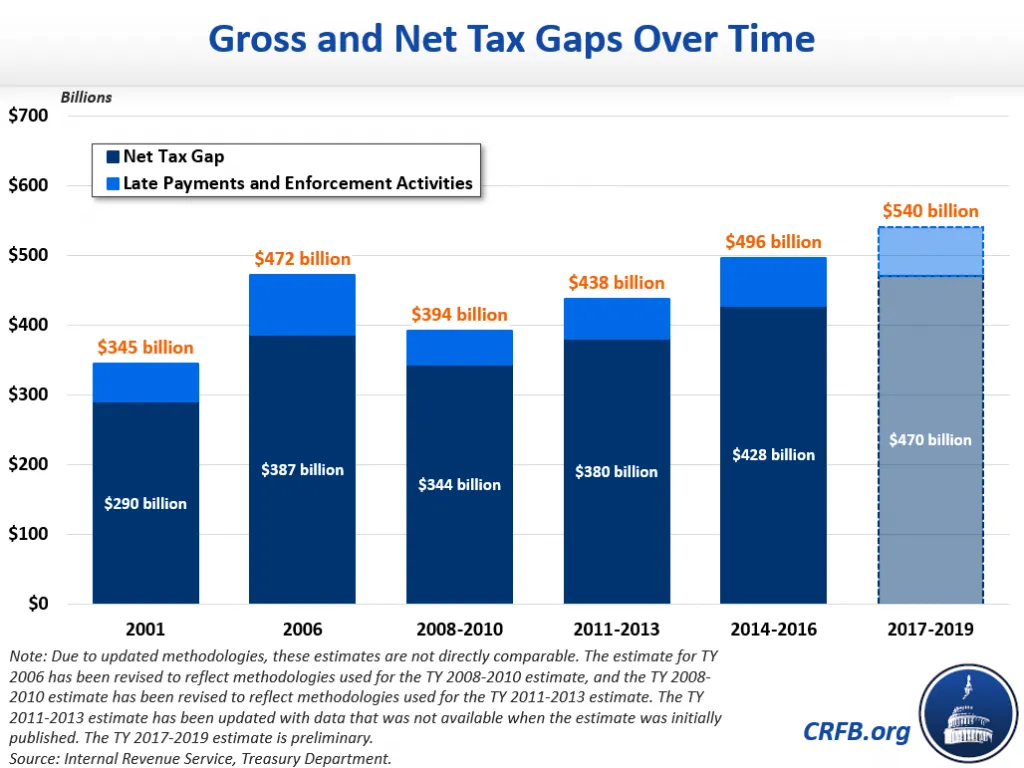

| IRS Tax Gap | U.S. loses $540 billion annually in unpaid taxes |

| High-Profile Case | Tax preparer Vanessa Ben facing denaturalization after tax fraud conviction |

| Professional Advice | File taxes properly, keep records, seek legal counsel if investigated |

| Official Resource | USCIS Citizenship Guide |

What is Denaturalization?

Denaturalization means revoking U.S. citizenship after it’s been granted. It’s not a slap on the wrist; it’s one of the harshest penalties in immigration law. Once denaturalized, a person reverts to permanent resident status if possible—or faces deportation if no lawful status remains.

For decades, denaturalization was reserved for the most extreme cases: war criminals, spies, or people who lied outright in their citizenship application. Tax crimes weren’t typically considered. But a new policy shift is widening the scope.

Why Tax Crimes Lead to Citizenship Denaturalization Are Now on the Radar?

