Singapore Slaps Infosys With ₹66 Lakh GST Fine: When news broke that Singapore slapped Infosys with a ₹66 lakh Goods and Services Tax (GST) fine, eyebrows went up not just in India but across the global business community. The penalty, equivalent to around SGD 97,035.90, was imposed for a delay in paying GST for the April–June 2025 period. While Infosys assured investors this fine won’t shake up its finances, the situation offers a valuable lesson for businesses operating internationally. This article breaks down the story in simple, plain-English terms so that even a 10-year-old can follow along, while also diving into the nitty-gritty details that professionals, business owners, and finance folks can’t afford to miss.

Singapore Slaps Infosys With ₹66 Lakh GST Fine

The story of Singapore fining Infosys ₹66 lakh for late GST payment isn’t about money—it’s about discipline, trust, and setting the right example. Whether you’re running a lemonade stand in Ohio or a billion-dollar IT empire in Bangalore, the principle is the same: pay your taxes on time. The lesson? Tax deadlines aren’t flexible. Infosys’s small stumble is your chance to get smarter about compliance before it costs you more than just cash—it could cost your reputation.

| Aspect | Details |

|---|---|

| Penalty Amount | SGD 97,035.90 (~₹66 lakh) |

| Reason | Delay in GST payment for April–June 2025 |

| Authority | Inland Revenue Authority of Singapore (IRAS) |

| Date of Notification | August 13, 2025 |

| Infosys Statement | “No material impact on operations or financials.” |

| Stock Price Impact | Infosys shares fell 0.6% post-announcement |

| Past Issues | Similar compliance hiccups in India, 2019 |

| Official Resource | IRAS GST Rules |

What Happened: The Fine in a Nutshell

Infosys, the Indian IT giant known for billion-dollar contracts and global outsourcing, was fined because it missed the GST payment deadline in Singapore. According to Singapore’s tax laws, companies must file and pay GST within one month after the end of their accounting period. Infosys slipped up, and IRAS responded with a penalty.

To put this in perspective—Infosys made over $18.6 billion in revenue in FY 2024, so ₹66 lakh is like pocket change. Still, it’s not just about money—it’s about reputation, compliance, and the reminder that even the biggest corporations can trip up if they ignore deadlines.

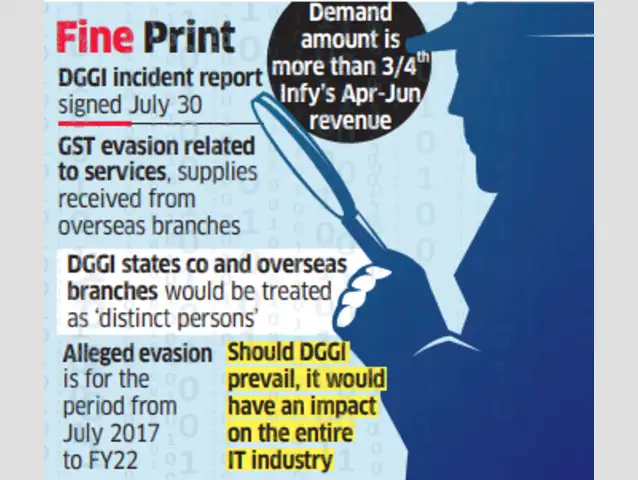

Historical Context: Not Infosys’s First Rodeo

Infosys has faced regulatory hiccups before:

- In 2019, Infosys came under fire in India for GST filing delays, though those were later clarified.

- Rival companies such as Wipro and Tata Consultancy Services (TCS) have also received tax-related notices in multiple countries, showing how compliance can be a recurring headache for Indian IT firms operating abroad.

- Globally, companies like Apple and Google have faced billion-dollar tax disputes in the European Union. Compared to that, Infosys’s penalty is tiny but symbolic.

This background matters because investors and regulators don’t just look at isolated incidents—they look at patterns.

Why This Matters?

For Big Companies

Late payments hit trust and credibility. Governments and clients expect tech giants like Infosys to set the gold standard in compliance.

For Small Businesses

This story is a wake-up call. If a global leader like Infosys can get fined, small firms have even less wiggle room. Late taxes can snowball into bigger fines, restricted operations, or even legal trouble.

