Starmer’s New Economic Advisor Pushes Labour to Scrap Pledges: When news broke that Sir Keir Starmer’s new economic advisor, Minouche Shafik, might be steering the UK Labour government toward tax hikes and rethinking campaign pledges, the headlines lit up like Times Square on New Year’s Eve. Folks across the pond—and even here in the States—are watching closely. Why? Because when one of the world’s largest economies changes course, it can shake up everything from Wall Street to your 401(k). This isn’t just some political drama in Westminster. It’s about jobs, money in your pocket, and how governments make tough calls when the cash register is running low. Let’s break it down in a way your 10-year-old could understand—but with enough detail for the pros reading this on their lunch break.

Starmer’s New Economic Advisor Pushes Labour to Scrap Pledges

At the end of the day, Starmer’s new economic advisor isn’t just about UK politics—it’s about global strategy. Minouche Shafik brings heavyweight credibility, but her guidance could mean higher taxes, scrapped pledges, or both. For everyday folks, the lesson is simple: stay informed, stay diversified, and don’t assume campaign promises are set in stone.

| Topic | Details |

|---|---|

| Who’s involved? | Sir Keir Starmer (UK Prime Minister) and Minouche Shafik (chief economic advisor, ex-Bank of England) |

| What’s happening? | Labour faces a fiscal shortfall and may need to raise taxes or scrap spending pledges |

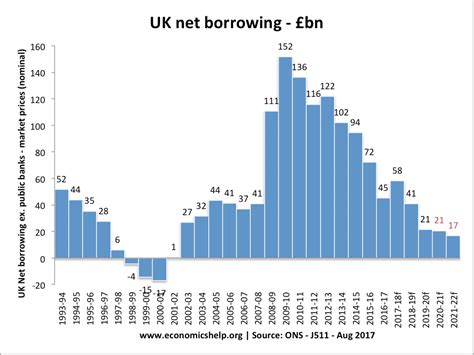

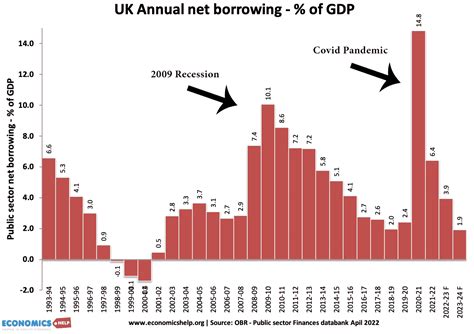

| Fiscal challenge | UK faces a projected £50 billion “black hole” |

| Labour’s pledge | Promised not to raise income tax, VAT, or National Insurance |

| Why it matters | Tax hikes could impact businesses, workers, and global investors |

| Official reference | UK Government Official Website |

Who Is Minouche Shafik and Why Should We Care?

Think of Minouche Shafik as the economic quarterback Starmer just drafted. She’s no rookie. Her resume includes:

- Deputy Governor at the Bank of England

- President of the London School of Economics

- Key leader at the International Monetary Fund (IMF)

She’s the kind of advisor who can walk into a room, drop an idea, and have both Wall Street traders and government ministers scribbling notes. So when she suggests Labour may need to rethink its game plan, you better believe people listen.

Why Labour’s Budget Is in Hot Water?

Here’s the deal:

- The UK government is staring at a £50 billion budget shortfall.

- Starmer campaigned on not raising income tax, VAT, or National Insurance—the “big three” in Britain.

- But governing is like trying to balance your household bills when your paycheck just shrank by 30%. Something’s gotta give.

In U.S. terms, imagine a president promising no new taxes while trying to fund Social Security, Medicare, defense, and a trillion-dollar infrastructure plan. Nice on paper. Painful in practice.

Lessons from History

This isn’t the first rodeo for Labour—or any government.

- In the 1970s, Labour raised taxes to fund public services, but the economy tanked, leading to what Brits called the “Winter of Discontent.”