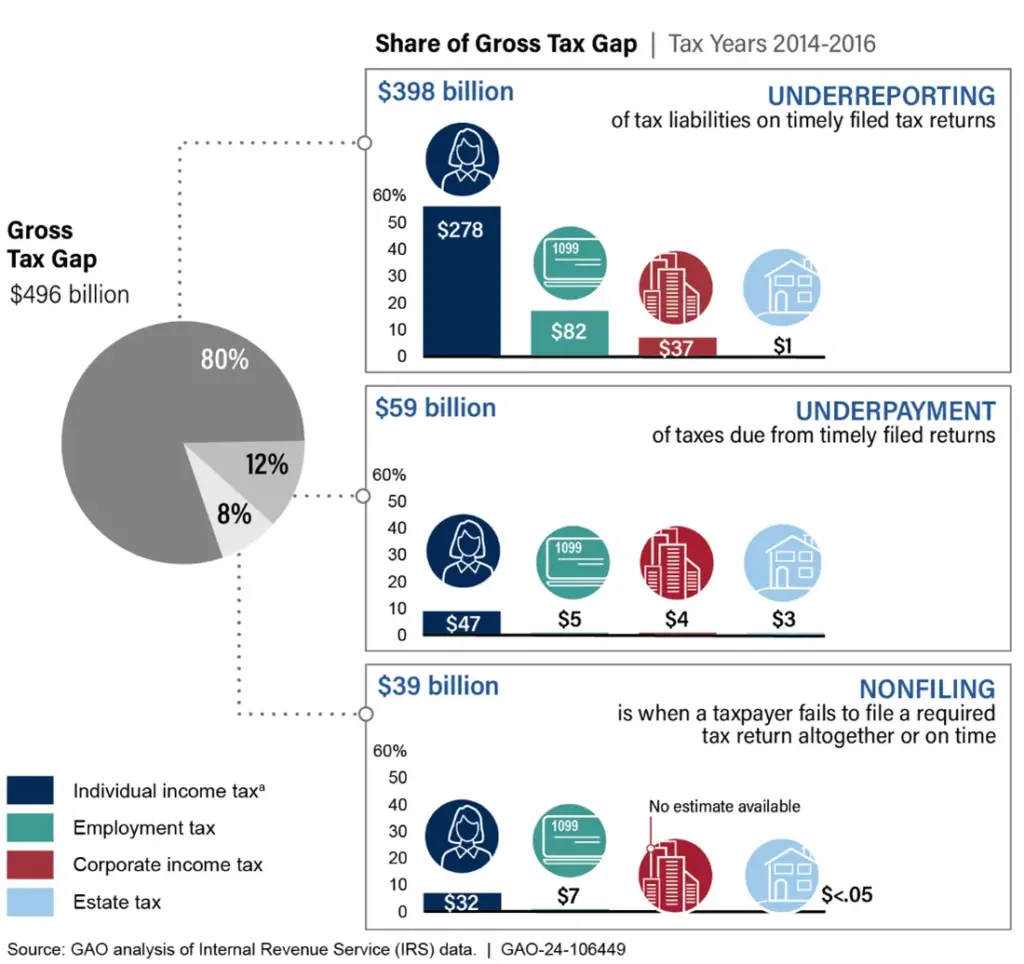

The IRS estimates the U.S. loses hundreds of billions each year due to unpaid or hidden taxes. To close this “tax gap,” the Department of Justice has argued that naturalized citizens who commit tax crimes—especially before naturalization—may have lied about their “good moral character,” which is required for citizenship.

If a person filed false tax returns before becoming a citizen, prosecutors argue that they essentially gained citizenship under false pretenses. That’s where denaturalization enters the picture.

Critics warn, however, that U.S. tax laws are notoriously complex. Even honest taxpayers can make mistakes. Should someone’s future as an American hinge on tax codes that even professionals debate?

Historical Background of Denaturalization

Denaturalization has a long and controversial history in America.

- Early 20th Century: Used against individuals accused of radicalism or fraud.

- Post-WWII: Targeted Nazi collaborators who concealed their past when applying for U.S. citizenship.

- Late 20th Century: Applied against terrorists and spies.

- 21st Century: Expanded into fraud cases, sham marriages, and now financial crimes.

The evolution shows a steady broadening of the government’s power to strip citizenship. Once reserved for war crimes, it now includes financial missteps.

Legal Standards and Court Requirements

U.S. courts apply an extremely high bar for denaturalization. The government must prove the case with “clear, convincing, and unequivocal evidence.” This isn’t the same as “beyond a reasonable doubt,” but it’s close.

The main legal grounds are:

- Illegal Procurement of Naturalization – The person wasn’t legally eligible at the time.

- Concealment or Willful Misrepresentation – They lied or omitted facts in the application.

- Disloyalty or Treasonous Conduct – Rare, usually tied to terrorism or enemy support.

With tax crimes, the government usually argues under the first two categories: that fraudulent tax behavior concealed disqualifying information or misrepresented moral character.

Real-Life Case Studies

- Vanessa Ben (2025): A naturalized U.S. tax preparer pled guilty to tax evasion. The DOJ now argues her fraud shows she was never eligible for citizenship, pushing for denaturalization. This case is considered a legal test for expanding grounds into financial misconduct.

- Nazi Collaborators: In the 1980s and 1990s, the U.S. successfully stripped dozens of ex-Nazis of citizenship after proving they lied about wartime crimes when immigrating. These cases set the precedent that fraud—even decades later—can undo citizenship.

- Marriage Fraud: In multiple cases, individuals lost citizenship when their sham marriages, used to gain residency and eventually citizenship, were uncovered years later.

These examples show how denaturalization law can stretch beyond traditional crimes of violence.

Global Comparisons

The U.S. isn’t alone in this debate.

- United Kingdom: Citizenship can be revoked if it’s “conducive to the public good.” Tax fraud has been included in certain cases.

- Canada: Focuses narrowly on fraud during naturalization; tax crimes alone aren’t enough.

- Germany: Citizenship may be revoked within five years if fraud is discovered. Tax crimes generally aren’t part of this.

- Australia: Expanded denaturalization powers in 2015 but mostly tied to terrorism, not taxes.

Compared globally, the U.S. is moving toward one of the stricter approaches, closer to the U.K. model.

Expert Opinions and Public Debate

Supporters argue:

- Citizenship is a privilege, not a right. Fraud undermines the process.

- Stronger rules will deter dishonesty in tax filings.

- The integrity of the naturalization system must be protected.

Critics counter:

- This risks creating a two-tier citizenship system, where naturalized citizens live in fear.

- Tax code complexity means mistakes could unfairly jeopardize lives.

- Expanding denaturalization risks abuse and discrimination against immigrant communities.

Law professors and immigration advocates warn that using tax crimes as grounds could set a precedent where other minor crimes might also threaten citizenship.

Professional Advice for Naturalized Citizens

Everyday Tax Compliance

- File taxes every year, even if you live abroad or think you don’t owe.

- Report all income, including freelance work, crypto, and rental earnings.

- Avoid “creative” tax strategies that aren’t legitimate.

Documentation

- Keep detailed records for at least seven years.

- Save bank statements, receipts, and employment forms.

Professional Support

- Hire a CPA for complex finances.

- If audited or investigated, consult both a tax attorney and immigration lawyer.

If Facing Investigation

- Don’t panic or ignore government notices.

- Cooperate but only through legal counsel.

- Remember: denaturalization is rare, but serious cases are pursued aggressively.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Implications for Professionals (Lawyers, CPAs, Advisors)

- Immigration lawyers should warn clients about tax compliance risks.

- Accountants should be trained on reporting rules for immigrant clients.

- Financial advisors should stress transparency in income reporting.

For professionals, understanding the intersection of tax law and immigration is now more crucial than ever.