For Professionals

If you’re a finance manager, accountant, or startup founder, this case underlines why tax compliance is not optional—it’s mission critical.

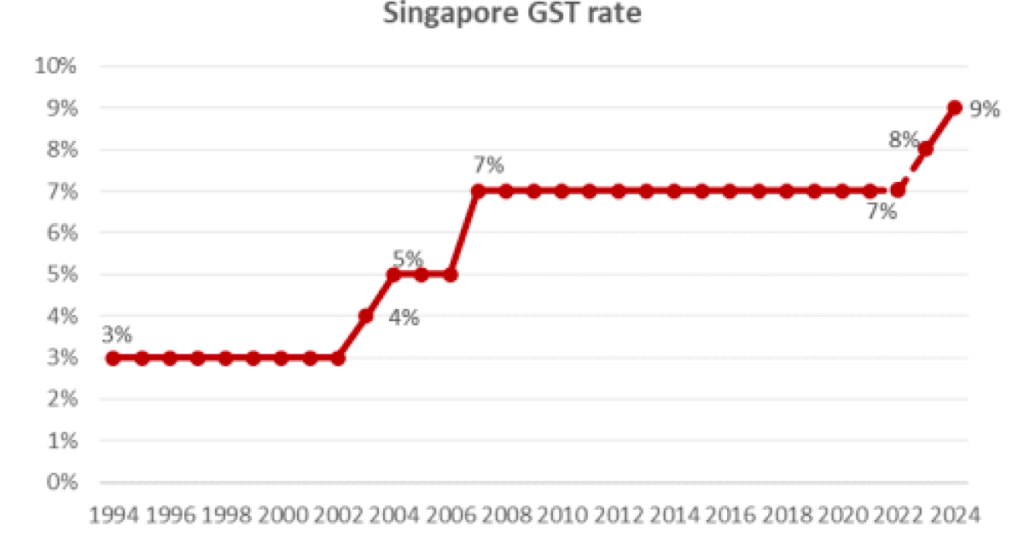

The GST Rulebook: How It Works in Singapore

GST in Singapore is pretty straightforward:

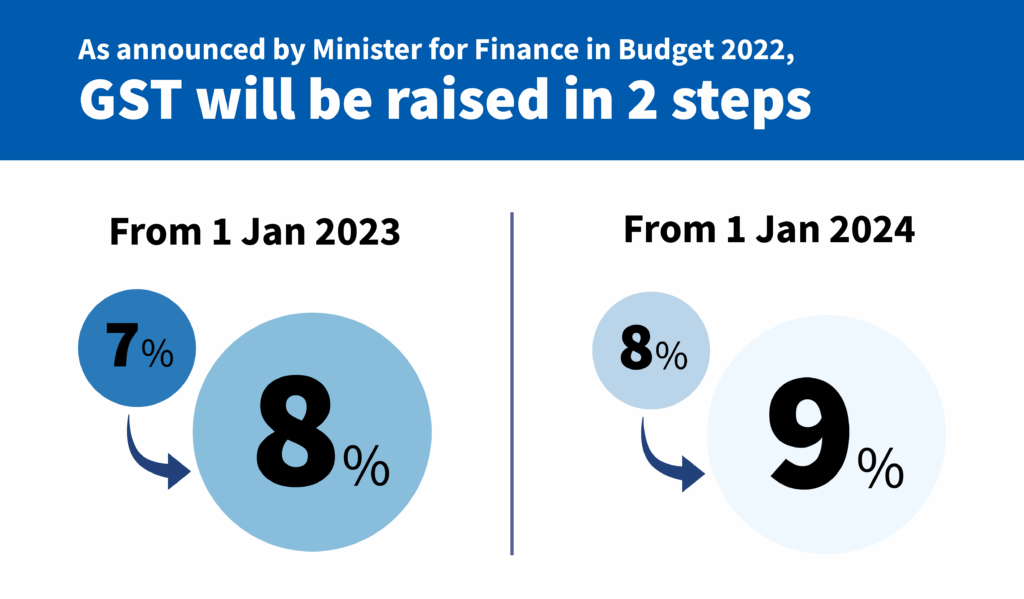

- Rate: Currently 9% (as of 2025, following the step-up from 8% in 2024).

- Deadline: Companies must file GST returns and pay their tax within 1 month from the end of each quarter.