- Tony Blair’s Labour (1997–2010) held tax rises back at first, but later expanded spending, funded partly by stealth taxes.

- In the U.S., remember the Bush-era tax cuts (2001, 2003)? They were popular but added to the deficit, leaving later presidents to wrestle with budget headaches.

The lesson? Campaign promises about taxes rarely survive contact with reality.

Breaking Down Labour’s Possible Moves As Starmer’s New Economic Advisor Pushes Labour to Scrap Pledges

Stealth Taxes

Governments sometimes freeze tax thresholds. Inflation quietly pushes more people into higher brackets. Boom—extra revenue without technically breaking a promise.

Wealth and Property Taxes

Raising capital gains, inheritance, or property taxes. This targets the wealthy but risks discouraging investment.

Corporate Taxes

Hiking business taxes could raise billions but risks pushing investment overseas.

Scrapping Spending Pledges

Delaying infrastructure, healthcare boosts, or education funding could ease fiscal strain—but break voter trust.

Case Study: When Pledges Are Broken

Remember George H.W. Bush’s “Read my lips: no new taxes”? He raised taxes anyway in 1990. It helped stabilize finances but probably cost him re-election.

Starmer risks a similar backlash if Labour shifts course—but avoiding tough decisions could crash the UK economy harder down the line.

The American Connection

So, why should Americans care about UK taxes? Because the global economy is like a giant game of Jenga. Pull out the wrong block in London, and the tower wobbles in New York.

- If the UK raises corporate taxes, multinational companies may rethink investment strategies, affecting U.S. partners.

- If the pound weakens, the dollar strengthens, which can hurt U.S. exporters.

- If markets panic, it could shift interest rates in the U.S., impacting mortgages and credit cards.

Think of it like this: when your neighbor’s roof leaks, sooner or later the water seeps into your basement.

Practical Advice: What This Means for You

Even if you’re sipping sweet tea in Georgia, UK tax hikes matter. Here’s why:

- Investors: UK tax policy affects stock prices, the pound’s value, and bond yields. If you hold international ETFs, keep watch.

- Small Business Owners: Supply chains connected to UK companies could see cost hikes.

- Families: Inflation and interest rates in the UK ripple globally. U.S. mortgage rates could creep up if markets react badly.

Financial Survival Guide: How to Stay Ahead

For Workers

- Budget like a pro: Build a rainy-day fund (3–6 months of expenses).

- Upskill: Recessions hit jobs. Online learning platforms can boost your resilience.

For Investors

- Check exposure: If more than 15% of your portfolio is UK-related, consider rebalancing.

- Think defensive stocks: Utilities, healthcare, and consumer staples hold steady when governments tighten belts.

For Businesses

- Scenario planning: Prepare for supply-chain costs to rise.

- Currency hedging: Protect against swings in the pound.

What Happens Next?

The autumn UK budget is expected to be the real test. If Labour:

- Raises taxes: They’ll face backlash but possibly stabilize the economy.

- Holds firm: They risk ballooning debt, higher borrowing costs, and investor panic.

Over the next 6–12 months, watch the UK’s credit ratings, the pound’s exchange rate, and inflation trends. These will tell you if Starmer and Shafik’s gamble pays off.

The Bigger Picture: Inflation, Growth, and Trust

Beyond taxes, this debate is about trust. Voters hate broken promises. Investors hate uncertainty. And families hate paying more for less.

- Inflation risks: Higher taxes could slow spending, cooling inflation—but too much, too fast, and growth stalls.

- Economic growth: Starmer has said “you can’t tax your way to growth.” That’s true—but ignoring fiscal gaps can tank growth even harder.

- Public trust: If Labour scraps too many pledges, voters may feel betrayed. That political cost can be just as damaging as economic ones.

UK Tax Fraud Crackdown — Indian-Origin Mastermind Ordered to Pay £90 Million

Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable

UK Can Squeeze More From Oil and Gas With Faster Tax Changes, Says Lobby