States Back GST Simplification to 5% & 18%: If you’ve been following India’s tax landscape, you’ve probably seen the buzz: states are backing the new GST simplification plan, which proposes just two major slabs—5% and 18%. But here’s the twist everyone’s talking about: what about sin goods like tobacco, alcohol, and luxury cars? Will they be hit harder with a new tax regime? Spoiler alert: yes, they’re likely headed for a higher 40% rate. This shake-up in the Goods and Services Tax (GST) system isn’t just about numbers—it’s about balancing state revenues, public health goals, and India’s push to simplify one of the world’s most complex tax systems. Let’s break it down in plain English so it’s easy to follow, even if you’re not a finance pro.

States Back GST Simplification to 5% & 18%

The GST simplification to 5% and 18% is a landmark reform, aimed at making India’s tax system simpler, fairer, and more business-friendly. But while most goods will benefit from lower and predictable rates, sin goods like tobacco, alcohol, and luxury cars will carry a heavy 40% burden. For ordinary citizens, it’s mostly good news—essentials stay cheap, appliances get affordable, and only indulgences face higher costs. For policymakers, the real challenge lies in balancing state revenues, business competitiveness, and social responsibility.

| Point | Details |

|---|---|

| New GST slabs | 5% (essentials) & 18% (most goods/services) |

| Special rate for sin goods | Proposed 40% GST on tobacco, alcohol, luxury cars |

| Current system | Four slabs: 5%, 12%, 18%, 28% (+cess on some goods) |

| Estimated revenue loss to states | Over ₹1.1 lakh crore (~0.3–0.4% of India’s GDP) if 28% items move to 18% |

| Policy goal | Simplify GST, reduce confusion, keep revenues stable |

| Official reference | GST Council – Government of India |

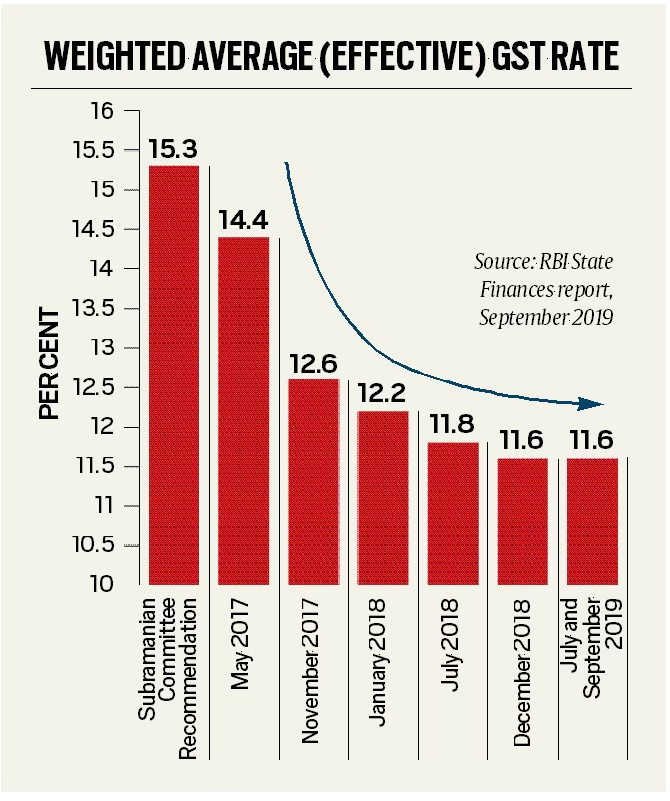

A Quick Flashback: How GST Got Here

India rolled out GST in July 2017, promising a “One Nation, One Tax” system. Before GST, businesses faced a jungle of state-level taxes—VAT, excise duty, service tax, and octroi—leading to double taxation and price distortions.

But instead of one flat rate, GST arrived with four major slabs (5%, 12%, 18%, 28%) plus an additional cess for luxury and harmful goods. While it streamlined compliance somewhat, it remained complex and contentious.

Over the years, critics pointed out three big issues:

- Too many slabs – Confusion over classification (is a biscuit luxury or essential?).

- Revenue strain – States worried about losing financial independence.

- Consumer frustration – Higher effective rates on mid-tier products.

That’s why the new plan is seen as a second-generation GST reform.

The Big Change: Two Slabs + A Sin Tax

Essentials remain untouched

- The 5% slab continues for basic needs like food grains, medicines, and some educational services.

Most goods in one bucket

- The 18% slab will cover the majority of goods and services—electronics, packaged foods, banking, and more.

Sin goods face higher taxes

- Sin goods are headed for a 40% slab, covering items like tobacco, cigarettes, pan masala, luxury cars, and possibly gambling services.

The idea is straightforward: keep daily life affordable, while luxury indulgences and harmful products pay for the gap.

What Counts as Sin Goods?

Sin goods typically include:

- Health risks: Tobacco, cigarettes, chewing products.

- Luxury indulgences: Premium cars, yachts, imported liquor.

- Risky behaviors: Gambling, betting, online gaming.

These aren’t just about “morals.” They have real public health and social costs, from rising healthcare bills to law enforcement. Taxing them harder helps governments offset those expenses.

