Small Cars May Get Cheaper Under New GST Reform: this is the big story making headlines in India’s auto sector. If you’ve been waiting to buy your first hatchback or scooter, this reform might bring you real savings. But if you’re eyeing a Mercedes or BMW, sorry — luxury vehicles will still burn a hole in your pocket. The Government of India is working on a bold revamp of the Goods and Services Tax (GST) system. Currently, there are four slabs (5%, 12%, 18%, and 28%), plus a cess for luxury goods. The new plan? Simplify it into just two primary slabs — 5% and 18% — plus a special 40% luxury bracket. If approved by the GST Council, this could roll out as early as Diwali 2025.

Small Cars May Get Cheaper Under New GST Reform

The bottom line is clear: Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly. The reform is a win for middle-class families, first-time car buyers, and the two-wheeler segment. Luxury vehicles, meanwhile, remain taxed heavily to balance wealth and revenue. If the plan kicks in during Diwali 2025, India could see one of its strongest auto booms ever. For everyday Indians, this reform may finally put affordable mobility within reach.

| Category | Current Tax (GST + Cess) | Proposed New Rate | Impact on Consumers | Reference |

|---|---|---|---|---|

| Small Cars / 2-Wheelers | 28% + cess (1–3%) | 18% | Prices could drop by 5–10%, making budget cars and scooters more affordable. | Official GST Portal |

| Luxury Cars / SUVs | ~43% (28% + cess up to 15%) | ~40% | Minimal relief; luxury vehicles remain costly. | Indian Express |

| Timeline | Current four-slab system | By Diwali 2025 | Rollout after GST Council approval; festive-season launch likely. | Reuters |

A Brief History: From VAT to GST

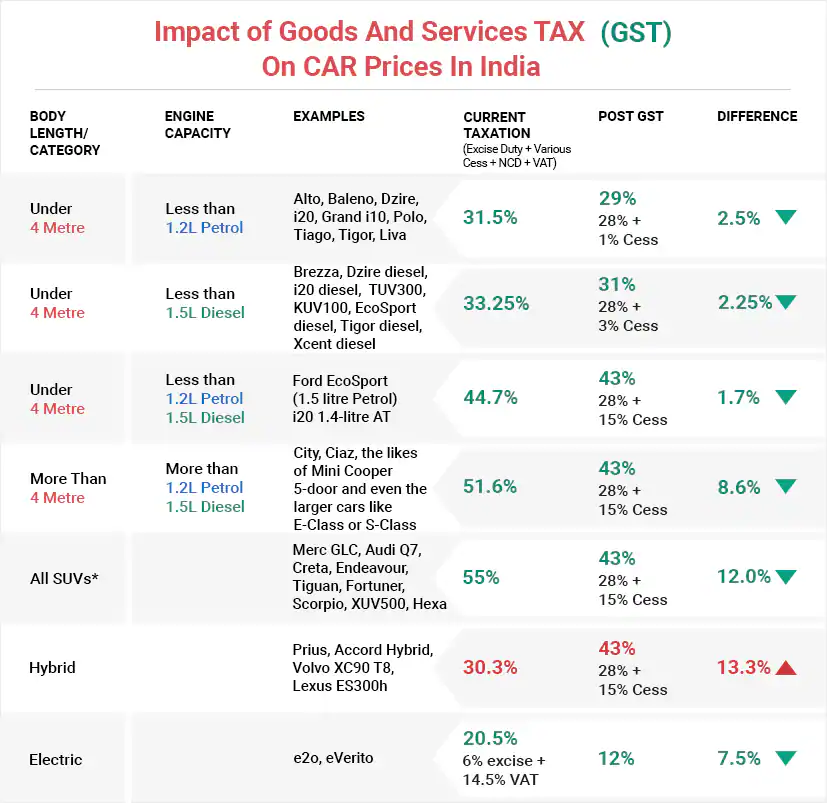

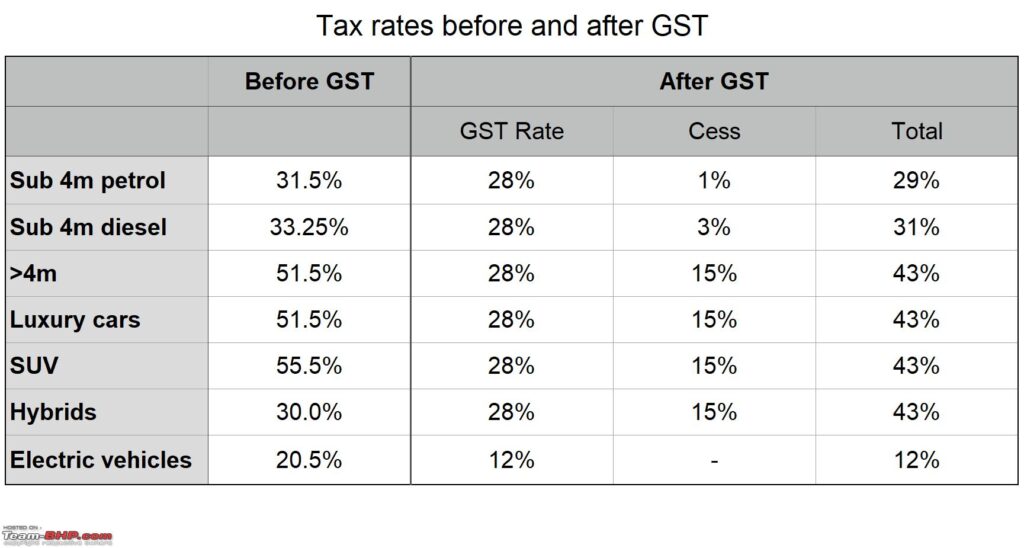

Before 2017, India had a patchwork of taxes — excise duty, VAT, road tax, and octroi — varying by state. A car sold in Delhi could cost thousands less than the same model in Maharashtra.

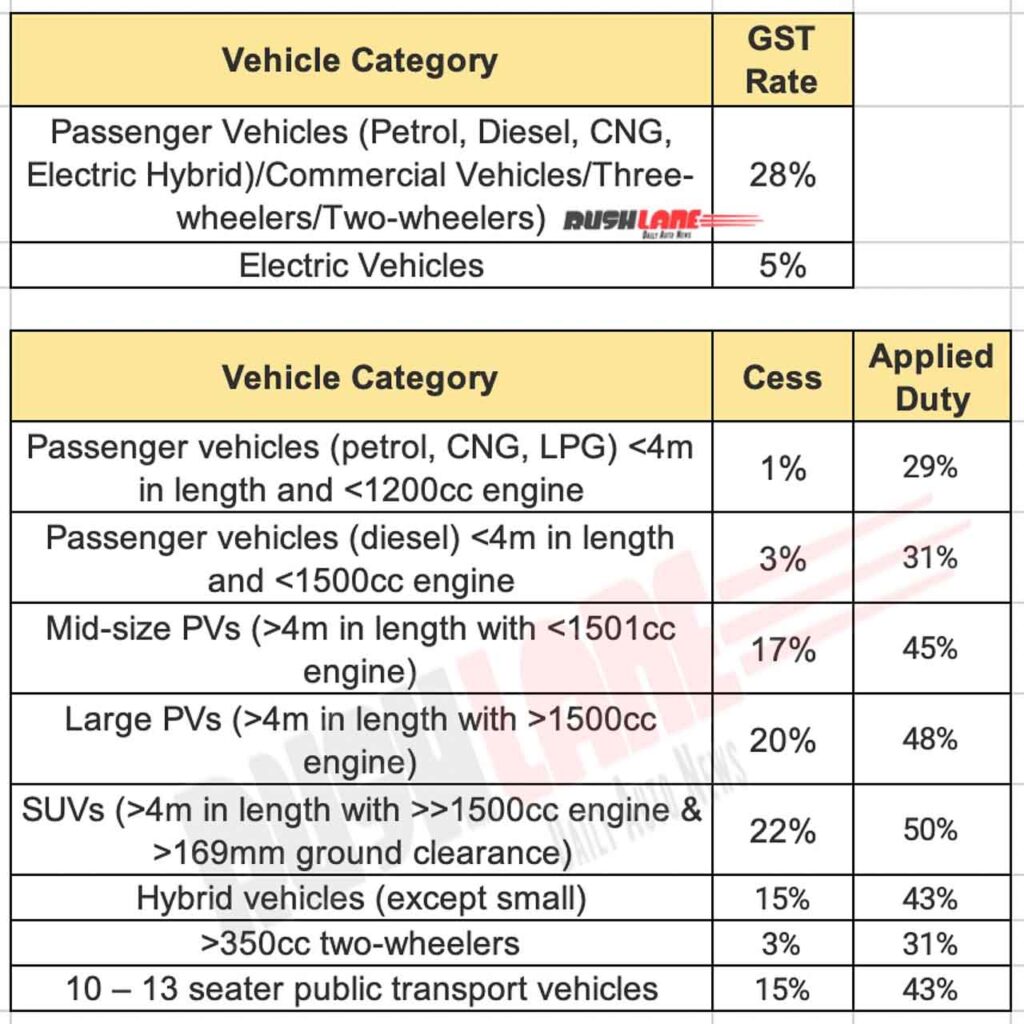

GST unified this system, removing inter-state barriers. However, automobiles were placed in the highest bracket (28% + cess) to balance revenue. While GST improved transparency, it also made cars — especially small and mid-segment ones — more expensive.

The 2025 reform aims to make GST simpler, predictable, and growth-friendly, aligning with the government’s goal of reaching a single slab by 2047.

Why Small Cars May Get Cheaper Under New GST Reform?

Small cars are the backbone of Indian mobility. Models like the Maruti Alto, Hyundai i10, Tata Punch, and Honda Amaze dominate sales. Right now, these cars attract 28% GST plus cess, inflating their cost.

With the shift to 18%, buyers could save anywhere between ₹30,000–₹60,000 on a mid-range hatchback priced around ₹6 lakh. For scooters and motorcycles like the Honda Activa or Hero Splendor, savings could be ₹5,000–₹8,000.

Cheaper small cars also mean:

- Boost in demand – The Indian auto industry could see sales rise by 8–10%.

- Stronger rural adoption – Two-wheelers and entry-level cars are key for rural India.

- Economic multiplier effect – The auto sector supports 3.7 crore jobs and contributes 7% to India’s GDP.

Why Luxury Cars Will Stay Expensive?

Luxury vehicles — Mercedes-Benz, BMW, Audi, Lexus — are already taxed at around 43% (28% GST + 15% cess). Under the reform, they will fall under the 40% slab.

But let’s do the math: On a ₹1 crore car, the tax burden may fall by about ₹3 lakh. For someone spending that much, it’s pocket change. Luxury cars will remain aspirational, keeping the “luxury = exclusivity” equation intact.

Rural vs Urban Impact

The reform’s benefits will be felt differently across India:

- Urban buyers: Metro city families will save money on compact cars and scooters, boosting affordability for first-time buyers.

- Rural buyers: Two-wheelers are lifelines in villages. A ₹70,000 bike becoming cheaper by ₹5,000 can make a big difference in adoption.

- Luxury buyers: Concentrated in metros like Delhi, Mumbai, and Bangalore — for them, the impact is negligible.

Comparison with Other Countries

How does India stack up globally?

- USA – Cars taxed at state sales tax, usually 5–10%. Significantly lower than India.

- European Union – Cars face VAT (19–25%), registration, and environmental levies, but no special “luxury car” bracket.

- China – Standard 13% VAT plus luxury/engine-size tax that can push imports up to 40%.

- India – Even after the reform, remains one of the most expensive car markets due to taxes.

What About the Used Car Market?

Most middle-class buyers start with used cars. Here’s what may happen:

- New small cars cheaper → used car prices drop slightly.

- Luxury used cars won’t see much impact since their taxes are already built into original sticker prices.

- Dealers may adjust financing deals and push certified used cars as an affordable alternative.

Environmental & EV Impact

Electric Vehicles (EVs) already enjoy 5% GST, so this reform doesn’t change much for them. However, experts warn that making petrol cars cheaper could slow EV adoption temporarily.

That said, India’s EV sales are still expected to grow, thanks to FAME-II subsidies, falling battery prices, and state incentives.

Festive Season Effect

Indians love buying cars and bikes during Diwali — a time considered auspicious for big purchases. If the reform kicks in by October 2025, automakers could see record-breaking sales.

Analysts expect:

- 10–12% surge in two-wheeler sales in Tier-2 and Tier-3 towns.

- Higher demand for hatchbacks and compact SUVs, especially under ₹10 lakh.

- Aggressive finance schemes by banks to ride the festive demand.

Financing & Loan Implications

Car loans are a big deal in India — over 75% of car buyers finance their purchase. With prices dropping:

- Loan EMIs will shrink by a few hundred to a few thousand rupees monthly.

- Banks may launch festive-season loan schemes with lower interest rates.

- Buyers will find it easier to qualify for loans, as cars fall into more affordable EMI brackets.

Industry Reactions

- SIAM: Calls it a “booster shot” for the auto industry.

- Luxury carmakers: Express disappointment, saying India still taxes premium cars among the highest globally.

- Economists: See it as an important step toward a unified GST.

Challenges & Criticisms

Not everyone is cheering. Critics point out:

- Revenue concerns – Cutting taxes on small cars may reduce government income in the short run.

- Luxury lobby pressure – Automakers may push for bigger cuts in the premium segment.

- Inflationary risks – If cheaper cars boost fuel demand, it could push petrol/diesel prices higher.

Step-by-Step Guide for Buyers

- Planning to buy a small car or scooter? Wait until Diwali 2025 — the savings are worth it.

- Luxury buyer? No need to wait — taxes stay almost the same.

- Looking at EVs? No changes, but government subsidies remain.

- Used car buyer? Watch for small dips in hatchback prices after new car rates drop.

- Financing tip: Compare festive-season auto loans — cheaper EMIs + lower taxes = double benefit.

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Bhaskar Reddy Vemireddy Appointed Judicial Member of GST Appellate Tribunal

India’s Tax Reform Needs Economics, Not Politics — The Hard Truth