Simple Tax Change Could Unlock ₹37,000 Crore Windfall For NRIs: When it comes to taxes, sometimes small tweaks create massive ripple effects. India is now at a crossroads with one such potential tweak—a proposal that could unlock a ₹37,000 crore ($4.4 billion) windfall annually for the Indian economy while making life easier for millions of Non-Resident Indians (NRIs). Here’s the gist: right now, if you’re an NRI and you spend more than 120 days in India during a financial year, you may be classified as a tax resident. That means the Indian government could tax your global income, including pensions, salaries, or investments earned abroad. Before 2021, this threshold used to be 182 days. Experts believe that if India reverts to the old 182-day residency rule, retirees and long-term visitors would feel more comfortable spending extended time in the country—translating into billions in consumer spending and a measurable boost to GDP.

Simple Tax Change Could Unlock ₹37,000 Crore Windfall For NRIs

A simple tax change—restoring the 182-day residency rule—has the potential to unlock ₹37,000 crore annually in NRI spending. It’s not just about money; it’s about welcoming the diaspora, creating jobs, boosting healthcare and real estate, and pushing GDP growth closer to targets. For retirees, it’s freedom and comfort. For India, it’s growth without massive government spending. Sometimes, the smartest policy isn’t a giant infrastructure project—it’s just giving people more time at home.

| Point | Details |

|---|---|

| Tax Rule in Question | Current: 120-day NRI stay limit. Proposal: Return to 182 days. |

| Estimated Windfall | ₹37,000 crore (~$4.4 billion) in new annual spending. |

| Who Benefits? | Around 160,000 retired NRI couples, mostly from the U.S. |

| Average Spend | ₹4 lakh ($4,800) per couple per month. |

| GDP Impact | Up to 0.7% boost annually due to multiplier effect. |

| Key Sectors | Real estate, healthcare, tourism, retail, hospitality. |

| Official Source | Government of India – Income Tax Rules |

The Backstory: Why the 120-Day Rule Was Introduced

The shift from 182 days to 120 days came in 2020 as part of India’s Union Budget announcements. The goal? To close tax loopholes. At the time, certain wealthy individuals were technically not tax residents anywhere in the world. They lived in Dubai for part of the year, spent time in India, and avoided paying taxes in both places.

The 120-day threshold was designed to bring such “stateless” individuals into the tax net. While the intention was fair, the unintended consequence was a chilling effect on middle-class NRIs and retirees—folks who simply wanted to spend time with family in India without worrying about global tax exposure.

Why Reverting to 182 Days Makes Sense?

For retirees and professionals abroad, the 182-day rule provided balance. It allowed them to spend half the year in India—long enough to connect with family, maintain property, and contribute to the local economy—without tax complications.

By reducing the threshold to 120 days, India effectively discouraged long-term stays. Families now cut visits short, retirees rethink plans, and spending shrinks.

Reverting to 182 days would send a positive signal: India welcomes its diaspora back.

Breaking Down the Numbers

- NRI Population: Around 4 million NRIs live in the United States.

- Retiree Estimate: Roughly 40% are retirees (≈1.6 million people).

- Potential Travelers: If 20% of them (≈160,000 couples) choose extended stays in India…

- Monthly Spending: Each couple spends about ₹4 lakh ($4,800) per month.

This adds up to:

160,000 couples × ₹4 lakh × 6 months = ₹37,000 crore per year.

And with an economic multiplier of 5, that equals nearly ₹1.85 lakh crore injected into GDP annually. That’s roughly 0.7% of GDP growth—a significant push for a country aiming for 7% annual growth.

The Multiplier Effect in Action

Every rupee spent by NRIs in India creates ripple effects across industries:

- Rent paid to landlords helps them reinvest in property or other businesses.

- Spending on groceries benefits farmers, suppliers, and delivery staff.

- Healthcare bills support hospitals, labs, pharmacies, and create jobs.

- Dining out fuels restaurants, drivers, food suppliers, and tourism.

In short, this spending creates jobs, supports small businesses, and boosts consumption.

Case Studies: Real-Life Examples

Take Anita and Prakash, a retired couple from New Jersey. They want to spend six months in Bengaluru with their grandchildren. But under the 120-day cap, they’re forced to cut short their trip to four months. Instead of renting a spacious apartment and hiring help, they choose short-term stays and limit expenses.

If the 182-day rule were restored, Anita and Prakash would commit to a six-month rental, hire a driver and cook, and spend freely on healthcare checkups. Multiply this story by thousands of couples, and the potential becomes crystal clear.

Sector-Wise Impact

- Real Estate: Serviced apartments, senior living communities, and rental markets would see a surge. Developers could even build housing specifically for returning NRIs.

- Healthcare: Hospitals, clinics, and home-care services would grow rapidly. The demand for preventive health checkups and wellness packages would rise.