- Penalty: Late payments typically carry a 5% surcharge on the outstanding amount, plus additional penalties if the delay drags on.

For example, if your GST due is SGD 1 million and you delay, the first penalty is SGD 50,000. Wait longer, and it just piles up with additional monthly penalties.

Market Reaction: Investors Take Note

After the penalty was announced, Infosys’s stock dipped by around 0.6% on the Bombay Stock Exchange. While the fine itself is tiny compared to Infosys’s revenue, investor sentiment often reacts more to headlines than hard numbers.

Analysts noted that while the financial impact is negligible, the reputational risk is real. In today’s fast-moving markets, trust can be worth more than quarterly profits. This was also evident when global giants like Facebook and Amazon faced regulatory fines that shook investor confidence even when the sums were immaterial.

Expert Opinions on Singapore Slaps Infosys With ₹66 Lakh GST Fine

- Rohit Bansal, Tax Consultant (New York):

“This case highlights why multinational companies must set up local compliance teams. A late tax payment in Singapore may look small, but when aggregated across regions, it can snowball.” - Priya Menon, Corporate Lawyer (Singapore):

“Singapore’s IRAS is known for strict enforcement. Even minor delays are penalized to reinforce discipline. Companies that treat deadlines casually are in for trouble.” - Dr. Anita Kapoor, Finance Professor (Delhi University):

“The Infosys penalty is symbolic—it reinforces the point that corporate governance isn’t just about earnings calls and shareholder reports. Tax discipline is part of ethical business.”

Practical Advice: How Businesses Can Avoid Such Penalties

1. Set Automated Reminders

Use cloud-based accounting tools like Xero, QuickBooks, or even simple calendar reminders.

2. Assign a Compliance Officer

Many global companies now employ a dedicated compliance team. Small businesses can outsource this to accounting firms.

3. Cross-Border Awareness

Don’t assume tax rules are the same everywhere. The IRS in the U.S., IRAS in Singapore, and India’s GST Council all operate differently.

4. Budget for Penalties (Just in Case)

Smart CFOs create a “compliance buffer fund.” Even if unused, it’s a safeguard.

5. Maintain Transparency

If a delay is unavoidable, notify the regulator. Many offer structured payment plans.

Quick Checklist: Do’s & Don’ts for GST Compliance

Do file early, at least a week before deadlines.

Do reconcile your books monthly, not quarterly.

Do invest in compliance software.

Don’t assume one-size-fits-all tax rules across countries.

Don’t ignore small penalties—they can escalate.

Don’t rely solely on auditors; internal checks matter too.

Cultural Angle: Compliance as a Habit

Inside companies, tax compliance isn’t just an accounting job—it’s cultural. In the U.S., we say “death and taxes are the only certainties.” The Infosys fine shows that building a compliance-first culture is as important as hitting sales targets. Employees, from junior accountants to senior VPs, need to treat deadlines as sacred.

This cultural mindset is what separates companies with good governance from those that constantly battle regulatory scrutiny.

Impact on Infosys Employees and Clients

While the fine itself doesn’t affect salaries or client contracts, such incidents create ripple effects:

- Employees may face tighter internal audits and stricter reporting lines.

- Clients, especially government agencies and large banks, may push for stronger compliance guarantees in contracts.

- The brand image takes a hit, and trust—once shaken—takes years to rebuild.

Global Comparisons: How Does This Stack Up?

- In India, GST penalties start at ₹10,000 or 10% of the tax due, whichever is higher.

- In the U.S., the IRS not only levies penalties but also charges interest on unpaid taxes.

- In Singapore, IRAS has one of the strictest enforcement reputations in Asia.

This shows that while Infosys’s fine is small, the lesson is universal: late payments cost money and reputation everywhere.

Future Outlook: Will Infosys Change Its Playbook?

Infosys has pledged to strengthen internal controls and compliance systems. Analysts expect the company to:

- Expand local finance teams in overseas markets.

- Automate tax filings across jurisdictions.

- Introduce stricter internal audits and board-level oversight.

If done right, this episode could serve as a turning point, showing clients and investors that Infosys takes compliance seriously.

GST Slashed To Just Two Rates As 99 Percent Items Get Cheaper This Diwali

GST Reshuffle on the Horizon as Government Considers Retaining Only 5% and 18% Rates

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties