State Govt Promises to Cover GST on Textiles: In a landmark step to revive India’s rich textile heritage, the Andhra Pradesh government has announced that it will cover the full Goods and Services Tax (GST) on all handloom textiles produced in the state. This new policy, effective August 7, 2025, coincides with National Handloom Day, a day dedicated to celebrating traditional weaving and artisanship in India.

The initiative isn’t just a symbolic gesture. It’s a strategic economic decision to support thousands of weavers struggling under the weight of taxes, production costs, and stiff competition from mass-produced fabrics. By lifting the burden of GST, the state is effectively empowering handloom workers to thrive in a competitive market, sustain their craft, and improve their livelihoods. This article unpacks everything you need to know about this policy shift—why it matters, how it works, what it means for weavers, and how other states can follow suit.

State Govt Promises to Cover GST on Textiles

Andhra Pradesh’s GST coverage on handloom textiles is a visionary step that acknowledges the immense value of traditional crafts—not just as a heritage symbol, but as a viable, respectable livelihood. This decision restores dignity, strengthens rural economies, and helps revive a sector long neglected by mainstream policy. If replicated across India, this could mark the beginning of a handloom renaissance—one that blends age-old skills with modern markets, enabling weavers to hold their heads high and their looms steady for generations to come.

| Category | Details |

|---|---|

| Policy | Andhra Pradesh to pay full GST on handloom textiles |

| Effective Date | August 7, 2025 – National Handloom Day |

| Electricity Support | Free power: 200 units/month for handlooms, 500 units/month for powerlooms |

| Weaver Fund | ₹5 crore Weaver Thrift Fund for financial security and welfare |

| Expected Impact | Reduced production costs, improved market access, better incomes |

| Beneficiaries | Over 34,000 weavers in Andhra Pradesh; 6.4 lakh nationally |

| Official Source | New Indian Express |

What is GST and Why Is It a Problem for Weavers?

GST, or Goods and Services Tax, is a nationwide indirect tax introduced in India in 2017 to streamline the tax structure. Handloom products, like sarees, shawls, and home furnishings, typically attract a 5% to 12% GST depending on the fabric and finish.

While GST has simplified tax compliance for many industries, it has been particularly harsh on small and unregistered weavers, who often cannot claim input tax credits and are forced to absorb the full cost of the tax themselves. This makes their products more expensive and less competitive than those produced by powerlooms or in bulk by large manufacturers.

A handloom weaver in a rural area might spend 10–15% of their total income on GST-related costs, including raw materials taxed at source. And most of them lack the infrastructure or literacy to navigate complex tax filings.

Why State Govt Promises to Cover GST on Textiles is a Turning Point?

The state government’s decision to absorb the GST cost is more than just a subsidy. It’s a bold economic strategy to:

- Reinforce the handloom economy, which is both labor-intensive and eco-friendly.

- Boost local employment and prevent rural migration.

- Encourage younger generations to stay in the handloom profession, which has seen significant drop-off in recent years.

Additionally, Andhra Pradesh’s approach aligns with the central government’s broader objective of boosting ‘Make in India’ and promoting traditional arts and rural entrepreneurship.

A Comprehensive Support Package for Weavers

This policy isn’t a standalone measure. It comes as part of a larger support package rolled out by the Andhra Pradesh government:

1. GST Coverage on Handloom Products

The state will pay GST directly to the central government for all eligible handloom products sold by registered weavers, cooperatives, and government-backed handloom societies.

2. Free Electricity Support

Weavers using traditional handlooms will receive up to 200 units of free electricity per month, while small-scale powerloom units will get 500 units per month—a huge cost-saving in energy-intensive textile processes.

3. ₹5 Crore Weaver Thrift Fund

This fund will act as a financial safety net, allowing weavers to access emergency assistance, health support, education benefits, and low-interest loans for capital investment. It’s a step toward not just financial aid, but long-term economic resilience.

4. Digital Empowerment and Market Linkage

Weavers will be encouraged to list their products on government-supported platforms like IndiaHandmade.com, which connects local artisans directly with national and international buyers.

5. Skill Training and Design Interventions

The government is also tying in skill upgradation programs and modern design support under the National Handloom Development Programme (NHDP), helping weavers to evolve with changing market demands.

Ground Reality: Voices from the Loom

Srinivas Rao, a 38-year-old weaver from Mangalagiri, shares,

“This is the first time in years I feel hopeful. Earlier, I’d sell a saree for ₹1,200 and get ₹100 at best after costs and taxes. Now, if the government is covering GST, that’s one less burden.”