- Tourism: Extended stays mean more domestic travel, hotel bookings, and local excursions.

- Retail: NRIs bring strong purchasing power, often preferring branded goods and premium products.

- Employment: Drivers, housekeepers, cooks, and local service providers gain steady income.

Global Comparisons

Other countries have mastered the art of attracting retirees:

- Portugal’s Golden Visa allows long stays with favorable tax rules.

- UAE’s Golden Visa encourages investors and retirees to live tax-free.

- Thailand’s Retirement Visa is designed for long-term foreign retirees.

- Canada’s Snowbirds—retirees who spend winters in Florida or Arizona—inject billions into U.S. state economies every year.

India could create its own version of a “diaspora residency program”, tapping into the strong emotional and cultural pull of NRIs.

The Challenges and Counterarguments

Of course, not everyone agrees with the proposal. Critics highlight:

- Potential for Misuse: Wealthy individuals could again exploit longer stays to avoid taxation elsewhere.

- Loss of Tax Revenue: The government risks losing income from those who would have been classified as tax residents.

- Administrative Burden: Tracking days accurately requires coordination between immigration and tax departments.

But proponents argue the indirect economic gains far outweigh direct tax revenue losses.

Expert Insights

- A study by Financial Express estimates that this move could generate a GDP impact similar to India’s IT services boom.

- NASSCOM points out that just as IT hiring creates 4–5 indirect jobs per fresher, NRI spending would multiply across the economy.