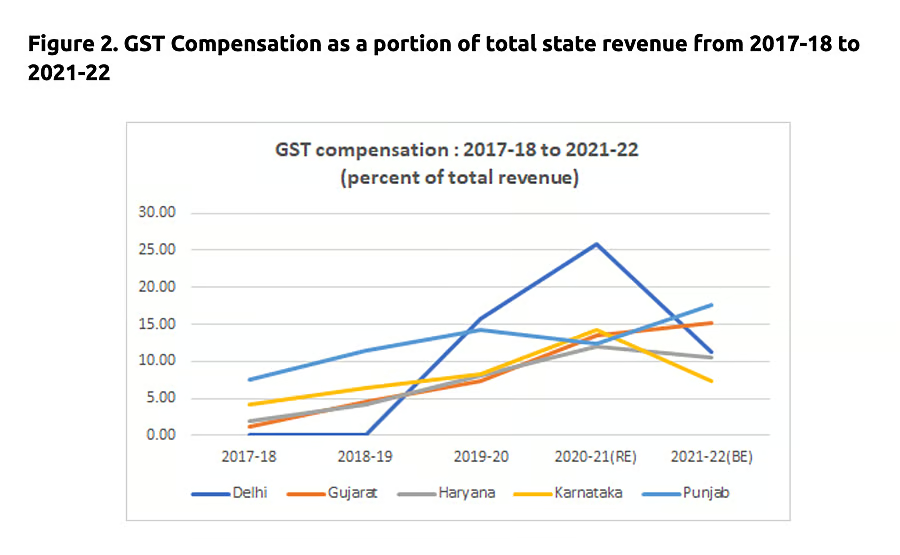

The Revenue Tug-of-War

Lowering the 28% slab to 18% may feel consumer-friendly, but it cuts state revenues significantly.

- Revenue loss: Estimated ₹1.1 lakh crore annually (~$13 billion).

- That equals 0.3–0.4% of GDP, enough to disrupt state budgets.

- States like Maharashtra and Tamil Nadu, which rely heavily on auto and tobacco taxes, could lose big.

The 40% sin slab is designed as a counterbalance. By targeting luxury and harmful goods, governments can plug revenue leaks while discouraging excessive consumption.

Why States Back GST Simplification to 5% & 18%?

Despite risks, states are backing simplification. Here’s why:

- Business-friendly signal – Fewer slabs improve “Ease of Doing Business.”

- Compensation talks – States are pushing the Center for a fiscal safety net.

- Public optics – Taxing harmful goods higher appeals to voters.

Put simply, states are willing to gamble on simplification if they get assurances on revenue support.

Consumer Impact: What You’ll Notice

For regular folks, the effects break down simply:

- Groceries and essentials: Still taxed at 5%. Bread, rice, medicines won’t get pricier.

- Electronics and appliances: Standardized at 18%. Expect lower bills for mid-range items like fridges or washing machines that used to face 28%.

- Luxury and harmful goods: Tobacco, alcohol, luxury SUVs, and imported liquor? Expect sharp hikes at 40%.

Example:

- A ₹30,000 washing machine currently taxed at 28% would now cost nearly ₹3,000 less under the 18% slab.

- A ₹50 lakh luxury SUV, however, could carry an extra ₹20 lakh in taxes at 40%.

Business and Industry Implications

Auto sector

- Mass-market cars benefit, moving from 28% to 18%.

- Luxury vehicles? Prices soar, possibly slowing demand.

FMCG (Fast-Moving Consumer Goods)

- Packaged snacks, cosmetics, and mid-tier products will stabilize under 18%. This could spur sales.

Tobacco and Liquor

- Heaviest impact. Higher prices may reduce demand, but black-market risks remain.

Startups and SMEs

- Simplified slabs mean fewer compliance headaches. Predictable rates boost investor confidence.

Global Context: How Other Countries Handle Sin Taxes

India isn’t alone. Many nations use sin taxes to balance budgets and curb consumption:

- USA: Cigarettes cost over $10 per pack in cities like New York, thanks to state and federal taxes. Sugary drink taxes are rising too.

- UK: Alcohol and tobacco are heavily taxed, directly funding the NHS.

- Singapore: Alcohol and tobacco are priced steeply to discourage overuse.

India’s 40% sin slab mirrors this global strategy—making harmful goods costly while protecting essentials.

Expert Opinions

Economists and industry groups are weighing in:

- Dr. Pronab Sen (Economist): “Simplification is overdue. But states must get compensation or fiscal imbalances will worsen.”

- Confederation of Indian Industry (CII): “Businesses will benefit from predictability, boosting investments and compliance.”

- Public health advocates: “Higher tobacco and alcohol taxes are proven tools to cut consumption. India could see health gains.”

Do Sin Taxes Change Behavior?

Research says yes.

- WHO data shows a 10% price increase in tobacco reduces consumption by 4% in rich nations, and 8% in poorer ones.

- In India, where cigarettes are relatively cheap, a 40% slab could have a strong deterrent effect.

This dual benefit—raising revenue and reducing harm—makes sin taxes politically appealing.

A Step-by-Step Guide to Understanding the New GST

- Essentials stay cheap – Food and medicine remain at 5%.

- Most goods/services standardized – Electronics, services, and mid-tier products sit at 18%.

- Sin and luxury products penalized – A new 40% slab ensures harmful or high-end goods cover the revenue gap.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two

Future Outlook: What’s Next?

This reform could pave the way for an eventual single GST rate in India, aligning with global best practices. But short-term challenges remain:

- Negotiations – States and the Center must iron out compensation formulas.

- Classification disputes – Businesses will lobby to avoid being labeled as “luxury.”

- Compliance transition – Adjusting accounting and billing systems will take time.

Still, simplification is a step toward making GST less of a maze and more of a roadmap.