Another weaver, Fatima Begum from Chirala, adds,

“Electricity is one of our biggest costs. Free power for my loom will let me reinvest that money into better dyes and yarn. I can also think about teaching my daughter the craft.”

These are not isolated cases. Thousands of families stand to benefit directly from this initiative, particularly in weaving clusters like Uppada, Pochampally, Venkatagiri, Dharmavaram, and Gadwal.

National Perspective: The Bigger Picture

According to a 2024 report by the Ministry of Textiles:

- 6.44 lakh handloom weavers have been supported by central government schemes between 2019 and 2024.

- 71% of beneficiaries are women, underscoring the gendered impact of the industry.

- States like Tamil Nadu, Andhra Pradesh, Uttar Pradesh, and West Bengal lead in total registered weavers and productivity.

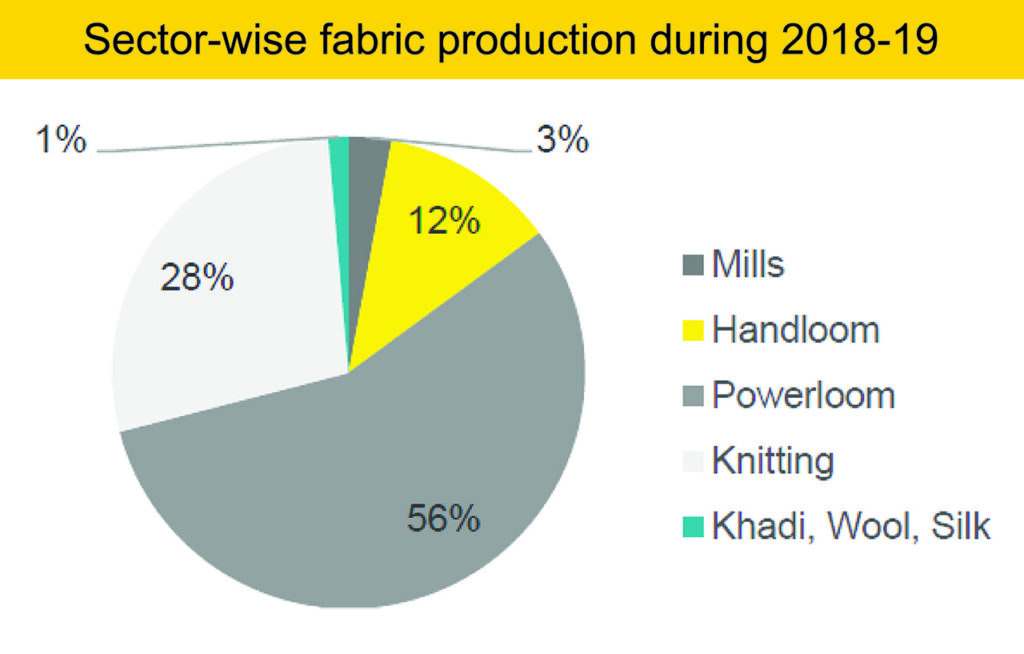

Despite these stats, the sector’s growth rate has lagged due to lack of consistent market support, pricing pressures, and growing competition from powerlooms and synthetic alternatives.

What Other States Can Learn and Implement?

Andhra Pradesh’s model provides a replicable framework for other states aiming to revitalize the handloom sector:

- Direct subsidy of GST, reducing end-user prices.

- Power subsidies and thrift funds to improve working capital access.

- Marketing support through government e-commerce platforms.

- Integrated training that combines traditional weaving with digital skills, social media promotion, and new design trends.

By integrating economic, cultural, and technological elements, this model offers a sustainable development path for a historically undervalued industry.

What Buyers Can Do to Support?

- Shop from verified handloom cooperatives, especially those listed on IndiaHandmade.com.

- Prefer natural-fiber clothing made by artisans over synthetic fast fashion.

- Spread the word by sharing this policy news with local fashion influencers, journalists, and educators.

- Support National Handloom Day events in your state or city.

Every purchase of a handwoven product isn’t just a style choice—it’s a vote for tradition, sustainability, and economic justice.

August 2025 GST Compliance Calendar: Everything You Need to Know to Stay Ahead of Deadlines

India’s GDP to Get Smarter? MoSPI Eyes GST, UPI, and Vehicle Data for Accuracy Boost

GST Revenue Hits ₹1.96 Lakh Crore in July — But Growth Momentum Slows