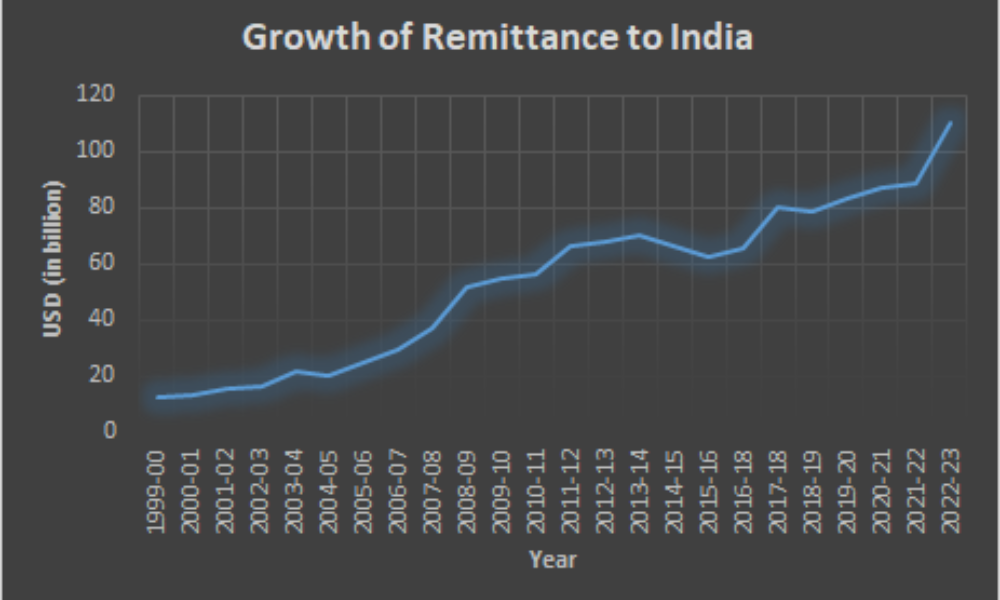

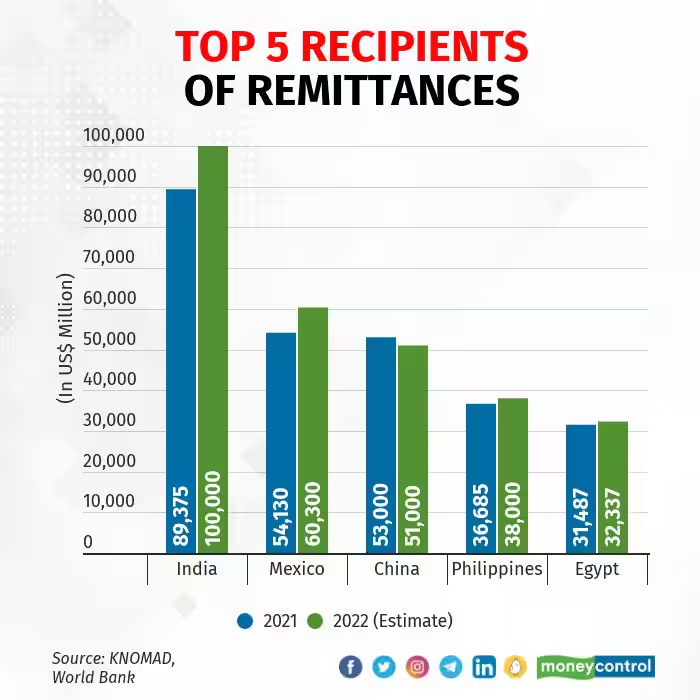

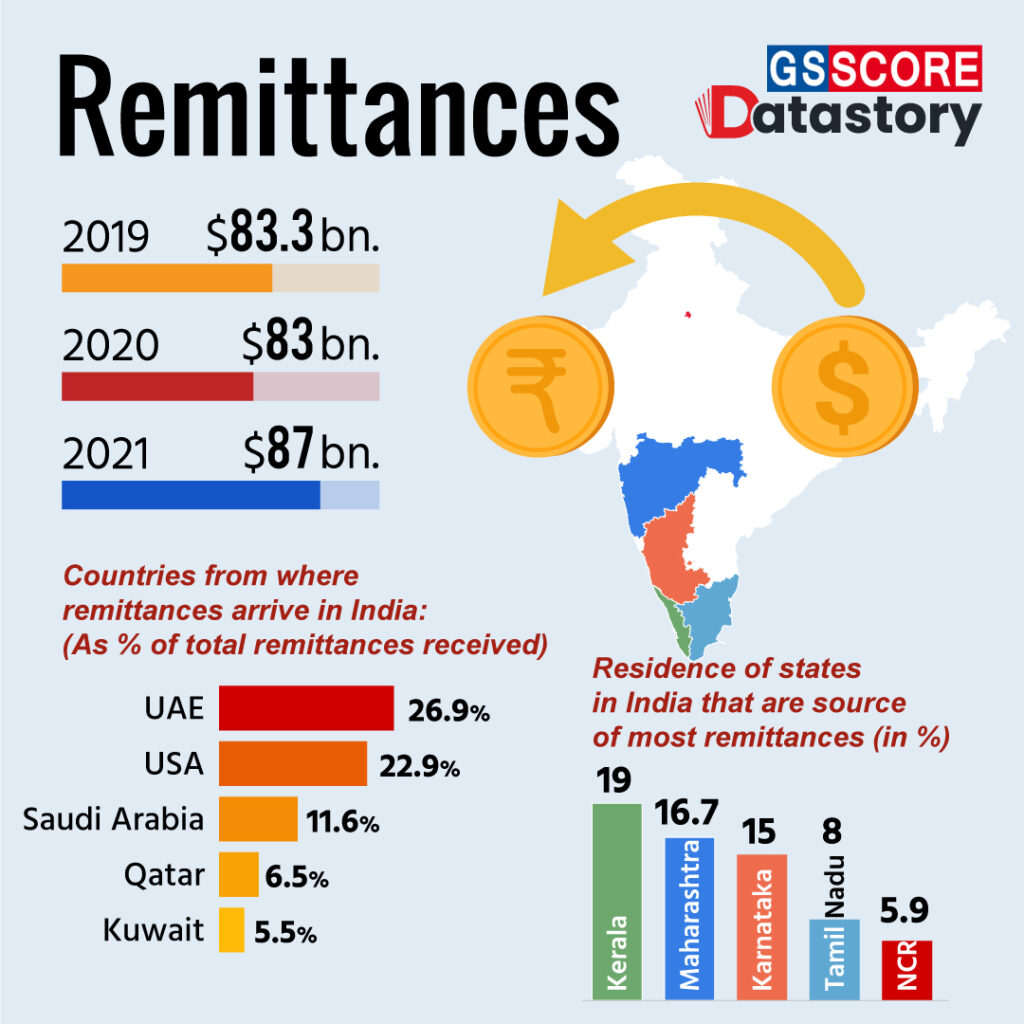

- According to World Bank data, India receives over $120 billion in annual remittances. Encouraging NRIs to spend more domestically could compound this advantage.

Practical Guide for Simple Tax Change Could Unlock ₹37,000 Crore Windfall For NRIs

If you’re an NRI considering longer stays in India, here are steps to prepare:

Step 1: Track Your Days

Use apps or logs to count your days in both countries. Both the IRS and Indian Income Tax Department have strict rules.

Step 2: Learn About DTAA

India has Double Taxation Avoidance Agreements (DTAA) with over 85 countries. These agreements prevent you from being taxed twice on the same income.

Step 3: Consult Cross-Border Experts

Specialized tax advisors can help align U.S. and Indian rules so you don’t fall through the cracks.

Step 4: Plan Your Budget

Consider long-term rentals, medical insurance in India, and cost of domestic help. The rupee stretch is significant compared to the U.S. dollar.

Step 5: Stay Updated

Tax laws evolve with each Union Budget.

Jane Street Tax Probe Deepens as EY Pulled Into Investigation

ITR-U Explained: Here’s How You Can Fix Your Tax Mistakes Up to 4 Years Late

NRI Students With Foreign Investments or Bank Accounts — The Income Tax Rules You Can’t Ignore